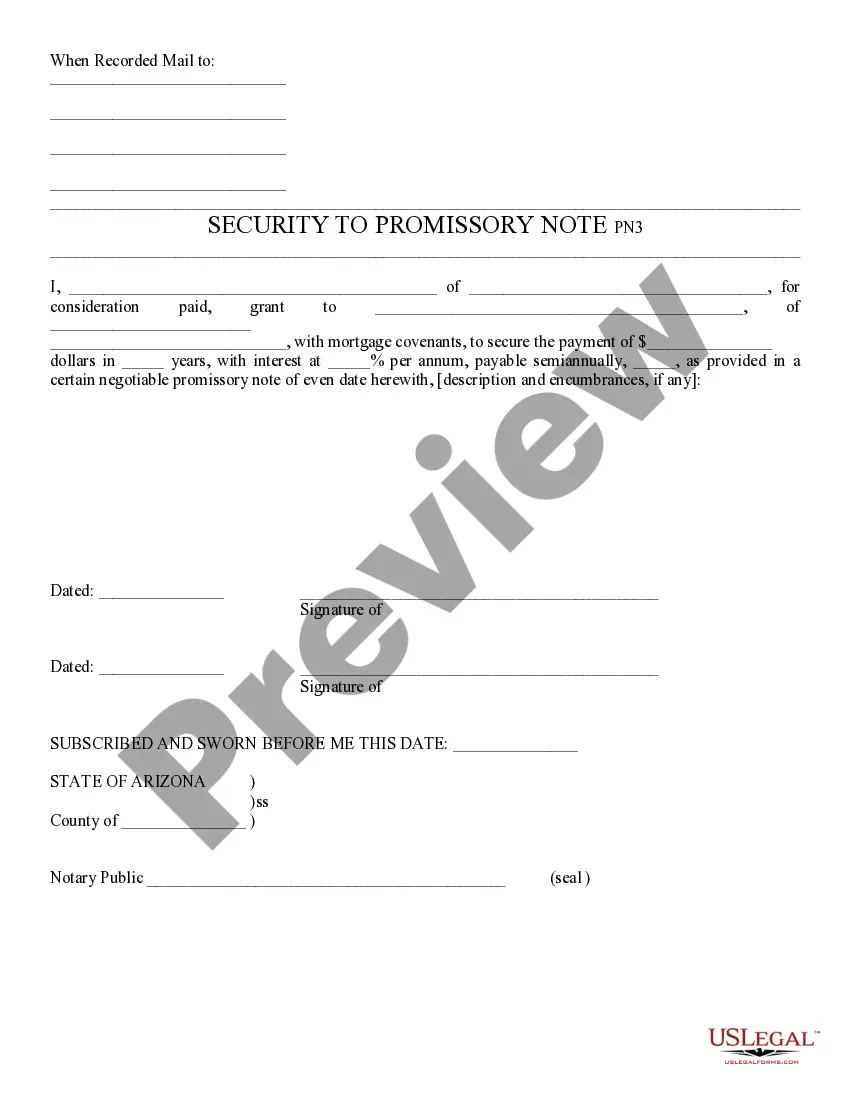

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Gilbert Arizona Security to Promissory Note is a legal instrument that ensures the protection of lenders and borrowers engaging in financial transactions within the town of Gilbert, Arizona. A Promissory Note is a written promise from the borrower to repay a certain amount of money to the lender within specified terms and conditions. In order to secure the repayment, a security agreement is often associated with the Promissory Note, granting the lender a security interest in specific assets or property of the borrower. In Gilbert, Arizona, there are several types of security to Promissory Note commonly used to safeguard lenders' interests. These include: 1. Real Estate Security: This type of security involves using real property, such as land or buildings, as collateral for the Promissory Note. The borrower agrees to grant the lender a security interest in the property, which can be foreclosed upon in the event of default. 2. Personal Property Security: Gilbert Arizona Security to Promissory Note can also be backed by personal property, which includes movable assets like vehicles, equipment, or inventory. The borrower pledges these items as collateral, and the lender may seize and sell them to recoup the outstanding debt if the borrower defaults. 3. Blanket Security: In some cases, borrowers may provide a blanket security interest, which encompasses all their present and future assets and property. This type of security is commonly used when the borrower has a wide range of assets that may change or expand over time. 4. Collateral Assignment: Another type of Gilbert Arizona Security to Promissory Note is collateral assignment, where the borrower assigns a specific existing asset, such as a life insurance policy or stocks, to the lender as collateral. In case of default, the lender can claim the asset's value to satisfy the debt. It is essential for lenders and borrowers in Gilbert, Arizona to understand and incorporate proper security measures when entering into Promissory Note agreements. By utilizing appropriate security mechanisms, both parties can ensure a fair and secure transaction, reducing the risk of potential financial loss. When drafting or enforcing a Gilbert Arizona Security to Promissory Note, consulting with legal professionals experienced in local laws and regulations is highly recommended ensuring compliance and protect the rights of all involved parties.Gilbert Arizona Security to Promissory Note is a legal instrument that ensures the protection of lenders and borrowers engaging in financial transactions within the town of Gilbert, Arizona. A Promissory Note is a written promise from the borrower to repay a certain amount of money to the lender within specified terms and conditions. In order to secure the repayment, a security agreement is often associated with the Promissory Note, granting the lender a security interest in specific assets or property of the borrower. In Gilbert, Arizona, there are several types of security to Promissory Note commonly used to safeguard lenders' interests. These include: 1. Real Estate Security: This type of security involves using real property, such as land or buildings, as collateral for the Promissory Note. The borrower agrees to grant the lender a security interest in the property, which can be foreclosed upon in the event of default. 2. Personal Property Security: Gilbert Arizona Security to Promissory Note can also be backed by personal property, which includes movable assets like vehicles, equipment, or inventory. The borrower pledges these items as collateral, and the lender may seize and sell them to recoup the outstanding debt if the borrower defaults. 3. Blanket Security: In some cases, borrowers may provide a blanket security interest, which encompasses all their present and future assets and property. This type of security is commonly used when the borrower has a wide range of assets that may change or expand over time. 4. Collateral Assignment: Another type of Gilbert Arizona Security to Promissory Note is collateral assignment, where the borrower assigns a specific existing asset, such as a life insurance policy or stocks, to the lender as collateral. In case of default, the lender can claim the asset's value to satisfy the debt. It is essential for lenders and borrowers in Gilbert, Arizona to understand and incorporate proper security measures when entering into Promissory Note agreements. By utilizing appropriate security mechanisms, both parties can ensure a fair and secure transaction, reducing the risk of potential financial loss. When drafting or enforcing a Gilbert Arizona Security to Promissory Note, consulting with legal professionals experienced in local laws and regulations is highly recommended ensuring compliance and protect the rights of all involved parties.