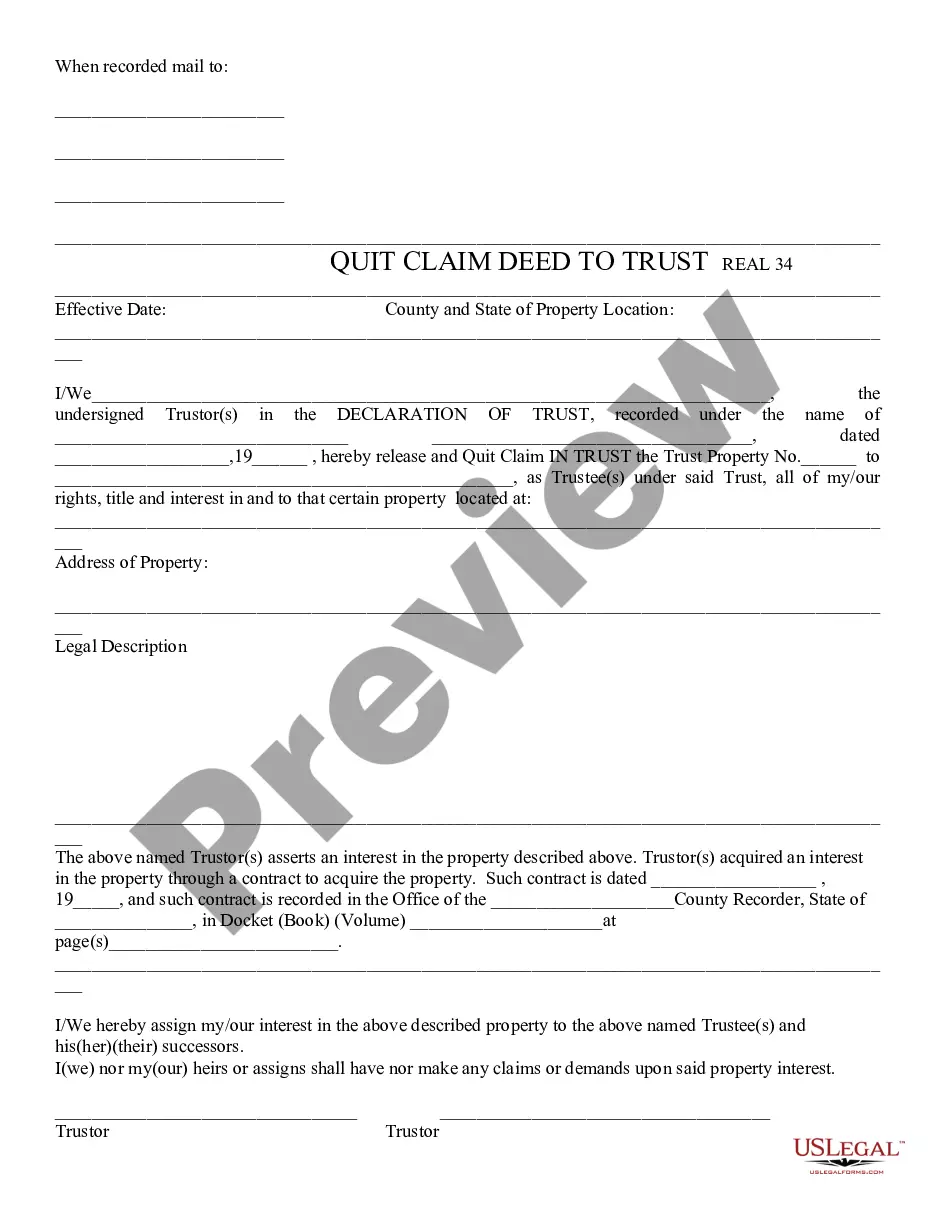

Quitclaim to Trust: This form is used by a Trustor of a trust, when he/she gives their rights to the property in the trust to the Trustee. The disclaimer further states that the Trustor will no longer claim any rights to the property handed over to the Trustee. It is available for download in both Word and Rich Text formats.

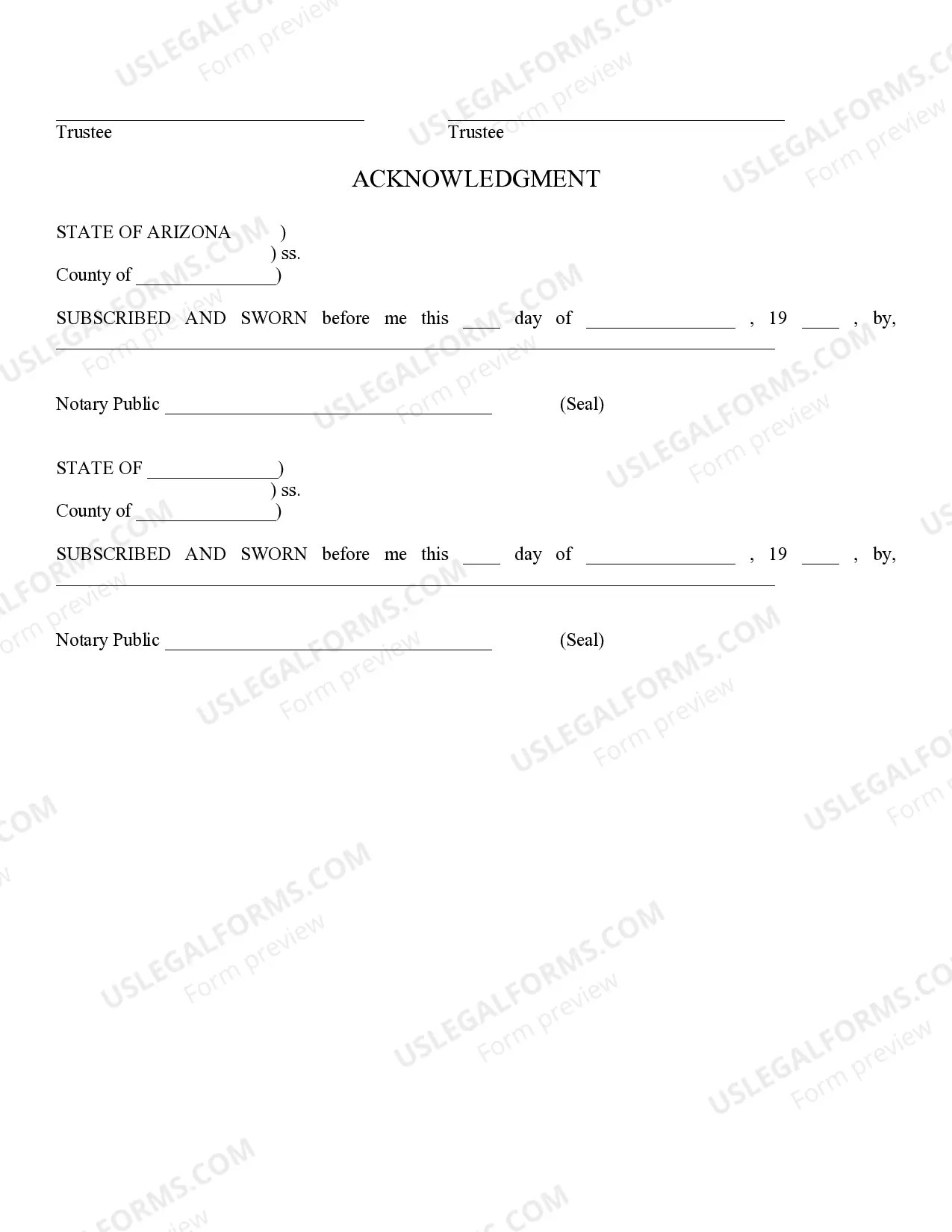

Scottsdale Arizona Quitclaim to Trust is a legal instrument commonly used in real estate transactions to transfer ownership of a property from an individual or entity to a trust. This type of transfer can be particularly beneficial for estate planning purposes, asset protection, and avoiding probate. A Quitclaim to Trust allows the property owner, known as the granter, to transfer their interest in the property to a trust, known as the grantee. By doing so, the granter effectively removes themselves as the legal owner of the property and places it under the ownership of the trust. This ensures that the property is managed according to the terms and conditions set forth in the trust agreement. In Scottsdale, Arizona, there are several types of Quitclaim to Trust methods available. These include: 1. Revocable Living Trust: A popular option for estate planning, this trust can be altered or revoked by the granter during their lifetime. It provides flexibility and control over the property while allowing for ease of transfer upon the granter's death. 2. Irrevocable Trust: Unlike a revocable living trust, an irrevocable trust cannot be changed or terminated without the permission of the beneficiaries. This type of trust offers greater asset protection and may have tax benefits, but it comes with less flexibility. 3. Special Needs Trust: This type of trust is designed to provide financial support for individuals with special needs without jeopardizing their eligibility for government assistance programs. It allows the granter to maintain control and provide for the beneficiary's long-term care. 4. Charitable Remainder Trust: A charitable remainder trust allows the granter to transfer property to a trust, where income is generated for a specified period of time. This income is then donated to a charitable organization upon the trust's termination, providing tax advantages for the granter. When executing a Quitclaim to Trust in Scottsdale, it is crucial to consult with an experienced attorney or estate planner specializing in trust law. They can help ensure that the transfer is properly documented, all legal requirements are met, and the trust is structured according to the granter's wishes. In conclusion, Scottsdale Arizona Quitclaim to Trust is a valuable tool for transferring property ownership to a trust, providing the granter with various benefits for estate planning, asset protection, and avoiding probate. Understanding the different types of trusts available, such as revocable living trusts, irrevocable trusts, special needs trusts, and charitable remainder trusts, allows individuals to make informed decisions based on their specific needs and objectives. Consulting with a knowledgeable professional is highly recommended navigating the complexities of this legal process effectively.