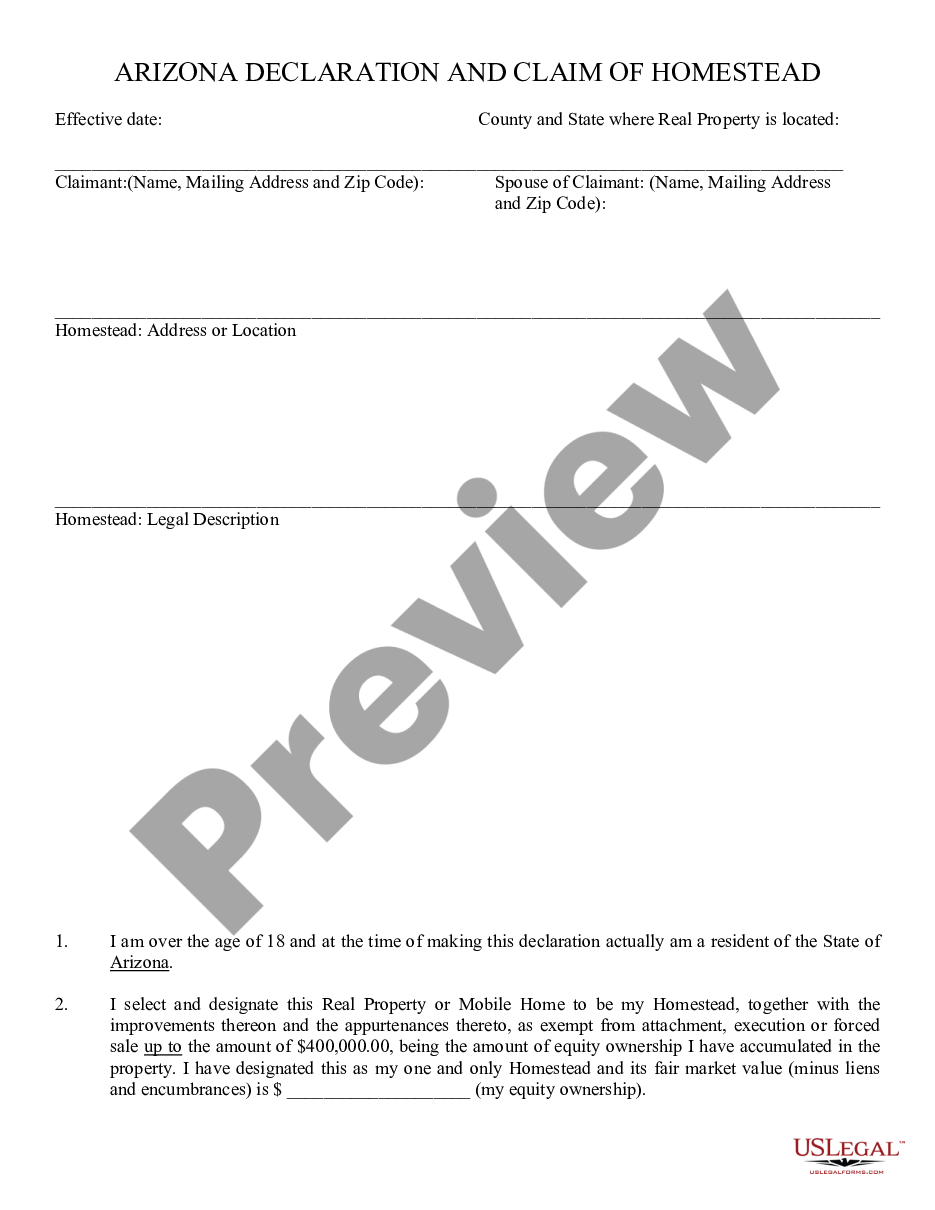

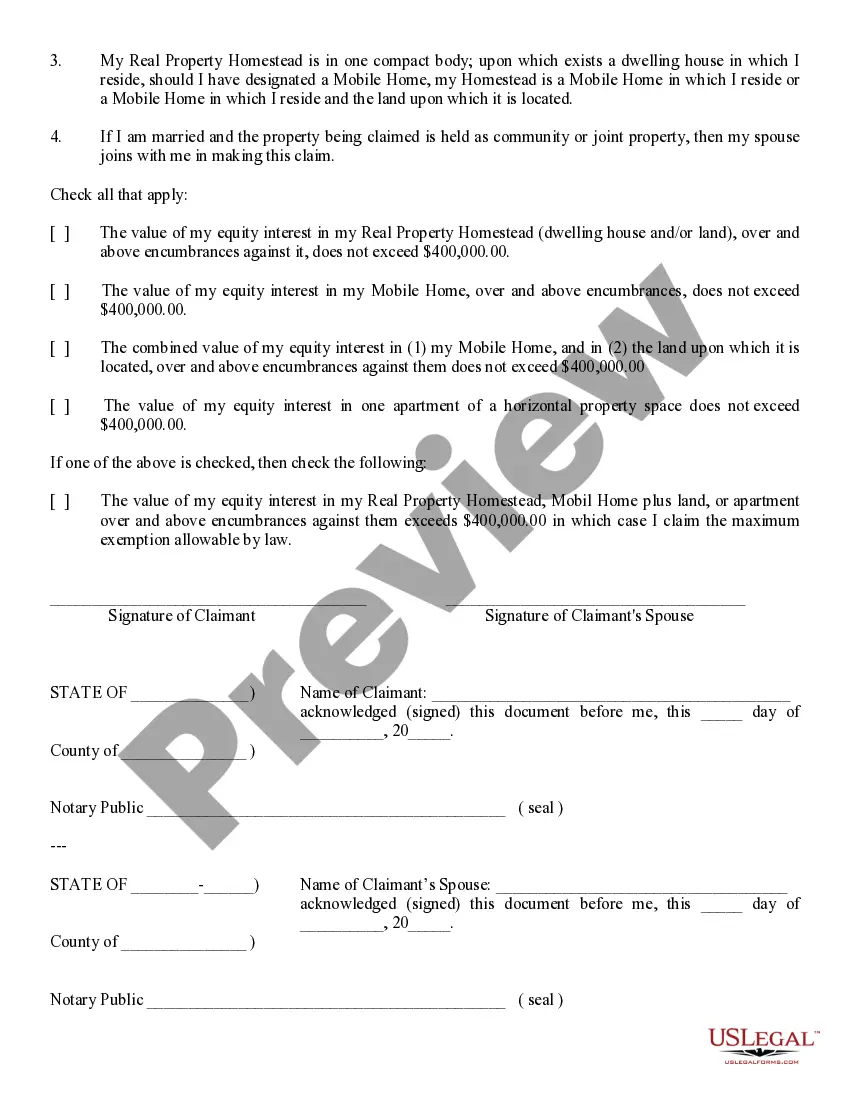

Declaration; Claim of Homestead - Arizona: This form allows for an exemption from the homestead being sold at foreclosure, up to a certain amount in value as provided in the Arizona statutes. This form is signed in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Maricopa Arizona Declaration and Claim of Homestead

Description

How to fill out Arizona Declaration And Claim Of Homestead?

Are you seeking a trustworthy and cost-effective supplier of legal documents to purchase the Maricopa Arizona Declaration and Claim of Homestead? US Legal Forms is your perfect answer.

Whether you need a simple arrangement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce through the court system, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business purposes. All the templates we offer are not generic and are tailored to meet the regulations of specific states and regions.

To download the document, you must Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can retrieve your previously acquired document templates at any time from the My documents tab.

Are you unfamiliar with our site? No problem. You can create an account with great ease, but before doing that, ensure to follow these steps.

Now you can set up your account. Then choose your subscription plan and proceed with the payment. Once the payment is finalized, you can download the Maricopa Arizona Declaration and Claim of Homestead in any available format. You can revisit the website whenever you need and redownload the document at no additional cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending hours researching legal papers online once and for all.

- Verify if the Maricopa Arizona Declaration and Claim of Homestead aligns with the regulations of your state and locality.

- Review the description of the form (if available) to understand who and what the form is designed for.

- Reinitiate your search if the template does not fit your specific situation.

Form popularity

FAQ

The discount for homestead exemption varies based on local tax regulations, but it typically can reduce your property taxes significantly. By claiming the homestead exemption through the Maricopa Arizona Declaration and Claim of Homestead, you open opportunities for tax savings that can improve your financial situation. Check with local authorities to understand the exact benefits you may qualify for.

Applying for a homestead exemption is generally a wise decision for homeowners in Arizona. This exemption provides critical protection for your property equity against creditors. By filing the Maricopa Arizona Declaration and Claim of Homestead, you not only secure this protection but also potentially reduce your property tax bill.

The Arizona homestead exemption, which protects homeowners from losing their equity during legal judgments, currently stands at $150,000 for single individuals. This amount rises for married couples and can greatly benefit those in financial distress. Use the Maricopa Arizona Declaration and Claim of Homestead to establish this safeguard effectively.

The new homestead law in Arizona has expanded the protections offered to homeowners, increasing the exemption amount significantly. As of now, homeowners can protect up to $250,000 in equity. To take advantage of this law, consider submitting the Maricopa Arizona Declaration and Claim of Homestead to secure the maximum benefits.

In Arizona, the homestead exemption protects up to $150,000 of equity in your home. This means that if you face bankruptcy or other financial difficulties, this equity is shielded from creditors. The Maricopa Arizona Declaration and Claim of Homestead is vital in securing this protection, providing peace of mind regarding your assets.

Homesteading your property in Arizona involves declaring your intent to use a portion of your home as a primary residence. By utilizing the Maricopa Arizona Declaration and Claim of Homestead, you formally declare this intent. Make sure you understand the requirements for ownership and residency to qualify for the benefits that homesteading offers.

To file for a homestead exemption in Arizona, start by completing the Maricopa Arizona Declaration and Claim of Homestead form. You can find this form on the US Legal Forms platform, which provides clear instructions and templates. After filling out the form, you'll submit it to your county recorder's office, ensuring that you also meet all eligibility requirements related to your property.

To apply for the Arizona homestead exemption, you must complete the Maricopa Arizona Declaration and Claim of Homestead form. This form is available through your county recorder's office or online on various legal platforms. Once you fill out the form, submit it to the county recorder's office along with any required documentation. Using resources like US Legal Forms can streamline this process and ensure you have all the correct materials organized for a successful application.

Qualifying for a homestead exemption in Arizona typically requires you to meet specific residency and ownership conditions. Homeowners must fill out the necessary forms, including the Maricopa Arizona Declaration and Claim of Homestead, and provide additional documentation if required. It’s wise to review the guidelines carefully to ensure compliance and maximize your exemption opportunities.

Yes, Maricopa County offers a senior property tax exemption for eligible homeowners over the age of 65. This exemption can significantly reduce your property tax liability. To take advantage of this benefit, consider leveraging the Maricopa Arizona Declaration and Claim of Homestead and ensure that you meet the necessary requirements.