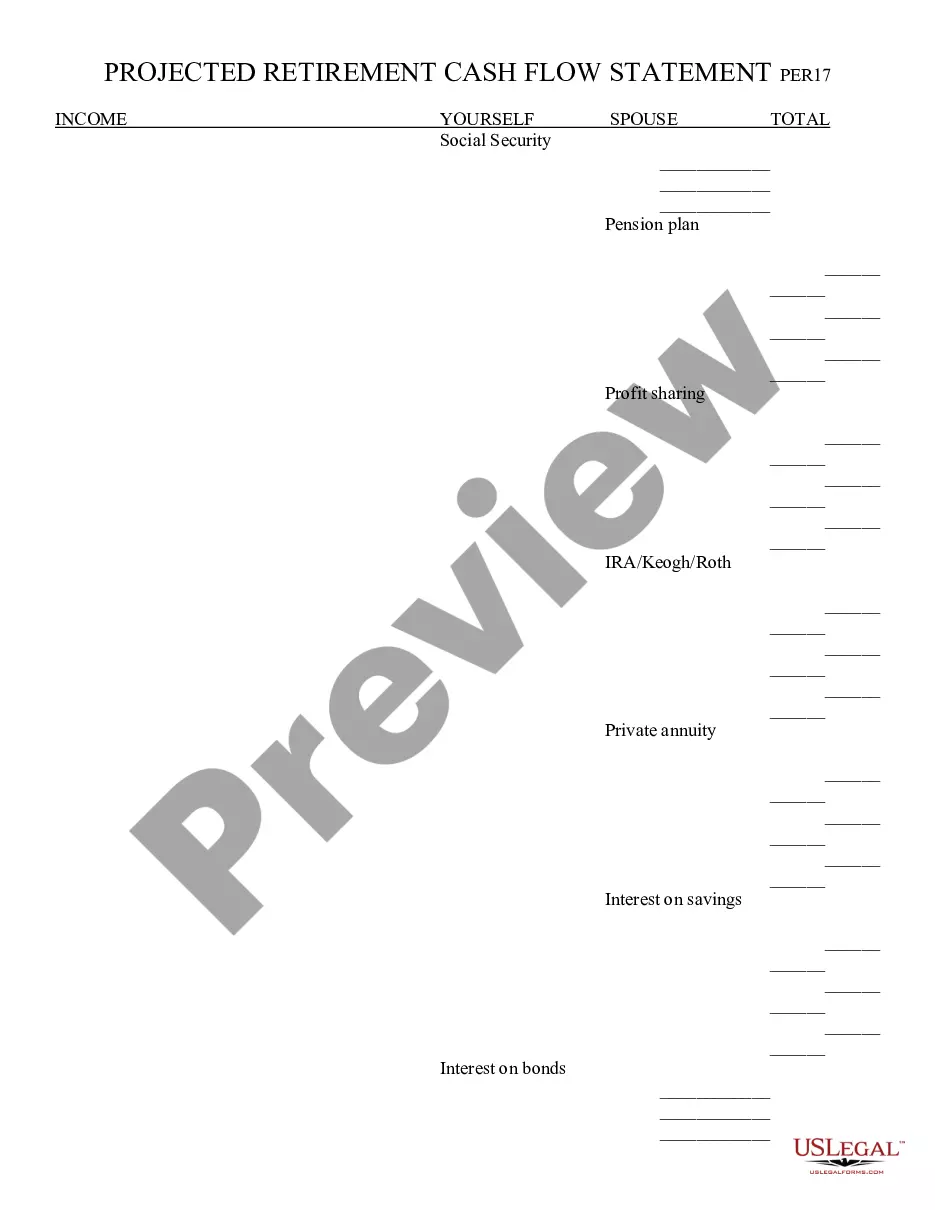

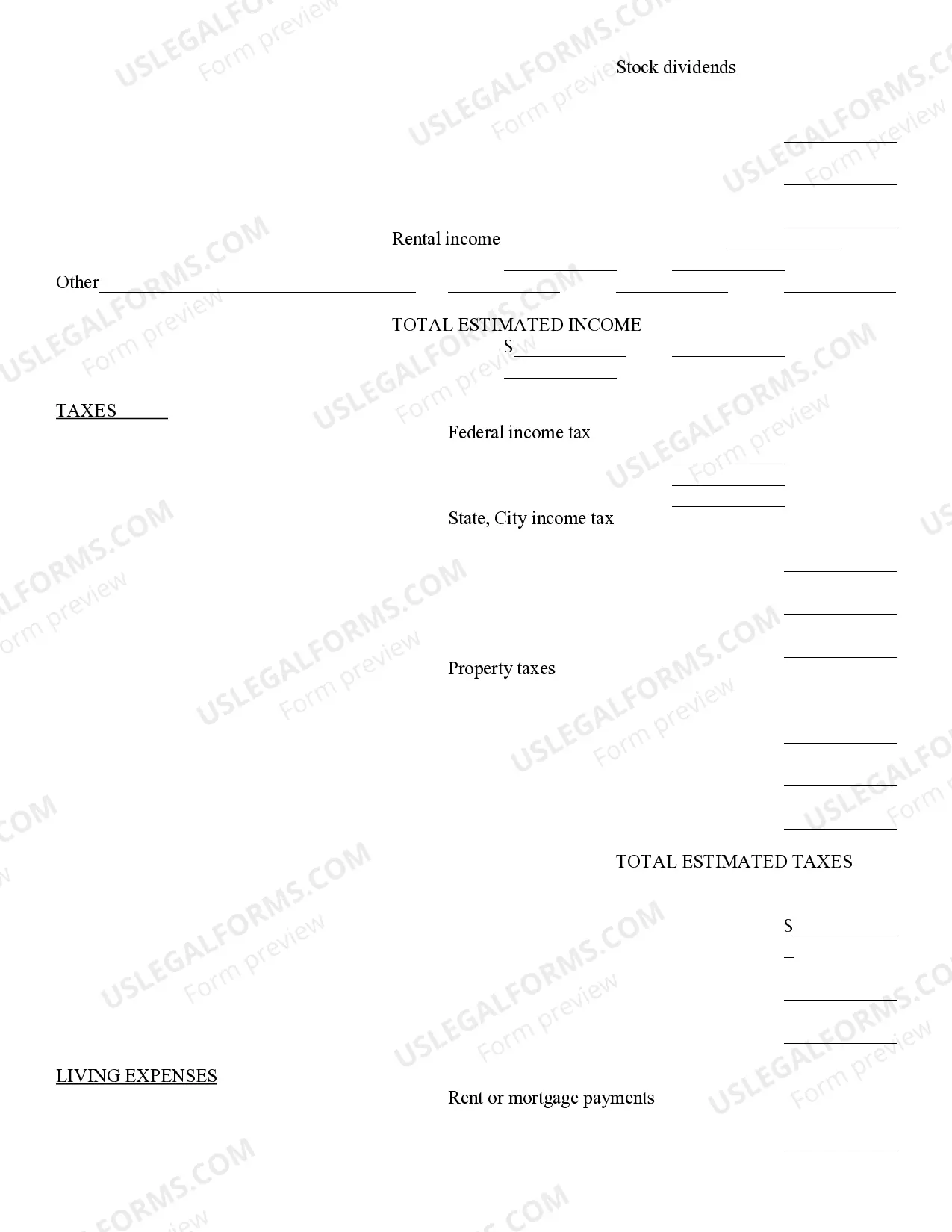

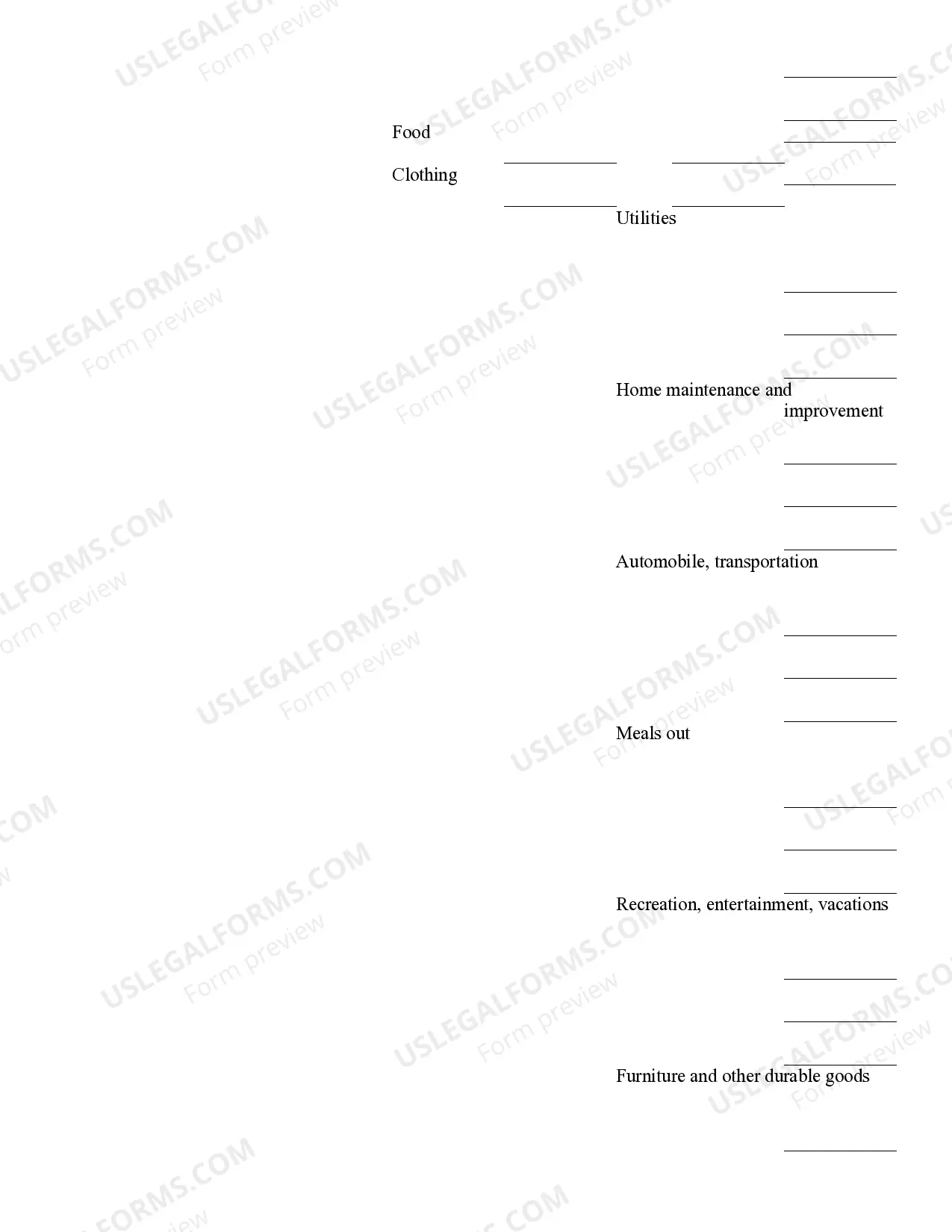

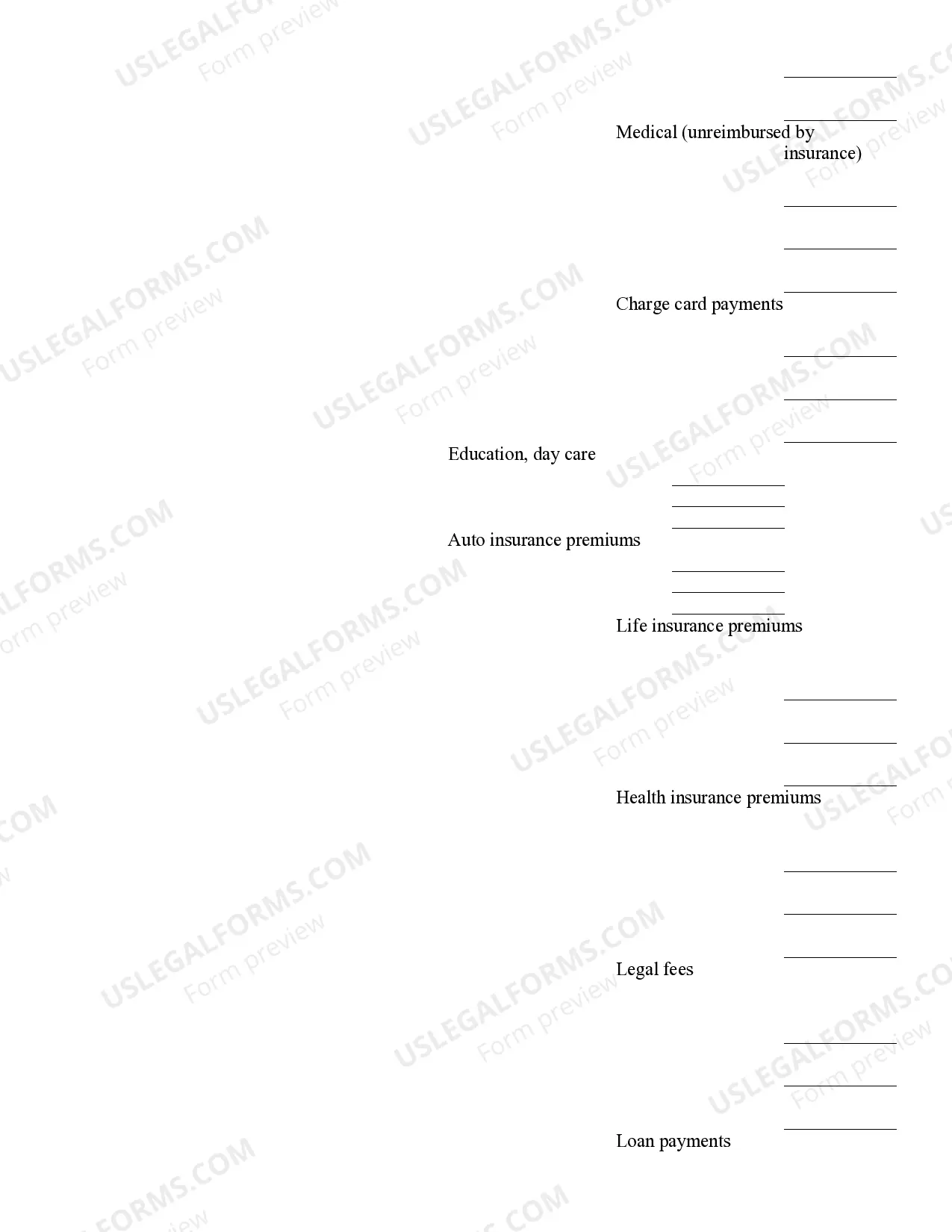

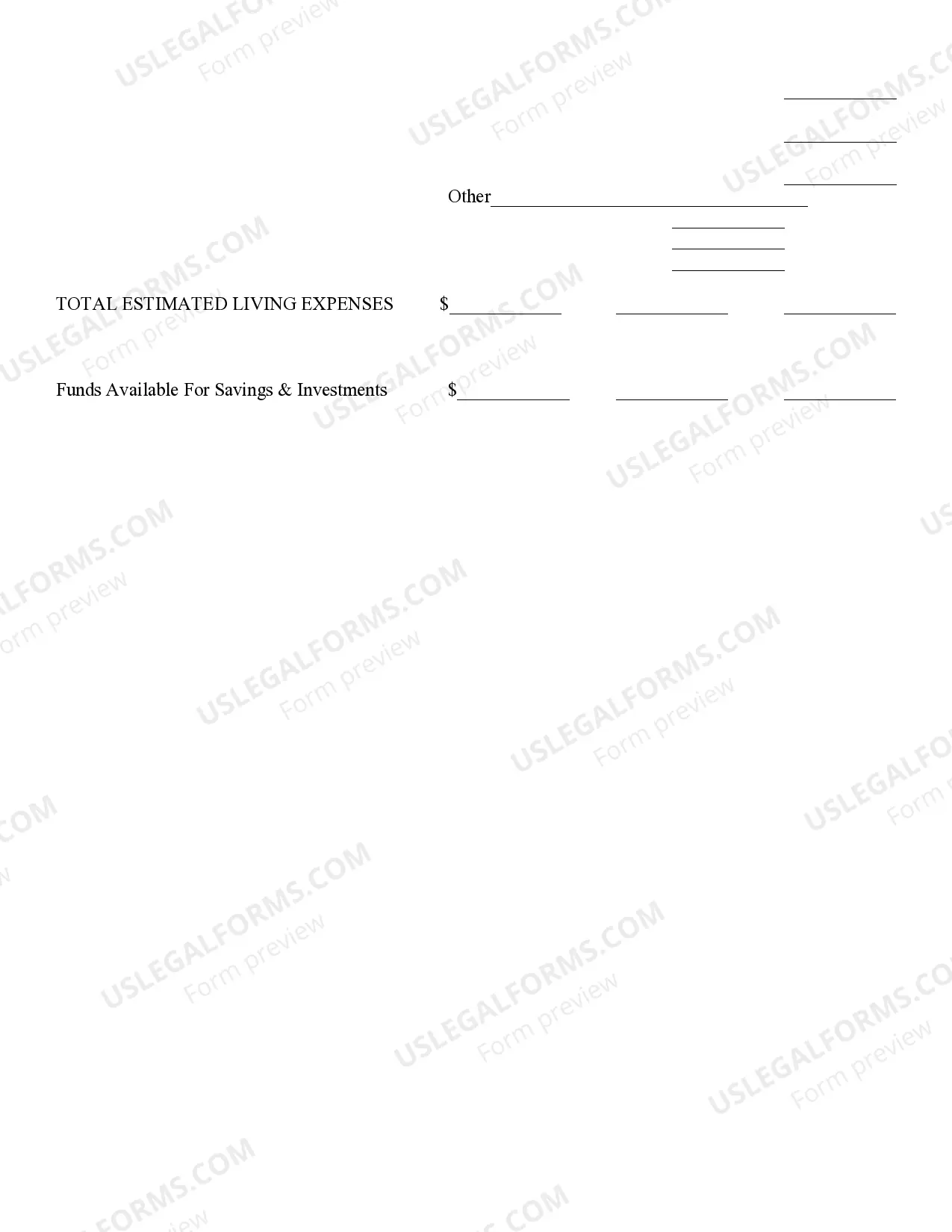

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Tempe Arizona Retirement Cash Flow refers to the income or cash flow a retiree receives during their retirement years while residing in the city of Tempe, Arizona. It encompasses various sources of income, such as retirement savings, pensions, Social Security benefits, investment returns, rental income, and any other income streams that contribute to the retiree's financial stability in retirement. Retirement cash flow in Tempe, Arizona can vary depending on the individual's financial situation and assets. Some common types of Tempe Arizona Retirement Cash Flow include: 1. Social Security Benefits: Retirees in Tempe can receive Social Security benefits, which are based on their work history and earnings throughout their career. These benefits can provide a steady cash flow to support retirees' lifestyle and cover their basic expenses. 2. Pension Plans: Some retirees in Tempe may have pension plans through their former employers. These defined benefit plans provide a fixed amount of cash flow to retirees based on their years of service and salary. Pension plans can be a reliable source of retirement income. 3. 401(k) or Individual Retirement Accounts (IRAs): Many individuals in Tempe contribute to retirement accounts like 401(k) or IRAs during their working years. These accounts can be used to generate cash flow during retirement through withdrawals or annuities. 4. Rental Income: Some retirees in Tempe may own rental properties from which they earn rental income. This can be an additional source of cash flow to supplement their retirement savings. 5. Investment Returns: Retirees may have invested in stocks, bonds, mutual funds, or real estate properties, which can generate returns to the form of dividends, interest, or capital gains. These investment returns add to the retirement cash flow and provide potential growth opportunities. 6. Annuities and Life Insurance: Retirees may opt to purchase annuities or life insurance policies that offer regular payments or lump-sum cash payouts during retirement. These financial products can provide additional cash flow to meet retirement needs. 7. Part-Time Employment: Some retirees in Tempe may choose to work part-time during retirement, either by continuing their previous profession or exploring new opportunities. This can provide both financial and social benefits, increasing their overall retirement cash flow. In summary, Tempe Arizona Retirement Cash Flow refers to the various sources of income that retirees in Tempe, Arizona rely on to financially support their retirement lifestyle. It can include Social Security benefits, pension plans, retirement savings, investment returns, rental income, and part-time employment. By diversifying their retirement cash flow, retirees can enhance their financial security and enjoy a fulfilling retirement in Tempe, Arizona.Tempe Arizona Retirement Cash Flow refers to the income or cash flow a retiree receives during their retirement years while residing in the city of Tempe, Arizona. It encompasses various sources of income, such as retirement savings, pensions, Social Security benefits, investment returns, rental income, and any other income streams that contribute to the retiree's financial stability in retirement. Retirement cash flow in Tempe, Arizona can vary depending on the individual's financial situation and assets. Some common types of Tempe Arizona Retirement Cash Flow include: 1. Social Security Benefits: Retirees in Tempe can receive Social Security benefits, which are based on their work history and earnings throughout their career. These benefits can provide a steady cash flow to support retirees' lifestyle and cover their basic expenses. 2. Pension Plans: Some retirees in Tempe may have pension plans through their former employers. These defined benefit plans provide a fixed amount of cash flow to retirees based on their years of service and salary. Pension plans can be a reliable source of retirement income. 3. 401(k) or Individual Retirement Accounts (IRAs): Many individuals in Tempe contribute to retirement accounts like 401(k) or IRAs during their working years. These accounts can be used to generate cash flow during retirement through withdrawals or annuities. 4. Rental Income: Some retirees in Tempe may own rental properties from which they earn rental income. This can be an additional source of cash flow to supplement their retirement savings. 5. Investment Returns: Retirees may have invested in stocks, bonds, mutual funds, or real estate properties, which can generate returns to the form of dividends, interest, or capital gains. These investment returns add to the retirement cash flow and provide potential growth opportunities. 6. Annuities and Life Insurance: Retirees may opt to purchase annuities or life insurance policies that offer regular payments or lump-sum cash payouts during retirement. These financial products can provide additional cash flow to meet retirement needs. 7. Part-Time Employment: Some retirees in Tempe may choose to work part-time during retirement, either by continuing their previous profession or exploring new opportunities. This can provide both financial and social benefits, increasing their overall retirement cash flow. In summary, Tempe Arizona Retirement Cash Flow refers to the various sources of income that retirees in Tempe, Arizona rely on to financially support their retirement lifestyle. It can include Social Security benefits, pension plans, retirement savings, investment returns, rental income, and part-time employment. By diversifying their retirement cash flow, retirees can enhance their financial security and enjoy a fulfilling retirement in Tempe, Arizona.