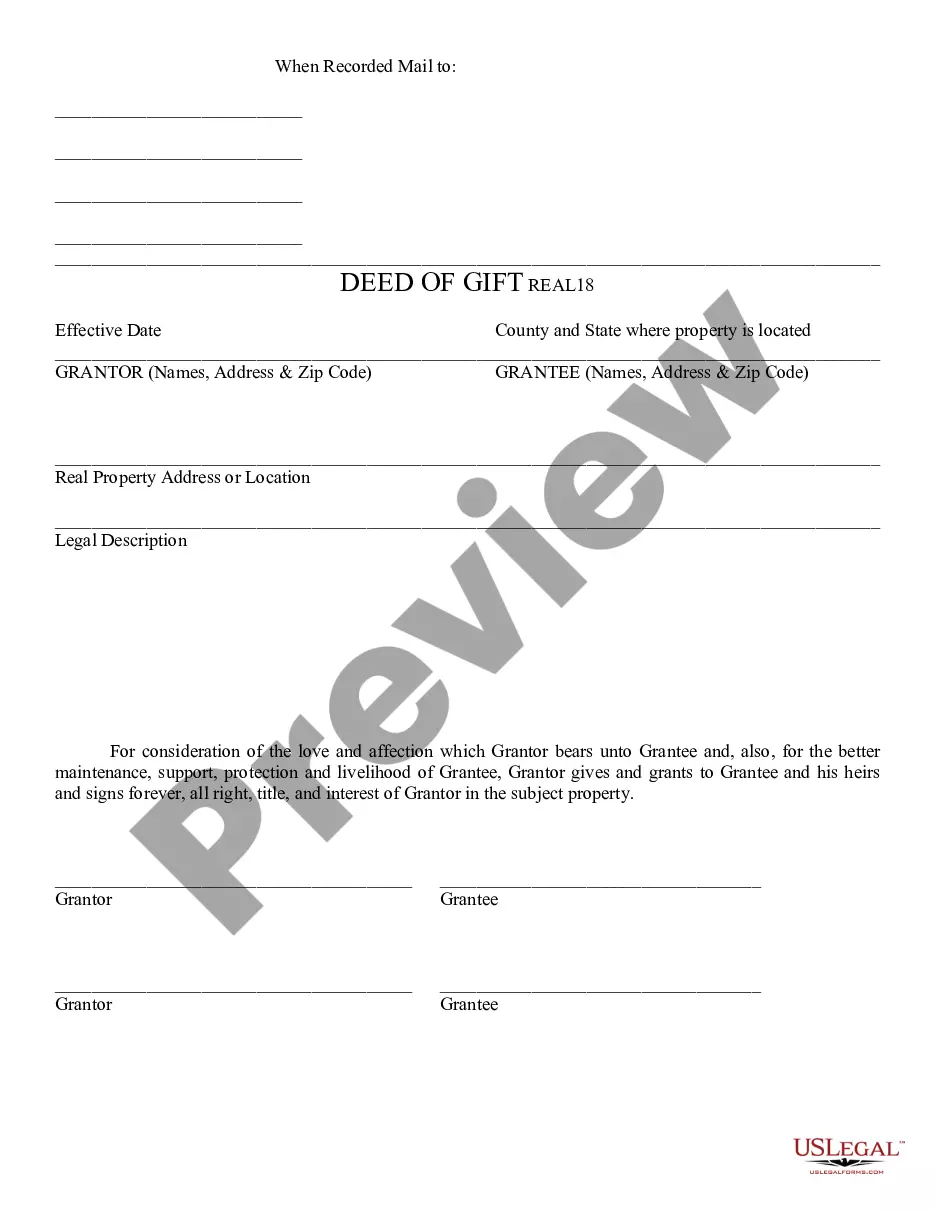

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Gift - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

A Surprise Arizona Deed of Gift is a legal document that conveys ownership of property from one party (the donor) to another (the recipient) without any exchange of money. This type of deed serves as evidence of the donor's intent to gift the property to the recipient willingly and voluntarily. The Surprise Arizona Deed of Gift is commonly used when individuals want to transfer ownership of real estate, personal belongings, or other assets to someone else, such as a family member or a charitable organization. This document helps ensure that the transfer is legally binding and protects the rights of both parties involved. There are different types of Surprise Arizona Deed of Gift, each tailored to specific needs or circumstances: 1. Real Estate Deed of Gift: This type of deed is used when gifting a piece of real estate, such as a house, land, or commercial property. It outlines the property's legal description, the donor's intent to gift the property, and any conditions or restrictions associated with the gift. 2. Personal Property Deed of Gift: This type of deed applies to the transfer of personal belongings, such as vehicles, artwork, jewelry, or furniture. It details the description of the gifted item, the donor's intent to gift it, and any relevant conditions or expectations. 3. Intergenerational Deed of Gift: This type of deed is specifically designed for the transfer of property between family members, such as parents to children or grandparents to grandchildren. It often involves the transfer of assets like homes, businesses, or investment accounts. 4. Charitable Deed of Gift: This type of deed is used when individuals wish to donate property or assets to a charitable organization, foundation, or institution. It ensures that the gift is transferred to the designated nonprofit entity legally and securely. It's important to note that a Surprise Arizona Deed of Gift should be prepared by an experienced attorney to ensure its compliance with local laws and regulations. Additionally, both the donor and recipient should fully understand the implications and potential tax implications of such a transfer.