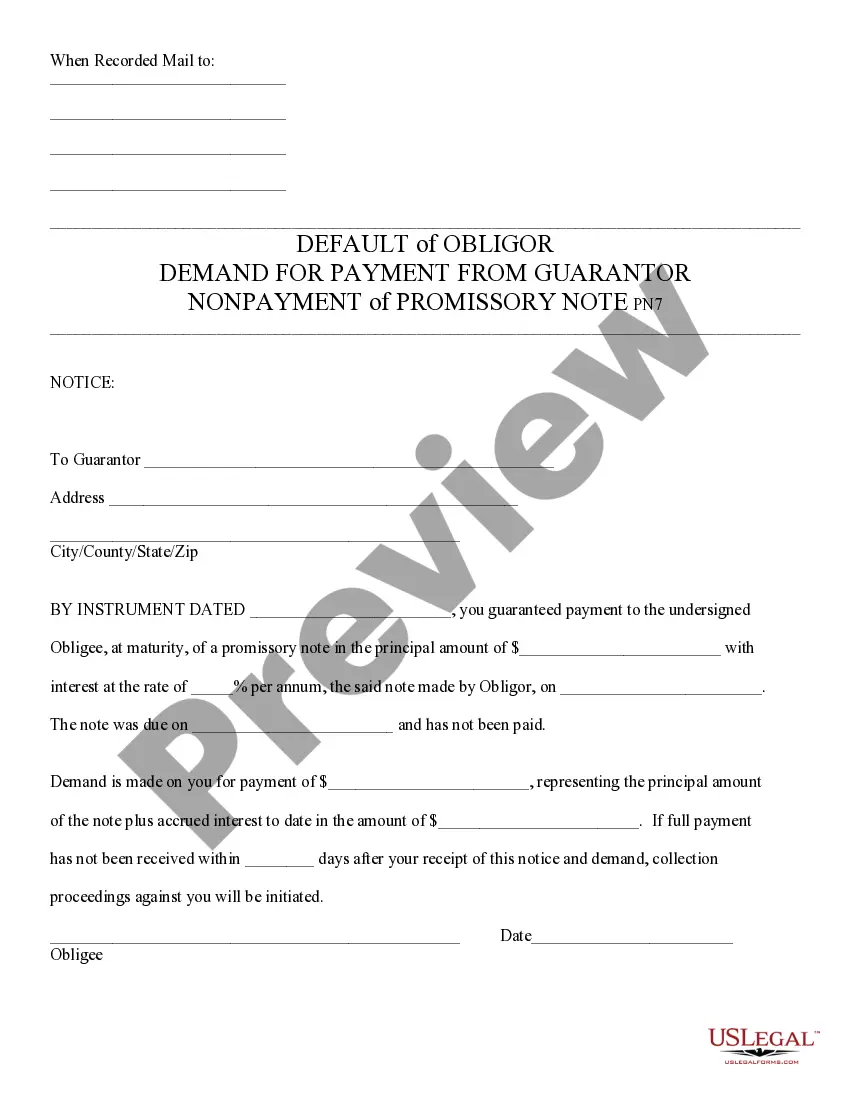

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Title: The Ins and Outs of Tucson, Arizona Default of Promissory Note and Demand for Payment Introduction: Understanding the concept of defaulting on a promissory note and the subsequent demand for payment is crucial for both borrowers and lenders in Tucson, Arizona. This article aims to provide a comprehensive overview of what constitutes defaulting on a promissory note in Tucson, as well as the different types of defaults and the consequences that follow. Key keywords: Tucson, Arizona, default of promissory note, demand for payment. 1. What is a Promissory Note? A promissory note is a legally binding document that outlines the terms and conditions of a loan, including repayment obligations, interest rates, and timelines. It serves as an agreement between the borrower and lender in Tucson, Arizona. 2. Tucson, Arizona Default of Promissory Note: A default on a promissory note in Tucson occurs when the borrower fails to meet the agreed-upon terms outlined in the promissory note. This may include missing payments, late payments, or breaching other loan-related obligations. 3. Demand for Payment: After a borrower defaults on a promissory note, the lender issues a formal demand for payment, requesting the outstanding balance, interest, and any associated penalties to be repaid promptly. 4. Types of Tucson, Arizona Defaults on Promissory Notes: a. Payment Default: This type of default occurs when a borrower fails to make scheduled payments as agreed upon in the promissory note. This could be due to financial hardship, unforeseen circumstances, or negligence. b. Covenant Default: When a borrower breaches one or more non-payment obligations stated in the promissory note, such as providing necessary insurance coverage or maintaining the collateral, it is considered a covenant default. c. Acceleration Default: In cases specified by the terms of the promissory note, lenders may choose to declare a default, known as an acceleration default, if the borrower defaults on any aspect of the loan agreement. This allows the lender to demand immediate repayment of the entire loan balance. d. Cross-Default: A cross-default occurs when a borrower defaults on multiple loans or obligations simultaneously, whether with the same lender or different creditors. This default can trigger a cross-default clause in the promissory note, leading to severe consequences. 5. Consequences and Remedies: Upon default, lenders can take legal actions against the defaulting borrower, seeking repayment of the debt through various means, including filing a lawsuit, foreclosure, or repossession of collateral. Additionally, lenders may report the default to credit reporting agencies, negatively affecting the borrower's creditworthiness. Conclusion: Tucson, Arizona has specific rules and regulations regarding promissory note default and subsequent demand for payment. It is essential for borrowers and lenders in Tucson to understand the different types of promissory note defaults to be prepared to take appropriate actions in case of default situations. Prompt communication and seeking legal advice are crucial in navigating the complexities of promissory note defaults in Tucson, Arizona.Title: The Ins and Outs of Tucson, Arizona Default of Promissory Note and Demand for Payment Introduction: Understanding the concept of defaulting on a promissory note and the subsequent demand for payment is crucial for both borrowers and lenders in Tucson, Arizona. This article aims to provide a comprehensive overview of what constitutes defaulting on a promissory note in Tucson, as well as the different types of defaults and the consequences that follow. Key keywords: Tucson, Arizona, default of promissory note, demand for payment. 1. What is a Promissory Note? A promissory note is a legally binding document that outlines the terms and conditions of a loan, including repayment obligations, interest rates, and timelines. It serves as an agreement between the borrower and lender in Tucson, Arizona. 2. Tucson, Arizona Default of Promissory Note: A default on a promissory note in Tucson occurs when the borrower fails to meet the agreed-upon terms outlined in the promissory note. This may include missing payments, late payments, or breaching other loan-related obligations. 3. Demand for Payment: After a borrower defaults on a promissory note, the lender issues a formal demand for payment, requesting the outstanding balance, interest, and any associated penalties to be repaid promptly. 4. Types of Tucson, Arizona Defaults on Promissory Notes: a. Payment Default: This type of default occurs when a borrower fails to make scheduled payments as agreed upon in the promissory note. This could be due to financial hardship, unforeseen circumstances, or negligence. b. Covenant Default: When a borrower breaches one or more non-payment obligations stated in the promissory note, such as providing necessary insurance coverage or maintaining the collateral, it is considered a covenant default. c. Acceleration Default: In cases specified by the terms of the promissory note, lenders may choose to declare a default, known as an acceleration default, if the borrower defaults on any aspect of the loan agreement. This allows the lender to demand immediate repayment of the entire loan balance. d. Cross-Default: A cross-default occurs when a borrower defaults on multiple loans or obligations simultaneously, whether with the same lender or different creditors. This default can trigger a cross-default clause in the promissory note, leading to severe consequences. 5. Consequences and Remedies: Upon default, lenders can take legal actions against the defaulting borrower, seeking repayment of the debt through various means, including filing a lawsuit, foreclosure, or repossession of collateral. Additionally, lenders may report the default to credit reporting agencies, negatively affecting the borrower's creditworthiness. Conclusion: Tucson, Arizona has specific rules and regulations regarding promissory note default and subsequent demand for payment. It is essential for borrowers and lenders in Tucson to understand the different types of promissory note defaults to be prepared to take appropriate actions in case of default situations. Prompt communication and seeking legal advice are crucial in navigating the complexities of promissory note defaults in Tucson, Arizona.