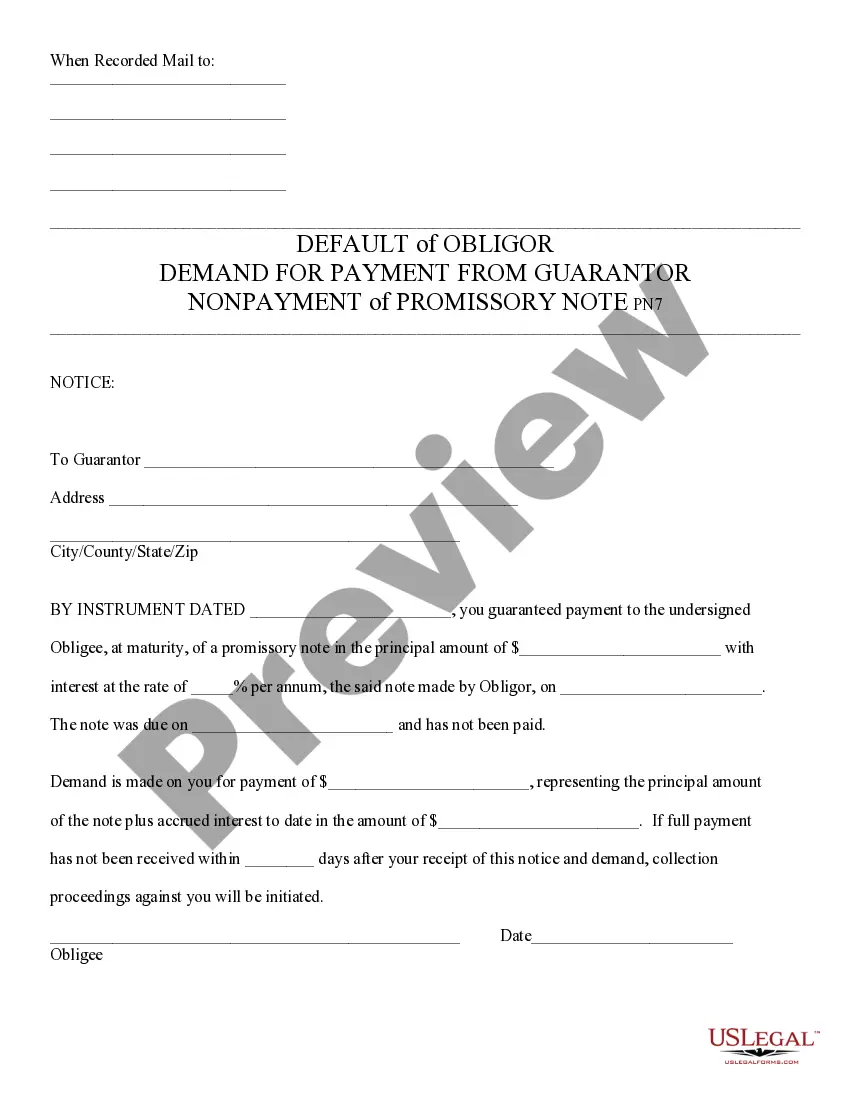

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Lima, Arizona Default of Promissory Note and Demand for Payment: In legal terms, a promissory note is a written agreement that outlines the terms and conditions of a loan. It serves as a legally binding document between a lender and a borrower, specifying the loan amount, repayment schedule, interest rate, and other relevant details. However, in some cases, borrowers may fail to meet their payment obligations, leading to a default on the promissory note. When a borrower in Lima, Arizona defaults on a promissory note, it means they have failed to make the agreed-upon payments within the specified timeframe. This can occur due to various reasons, such as financial hardship, unexpected circumstances, or deliberate non-compliance with the loan agreement. Regardless of the cause, the lender has the right to take legal action to enforce the repayment. A Default of Promissory Note and Demand for Payment typically involves the following steps: 1. Notice of Default: The lender must send a formal written notice of default to the borrower, notifying them of their failure to make payments as agreed. This notice serves as a warning and an opportunity for the borrower to rectify the situation before further legal actions are taken. 2. Demand for Payment: Along with the notice of default, the lender issues a demand for payment, requiring the borrower to settle the outstanding balance within a specific timeframe. The demand for payment is a formal communication that emphasizes the borrower's obligation to repay the loan and notifies them of the potential consequences of continued default. 3. Legal Remedies: If the borrower fails to respond or comply with the demand for payment, the lender may pursue legal remedies to recover the amount owed. In Lima, Arizona, there are different types of remedies available, including: a. Lawsuit for Breach of Contract: The lender can file a lawsuit against the borrower for breach of contract, seeking a judgment for the outstanding debt, plus any applicable interest and legal fees. b. Property Lien: In some cases, the lender may secure a property lien against assets owned by the borrower, such as real estate or vehicles. This serves as collateral and ensures that the lender can recover their funds when the property is sold or transferred. c. Wage Garnishment: If a court order is obtained, the lender may garnish the borrower's wages, meaning a portion of their income is automatically withheld to repay the debt. d. Asset Seizure: In extreme cases, if other collection methods fail, the lender may request the court's permission to seize the borrower's assets, including bank accounts or personal property. Overall, a Lima, Arizona Default of Promissory Note and Demand for Payment is a legal process initiated by a lender to enforce the repayment of a defaulted promissory note. It involves issuing a notice of default, demanding payment, and potentially pursuing legal remedies such as lawsuits, property liens, wage garnishment, or asset seizure.Lima, Arizona Default of Promissory Note and Demand for Payment: In legal terms, a promissory note is a written agreement that outlines the terms and conditions of a loan. It serves as a legally binding document between a lender and a borrower, specifying the loan amount, repayment schedule, interest rate, and other relevant details. However, in some cases, borrowers may fail to meet their payment obligations, leading to a default on the promissory note. When a borrower in Lima, Arizona defaults on a promissory note, it means they have failed to make the agreed-upon payments within the specified timeframe. This can occur due to various reasons, such as financial hardship, unexpected circumstances, or deliberate non-compliance with the loan agreement. Regardless of the cause, the lender has the right to take legal action to enforce the repayment. A Default of Promissory Note and Demand for Payment typically involves the following steps: 1. Notice of Default: The lender must send a formal written notice of default to the borrower, notifying them of their failure to make payments as agreed. This notice serves as a warning and an opportunity for the borrower to rectify the situation before further legal actions are taken. 2. Demand for Payment: Along with the notice of default, the lender issues a demand for payment, requiring the borrower to settle the outstanding balance within a specific timeframe. The demand for payment is a formal communication that emphasizes the borrower's obligation to repay the loan and notifies them of the potential consequences of continued default. 3. Legal Remedies: If the borrower fails to respond or comply with the demand for payment, the lender may pursue legal remedies to recover the amount owed. In Lima, Arizona, there are different types of remedies available, including: a. Lawsuit for Breach of Contract: The lender can file a lawsuit against the borrower for breach of contract, seeking a judgment for the outstanding debt, plus any applicable interest and legal fees. b. Property Lien: In some cases, the lender may secure a property lien against assets owned by the borrower, such as real estate or vehicles. This serves as collateral and ensures that the lender can recover their funds when the property is sold or transferred. c. Wage Garnishment: If a court order is obtained, the lender may garnish the borrower's wages, meaning a portion of their income is automatically withheld to repay the debt. d. Asset Seizure: In extreme cases, if other collection methods fail, the lender may request the court's permission to seize the borrower's assets, including bank accounts or personal property. Overall, a Lima, Arizona Default of Promissory Note and Demand for Payment is a legal process initiated by a lender to enforce the repayment of a defaulted promissory note. It involves issuing a notice of default, demanding payment, and potentially pursuing legal remedies such as lawsuits, property liens, wage garnishment, or asset seizure.