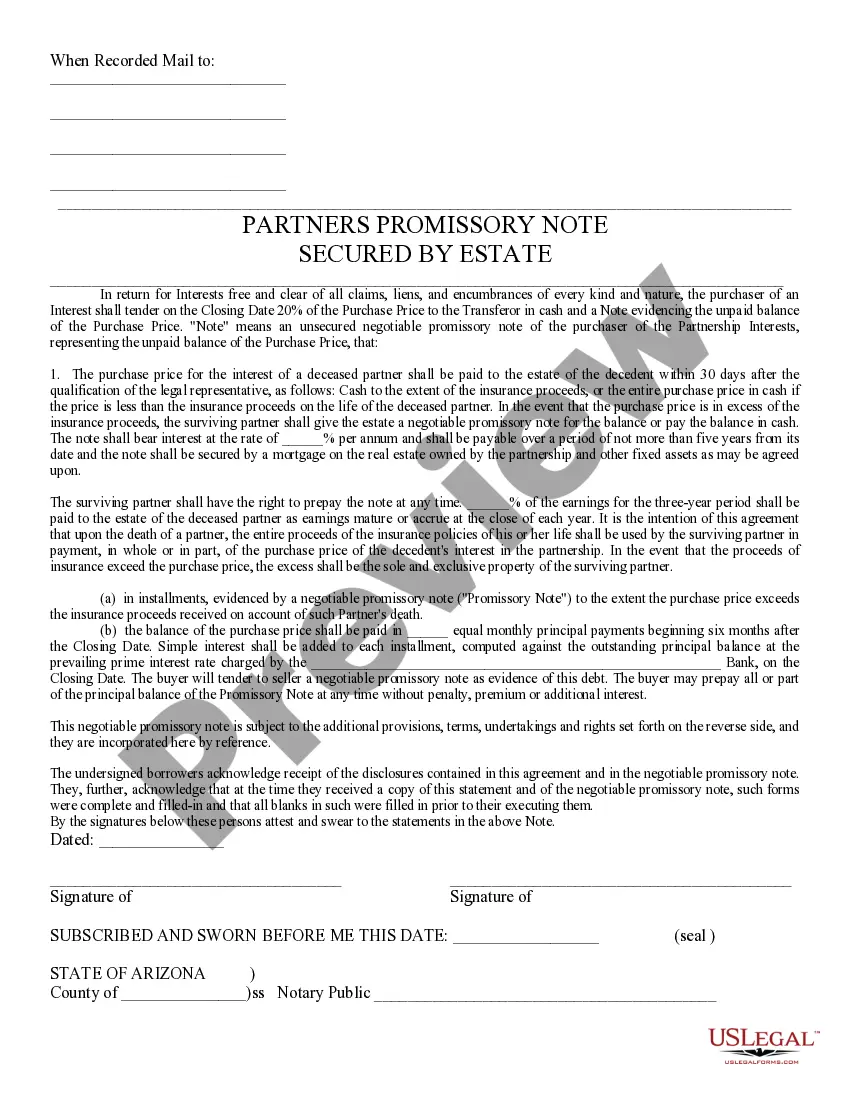

In return for interests free and clear of all claims, liens, and encumbrances of every kind and nature, the purchaser of an interest shall tender on the closing date a certain percentage of the purchase price to the transferor in cash and a note evidencing the unpaid balance of the purchase price.

A Mesa Arizona Partners Note Secured by Estate refers to a legal document that acts as evidence of an agreement between partners in Mesa, Arizona, where a specific property is used as collateral to secure a loan or debt. This type of note is commonly utilized in real estate transactions or business ventures involving multiple partners. In such an agreement, the primary parties involved are the partners and the lender. The partners could be individuals, corporations, or any other legal entities who have entered into a partnership for a common purpose, such as purchasing a property for investment or starting a business venture. The lender, on the other hand, can be a financial institution, private investor, or an individual who provides the necessary funds. The key aspect of a Partners Note Secured by Estate is the collateral involved, which is typically a valuable property or estate owned by the partners. This collateral acts as security for the lender, ensuring that if the partners default on the loan, the lender has the right to seize and sell the property to recover the outstanding debts. The lender will likely conduct a thorough evaluation of the estate's value and condition before approving the loan amount and determining the terms and interest rates. Different types of Partners Notes Secured by Estate can vary based on the nature of the partnership and the purpose of the loan. Some common variations include: 1. Real Estate Partnership Note: This type of note involves partners who collaborate to invest in real estate properties, such as residential or commercial buildings. The partners pool their resources to acquire the property and secure a loan using it as collateral. The earned income from the property may be used to repay the loan. 2. Business Partnership Note: In this case, a group of partners comes together to establish a business venture, such as a restaurant, retail store, or technology startup. The partners may need additional capital to start or expand their business, and they utilize a loan secured by the partnership's assets, including any real estate, equipment, or inventory. 3. Joint Venture Note: A joint venture typically involves two or more parties joining forces for a specific project or endeavor. These partners may collaborate on a real estate development project or a large-scale business venture. A note secured by estate can be used to finance the joint venture, with all partners sharing responsibility for repayment. Overall, a Mesa Arizona Partners Note Secured by Estate is a legal instrument that enables partners in Mesa, Arizona, to secure a loan by offering a valuable property or estate as collateral. The exact terms and conditions of the note will vary depending on the partnership's nature, the purpose of the loan, and the lender's requirements.A Mesa Arizona Partners Note Secured by Estate refers to a legal document that acts as evidence of an agreement between partners in Mesa, Arizona, where a specific property is used as collateral to secure a loan or debt. This type of note is commonly utilized in real estate transactions or business ventures involving multiple partners. In such an agreement, the primary parties involved are the partners and the lender. The partners could be individuals, corporations, or any other legal entities who have entered into a partnership for a common purpose, such as purchasing a property for investment or starting a business venture. The lender, on the other hand, can be a financial institution, private investor, or an individual who provides the necessary funds. The key aspect of a Partners Note Secured by Estate is the collateral involved, which is typically a valuable property or estate owned by the partners. This collateral acts as security for the lender, ensuring that if the partners default on the loan, the lender has the right to seize and sell the property to recover the outstanding debts. The lender will likely conduct a thorough evaluation of the estate's value and condition before approving the loan amount and determining the terms and interest rates. Different types of Partners Notes Secured by Estate can vary based on the nature of the partnership and the purpose of the loan. Some common variations include: 1. Real Estate Partnership Note: This type of note involves partners who collaborate to invest in real estate properties, such as residential or commercial buildings. The partners pool their resources to acquire the property and secure a loan using it as collateral. The earned income from the property may be used to repay the loan. 2. Business Partnership Note: In this case, a group of partners comes together to establish a business venture, such as a restaurant, retail store, or technology startup. The partners may need additional capital to start or expand their business, and they utilize a loan secured by the partnership's assets, including any real estate, equipment, or inventory. 3. Joint Venture Note: A joint venture typically involves two or more parties joining forces for a specific project or endeavor. These partners may collaborate on a real estate development project or a large-scale business venture. A note secured by estate can be used to finance the joint venture, with all partners sharing responsibility for repayment. Overall, a Mesa Arizona Partners Note Secured by Estate is a legal instrument that enables partners in Mesa, Arizona, to secure a loan by offering a valuable property or estate as collateral. The exact terms and conditions of the note will vary depending on the partnership's nature, the purpose of the loan, and the lender's requirements.