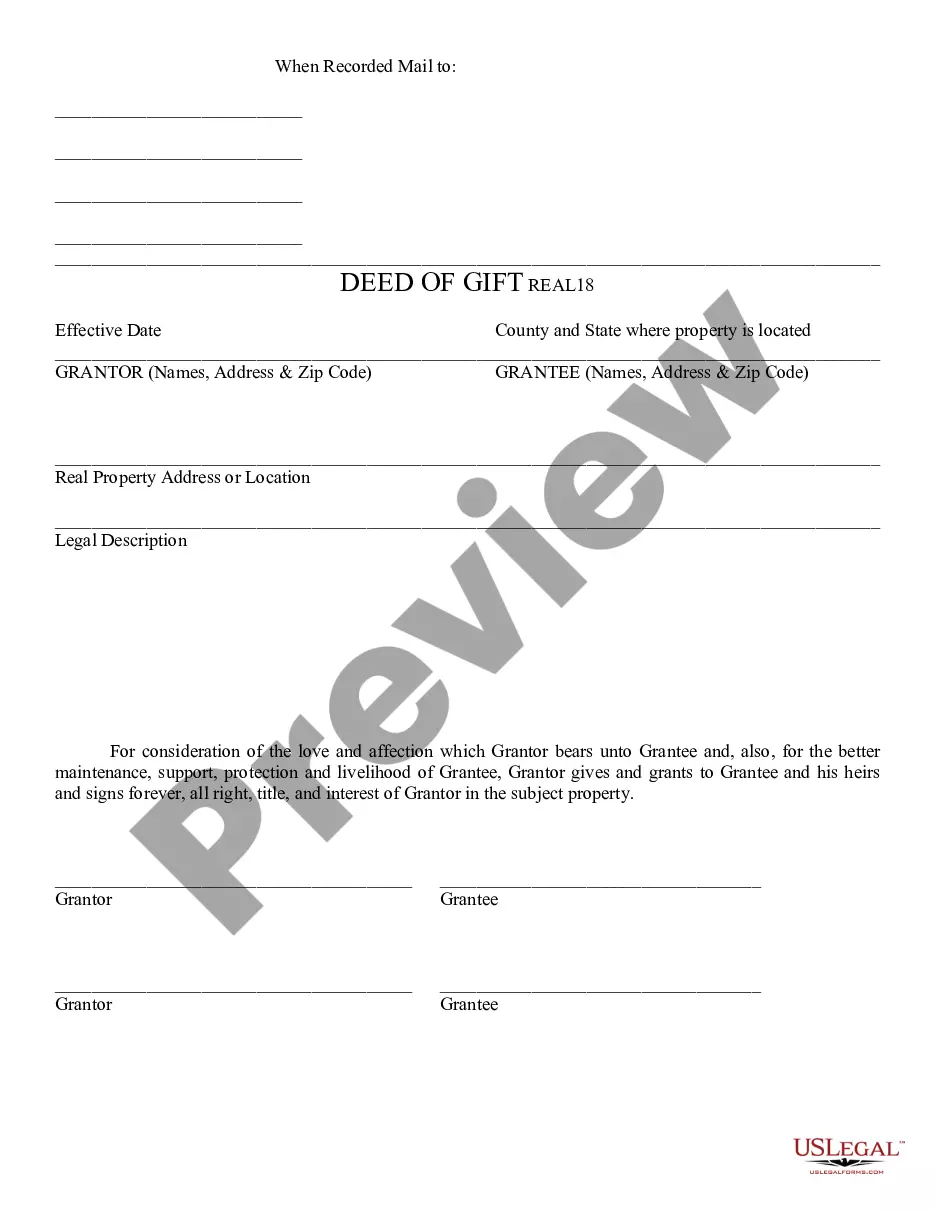

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Gift - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Chandler Arizona Deed of Gift

Description

How to fill out Arizona Deed Of Gift?

Irrespective of societal or occupational rank, completing legal paperwork is an unfortunate obligation in the current era.

Frequently, it’s nearly impossible for individuals lacking legal expertise to generate such documents independently, mainly due to the intricate language and legal subtleties they involve.

This is where US Legal Forms can be a lifesaver.

Verify that the form you have located is applicable to your region as the laws of one state or county may not be valid for another.

If the form you selected doesn’t meet your requirements, you can restart and search for the needed document.

- Our platform provides a vast repository with over 85,000 ready-to-utilize state-specific forms applicable to nearly any legal circumstance.

- US Legal Forms is also a superb asset for associates or legal advisors seeking to enhance efficiency using our DIY paperwork.

- Whether you need the Chandler Arizona Deed of Gift or any other document valid in your state or municipality, with US Legal Forms, everything is readily accessible.

- Here’s how you can quickly acquire the Chandler Arizona Deed of Gift using our reliable platform.

- If you are an existing client, you can simply Log In to your account to access the required form.

- On the other hand, if you are new to our collection, make sure to follow these guidelines prior to acquiring the Chandler Arizona Deed of Gift.

Form popularity

FAQ

To find a property deed in Arizona, you can start by visiting the county recorder's office. Most counties provide online access to property records through their official websites. Simply search using the property address or the owner's name. Additionally, using the US Legal Forms platform can simplify the process of locating and obtaining a Chandler Arizona Deed of Gift.

Yes, property ownership in Arizona is generally considered a matter of public record. This means that anyone can access information about property ownership, including details like the deed and previous transactions. Transparency in property ownership benefits both buyers and sellers, allowing for informed decisions. Utilizing a Chandler Arizona Deed of Gift ensures your property transfers are documented properly, contributing to the public record.

Chandler, Arizona, is a city located in Maricopa County. It is known for its rich history, vibrant community, and growing economy. As a prominent city in the Phoenix metropolitan area, Chandler offers a range of amenities and services that contribute to its appeal as a residential location. Residents often use resources like the Chandler Arizona Deed of Gift to facilitate property transfers and maintain the area's charm.

In Arizona, for a deed to be legally effective, it must be signed, notarized, and recorded with the County Recorder's Office. The deed should include specific information, such as the legal description of the property and the names of the parties involved. Properly recording the Chandler Arizona Deed of Gift ensures that your intentions regarding property transfer are recognized legally. It protects your beneficiaries and helps avoid future disputes.

Yes, Arizona allows for the use of a beneficiary deed, which is a useful estate planning tool. It enables property owners to transfer real estate to beneficiaries upon death without going through probate. This deed can simplify the transfer process and maintain privacy regarding property ownership. Using a Chandler Arizona Deed of Gift can also complement your estate plan, ensuring smooth transitions.

To add a name to a deed in Arizona, you will use a Chandler Arizona Deed of Gift. This legal document allows you to transfer an interest in the property to another individual. After drafting the deed with correct information, you must sign and record it with the county recorder’s office. U.S. Legal Forms simplifies this process with easy-to-use templates.

In Arizona, a beneficiary deed supersedes a will concerning the property it covers. If you have designated someone in a Chandler Arizona Deed of Gift and also mentioned that property in your will, the beneficiary deed will take precedence after your death. This highlights the importance of being clear about your wishes in both documents. Consulting with legal professionals can ensure your intentions are well documented.

A beneficiary deed in Arizona allows you to designate someone to receive your property upon your passing, without going through probate. Essentially, it acts like a Chandler Arizona Deed of Gift but is effective only after your death. This means you maintain full control of the property while you are alive. U.S. Legal Forms offers comprehensive guides on how to execute beneficiary deeds correctly.

Transferring a property title to a family member typically involves using a Chandler Arizona Deed of Gift. This deed specifies that ownership is being transferred to a relative without any financial exchange. After preparing the deed, it must be signed and recorded with the relevant county office to be effective. U.S. Legal Forms provides user-friendly templates for this kind of transfer.

When adding someone to a deed in Arizona, such as through a Chandler Arizona Deed of Gift, you may need to consider gift tax implications. If the value of the property exceeds certain thresholds, it could trigger federal gift tax considerations. Additionally, changing the deed may affect property taxes based on the new ownership status. It is advisable to consult a tax professional for specific guidance.