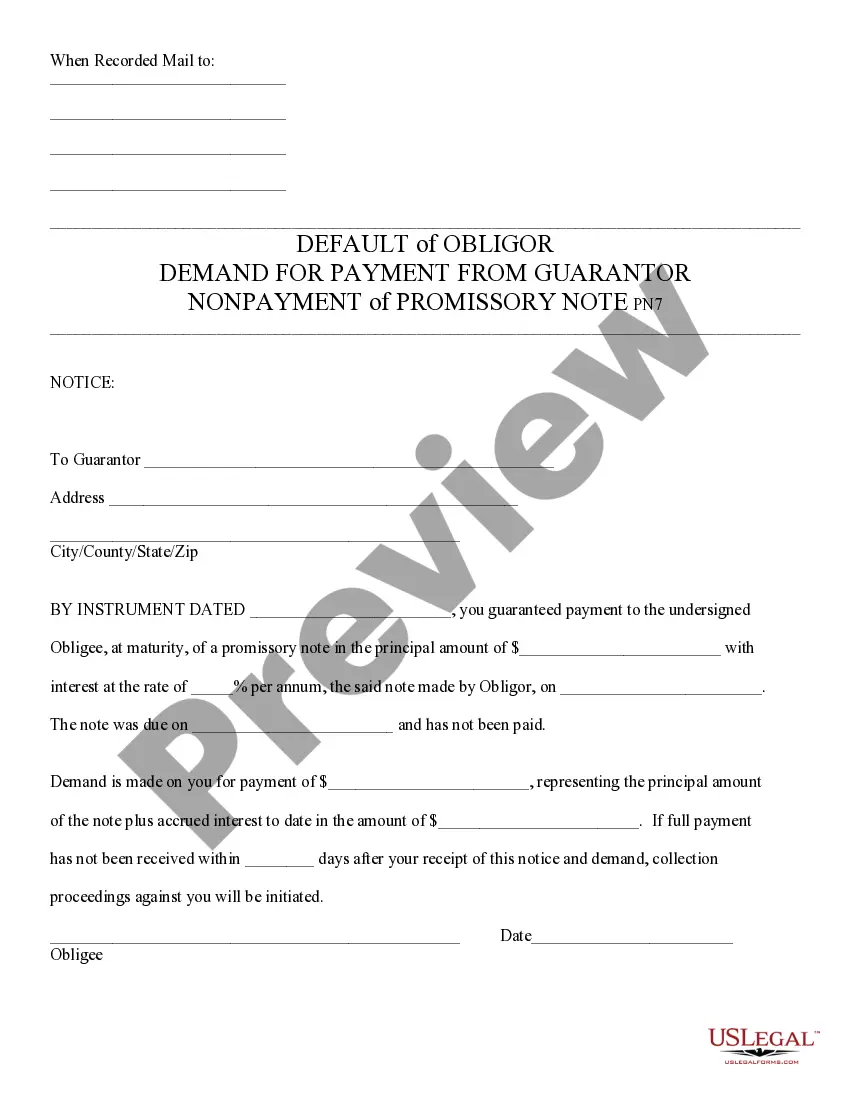

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

A Phoenix Arizona Default of Promissory Note and Demand for Payment refers to a legally binding document that deals with the failure of a borrower in fulfilling their financial obligation as specified in a promissory note. In simpler terms, it is a formal declaration highlighting that the borrower has defaulted on their loan repayment, and a demand is made to initiate immediate payment to rectify the situation. There are different types of Default of Promissory Note and Demand for Payment in Phoenix, Arizona, each having a specific purpose depending on the circumstances. Some of the most common types include: 1. Absolute Default: This type of default occurs when the borrower completely fails to make any payment on the specified due date. It signifies a complete breach of the loan agreement and may result in legal action. 2. Partial Default: A partial default takes place when the borrower fails to pay a certain portion or installment of the loan amount as per the promissory note. This could be due to financial constraints or overlooking the payment schedule. 3. Late Payment Default: In cases of a late payment default, the borrower fails to make the loan payment within the agreed-upon timeframe, but eventually pays it after the due date has passed. 4. Non-Monetary Default: This type of default refers to violations of other terms mentioned in the promissory note, apart from the financial aspect. For example, the borrower may have breached a condition related to insurance coverage or maintenance responsibilities. To initiate the process of Default of Promissory Note and Demand for Payment in Phoenix, Arizona, certain steps need to be followed. First, the lender must provide written notice to the borrower, stating the default and specifying the amount due. The notice should include a demand for payment within a certain period, typically 30 days, to rectify the default. The Default of Promissory Note and Demand for Payment should clearly outline the consequences of non-payment, including possible legal action, accrual of interest, or additional penalties. Furthermore, it is crucial to include the full details of the loan agreement, such as the loan amount, interest rate, repayment schedule, and any applicable collateral. It's important to note that the precise requirements and legal procedures for initiating a default and demand for payment may vary based on specific state laws in Arizona. Therefore, it is advisable to consult with an attorney specialized in contract and loan law to ensure compliance and navigate the process effectively. Overall, a Phoenix Arizona Default of Promissory Note and Demand for Payment is a document used to address the failure of a borrower in repaying a loan as per the agreed terms. It serves as a formal notice to the borrower, demanding immediate payment to prevent further legal action and protect the interests of the lender.A Phoenix Arizona Default of Promissory Note and Demand for Payment refers to a legally binding document that deals with the failure of a borrower in fulfilling their financial obligation as specified in a promissory note. In simpler terms, it is a formal declaration highlighting that the borrower has defaulted on their loan repayment, and a demand is made to initiate immediate payment to rectify the situation. There are different types of Default of Promissory Note and Demand for Payment in Phoenix, Arizona, each having a specific purpose depending on the circumstances. Some of the most common types include: 1. Absolute Default: This type of default occurs when the borrower completely fails to make any payment on the specified due date. It signifies a complete breach of the loan agreement and may result in legal action. 2. Partial Default: A partial default takes place when the borrower fails to pay a certain portion or installment of the loan amount as per the promissory note. This could be due to financial constraints or overlooking the payment schedule. 3. Late Payment Default: In cases of a late payment default, the borrower fails to make the loan payment within the agreed-upon timeframe, but eventually pays it after the due date has passed. 4. Non-Monetary Default: This type of default refers to violations of other terms mentioned in the promissory note, apart from the financial aspect. For example, the borrower may have breached a condition related to insurance coverage or maintenance responsibilities. To initiate the process of Default of Promissory Note and Demand for Payment in Phoenix, Arizona, certain steps need to be followed. First, the lender must provide written notice to the borrower, stating the default and specifying the amount due. The notice should include a demand for payment within a certain period, typically 30 days, to rectify the default. The Default of Promissory Note and Demand for Payment should clearly outline the consequences of non-payment, including possible legal action, accrual of interest, or additional penalties. Furthermore, it is crucial to include the full details of the loan agreement, such as the loan amount, interest rate, repayment schedule, and any applicable collateral. It's important to note that the precise requirements and legal procedures for initiating a default and demand for payment may vary based on specific state laws in Arizona. Therefore, it is advisable to consult with an attorney specialized in contract and loan law to ensure compliance and navigate the process effectively. Overall, a Phoenix Arizona Default of Promissory Note and Demand for Payment is a document used to address the failure of a borrower in repaying a loan as per the agreed terms. It serves as a formal notice to the borrower, demanding immediate payment to prevent further legal action and protect the interests of the lender.