This form is a durable power of attorney. The form provides that the agent of the principal is only authorized to use the principal's funds for the best interest of the principal. If the agent fails to comply with principal's instructions, the agent then may be liable for criminal charges or civil liability.

Gilbert Arizona Durable Power of Attorney

Description

How to fill out Arizona Durable Power Of Attorney?

No matter one's social or professional rank, completing legal documents is an unfortunate obligation in the modern world.

Often, it's nearly impossible for an individual without legal expertise to produce this type of paperwork from the beginning, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms comes to offer assistance. Our platform provides an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

If the form you selected does not fulfill your needs, you can restart and search for the appropriate document.

Click Buy now and choose the subscription option that suits you best. Log In using your account details or sign up for a new one from scratch.

- Whether you need the Gilbert Arizona Durable Power of Attorney or any other document that is valid in your state or locality, with US Legal Forms, everything is accessible to you.

- Here’s how to obtain the Gilbert Arizona Durable Power of Attorney promptly using our reliable service.

- If you are already a current customer, simply Log In to your account to download the required form.

- However, if you are new to our library, make sure to follow these steps before downloading the Gilbert Arizona Durable Power of Attorney.

- Verify that the template you found is appropriate for your region, as the laws of one state or area do not apply to another.

- Review the form and read through a brief description (if available) of the situations the document can be utilized for.

Form popularity

FAQ

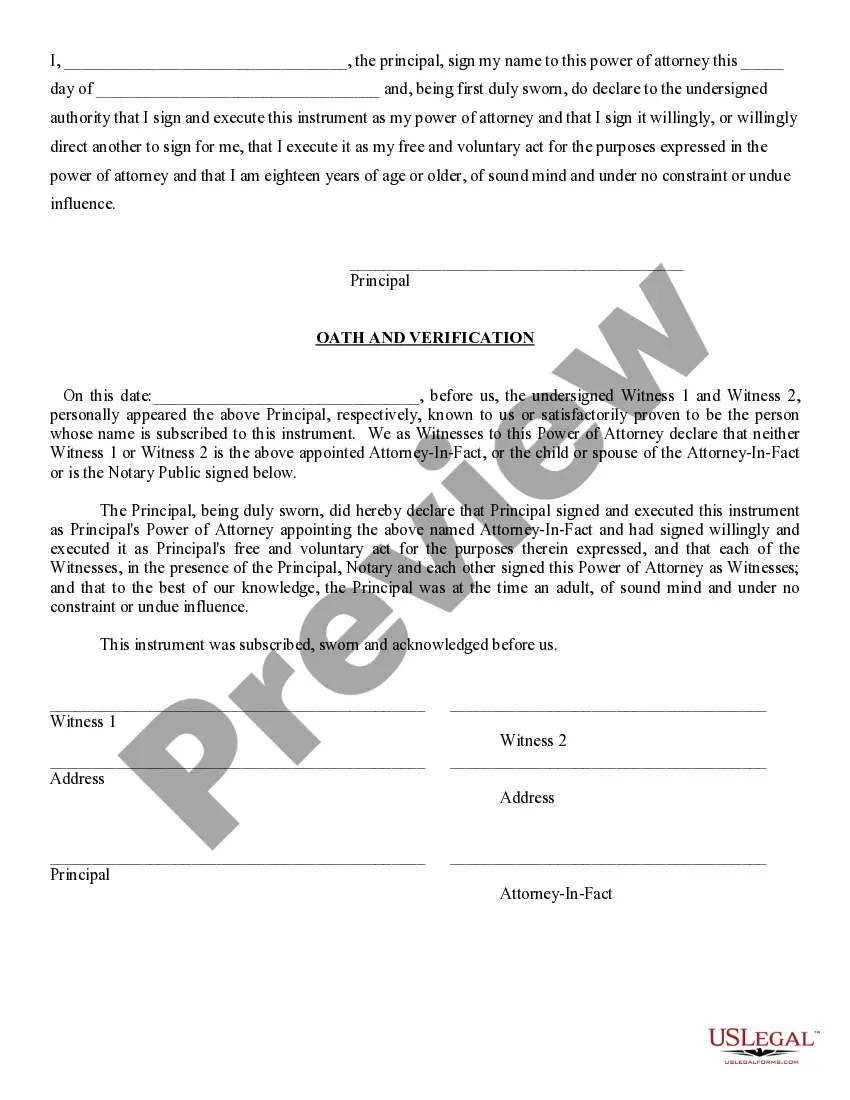

Filing a Gilbert Arizona Durable Power of Attorney involves a few steps. First, you must complete the power of attorney form, ensuring that all necessary information is accurate. After the form is signed and notarized, it does not need to be filed with a court but should be kept in a safe place and shared with the relevant parties. For assistance and guidance in creating and managing this document, uslegalforms can provide valuable resources and templates.

To create a valid Gilbert Arizona Durable Power of Attorney, it is essential that the document is notarized. Notarization adds an extra layer of verification and ensures that the signatures on the document are legitimate. Moreover, it provides assurance that you are granting authority voluntarily and without any pressure. Thus, having your power of attorney notarized is an important step in the process.

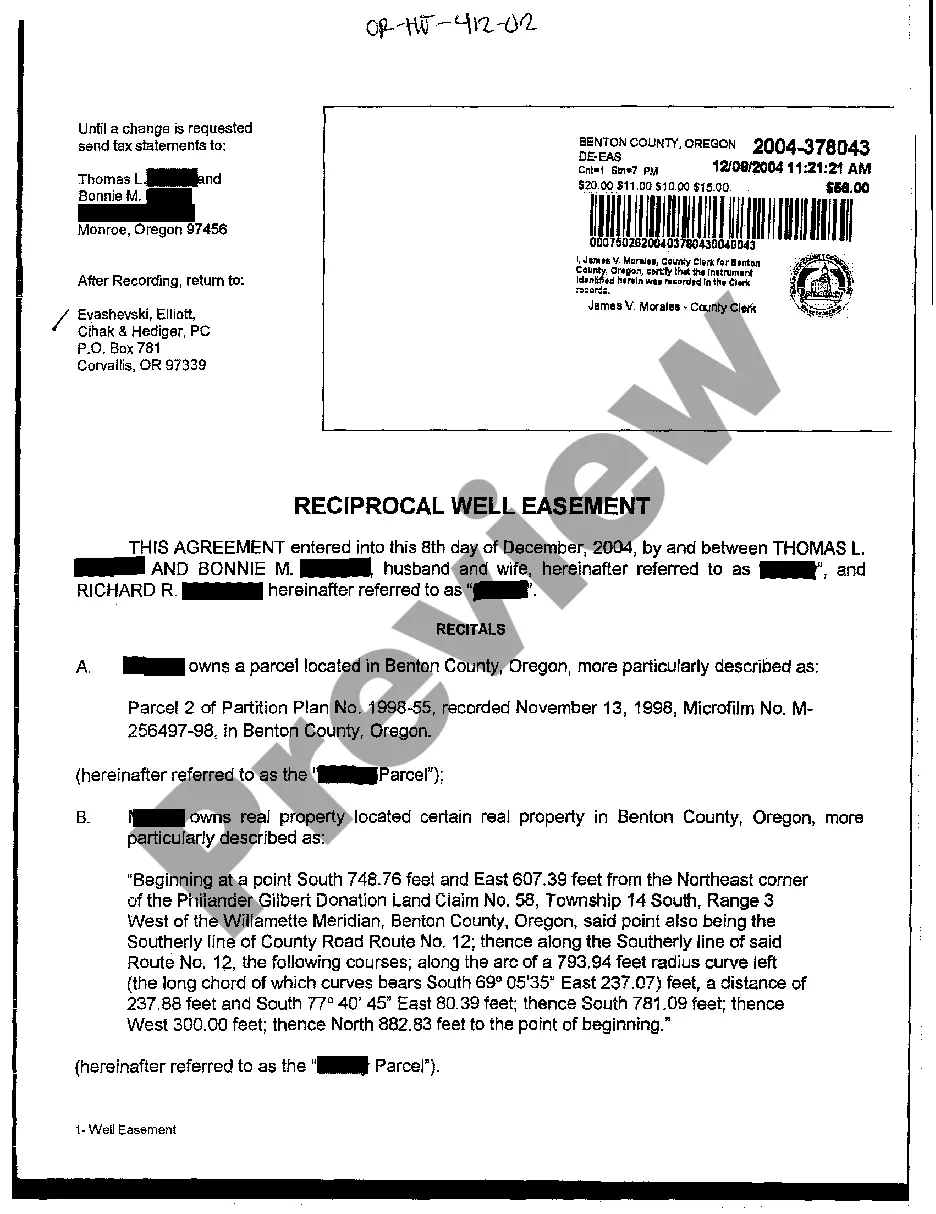

In Arizona, you do not have to record a power of attorney to make it effective, including a Gilbert Arizona Durable Power of Attorney. However, if your agent needs to use the power of attorney for real estate transactions, recording may become necessary. It is wise to consult US Legal Forms to understand when recording might be beneficial in your specific situation.

Yes, a power of attorney must be witnessed in Arizona to be considered valid. When you create a Gilbert Arizona Durable Power of Attorney, ensure that it is signed in the presence of at least one witness. This step is essential for the document’s acceptance by financial institutions and healthcare providers. Using a platform like US Legal Forms can guide you through the witnessing requirements efficiently.

The best way to establish a Gilbert Arizona Durable Power of Attorney is to work with a reliable legal platform like US Legal Forms. You can easily access customizable templates that meet Arizona's legal requirements. After selecting the appropriate form, complete it carefully, ensuring you name your agent clearly. Finally, you should have the document signed by witnesses to confirm its validity.

A power of attorney in Arizona remains valid until it is revoked by the individual who created it, or until that individual passes away. With a durable power of attorney, the authority persists even if the individual becomes incapacitated. This feature makes the Gilbert Arizona Durable Power of Attorney a vital tool for managing health and financial affairs. Always consider consulting resources such as US Legal Forms for ongoing support and updates.

To obtain a durable power of attorney in Arizona, you should first decide who you want to designate as your agent. Then, you can create the document, ensuring it meets Arizona's legal requirements. You might find it helpful to access templates or services like US Legal Forms, which provide guidance for your Gilbert Arizona Durable Power of Attorney. Once completed, you should sign it in front of a notary.

In Arizona, an individual who grants the durable power of attorney retains the ability to revoke or change it at any time while they are competent. Additionally, a court can intervene if there is evidence of misuse by the agent. Therefore, it's crucial to choose a trustworthy person as your agent in your Gilbert Arizona Durable Power of Attorney. US Legal Forms can assist with understanding the implications of these decisions.

In Arizona, a durable power of attorney does not need to be recorded to be valid. However, if you choose to use it for real estate transactions, recording may be beneficial. Having your Gilbert Arizona Durable Power of Attorney readily available can simplify many legal processes. For thorough guidance, consider using resources like US Legal Forms to ensure all documentation is correct.

Recording a power of attorney is not mandatory in Arizona. However, if you wish to record your Gilbert Arizona Durable Power of Attorney, you can bring it to your local county recorder's office. This step can help ensure that financial institutions or other parties easily recognize your agent's authority to act on your behalf.