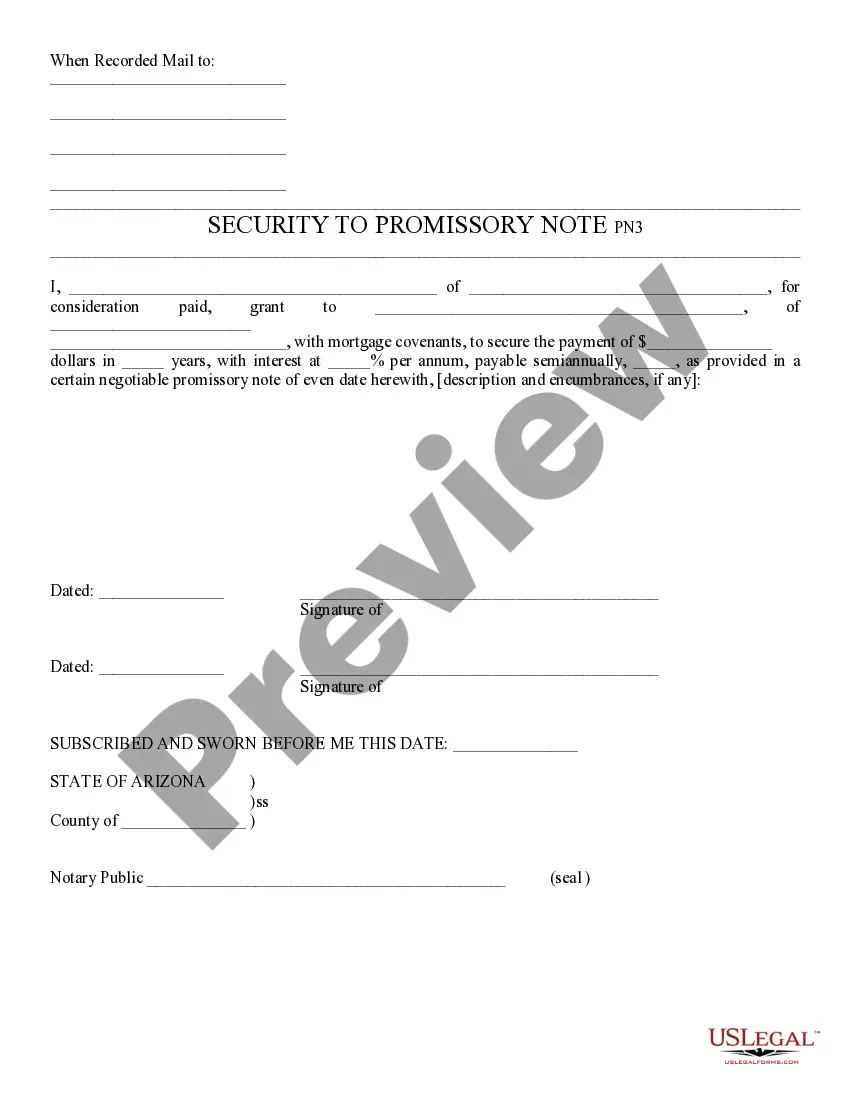

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Maricopa Arizona Security to Promissory Note is a legally binding document that establishes an agreement between a lender and a borrower regarding the repayment of a loan. It ensures the lender's security by allowing them to claim an identified asset or property if the borrower fails to meet the repayment obligations outlined in the note. This type of promissory note is specific to Maricopa, Arizona and is subject to the state's laws and regulations. There are different types of Maricopa Arizona Security to Promissory Note that can be used depending on the specific circumstances: 1. Real Estate Promissory Note: This note is commonly used for loans related to real estate transactions. It includes specific details about the property, such as its address, legal description, and any encumbrances. In case of default, the lender has the right to initiate foreclosure proceedings on the property. 2. Personal Property Promissory Note: This note is applicable when the loan is granted for personal possessions such as vehicles, boats, or valuable assets. The borrower pledges the identified personal property as collateral, and in case of default, the lender has the right to seize and sell the pledged item to recover the outstanding debt. 3. Secured Promissory Note with Co-signer: This type of note involves a co-signer who guarantees repayment in case the primary borrower defaults. Both the borrower and the co-signer are jointly liable for the debt, and the lender can pursue either party or both for repayment. 4. Business Promissory Note: This note is specifically designed for loans extended to businesses or commercial ventures. It outlines the terms of the loan, including the repayment schedule, interest rate, and any security agreements to protect the lender's interests, such as a lien on business assets or accounts receivable. Maricopa Arizona Security to Promissory Note provides a legal framework for lenders and borrowers to establish a clear understanding of the loan terms and the consequences of default. It is important for all parties involved to carefully review and negotiate the terms of the note before signing to ensure their rights and obligations are protected. Consulting with an attorney familiar with Maricopa, Arizona laws is highly recommended ensuring compliance with local regulations and avoid any potential legal issues.Maricopa Arizona Security to Promissory Note is a legally binding document that establishes an agreement between a lender and a borrower regarding the repayment of a loan. It ensures the lender's security by allowing them to claim an identified asset or property if the borrower fails to meet the repayment obligations outlined in the note. This type of promissory note is specific to Maricopa, Arizona and is subject to the state's laws and regulations. There are different types of Maricopa Arizona Security to Promissory Note that can be used depending on the specific circumstances: 1. Real Estate Promissory Note: This note is commonly used for loans related to real estate transactions. It includes specific details about the property, such as its address, legal description, and any encumbrances. In case of default, the lender has the right to initiate foreclosure proceedings on the property. 2. Personal Property Promissory Note: This note is applicable when the loan is granted for personal possessions such as vehicles, boats, or valuable assets. The borrower pledges the identified personal property as collateral, and in case of default, the lender has the right to seize and sell the pledged item to recover the outstanding debt. 3. Secured Promissory Note with Co-signer: This type of note involves a co-signer who guarantees repayment in case the primary borrower defaults. Both the borrower and the co-signer are jointly liable for the debt, and the lender can pursue either party or both for repayment. 4. Business Promissory Note: This note is specifically designed for loans extended to businesses or commercial ventures. It outlines the terms of the loan, including the repayment schedule, interest rate, and any security agreements to protect the lender's interests, such as a lien on business assets or accounts receivable. Maricopa Arizona Security to Promissory Note provides a legal framework for lenders and borrowers to establish a clear understanding of the loan terms and the consequences of default. It is important for all parties involved to carefully review and negotiate the terms of the note before signing to ensure their rights and obligations are protected. Consulting with an attorney familiar with Maricopa, Arizona laws is highly recommended ensuring compliance with local regulations and avoid any potential legal issues.