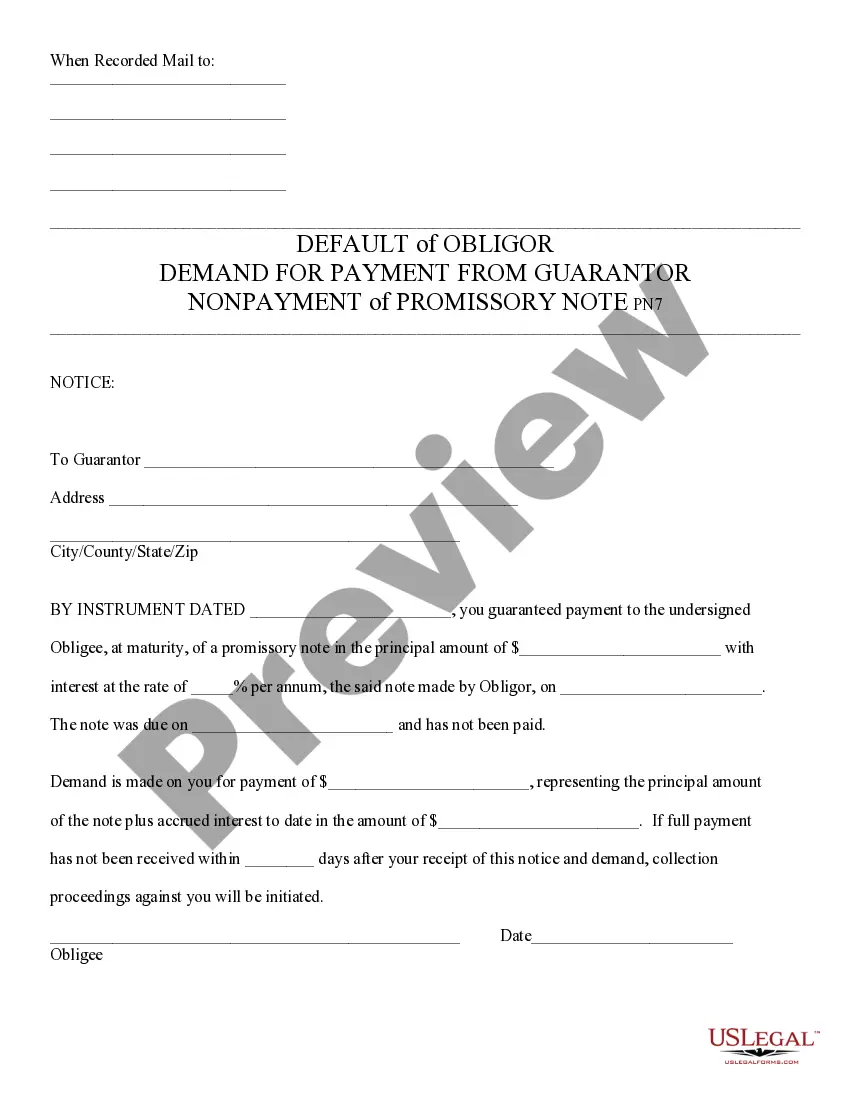

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Pima Arizona Default of Promissory Note and Demand for Payment

Description

How to fill out Arizona Default Of Promissory Note And Demand For Payment?

Are you in need of a dependable and budget-friendly provider of legal documents to obtain the Pima Arizona Default of Promissory Note and Demand for Payment? US Legal Forms is your premier choice.

Whether you need a simple agreement to establish rules for living together with your partner or a set of documents to facilitate your separation or divorce through the court system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use.

All templates we provide are not generic and are structured according to the specifications of specific states and counties.

To download the document, you must Log In to your account, locate the desired form, and click the Download button next to it. Please note that you can download your previously acquired document templates anytime from the My documents tab.

Now you can set up your account. Then select the subscription plan and move forward to payment. After completing the payment, download the Pima Arizona Default of Promissory Note and Demand for Payment in any format provided. You can revisit the website anytime and redownload the document free of charge.

Obtaining the latest legal documents has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending hours searching for legal papers online.

- Is this your first visit to our site? Don't worry.

- You can create an account in just a few minutes, but before that, ensure to do the following.

- Check if the Pima Arizona Default of Promissory Note and Demand for Payment adheres to the laws of your state and locality.

- Review the form’s details (if available) to understand who and what the document is intended for.

- Restart your search if the form isn't appropriate for your legal situation.

Form popularity

FAQ

If you default on a promissory note, you may face various repercussions, including damage to your credit score and potential legal action from the lender. In Pima, Arizona, the lender may file a lawsuit to recover the owed amount. It’s essential to communicate with your lender to discuss possible solutions before matters escalate. Utilizing platforms like US Legal Forms can provide valuable resources and guidance regarding the Pima Arizona Default of Promissory Note and Demand for Payment.

When a person defaults on a promissory note, the lender typically initiates a demand for payment. This may involve sending a written notice or formally contacting the borrower. In Pima, Arizona, the lender may also pursue legal action to recover the owed amount, which could lead to court proceedings. Staying informed about the Pima Arizona Default of Promissory Note and Demand for Payment can help borrowers understand their rights.

Yes, a promissory note can indeed be structured to be payable on demand, meaning the lender can request repayment at any time. This can provide flexibility but also requires clear communication between both parties. If you need help drafting such notes, explore the resources available at US Legal Forms to ensure compliance with Pima Arizona Default of Promissory Note.

When a borrower defaults on a promissory note, start by reviewing the terms outlined in the document. You may need to contact the borrower to discuss the missed payment and possible solutions. If the issue persists, consider legal action, particularly in relation to a Pima Arizona Default of Promissory Note and Demand for Payment, to protect your interests.

Must be filed within 20 days of being served; Cannot claim an award of more than $3,500 or else it has to be transfered out of small claims; and. Cannot be amended.

Prepared forms must be printed and filed with the Clerk of the Superior Court, 110 W. Congress, Tucson, Arizona 85701. The Clerk of the Superior Court has a fee schedule for filing fees that must be paid with the filing of these legal forms and the cost of making copies.

It costs $16.00 to file a small claims complaint and $9.00 for a defendant to file an answer. Other filings or actions in the case may have additional fees. For those with low incomes, the filing fee may be waived by filling out a fee waiver form.

Step 1 ? Verify with the Superior Court.Step 2 ? Application for Change of Name.Step 3 ? Consent of Name Change from Other Parent (if applicable)Step 4 ? Notarize Documents.Step 5 ? Civil Cover Sheet.Step 6 ? File Forms with the Superior Court.Step 7 ? Notice of Hearing.Step 8 ? Notify Spouse (if applicable)

Step 1 ? Verify with the Superior Court.Step 2 ? Application for Change of Name.Step 3 ? Consent of Name Change from Other Parent (if applicable)Step 4 ? Notarize Documents.Step 5 ? Civil Cover Sheet.Step 6 ? File Forms with the Superior Court.Step 7 ? Notice of Hearing.Step 8 ? Notify Spouse (if applicable)

On the other hand, in Pima County, the Clerk of Court's fee schedule shows the filing fee for a name change request at $236.00. Both the Maricopa County Superior Court and the Pima County Superior Court have forms with instructions available online for you to read and fill out in order to change your name.