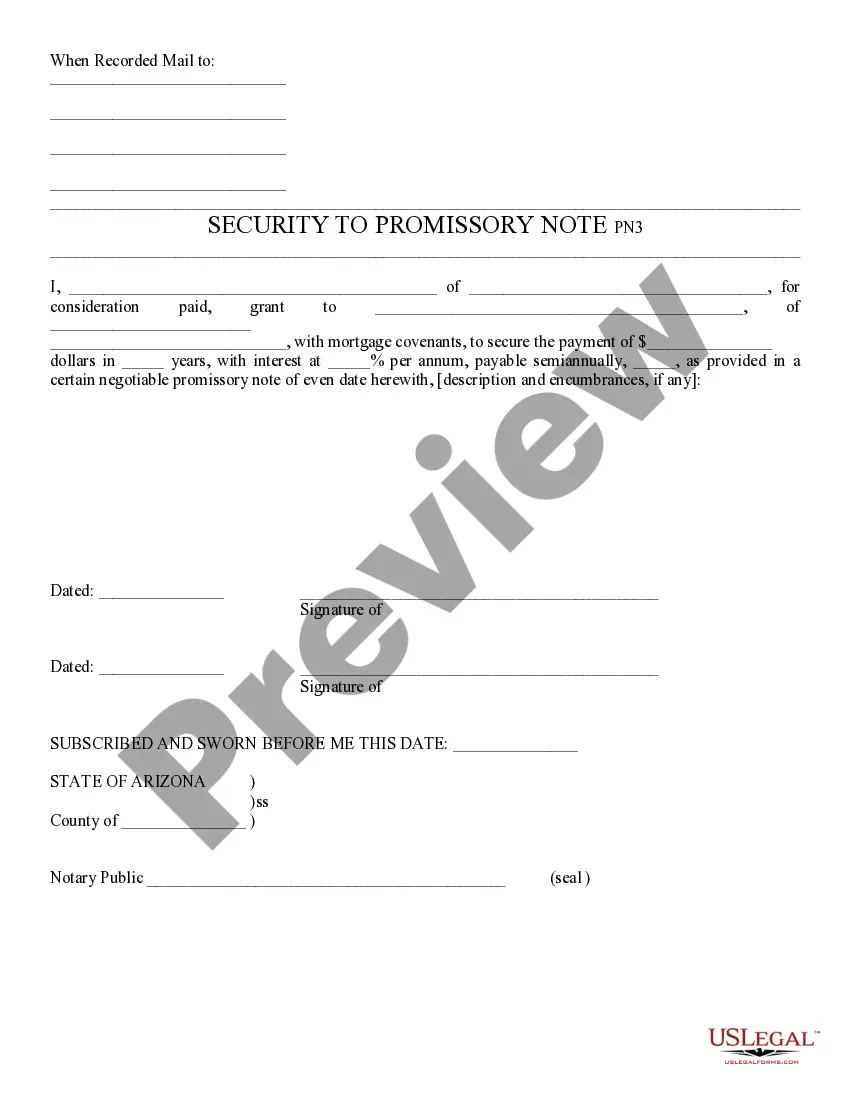

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Scottsdale, Arizona Security to Promissory Note A Security to Promissory Note in Scottsdale, Arizona acts as a legal contract that provides security to the lender in the event that the borrower defaults on their repayment obligations. This agreement ensures that the lender has a recourse to recover their investment by securing assets or collateral held by the borrower. There are different types of Scottsdale, Arizona Security to Promissory Notes. They include: 1. Real Estate Mortgage Promissory Note: This type of security to promissory note involves using real estate property as collateral. In this case, if the borrower fails to make timely payments or defaults, the lender can initiate foreclosure proceedings to satisfy the outstanding debt. 2. Business Promissory Note with Personal Guarantee: This type of promissory note is commonly used in financing business ventures. The borrower agrees to secure the loan with an asset, such as equipment, inventory, or accounts receivable. Additionally, the borrower provides a personal guarantee, ensuring repayment even if the business cannot fulfill its obligations. 3. Vehicle Promissory Note: This type of security to promissory note is commonly used in auto financing. The vehicle itself serves as collateral, and the lender can repossess it if the borrower fails to make payments. This type of note is often used by car dealerships or financial institutions offering auto loans. 4. Secured Promissory Note with Stocks or Bonds: This type of security to promissory note involves using stocks, bonds, or other securities as collateral. The borrower pledges these assets to secure the loan, providing the lender with a means of recourse if the borrower defaults. It is important for both parties involved in a Scottsdale, Arizona Security to Promissory Note to understand the terms and conditions outlined in the agreement. These may include the repayment schedule, interest rates, late payment penalties, and the process for handling defaults. Additionally, the note should comply with relevant federal and state laws to ensure its enforceability. By utilizing a Scottsdale, Arizona Security to Promissory Note, lenders can have peace of mind knowing that their investment is protected, while borrowers can benefit from potentially lower interest rates due to the reduced risk associated with secured loans.Scottsdale, Arizona Security to Promissory Note A Security to Promissory Note in Scottsdale, Arizona acts as a legal contract that provides security to the lender in the event that the borrower defaults on their repayment obligations. This agreement ensures that the lender has a recourse to recover their investment by securing assets or collateral held by the borrower. There are different types of Scottsdale, Arizona Security to Promissory Notes. They include: 1. Real Estate Mortgage Promissory Note: This type of security to promissory note involves using real estate property as collateral. In this case, if the borrower fails to make timely payments or defaults, the lender can initiate foreclosure proceedings to satisfy the outstanding debt. 2. Business Promissory Note with Personal Guarantee: This type of promissory note is commonly used in financing business ventures. The borrower agrees to secure the loan with an asset, such as equipment, inventory, or accounts receivable. Additionally, the borrower provides a personal guarantee, ensuring repayment even if the business cannot fulfill its obligations. 3. Vehicle Promissory Note: This type of security to promissory note is commonly used in auto financing. The vehicle itself serves as collateral, and the lender can repossess it if the borrower fails to make payments. This type of note is often used by car dealerships or financial institutions offering auto loans. 4. Secured Promissory Note with Stocks or Bonds: This type of security to promissory note involves using stocks, bonds, or other securities as collateral. The borrower pledges these assets to secure the loan, providing the lender with a means of recourse if the borrower defaults. It is important for both parties involved in a Scottsdale, Arizona Security to Promissory Note to understand the terms and conditions outlined in the agreement. These may include the repayment schedule, interest rates, late payment penalties, and the process for handling defaults. Additionally, the note should comply with relevant federal and state laws to ensure its enforceability. By utilizing a Scottsdale, Arizona Security to Promissory Note, lenders can have peace of mind knowing that their investment is protected, while borrowers can benefit from potentially lower interest rates due to the reduced risk associated with secured loans.