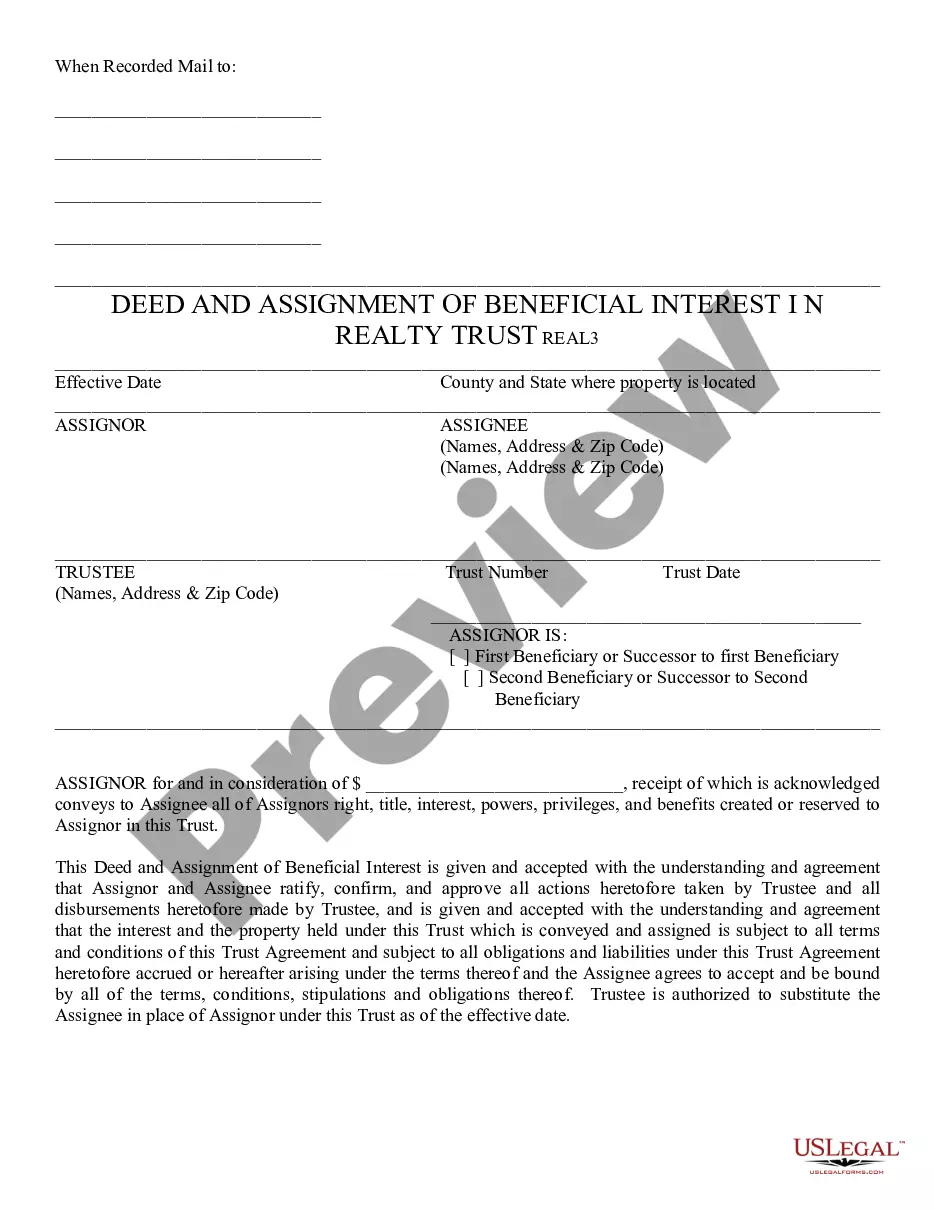

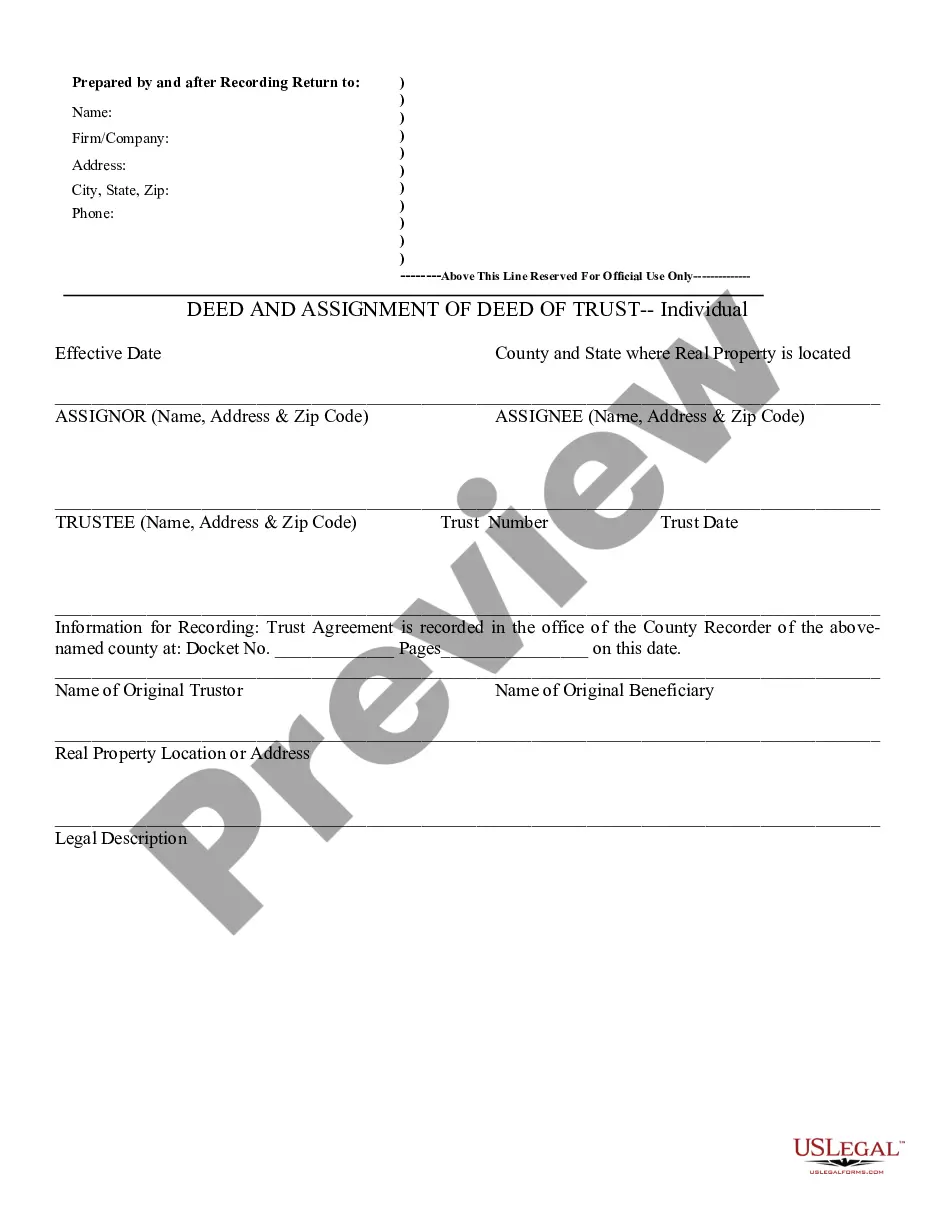

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed & Assignment of Beneficial Interest in Realty Trust, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Mesa Arizona Deed and Assignment of Beneficial Interest in Realty Trust

Description

How to fill out Arizona Deed And Assignment Of Beneficial Interest In Realty Trust?

If you are in search of a pertinent form template, it’s incredibly challenging to locate a more advantageous location than the US Legal Forms site – likely the most comprehensive libraries on the web.

With this collection, you can acquire numerous templates for both business and personal use categorized by types and regions, or keywords.

Utilizing our sophisticated search option, locating the most recent Mesa Arizona Deed and Assignment of Beneficial Interest in Realty Trust is as simple as 1-2-3.

Confirm your selection. Click the Buy now button. Subsequently, choose the desired subscription plan and provide the necessary information to register for an account.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

- Additionally, the relevance of each document is confirmed by a team of experienced attorneys who consistently review the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, to obtain the Mesa Arizona Deed and Assignment of Beneficial Interest in Realty Trust is merely to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the very first time, simply follow the guidelines outlined below.

- Ensure you have located the form you require. Review its description and use the Preview feature (if accessible) to examine its content.

- If it doesn't fulfill your requirements, utilize the Search bar at the top of the page to find the desired document.

Form popularity

FAQ

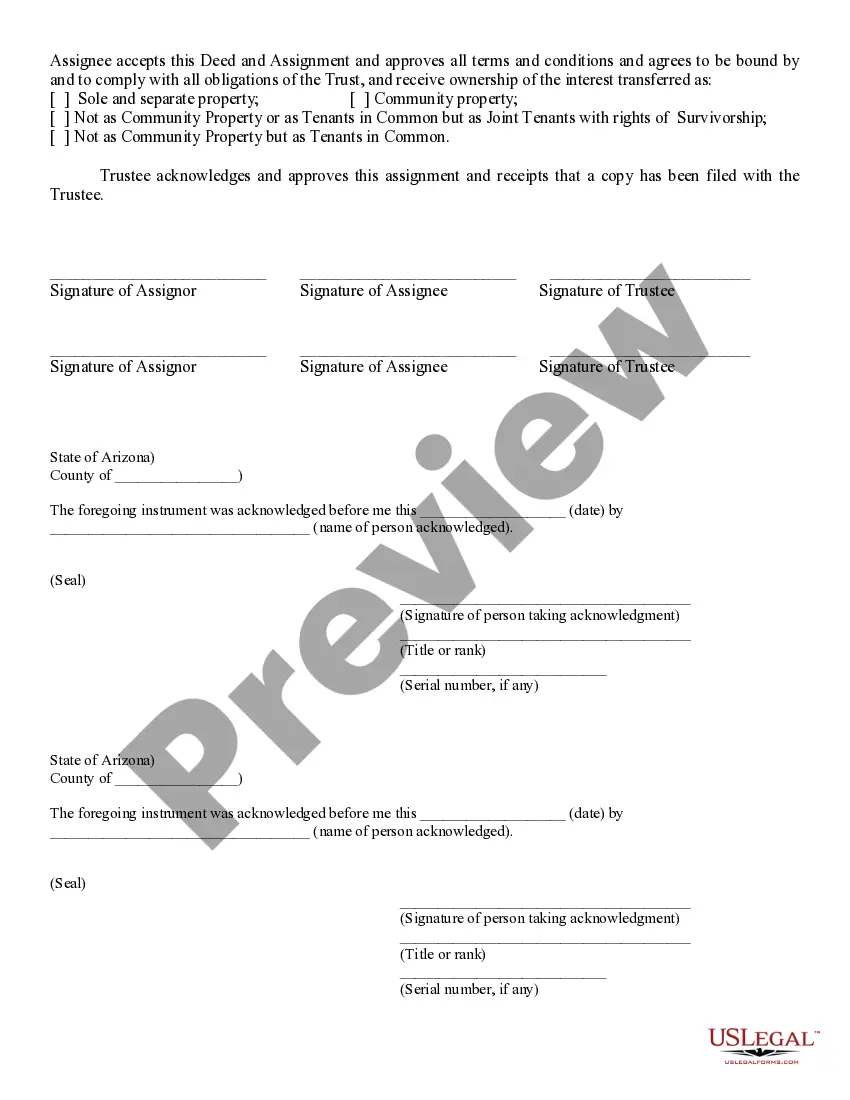

In Arizona, you can take title as Community Property, Community Property with Right of Survivorship, Joint Tenants with Right of Survivorship, Tenants in Common, Sole and Separate, Single, Unmarried, Trust, and Corporations/Partnerships/Limited Liability Company.

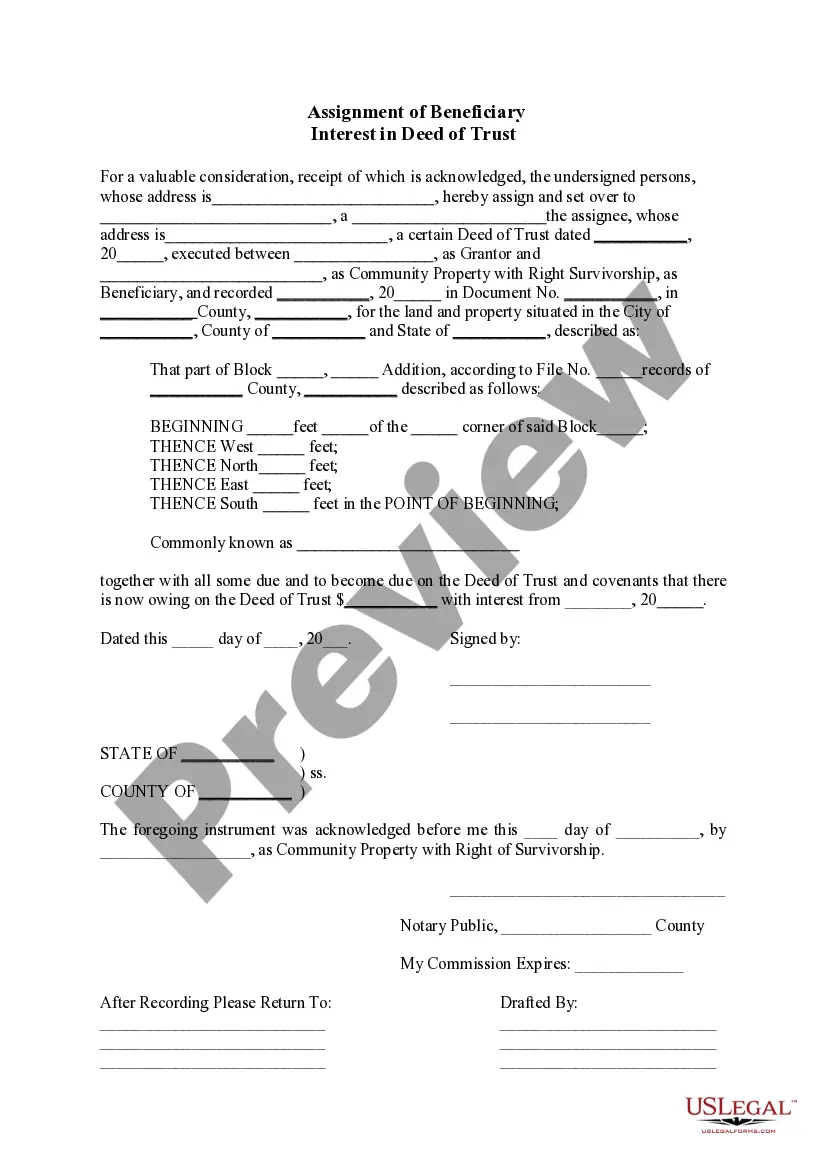

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

Assignment of Beneficial Interest means an assignment of ownership interest in a Purchaser Entity from a BI Seller to a Purchaser substantially in the form of Exhibit A-1, A-2 or A-3, as applicable, hereto or in the Agreed Form.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Transferring a property into a trust as a gift or to children is a means to securing your assets, but it's important to account for these additional costs. There is a way to avoid inheritance tax in particular, however.

Real Estate ? Real estate which is to be transferred into a trust must be conveyed in an Arizona Deed. The document must be signed by all parties in front of a Notary Public and filed with the County Recorder's Office.

Real Estate ? Real estate which is to be transferred into a trust must be conveyed in an Arizona Deed. The document must be signed by all parties in front of a Notary Public and filed with the County Recorder's Office.

You may create life estates or any other form of ownership recognized in Arizona. Beneficiary deeds work well when the title will pass to a single individual or to a few individuals all of whom share a common vision of what to do with the property.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.