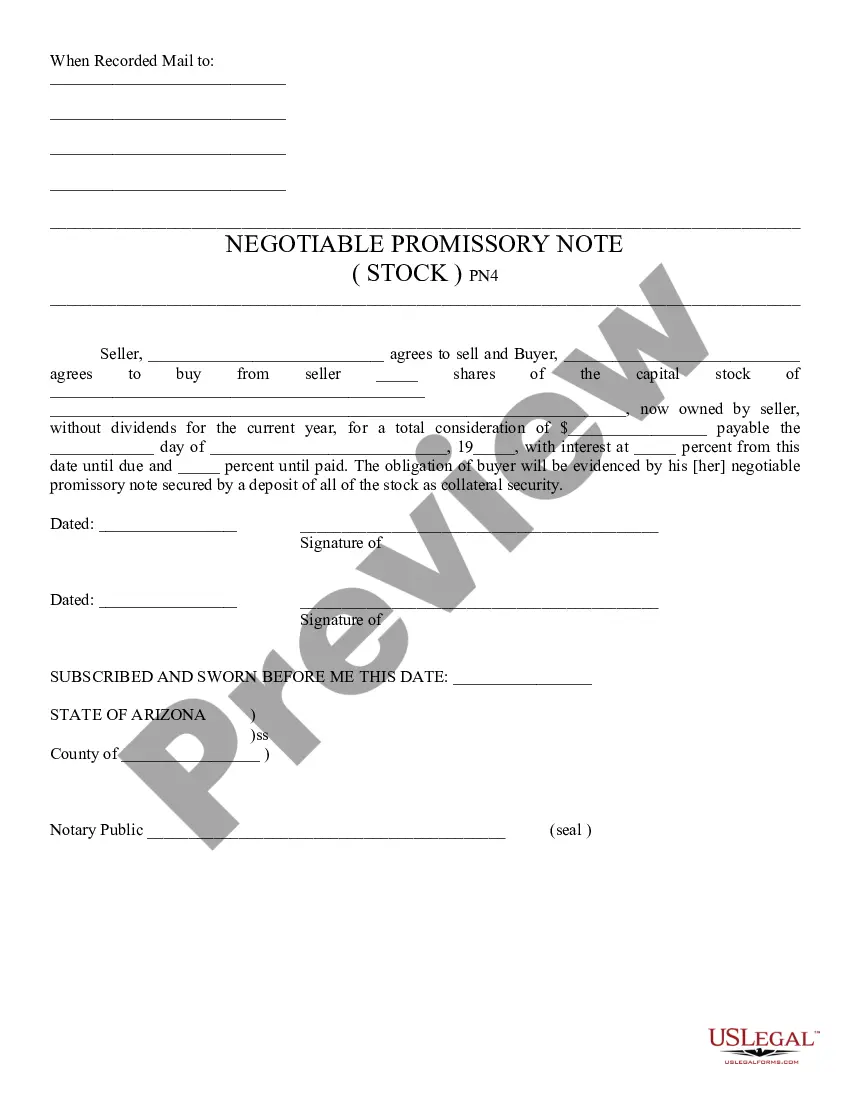

Negotiable Promissory Note for Stock - Arizona: This is a form which gives stock, in exchange for the signing of a negotiable promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

A negotiable promissory note for stock in Scottsdale, Arizona is a legal document that outlines the terms and conditions under which a lender agrees to lend money to a borrower in exchange for a specified number of shares of stock. This type of note is often used as a financing mechanism in business transactions, allowing companies to raise capital by offering investors the opportunity to invest in their stock. The Scottsdale, Arizona negotiable promissory note for stock serves as evidence of the debt owed by the borrower to the lender and includes various key elements such as the principal amount borrowed, interest rate, repayment terms, maturity date, and the number of shares of stock to be issued. The negotiable promissory note is "negotiable" because it can be transferred from one party to another, allowing the lender to sell or assign the debt to a third party if desired. This flexibility makes it easier for companies to secure financing, as potential investors can purchase the note from the original lender. There are different types of Scottsdale, Arizona negotiable promissory notes for stock, including: 1. Convertible Promissory Note: This type of note allows the lender to convert the debt into equity (shares of stock) at a future date, usually at a predetermined conversion price. It provides additional flexibility for both the borrower and the lender, as it allows the lender to participate in the potential upside of the borrower's business. 2. Secured Promissory Note: In this case, the note is secured by specific assets of the borrower, such as the company's assets or the shares of stock being issued. If the borrower fails to repay the debt, the lender has the right to seize and sell the pledged assets to recover the outstanding amount. 3. Unsecured Promissory Note: This type of note does not have any specific collateral backing it. The lender relies solely on the borrower's promise to repay the debt. Consequently, unsecured notes often have higher interest rates compared to secured notes due to the increased risk for the lender. Negotiable promissory notes for stock in Scottsdale, Arizona are essential financial instruments that facilitate capital raising for businesses. These notes provide a mutually beneficial arrangement for both borrower and lender, enabling companies to access necessary funds while providing investors with an opportunity to participate in an enterprise's potential success.A negotiable promissory note for stock in Scottsdale, Arizona is a legal document that outlines the terms and conditions under which a lender agrees to lend money to a borrower in exchange for a specified number of shares of stock. This type of note is often used as a financing mechanism in business transactions, allowing companies to raise capital by offering investors the opportunity to invest in their stock. The Scottsdale, Arizona negotiable promissory note for stock serves as evidence of the debt owed by the borrower to the lender and includes various key elements such as the principal amount borrowed, interest rate, repayment terms, maturity date, and the number of shares of stock to be issued. The negotiable promissory note is "negotiable" because it can be transferred from one party to another, allowing the lender to sell or assign the debt to a third party if desired. This flexibility makes it easier for companies to secure financing, as potential investors can purchase the note from the original lender. There are different types of Scottsdale, Arizona negotiable promissory notes for stock, including: 1. Convertible Promissory Note: This type of note allows the lender to convert the debt into equity (shares of stock) at a future date, usually at a predetermined conversion price. It provides additional flexibility for both the borrower and the lender, as it allows the lender to participate in the potential upside of the borrower's business. 2. Secured Promissory Note: In this case, the note is secured by specific assets of the borrower, such as the company's assets or the shares of stock being issued. If the borrower fails to repay the debt, the lender has the right to seize and sell the pledged assets to recover the outstanding amount. 3. Unsecured Promissory Note: This type of note does not have any specific collateral backing it. The lender relies solely on the borrower's promise to repay the debt. Consequently, unsecured notes often have higher interest rates compared to secured notes due to the increased risk for the lender. Negotiable promissory notes for stock in Scottsdale, Arizona are essential financial instruments that facilitate capital raising for businesses. These notes provide a mutually beneficial arrangement for both borrower and lender, enabling companies to access necessary funds while providing investors with an opportunity to participate in an enterprise's potential success.