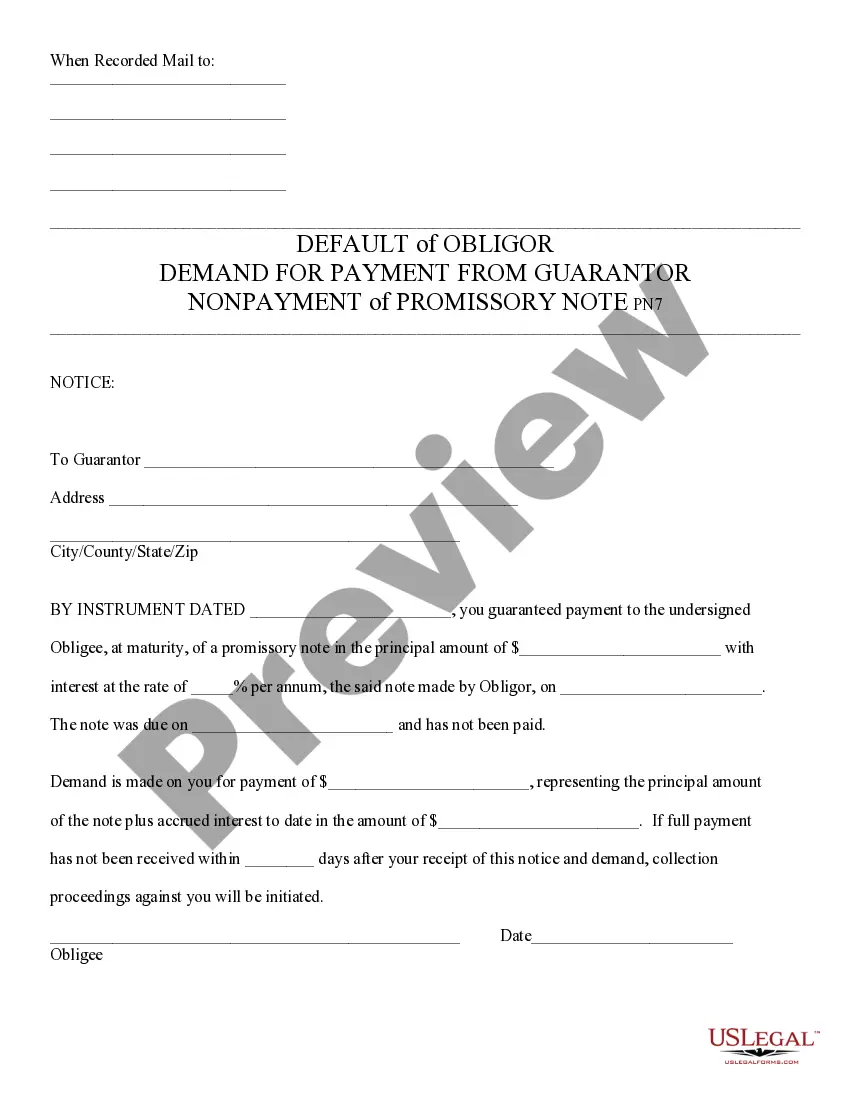

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Chandler Arizona Default of Promissory Note and Demand for Payment

Description

How to fill out Arizona Default Of Promissory Note And Demand For Payment?

Finding authenticated templates tailored to your local laws can be challenging unless you utilize the US Legal Forms database.

It’s a web-based compilation of over 85,000 legal documents for both individual and business needs as well as various real-life scenarios.

All the files are correctly organized by their area of application and jurisdiction, making the search for the Chandler Arizona Default of Promissory Note and Demand for Payment as straightforward as one, two, three.

Keep your documentation organized and compliant with legal standards is critically important. Leverage the US Legal Forms library to always have vital document templates for any requirements readily accessible!

- Review the Preview mode and template description.

- Ensure you have selected the correct document that satisfies your criteria and fully aligns with your local jurisdiction requirements.

- Search for another template if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the accurate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To fill a demand promissory note, clearly indicate the lender's name and the borrower's information, along with the total amount owed. Include a statement granting the lender the right to demand payment at any time. Lastly, always consider the legal ramifications of a Chandler Arizona default of promissory note and demand for payment for proper management of financial agreements.

An on-demand promissory note allows the lender to request repayment at any time. For instance, if you sign a note stating that you owe $500 with a clause that the lender can demand payment immediately, this note falls under the on-demand category. Understanding this in the context of Chandler, Arizona default scenarios helps you prepare for potential legal obligations.

One disadvantage of a promissory note is that it can result in a legal obligation that may be challenging to fulfill if circumstances change. Additionally, if you default, you may face legal actions, such as demands for payment, which can be stressful. In Chandler, Arizona, borrowers should consider their financial stability before entering into a promissory note agreement to mitigate risks.

Yes, a borrower can default on a promissory note if they fail to make the required payments. Defaulting can lead to serious consequences, such as legal actions and damage to your credit score. In Chandler, Arizona, avoiding default requires a clear understanding of the payment terms outlined in the promissory note, alongside timely communication if financial difficulties arise.

If you default on a promissory note, the lender has several options to recover the owed amount, which may include legal action or seizing collateral. In Chandler, Arizona, this can lead to significant financial consequences and damage to your credit score. It is essential to address any payment issues promptly to avoid falling into default.

If someone defaults on a promissory note, begin by reaching out to discuss the situation. Open communication may lead to a resolution, such as setting up a payment plan. If this does not work, consider sending a formal demand for payment and, if necessary, using legal resources to enforce your rights in Chandler, Arizona through platforms like USLegalForms for proper documentation.

The statute of limitations for collecting on a promissory note in Arizona is typically six years from the date of default. This time frame is important to consider if you are dealing with a Chandler Arizona default of promissory note and demand for payment. As the deadline approaches, both lenders and borrowers should take necessary actions to avoid losing rights.

If you default on a promissory note, the lender may initiate legal action to recover the owed amount. In Chandler, Arizona, defaulting can lead to additional fees, damage to your credit score, or eventual court judgments against you. It is essential to communicate with the lender to discuss potential solutions before the situation escalates.

Enforcing a defaulted promissory note typically involves sending a formal demand for payment to the borrower. In Chandler, Arizona, this demand letter should clearly state the amount due and outline the consequences of continued non-payment. If necessary, you can seek legal advice to explore options, such as pursuing a lawsuit.

Yes, a promissory note can be structured to be on demand. This means the lender can request repayment at any time. In Chandler, Arizona, this setup allows for flexibility for the lender while also requiring the borrower to be prepared for payment. Understanding your note's terms is crucial for managing repayment expectations.