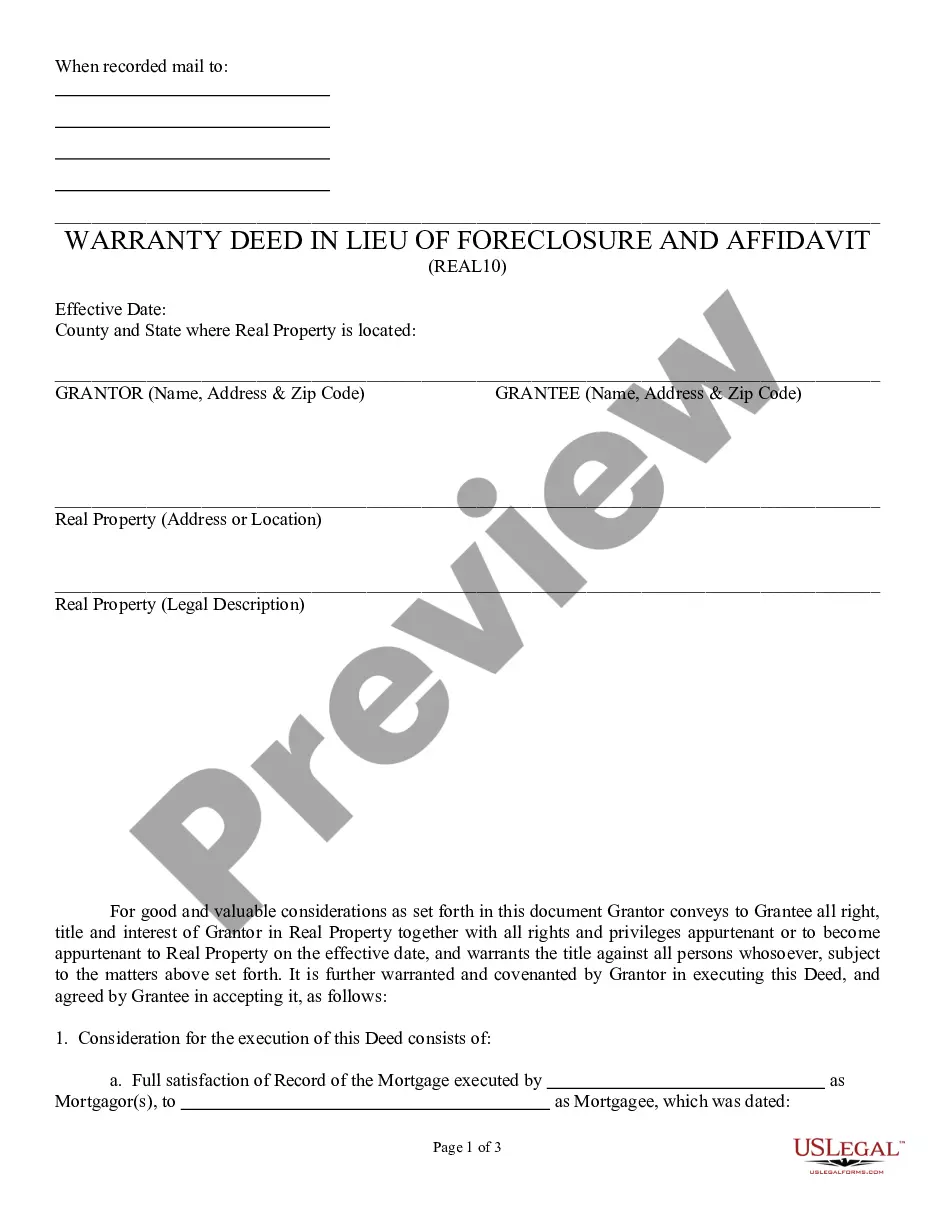

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Warranty Deed in Lieu of Foreclosure & Affidavit - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Phoenix Arizona Warranty Deed in Lieu of Foreclosure and Affidavit

Description

How to fill out Arizona Warranty Deed In Lieu Of Foreclosure And Affidavit?

If you have previously made use of our service, sign in to your account and store the Phoenix Arizona Warranty Deed in Lieu of Foreclosure and Affidavit on your device by clicking the Download button. Ensure your subscription remains active. If it is not, renew it according to your payment agreement.

If this is your initial engagement with our service, adhere to these straightforward steps to obtain your file.

You have continuous access to every document you have purchased: you can locate it in your profile under the My documents section whenever you wish to use it again. Take advantage of the US Legal Forms service to efficiently find and save any template for your personal or business requirements!

- Confirm you’ve located a suitable document. Review the details and use the Preview feature, if accessible, to verify if it fulfills your needs. If it doesn't meet your preferences, employ the Search tab above to find the correct one.

- Acquire the template. Hit the Buy Now button and select either a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finish the purchase.

- Retrieve your Phoenix Arizona Warranty Deed in Lieu of Foreclosure and Affidavit. Select the file format for your document and save it to your device.

- Finalize your sample. Print it or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

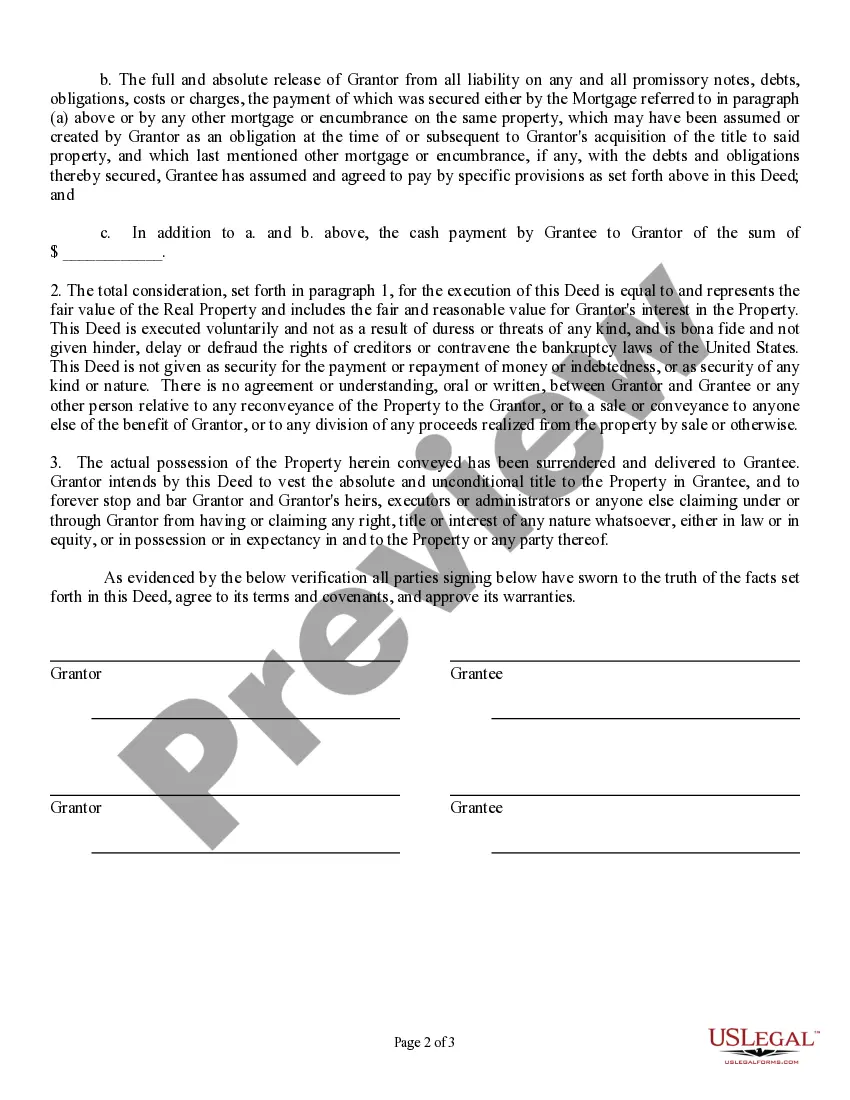

Nonetheless, a lender may reject a deed-in-lieu proposal by the borrower if the lender is concerned that the terms are unacceptable or if the lender will inherit encumbrances, judgments, or tax liens filed against the property.

The Arizona warranty deed is a form of deed that provides an unlimited warranty of title. It makes an absolute guarantee that the current owner has good title to the property. The warranty is not limited to the time that the current owner owned the property.

General warranty deed: A general warranty deed is the most common type of deed used to transfer fee simple ownership of a property. Unlike a quitclaim deed, a general warranty deed does confirm a grantor's ownership and a legal right to sell.

How to obtain a copy. Homeowners can request copies of their property records from the Recorder's Office by calling 602-506-3535 or visiting recorder.maricopa.gov.

Quitclaim deeds are the least desirable of all the property deeds. They make no guarantees to the buyer that there are no liens on the property, so when a buyer receives a quitclaim deed on a piece of property, they take on a considerable amount of risk, especially when compared to other deed types.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

The Deed of Trust is the primary security document used in Arizona. There are many similarities between the Deed of Trust and the Mortgage, which is what most Iowa property owners are familiar with, but there are significant differences as well, which a prospective owner should be aware of before buying in Arizona.

Arizona Grant Deed Information. A conveyance of land in Arizona is made by a deed in writing, subscribed and delivered by the party granting the estate, or by the granting party's agent, authorized in writing (33-401). The grant deed is similar to a warranty deed but does not include additional guarantees.

Quitclaim Deed in Arizona Quitclaim deeds are not often used when the sale of the property is involved for obvious reasons. Quitclaim deeds are much more common when there is a transfer of property from one family member to another or after a divorce.

What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? It is an adverse element in the borrower's credit history. The lender takes the real estate subject to all junior liens. The process is lengthy and involves a lawsuit.