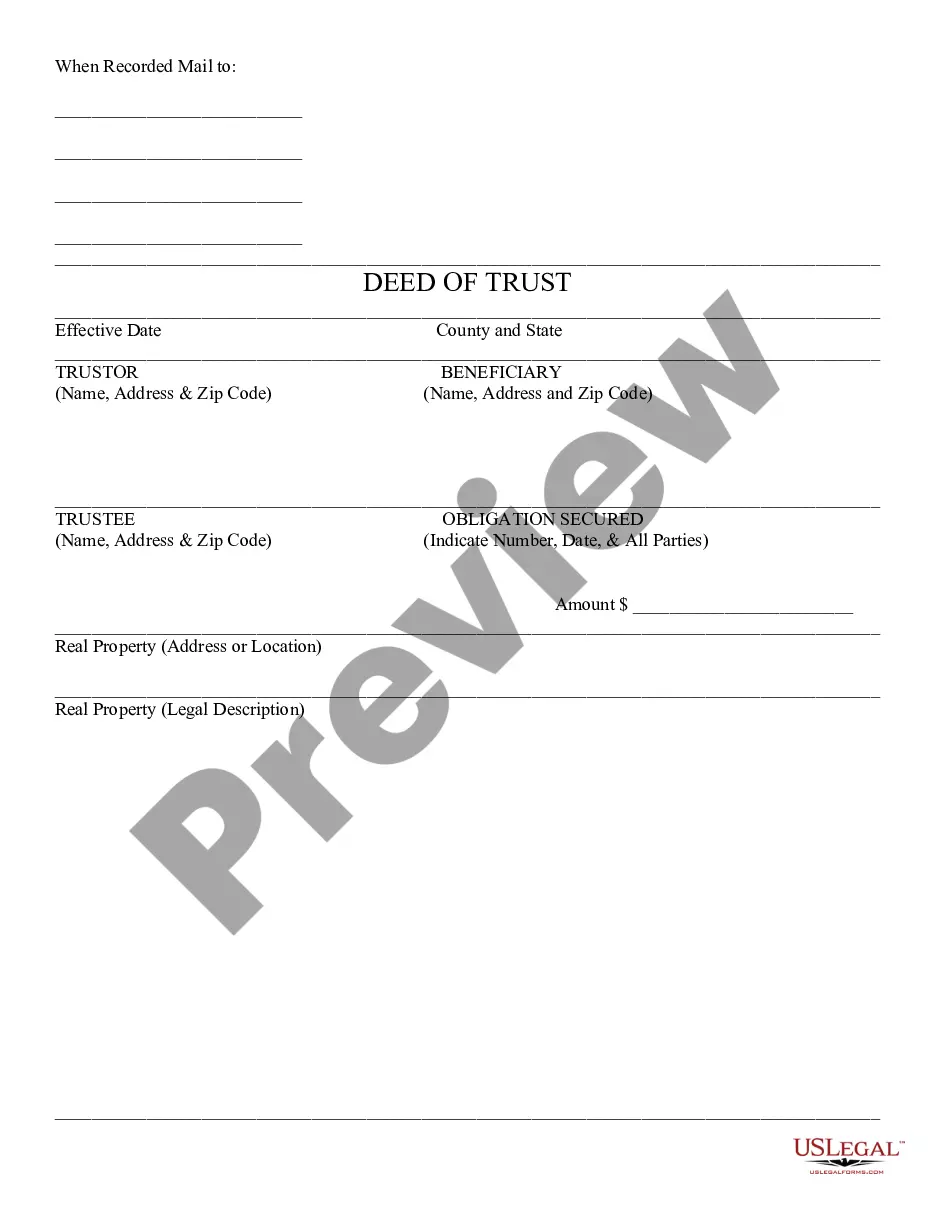

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Trust - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Tempe Arizona Deed of Trust

Description

How to fill out Arizona Deed Of Trust?

If you’ve previously employed our service, Log In to your account and store the Tempe Arizona Deed of Trust on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your first time using our service, follow these easy steps to obtain your document.

You have indefinite access to every document you’ve acquired: you can find it in your profile under the My documents section whenever you need to retrieve it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you’ve found the correct document. Browse through the description and utilize the Preview feature, if available, to verify if it suits your needs. If it doesn’t work for you, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Tempe Arizona Deed of Trust. Choose the file format for your document and save it to your device.

- Fill out your form. Print it or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

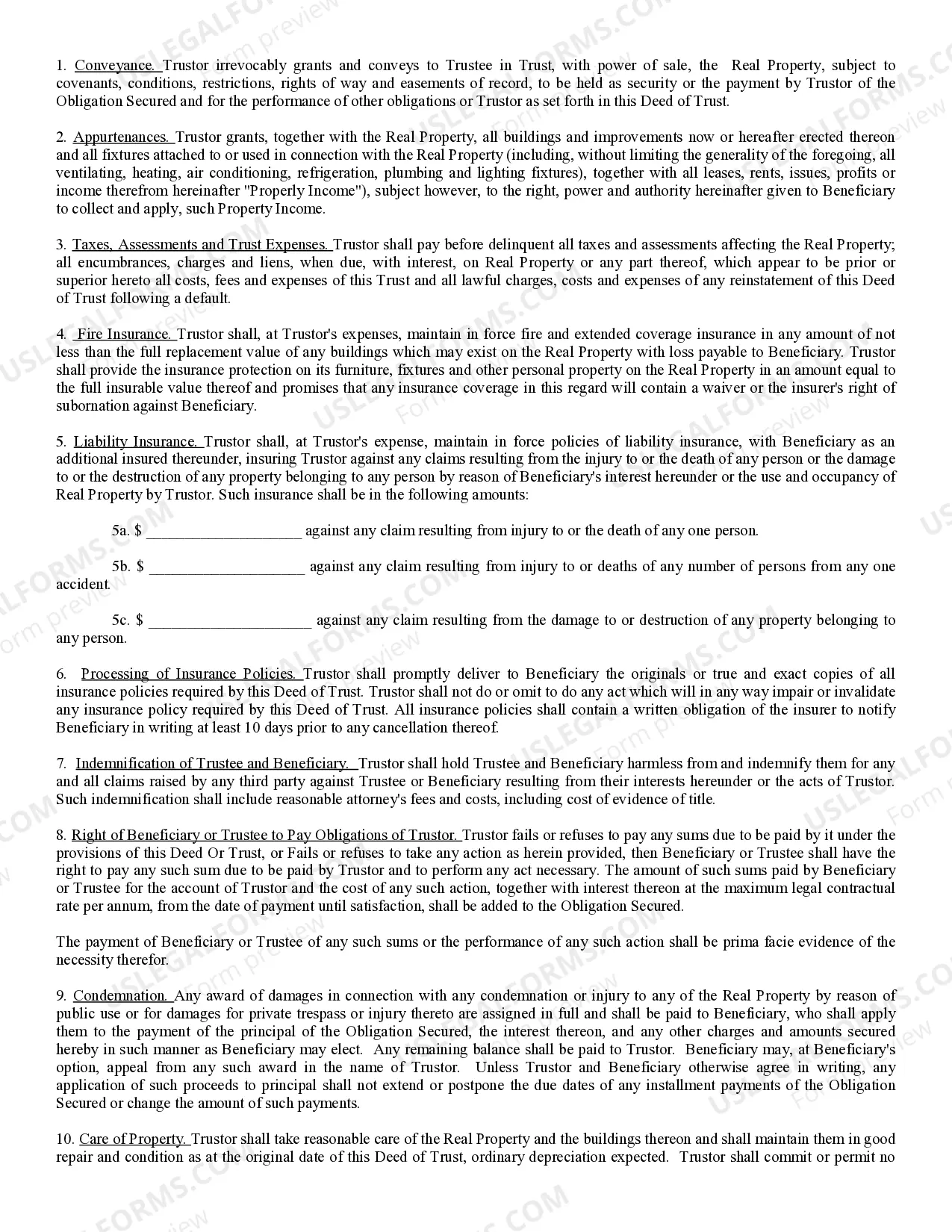

In Arizona, a deed does not have to be recorded to be valid between private parties. However, recording is crucial for protecting your rights against third-party claims. For a Tempe Arizona Deed of Trust, recording ensures your interest in the property is recognized publicly and can prevent future disputes.

Yes, Arizona does use deeds of trust as a common method for securing loans. A Tempe Arizona Deed of Trust provides a legal framework for lenders to claim property in case of default. Understanding this structure can help you make informed decisions about property investments.

To record a deed in Maricopa County, AZ, you should go to the Maricopa County Recorder’s Office. This office accepts the deed and assigns a recording number. If you are dealing with a Tempe Arizona Deed of Trust, make sure to bring all necessary documents to expedite the recording process.

The recording process for a deed in Arizona usually takes a few days to a couple of weeks. The exact time may depend on the workload of the county recorder's office. For a Tempe Arizona Deed of Trust, ensuring prompt recording helps secure your interests in the property effectively.

If a deed is not recorded in Arizona, it may still be valid between the parties involved, but it can create complications. Unrecorded deeds might not protect your ownership against claims from third parties. In the case of a Tempe Arizona Deed of Trust, recording keeps a public record of your interest in the property, reducing the risk of disputes.

To obtain a beneficiary deed in Arizona, you must draft and file the deed with the County Recorder's Office. This document allows you to designate a beneficiary who will inherit the property upon your passing. Platforms such as USLegalForms can provide you with the necessary forms and instructions to effectively create and file your Tempe Arizona Deed of Trust, ensuring a smooth transfer of property.

If you need a copy of your house deed in Arizona, start by contacting your local County Recorder's Office. You can request a certified copy of your Tempe Arizona Deed of Trust either in person or via their website. For added convenience, services like USLegalForms can assist you in navigating the steps necessary to secure your property documents.

To obtain a copy of your deed in Arizona, you can visit the County Recorder's Office where the property is located. You may request copies in person or through their online services. Additionally, using platforms like USLegalForms can streamline this process by providing guidance and resources to help you locate your Tempe Arizona Deed of Trust quickly.

Yes, you can write your own trust in Arizona, but it is crucial to ensure that it meets all legal requirements. While templates and online resources can guide you, consulting an attorney may be beneficial for complex cases. With US Legal Forms, you can find user-friendly templates for a Tempe Arizona Deed of Trust, making it easier to draft your own legally sound documents.

Yes, Arizona is considered a deed state, which means it uses deeds of trust to secure loans rather than mortgages. This process allows for a more streamlined foreclosure process if necessary. If you want to understand better how a Tempe Arizona Deed of Trust works, exploring resources on US Legal Forms can provide valuable insights and templates.