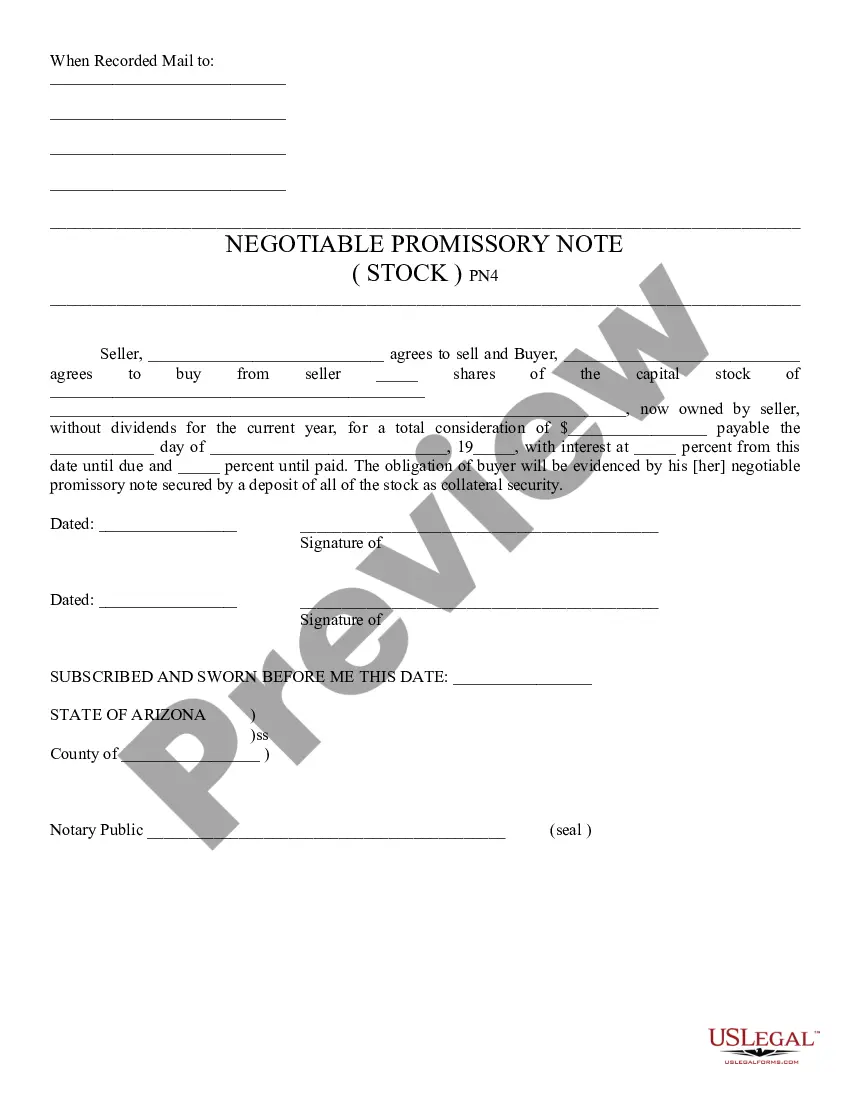

Negotiable Promissory Note for Stock - Arizona: This is a form which gives stock, in exchange for the signing of a negotiable promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

A Gilbert Arizona negotiable promissory note for stock is a legally binding document that outlines an agreement between two parties in which one party promises to repay a certain amount of stock to the other party by a specific date. This type of note is commonly used in business transactions, particularly in the context of startups, mergers, or acquisitions. In this agreement, the party borrowing the stock (the issuer) guarantees in writing to repay the stock with interest to the lender (the payee). The note specifies the terms and conditions of the repayment, including the principal amount, interest rate, maturity date, and any additional provisions that may be relevant. It is important to note that a negotiable promissory note for stock is a valuable financial instrument that can be transferred or sold to third parties as endorsed by the payee. The different types of Gilbert Arizona negotiable promissory notes for stock that may exist include: 1. Convertible Promissory Notes: These types of notes allow the lender to convert the debt into company stock at a predetermined conversion rate or upon certain trigger events such as an initial public offering (IPO). This type of note is often used in startups where equity investment is sought, but the valuation is uncertain. 2. Secured Promissory Notes: These notes are backed by collateral, such as company assets, to provide additional security to the lender in case of default. It ensures that the lender has a legal claim to specific assets to recover their investment in case of non-payment. 3. Unsecured Promissory Notes: Unlike secured notes, unsecured promissory notes do not have any collateral backing them. In this type of note, the lender relies solely on the borrower's creditworthiness, making it riskier for the lender. 4. Demand Promissory Notes: These notes allow the lender to demand repayment of the stock at any time, usually without any specific maturity date. They provide more flexibility to the lender but may also increase risks for the borrower. When drafting a Gilbert Arizona negotiable promissory note for stock, it is crucial to consult with legal professionals to ensure compliance with local laws and to address all relevant terms and conditions thoroughly. Additionally, it is important to conduct due diligence, including evaluating the financial stability of the issuer and determining the fair value of the stock being pledged as collateral.A Gilbert Arizona negotiable promissory note for stock is a legally binding document that outlines an agreement between two parties in which one party promises to repay a certain amount of stock to the other party by a specific date. This type of note is commonly used in business transactions, particularly in the context of startups, mergers, or acquisitions. In this agreement, the party borrowing the stock (the issuer) guarantees in writing to repay the stock with interest to the lender (the payee). The note specifies the terms and conditions of the repayment, including the principal amount, interest rate, maturity date, and any additional provisions that may be relevant. It is important to note that a negotiable promissory note for stock is a valuable financial instrument that can be transferred or sold to third parties as endorsed by the payee. The different types of Gilbert Arizona negotiable promissory notes for stock that may exist include: 1. Convertible Promissory Notes: These types of notes allow the lender to convert the debt into company stock at a predetermined conversion rate or upon certain trigger events such as an initial public offering (IPO). This type of note is often used in startups where equity investment is sought, but the valuation is uncertain. 2. Secured Promissory Notes: These notes are backed by collateral, such as company assets, to provide additional security to the lender in case of default. It ensures that the lender has a legal claim to specific assets to recover their investment in case of non-payment. 3. Unsecured Promissory Notes: Unlike secured notes, unsecured promissory notes do not have any collateral backing them. In this type of note, the lender relies solely on the borrower's creditworthiness, making it riskier for the lender. 4. Demand Promissory Notes: These notes allow the lender to demand repayment of the stock at any time, usually without any specific maturity date. They provide more flexibility to the lender but may also increase risks for the borrower. When drafting a Gilbert Arizona negotiable promissory note for stock, it is crucial to consult with legal professionals to ensure compliance with local laws and to address all relevant terms and conditions thoroughly. Additionally, it is important to conduct due diligence, including evaluating the financial stability of the issuer and determining the fair value of the stock being pledged as collateral.