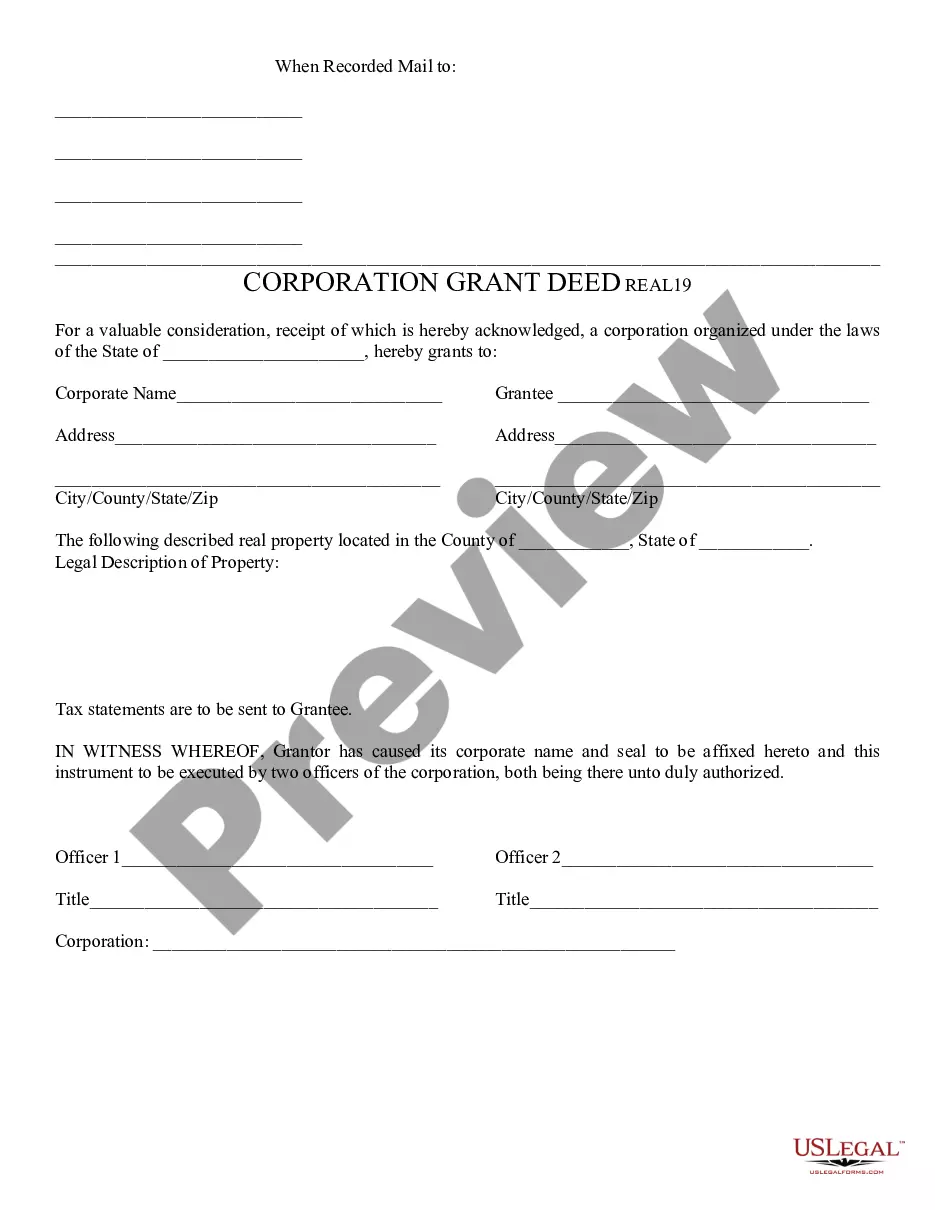

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Corporate Grant Deed - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

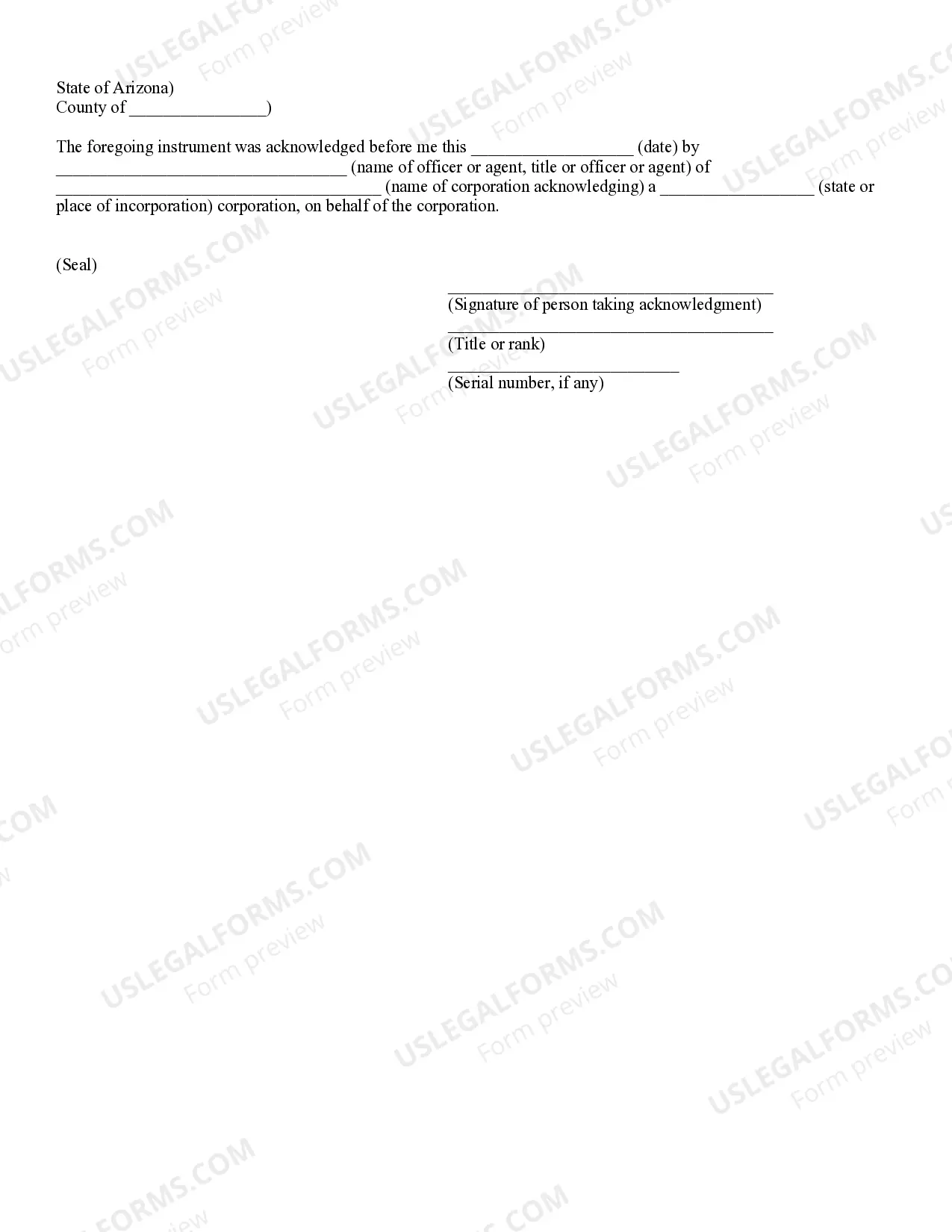

A Surprise Arizona Corporate Grant Deed is a legal document that transfers ownership of real property from a corporation to another party or entity in Surprise, Arizona. This type of deed is commonly used when a corporate entity wants to transfer ownership of a property they own to a different individual or business. A Corporate Grant Deed in Surprise, Arizona is typically used in situations where a corporation needs to transfer ownership of property in a transparent and secure manner. This type of deed ensures that the property's title is cleanly transferred, free from any existing liens or encumbrances. In Surprise, Arizona, there are several types of Corporate Grant Deeds, each serving a specific purpose. Some common types include: 1. General Corporate Grant Deed: This type of deed is used to transfer general ownership of real property from a corporation to another individual or business entity. It is a straightforward deed that conveys the property without any specific warranties. 2. Special Corporate Grant Deed: A special corporate grant deed is used when the corporation wants to transfer property with specific warranties or conditions. This may include warranty of title, warranty against encumbrances, or other guarantees. 3. Quitclaim Corporate Grant Deed: In cases where the corporation is transferring property without making any warranties or guarantees, they may choose to use a quitclaim corporate grant deed. This type of deed releases the corporation's interest in the property without any assurances regarding the title. 4. Subordinate Corporate Grant Deed: If there are existing liens or encumbrances on the property, a corporation may use a subordinate corporate grant deed to transfer ownership while acknowledging the superior rights of the existing lien holders. When a Surprise Arizona Corporate Grant Deed is executed, it typically includes information such as the names and addresses of the parties involved, property description, purchase price (if applicable), and any specific terms or conditions of the transfer. It is important to consult with a qualified attorney or real estate professional when dealing with corporate grant deeds to ensure compliance with local laws and regulations.A Surprise Arizona Corporate Grant Deed is a legal document that transfers ownership of real property from a corporation to another party or entity in Surprise, Arizona. This type of deed is commonly used when a corporate entity wants to transfer ownership of a property they own to a different individual or business. A Corporate Grant Deed in Surprise, Arizona is typically used in situations where a corporation needs to transfer ownership of property in a transparent and secure manner. This type of deed ensures that the property's title is cleanly transferred, free from any existing liens or encumbrances. In Surprise, Arizona, there are several types of Corporate Grant Deeds, each serving a specific purpose. Some common types include: 1. General Corporate Grant Deed: This type of deed is used to transfer general ownership of real property from a corporation to another individual or business entity. It is a straightforward deed that conveys the property without any specific warranties. 2. Special Corporate Grant Deed: A special corporate grant deed is used when the corporation wants to transfer property with specific warranties or conditions. This may include warranty of title, warranty against encumbrances, or other guarantees. 3. Quitclaim Corporate Grant Deed: In cases where the corporation is transferring property without making any warranties or guarantees, they may choose to use a quitclaim corporate grant deed. This type of deed releases the corporation's interest in the property without any assurances regarding the title. 4. Subordinate Corporate Grant Deed: If there are existing liens or encumbrances on the property, a corporation may use a subordinate corporate grant deed to transfer ownership while acknowledging the superior rights of the existing lien holders. When a Surprise Arizona Corporate Grant Deed is executed, it typically includes information such as the names and addresses of the parties involved, property description, purchase price (if applicable), and any specific terms or conditions of the transfer. It is important to consult with a qualified attorney or real estate professional when dealing with corporate grant deeds to ensure compliance with local laws and regulations.