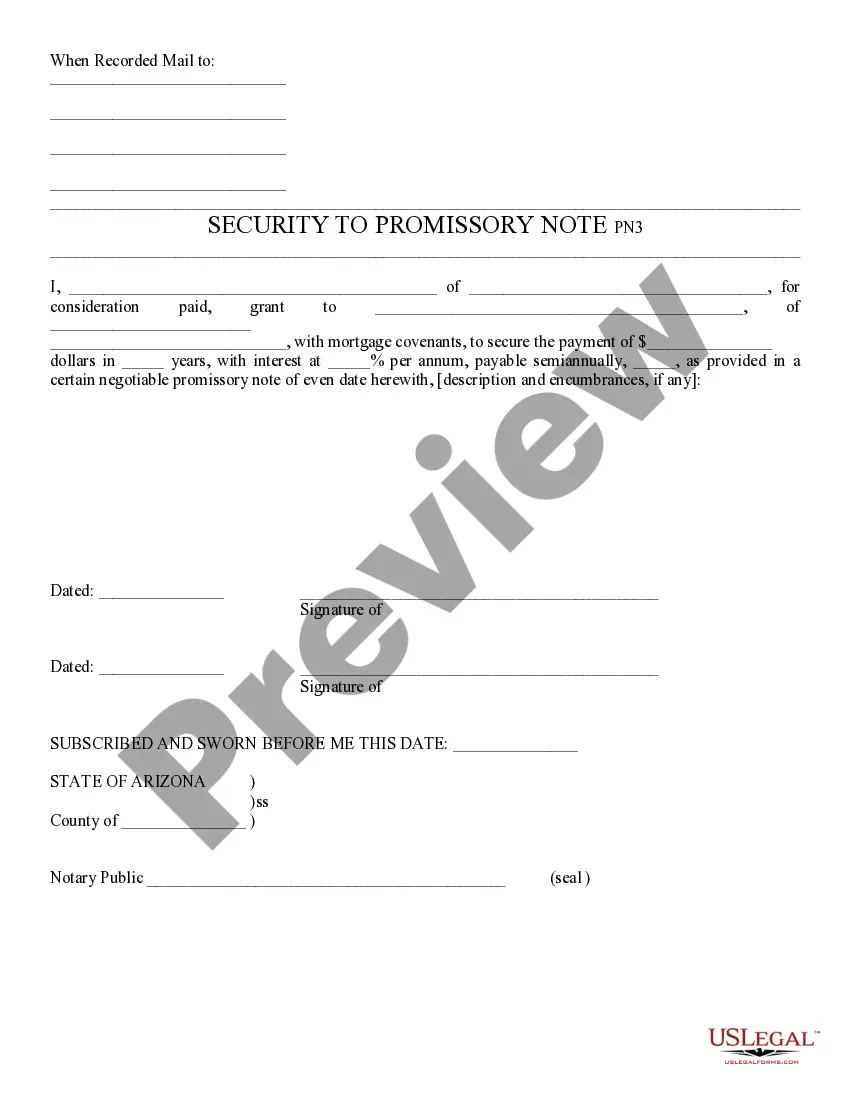

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Lima Arizona Security to Promissory Note is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in Lima, Arizona. It serves as evidence of the debt owed by the borrower to the lender and provides security for the repayment of the loan. This note is a crucial instrument in protecting the lender's rights and ensuring that the borrower fulfills their financial obligations. The Lima Arizona Security to Promissory Note typically contains essential details such as the principal amount borrowed, the interest rate charged, the repayment schedule, and any applicable late fees or penalties. In addition, it may also include provisions regarding prepayment options, default consequences, collateral requirements, and any other relevant terms agreed upon by both parties. These terms are essential to clarify the rights and responsibilities of both the lender and the borrower. When it comes to different types of Lima Arizona Security to Promissory Note, there may exist variations depending on the specific circumstances or objectives of the lender and borrower. For instance: 1. Secured Promissory Note: This type of note includes provisions for collateral, such as property or assets, that the borrower pledges as security. In case of default, the lender can pursue legal remedies to seize or liquidate the collateral to recover the loan amount. 2. Unsecured Promissory Note: In contrast to a secured note, an unsecured note does not require collateral. The borrower's creditworthiness is typically the primary basis upon which the lender decides to extend the loan. 3. Balloon Promissory Note: This note structure involves scheduled payments for a certain period, followed by a final lump-sum payment, known as a balloon payment, to clear the remaining balance. Balloon notes are useful in situations where regular payments may be challenging for the borrower initially. 4. Installment Promissory Note: This type of note involves regular, equal payments over a defined period, typically monthly or quarterly. Each payment covers both the principal amount borrowed and the accrued interest. It's essential for both lenders and borrowers in Lima, Arizona, to understand the specific type of promissory note they are entering into and seek legal advice if necessary. By clearly defining the terms and conditions in a Lima Arizona Security to Promissory Note, both parties can ensure a fair and transparent loan agreement while mitigating financial risks.Lima Arizona Security to Promissory Note is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in Lima, Arizona. It serves as evidence of the debt owed by the borrower to the lender and provides security for the repayment of the loan. This note is a crucial instrument in protecting the lender's rights and ensuring that the borrower fulfills their financial obligations. The Lima Arizona Security to Promissory Note typically contains essential details such as the principal amount borrowed, the interest rate charged, the repayment schedule, and any applicable late fees or penalties. In addition, it may also include provisions regarding prepayment options, default consequences, collateral requirements, and any other relevant terms agreed upon by both parties. These terms are essential to clarify the rights and responsibilities of both the lender and the borrower. When it comes to different types of Lima Arizona Security to Promissory Note, there may exist variations depending on the specific circumstances or objectives of the lender and borrower. For instance: 1. Secured Promissory Note: This type of note includes provisions for collateral, such as property or assets, that the borrower pledges as security. In case of default, the lender can pursue legal remedies to seize or liquidate the collateral to recover the loan amount. 2. Unsecured Promissory Note: In contrast to a secured note, an unsecured note does not require collateral. The borrower's creditworthiness is typically the primary basis upon which the lender decides to extend the loan. 3. Balloon Promissory Note: This note structure involves scheduled payments for a certain period, followed by a final lump-sum payment, known as a balloon payment, to clear the remaining balance. Balloon notes are useful in situations where regular payments may be challenging for the borrower initially. 4. Installment Promissory Note: This type of note involves regular, equal payments over a defined period, typically monthly or quarterly. Each payment covers both the principal amount borrowed and the accrued interest. It's essential for both lenders and borrowers in Lima, Arizona, to understand the specific type of promissory note they are entering into and seek legal advice if necessary. By clearly defining the terms and conditions in a Lima Arizona Security to Promissory Note, both parties can ensure a fair and transparent loan agreement while mitigating financial risks.