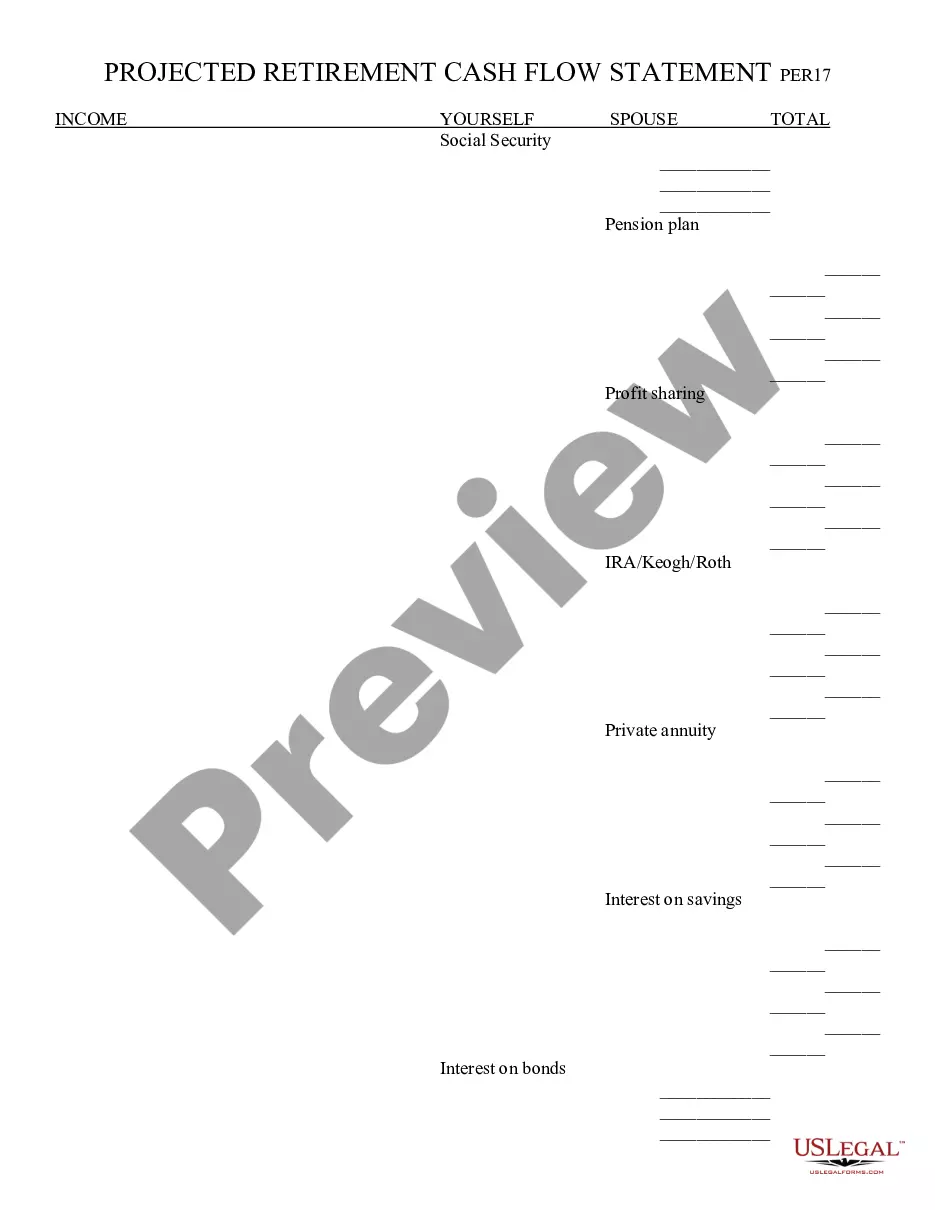

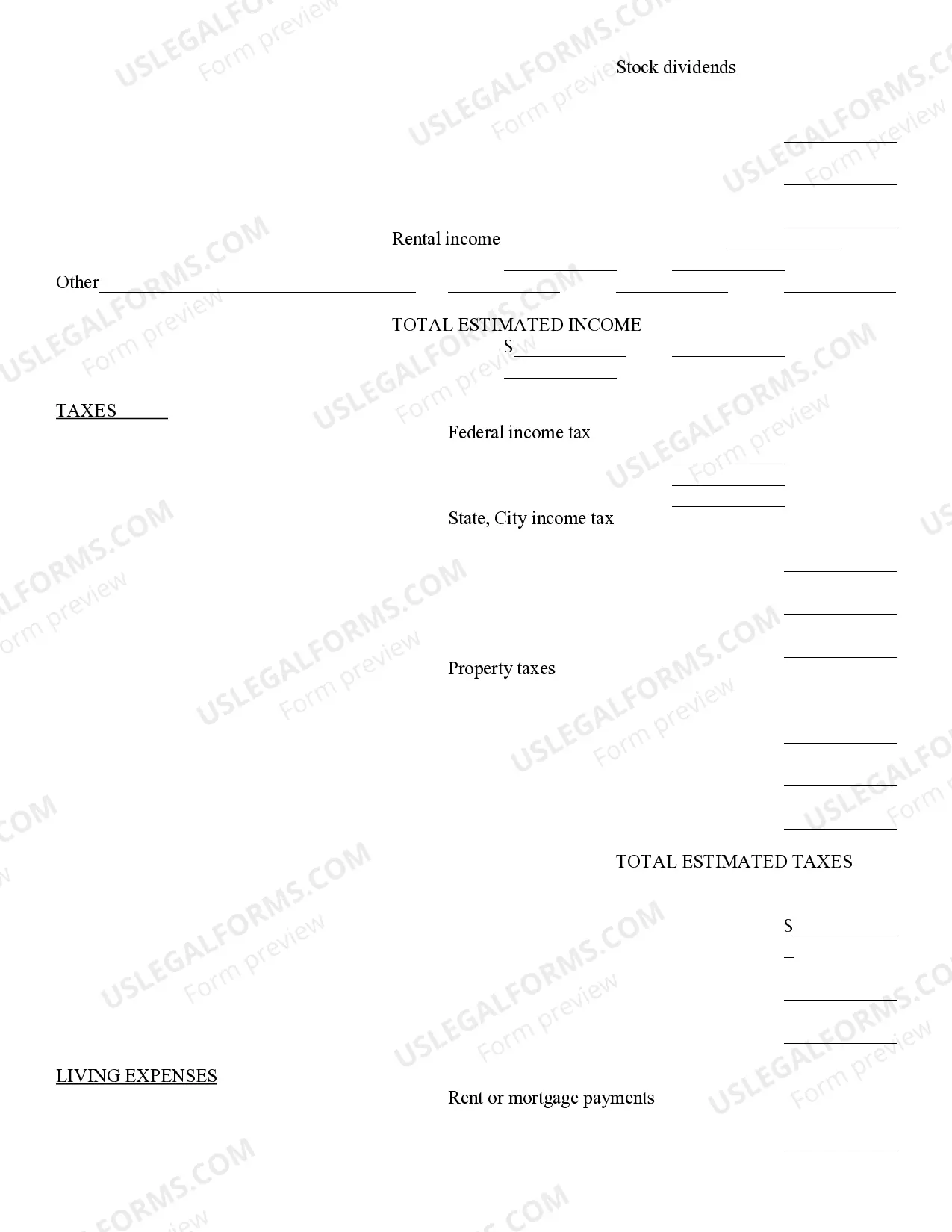

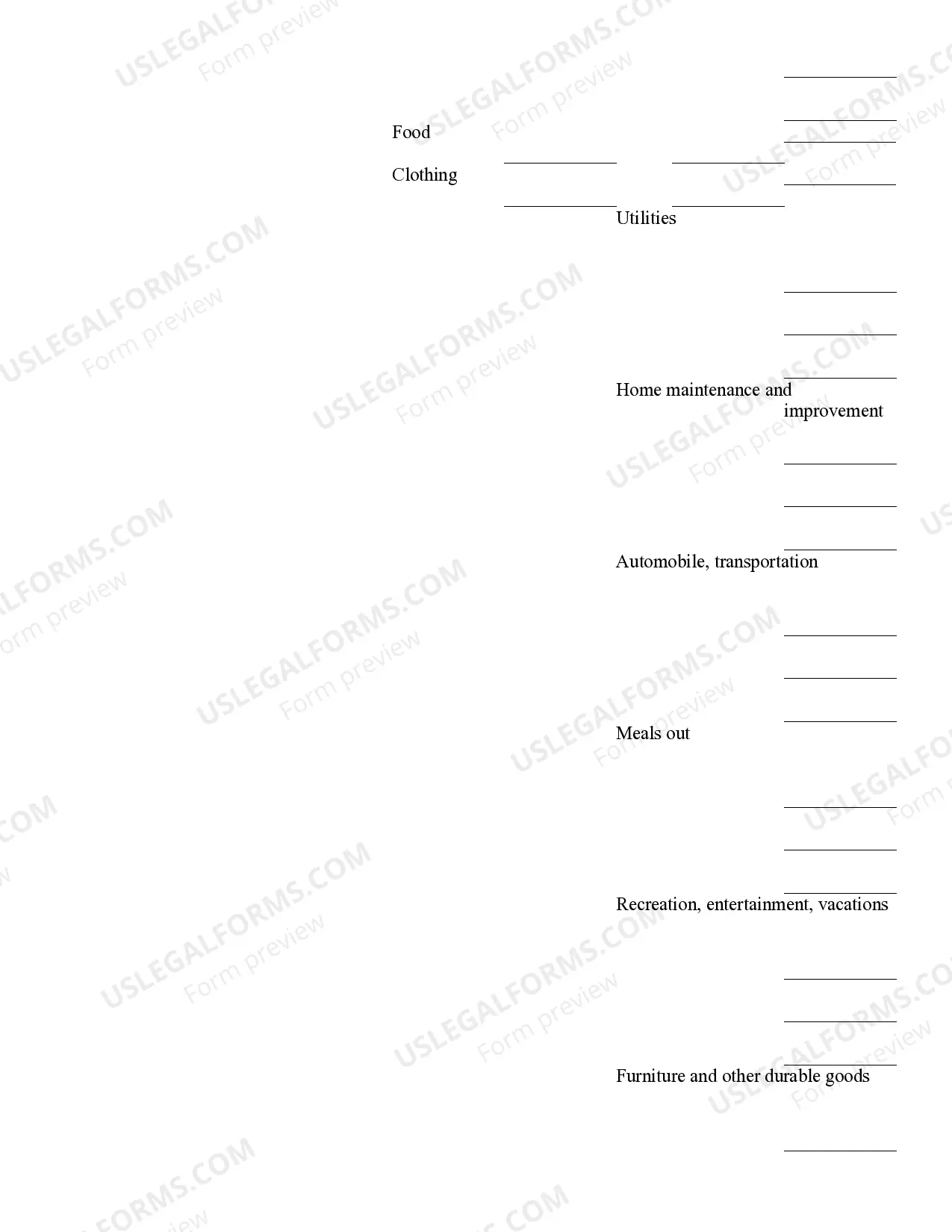

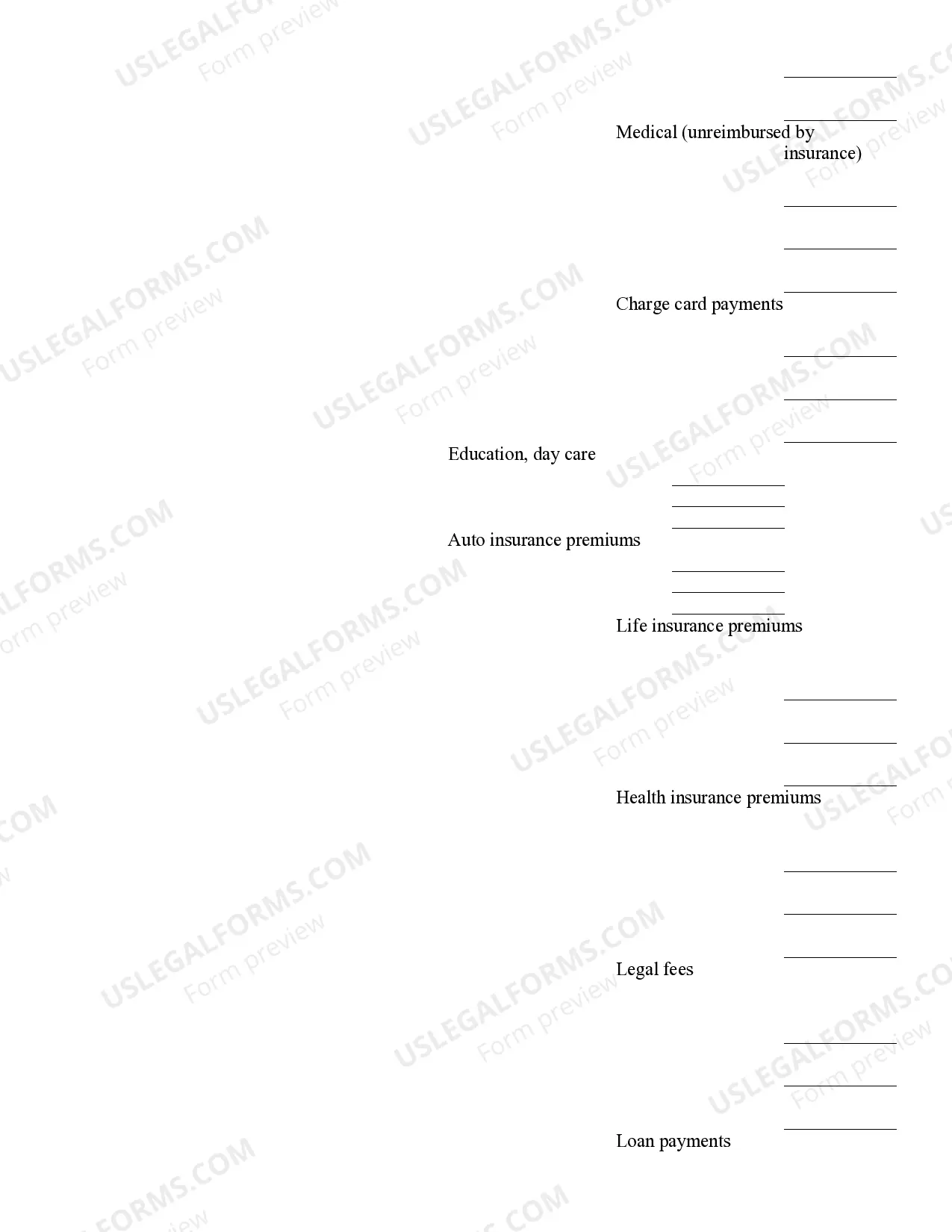

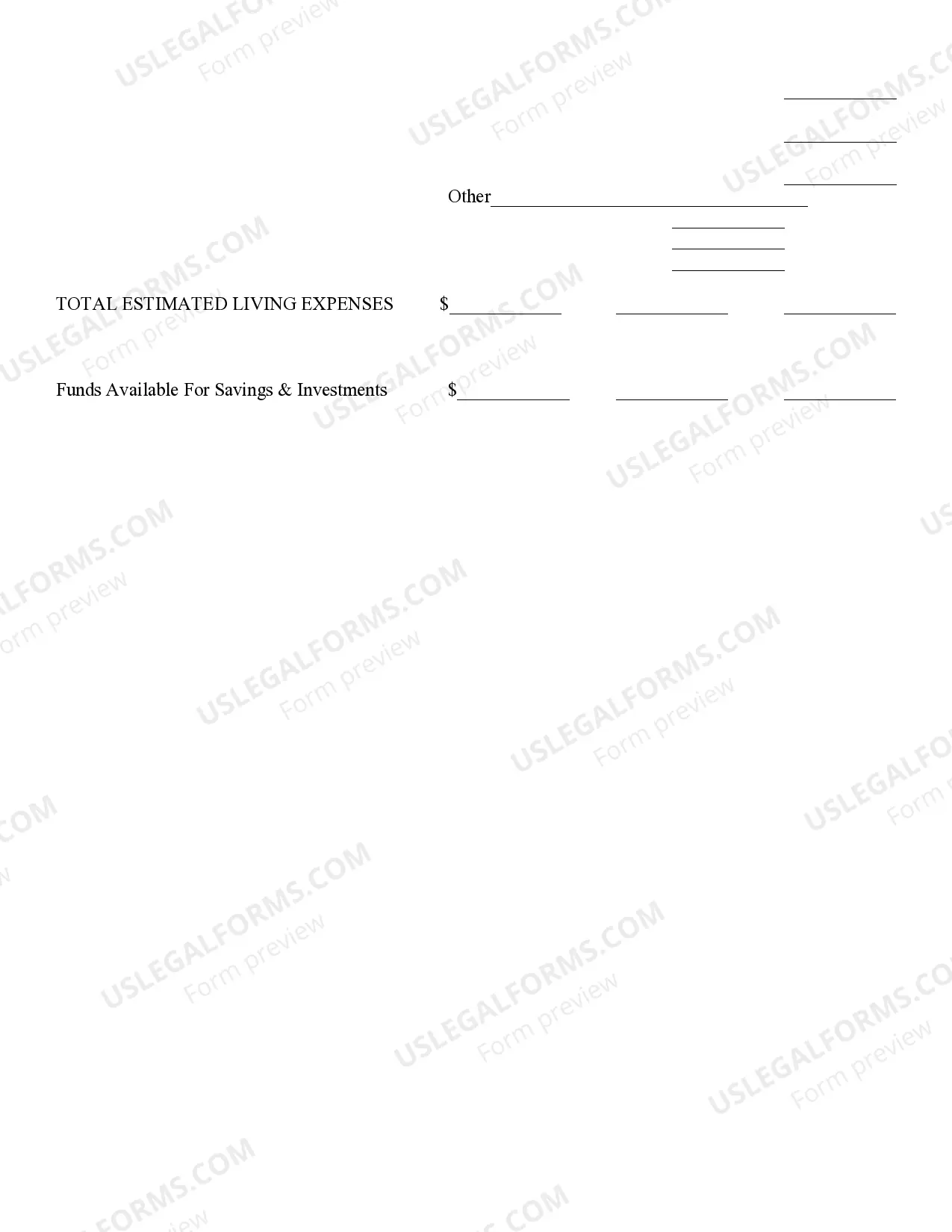

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Tucson, Arizona Retirement Cash Flow: Detailed Description and Types Tucson, located in the beautiful state of Arizona, is a popular destination for retirees seeking a serene yet vibrant lifestyle. Aside from its picturesque landscapes and warm climate, Tucson offers a variety of retirement cash flow options to ensure a comfortable and financially stable future. One type of retirement cash flow in Tucson is Social Security income. Retirees can rely on this federal program, which provides a monthly payment based on their lifetime earnings. Tucson's relatively low cost of living compared to other retirement destinations makes the Social Security income a valuable asset, as it can cover essential expenses such as housing, healthcare, and daily living costs. Another retirement cash flow option in Tucson is an individual's personal savings and investments. Many retirees have diligently saved throughout their working years and can now enjoy the fruits of their financial prudence. These savings can be utilized to provide an additional cushion for retirement, ensuring a higher standard of living and enabling retirees to indulge in leisure activities, travel, or pursue new hobbies. Real estate investments also form a significant aspect of Tucson's retirement cash flow options. Retirees can invest in properties such as rental homes, multi-family units, or even commercial spaces to generate passive income. The demand for rental properties in Tucson remains consistent due to a growing population and an influx of tourists, allowing retirees to have reliable streams of cash flow beyond traditional retirement sources. Pension plans are another source of retirement cash flow in Tucson. Many retirees may have worked for companies or organizations that offer pension benefits, guaranteeing them a fixed income after retirement. These pension plans often act as a stable source of cash flow, providing retirees with peace of mind and financial security in their golden years. Additionally, part-time employment or consulting opportunities serve as supplementary retirement cash flow options in Tucson. Many retirees choose to continue working on a more flexible basis to not only boost their income but also maintain a sense of purpose and engagement within the community. In summary, Tucson, Arizona, offers retirees various retirement cash flow options to ensure a fulfilling and financially secure lifestyle. These options include Social Security income, personal savings and investments, real estate investments, pension plans, and part-time employment. With careful planning and allocation of resources, retirees can enjoy the desert beauty and abundant opportunities that Tucson has to offer while maintaining a comfortable and worry-free retirement.Tucson, Arizona Retirement Cash Flow: Detailed Description and Types Tucson, located in the beautiful state of Arizona, is a popular destination for retirees seeking a serene yet vibrant lifestyle. Aside from its picturesque landscapes and warm climate, Tucson offers a variety of retirement cash flow options to ensure a comfortable and financially stable future. One type of retirement cash flow in Tucson is Social Security income. Retirees can rely on this federal program, which provides a monthly payment based on their lifetime earnings. Tucson's relatively low cost of living compared to other retirement destinations makes the Social Security income a valuable asset, as it can cover essential expenses such as housing, healthcare, and daily living costs. Another retirement cash flow option in Tucson is an individual's personal savings and investments. Many retirees have diligently saved throughout their working years and can now enjoy the fruits of their financial prudence. These savings can be utilized to provide an additional cushion for retirement, ensuring a higher standard of living and enabling retirees to indulge in leisure activities, travel, or pursue new hobbies. Real estate investments also form a significant aspect of Tucson's retirement cash flow options. Retirees can invest in properties such as rental homes, multi-family units, or even commercial spaces to generate passive income. The demand for rental properties in Tucson remains consistent due to a growing population and an influx of tourists, allowing retirees to have reliable streams of cash flow beyond traditional retirement sources. Pension plans are another source of retirement cash flow in Tucson. Many retirees may have worked for companies or organizations that offer pension benefits, guaranteeing them a fixed income after retirement. These pension plans often act as a stable source of cash flow, providing retirees with peace of mind and financial security in their golden years. Additionally, part-time employment or consulting opportunities serve as supplementary retirement cash flow options in Tucson. Many retirees choose to continue working on a more flexible basis to not only boost their income but also maintain a sense of purpose and engagement within the community. In summary, Tucson, Arizona, offers retirees various retirement cash flow options to ensure a fulfilling and financially secure lifestyle. These options include Social Security income, personal savings and investments, real estate investments, pension plans, and part-time employment. With careful planning and allocation of resources, retirees can enjoy the desert beauty and abundant opportunities that Tucson has to offer while maintaining a comfortable and worry-free retirement.