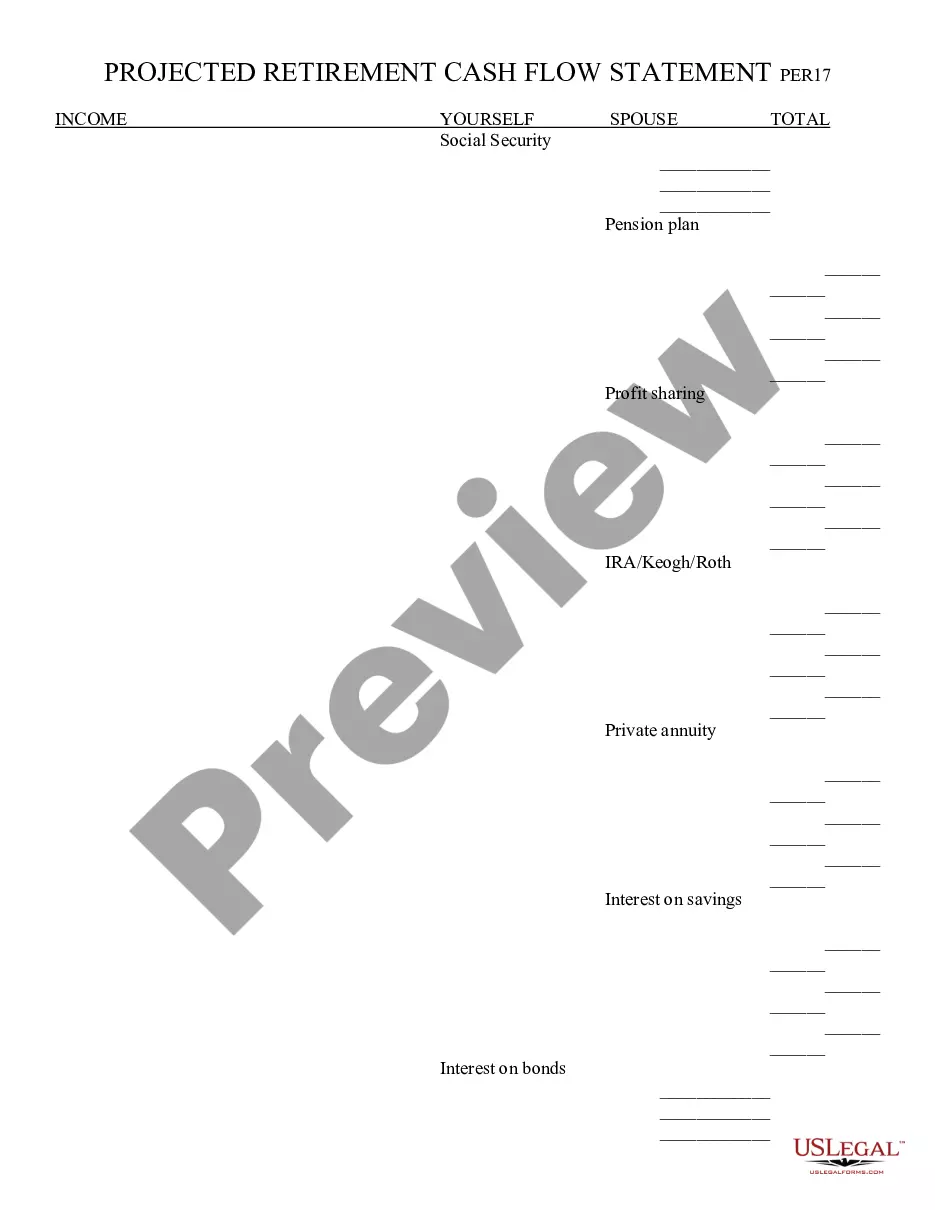

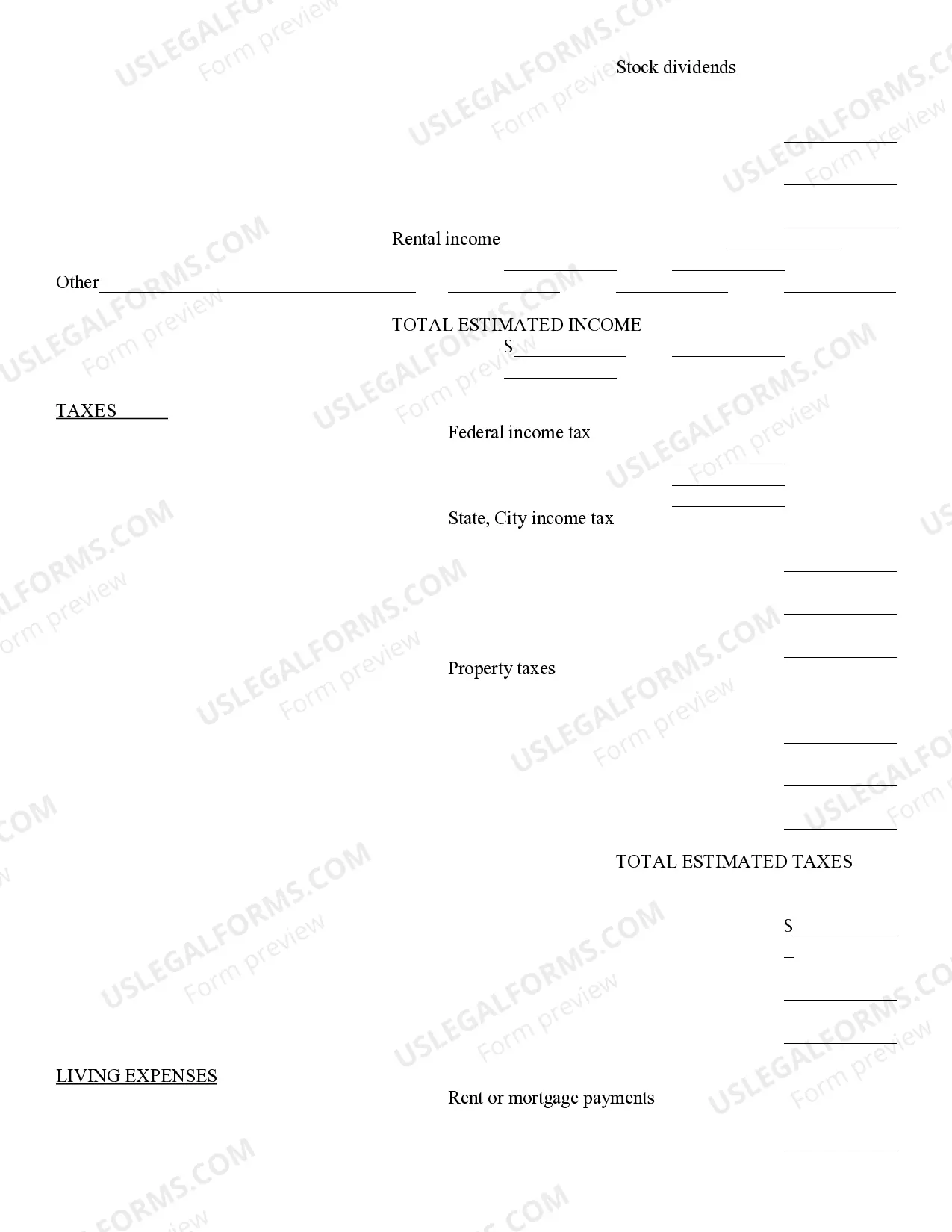

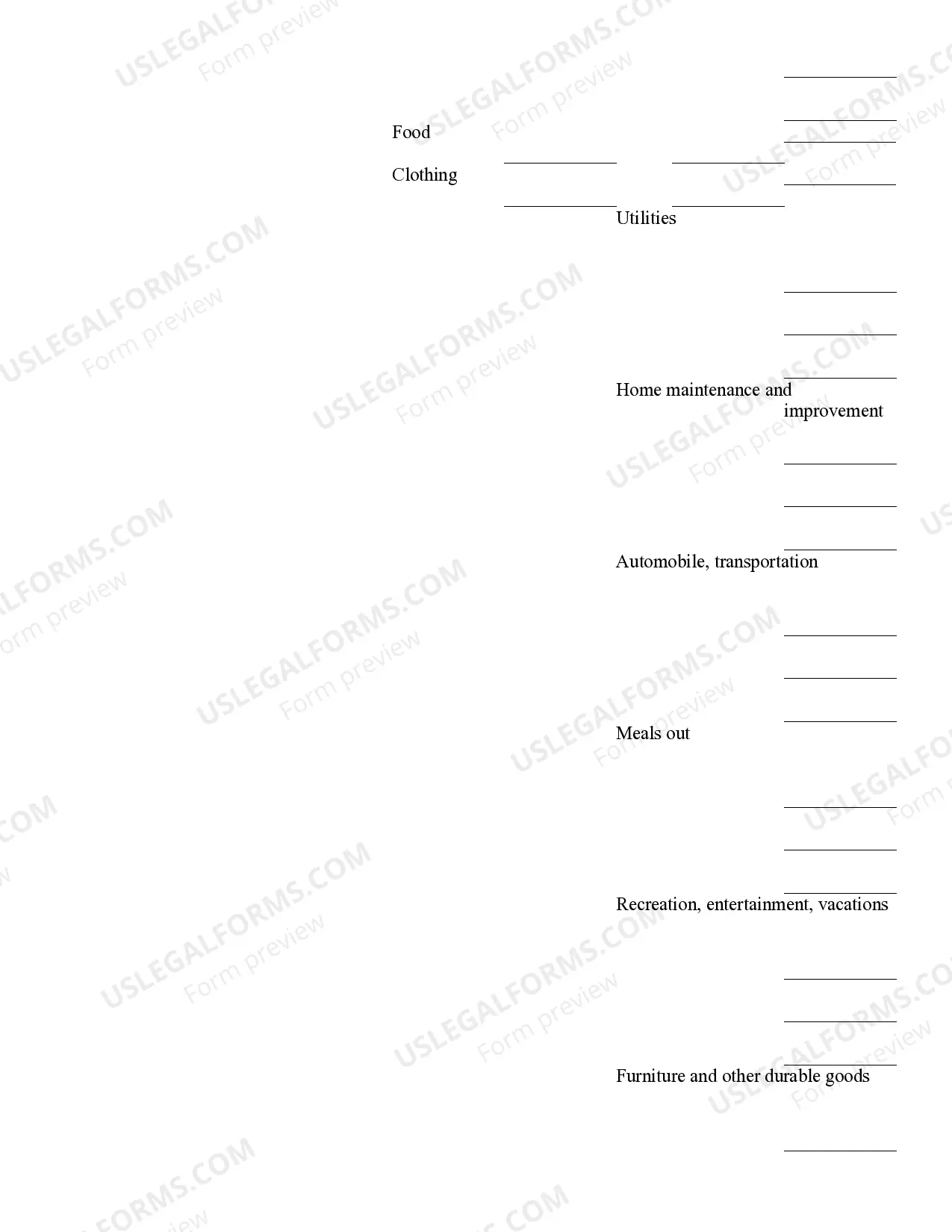

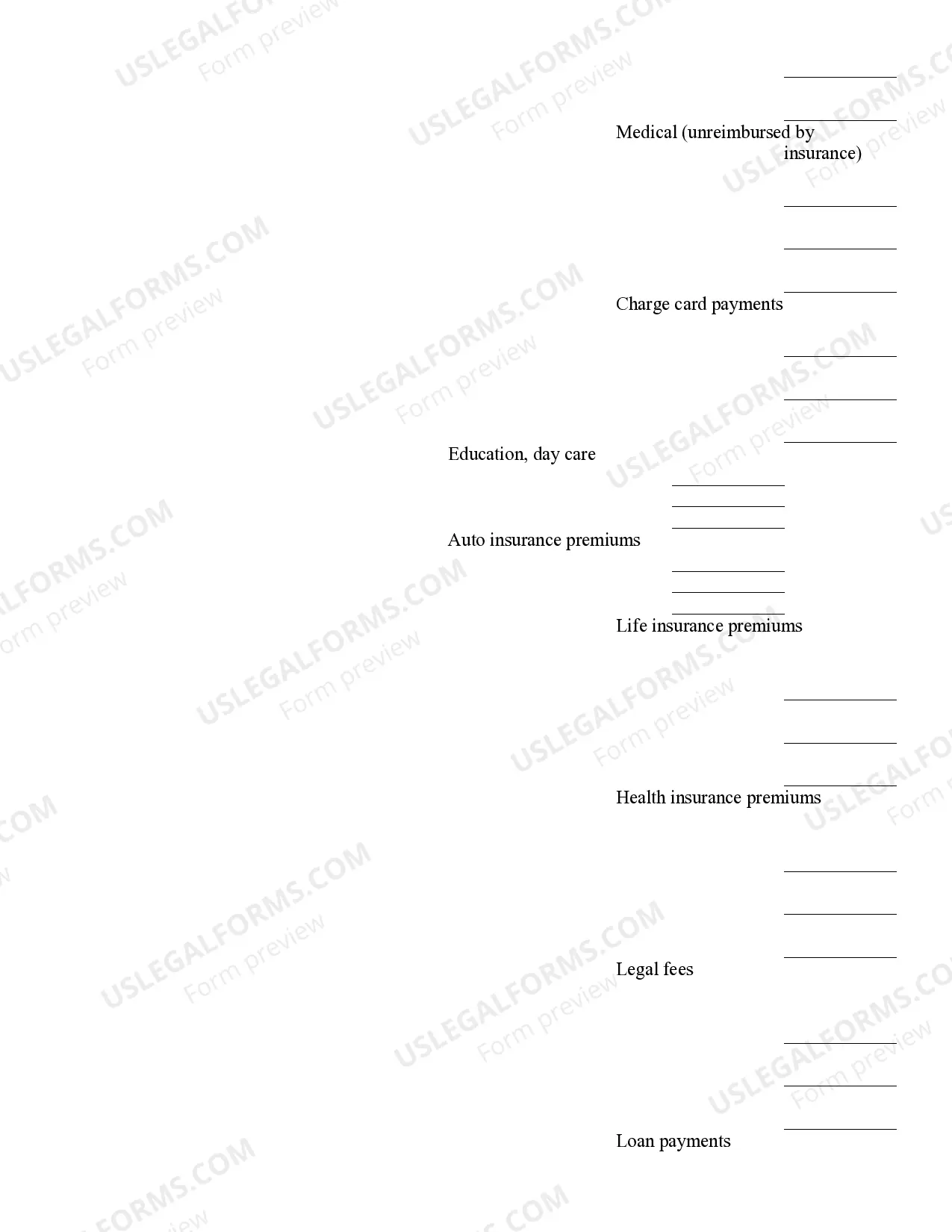

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Surprise Arizona Retirement Cash Flow is a financial concept that refers to the income generated by retirees living in Surprise, Arizona for their daily expenses, investments, and overall financial stability. It encompasses the various sources and streams of income that contribute to maintaining a comfortable lifestyle during retirement. There are several types of Surprise Arizona Retirement Cash Flow, each with its own characteristics and purposes. 1. Pension Benefits: Many retirees in Surprise, Arizona may have contributed to a pension plan throughout their working years. This type of retirement cash flow provides a regular income based on the number of years worked and the average salary earned. 2. Social Security: Social Security benefits play a significant role in retirement cash flow for individuals who have contributed to the system during their working years. These benefits are based on factors such as the number of years worked, income history, and age at retirement. 3. Retirement Savings and Investments: Individuals often save and invest in various retirement accounts like 401(k), Individual Retirement Accounts (IRAs), or personal investment portfolios. These savings and investments generate cash flow during retirement through interest, dividends, capital gains, and distributions. 4. Rental Income: Some retirees in Surprise, Arizona may have rental properties, such as vacation homes or investment properties. Rental income from these properties can contribute to their retirement cash flow. 5. Part-Time Work: Retirees who opt to work part-time during their retirement years can supplement their retirement cash flow with additional income from these employment opportunities. 6. Annuities: Retirees may choose to purchase annuity products, which provide a steady stream of income throughout retirement. These annuities can be fixed, variable, or indexed, depending on the retiree's preferences and risk tolerance. 7. Dividend Payments: Retirees who invest in dividend-paying stocks or mutual funds can receive regular cash flow through dividend payments, which can contribute to their retirement cash flow. 8. Business or Entrepreneurial Income: Some retirees may choose to start a small business or become entrepreneurs during retirement. The income generated from such ventures can become part of their retirement cash flow. 9. Inheritance: In some cases, retirees may receive inheritances from deceased loved ones, which can add to their retirement cash flow. 10. Health Savings Accounts: Retirees who have accumulated funds in health savings accounts (Has) can utilize these funds tax-free for eligible medical expenses, contributing to their overall retirement cash flow. In conclusion, Surprise Arizona Retirement Cash Flow encompasses various income sources, including pension benefits, Social Security, retirement savings, rental income, part-time work, annuities, dividends, business income, inheritances, and health savings accounts. These different types of cash flow aim to provide financial stability and support the retirement lifestyle of individuals enjoying their golden years in Surprise, Arizona.Surprise Arizona Retirement Cash Flow is a financial concept that refers to the income generated by retirees living in Surprise, Arizona for their daily expenses, investments, and overall financial stability. It encompasses the various sources and streams of income that contribute to maintaining a comfortable lifestyle during retirement. There are several types of Surprise Arizona Retirement Cash Flow, each with its own characteristics and purposes. 1. Pension Benefits: Many retirees in Surprise, Arizona may have contributed to a pension plan throughout their working years. This type of retirement cash flow provides a regular income based on the number of years worked and the average salary earned. 2. Social Security: Social Security benefits play a significant role in retirement cash flow for individuals who have contributed to the system during their working years. These benefits are based on factors such as the number of years worked, income history, and age at retirement. 3. Retirement Savings and Investments: Individuals often save and invest in various retirement accounts like 401(k), Individual Retirement Accounts (IRAs), or personal investment portfolios. These savings and investments generate cash flow during retirement through interest, dividends, capital gains, and distributions. 4. Rental Income: Some retirees in Surprise, Arizona may have rental properties, such as vacation homes or investment properties. Rental income from these properties can contribute to their retirement cash flow. 5. Part-Time Work: Retirees who opt to work part-time during their retirement years can supplement their retirement cash flow with additional income from these employment opportunities. 6. Annuities: Retirees may choose to purchase annuity products, which provide a steady stream of income throughout retirement. These annuities can be fixed, variable, or indexed, depending on the retiree's preferences and risk tolerance. 7. Dividend Payments: Retirees who invest in dividend-paying stocks or mutual funds can receive regular cash flow through dividend payments, which can contribute to their retirement cash flow. 8. Business or Entrepreneurial Income: Some retirees may choose to start a small business or become entrepreneurs during retirement. The income generated from such ventures can become part of their retirement cash flow. 9. Inheritance: In some cases, retirees may receive inheritances from deceased loved ones, which can add to their retirement cash flow. 10. Health Savings Accounts: Retirees who have accumulated funds in health savings accounts (Has) can utilize these funds tax-free for eligible medical expenses, contributing to their overall retirement cash flow. In conclusion, Surprise Arizona Retirement Cash Flow encompasses various income sources, including pension benefits, Social Security, retirement savings, rental income, part-time work, annuities, dividends, business income, inheritances, and health savings accounts. These different types of cash flow aim to provide financial stability and support the retirement lifestyle of individuals enjoying their golden years in Surprise, Arizona.