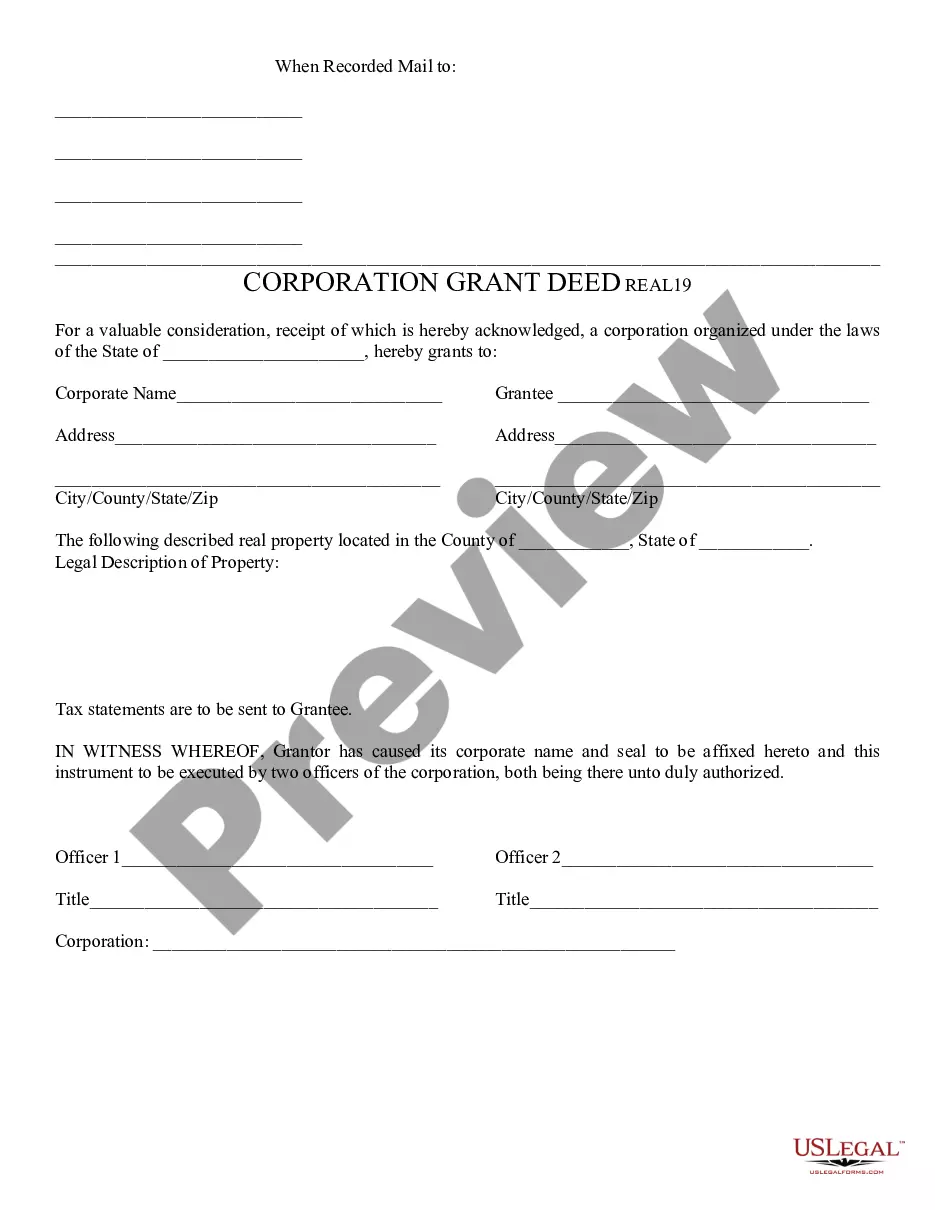

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Corporate Grant Deed - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

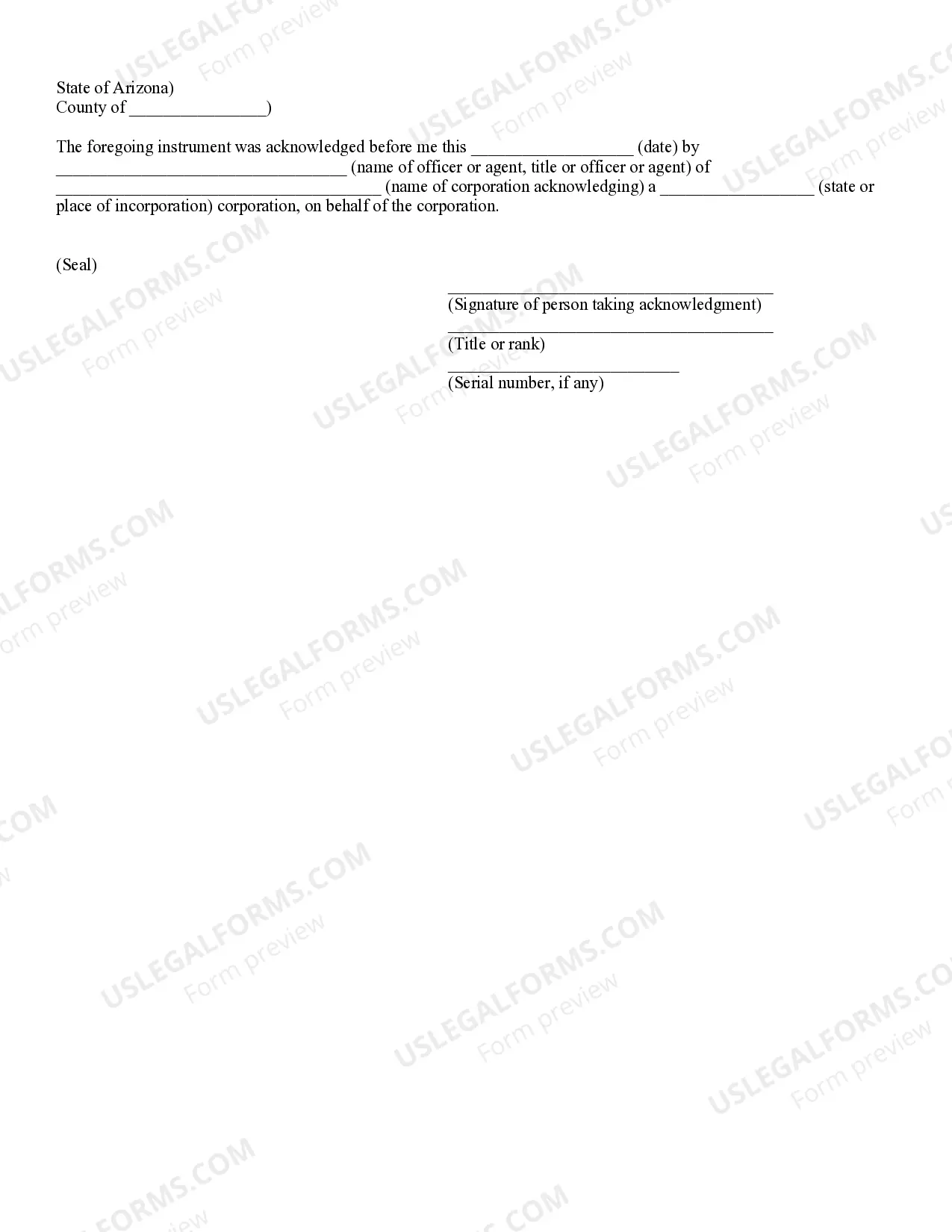

A Phoenix Arizona Corporate Grant Deed is a legal document that conveys the ownership of real property from a corporation to another party. It is commonly used in real estate transactions and serves as proof of the transfer of property rights. The grant deed is filed with the county recorder's office in Phoenix, Arizona, and becomes part of the public record. The granter, which is the corporation transferring the property, guarantees that they have the legal right to convey the property and that it is free from any encumbrances, except those specifically stated in the deed. The granter also ensures that they will defend the title against any claims arising from the actions of the granter or any previous owners. The grant deed includes several essential components, such as the name and legal description of the property being conveyed, the names of the granter and grantee, and the consideration given for the transfer. It should also be signed and dated by an authorized representative of the corporate entity. In Phoenix, Arizona, there are various types of corporate grant deeds that may be used depending on specific circumstances: 1. General Corporate Grant Deed: This is the most common type where the corporation transfers the property to another party without any specific obligations or conditions attached. 2. Special Corporate Grant Deed: In some cases, the transfer may be subject to certain conditions or restrictions that are outlined in the deed. These conditions could include easements, use restrictions, or specific performance obligations. 3. Corporation-Exempt Corporate Grant Deed: This type of deed is often used when a corporation is transferring property to a governmental agency or a nonprofit organization exempt from certain property taxes. It ensures that the recipient will continue to qualify for the tax exemption. It is important to consult with a qualified attorney or legal professional when dealing with a Phoenix Arizona Corporate Grant Deed to ensure compliance with all applicable laws and regulations.A Phoenix Arizona Corporate Grant Deed is a legal document that conveys the ownership of real property from a corporation to another party. It is commonly used in real estate transactions and serves as proof of the transfer of property rights. The grant deed is filed with the county recorder's office in Phoenix, Arizona, and becomes part of the public record. The granter, which is the corporation transferring the property, guarantees that they have the legal right to convey the property and that it is free from any encumbrances, except those specifically stated in the deed. The granter also ensures that they will defend the title against any claims arising from the actions of the granter or any previous owners. The grant deed includes several essential components, such as the name and legal description of the property being conveyed, the names of the granter and grantee, and the consideration given for the transfer. It should also be signed and dated by an authorized representative of the corporate entity. In Phoenix, Arizona, there are various types of corporate grant deeds that may be used depending on specific circumstances: 1. General Corporate Grant Deed: This is the most common type where the corporation transfers the property to another party without any specific obligations or conditions attached. 2. Special Corporate Grant Deed: In some cases, the transfer may be subject to certain conditions or restrictions that are outlined in the deed. These conditions could include easements, use restrictions, or specific performance obligations. 3. Corporation-Exempt Corporate Grant Deed: This type of deed is often used when a corporation is transferring property to a governmental agency or a nonprofit organization exempt from certain property taxes. It ensures that the recipient will continue to qualify for the tax exemption. It is important to consult with a qualified attorney or legal professional when dealing with a Phoenix Arizona Corporate Grant Deed to ensure compliance with all applicable laws and regulations.