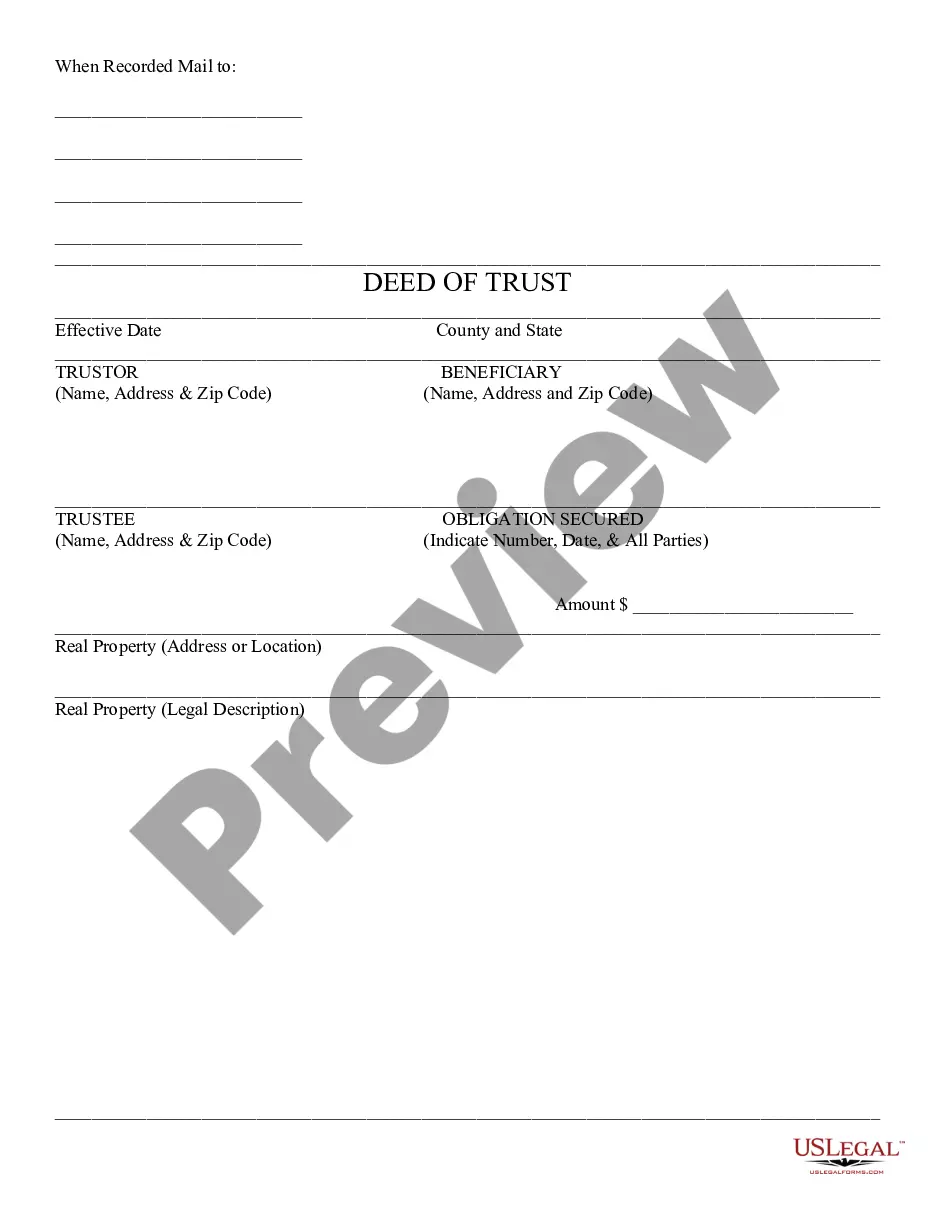

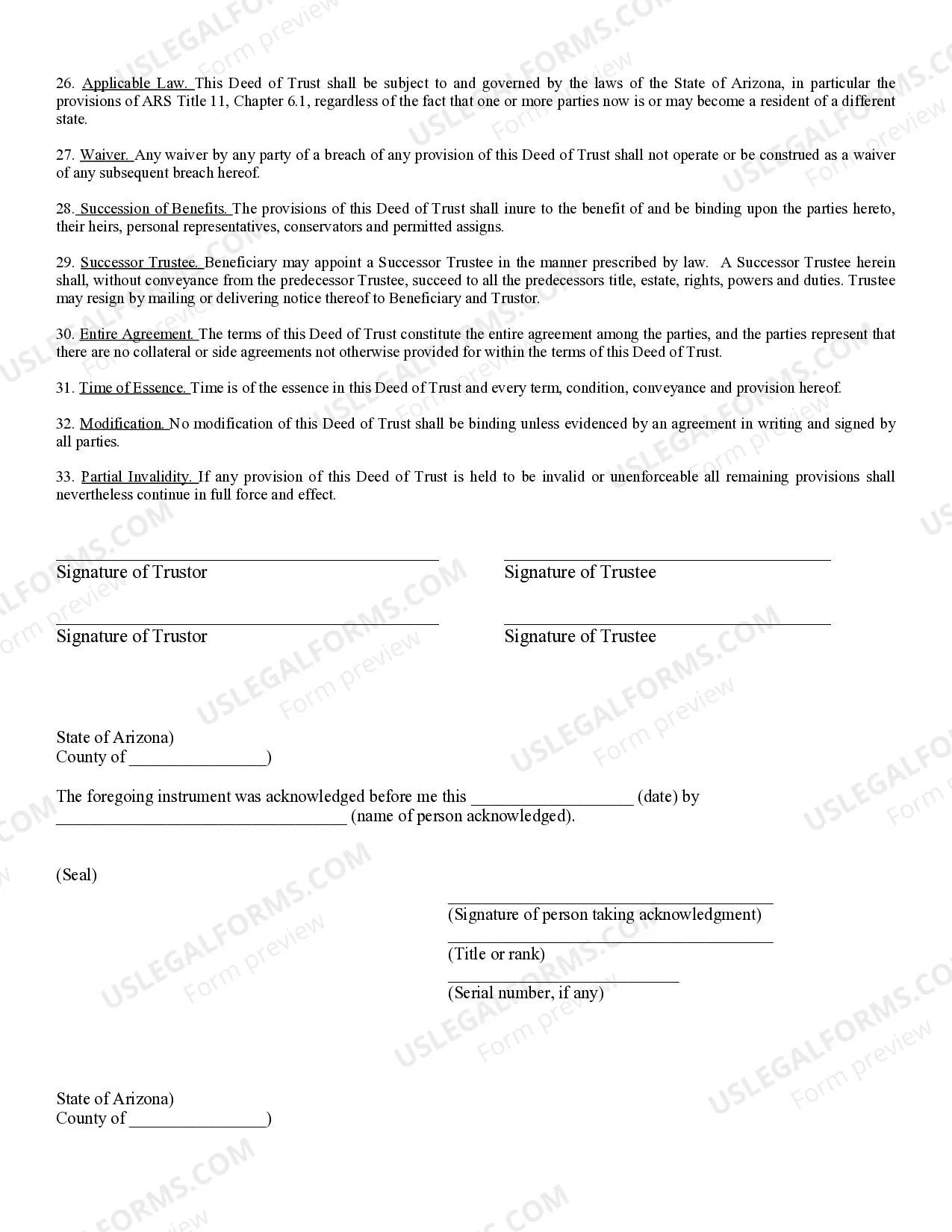

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Trust - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

The Lima Arizona Deed of Trust is a legal document that serves as a security instrument in real estate transactions. It is used to secure a loan or mortgage by creating a lien on the property until the debt is repaid. The deed of trust is commonly used in Arizona instead of a mortgage, as it allows for non-judicial foreclosure, which can expedite the foreclosure process. In a Lima Arizona Deed of Trust, there are typically three parties involved: the trust or (borrower), the beneficiary (lender), and the trustee (neutral third party). The trust or conveys the property's title to the trustee as collateral for the loan, while the beneficiary provides the funds. Different types of Lima Arizona Deed of Trust may include: 1. First Deed of Trust: This is the primary lien on the property, usually taken out when purchasing a new home. It has the highest priority in terms of repayment in case of default. 2. Second Deed of Trust: Also known as a second mortgage, this type of deed of trust is taken out when there is already an existing first deed of trust. It has a lower priority and is usually used to access additional funds using the property as collateral. 3. Wraparound Deed of Trust: In this scenario, a second deed of trust is taken out, but it includes the existing first deed of trust. The borrower makes payments to the wraparound lender, who then pays the first trust deed holder. The lender consolidates both loans and charges an overall interest rate. 4. Non-Assumable Deed of Trust: This type of deed of trust restricts the transfer of the loan and property to another party without the lender's consent. If the borrower wants to sell the property, the loan must typically be repaid in full before transferring the title. 5. Assumable Deed of Trust: In contrast to a non-assumable deed of trust, this type allows for the transfer of the loan and property to another party who takes over the loan obligations and payments. The new borrower assumes the original loan terms. The Lima Arizona Deed of Trust provides legal protection for both borrowers and lenders in real estate transactions. However, it is important to consult with a real estate attorney or professional to fully understand the specifics and implications of each type of deed of trust.