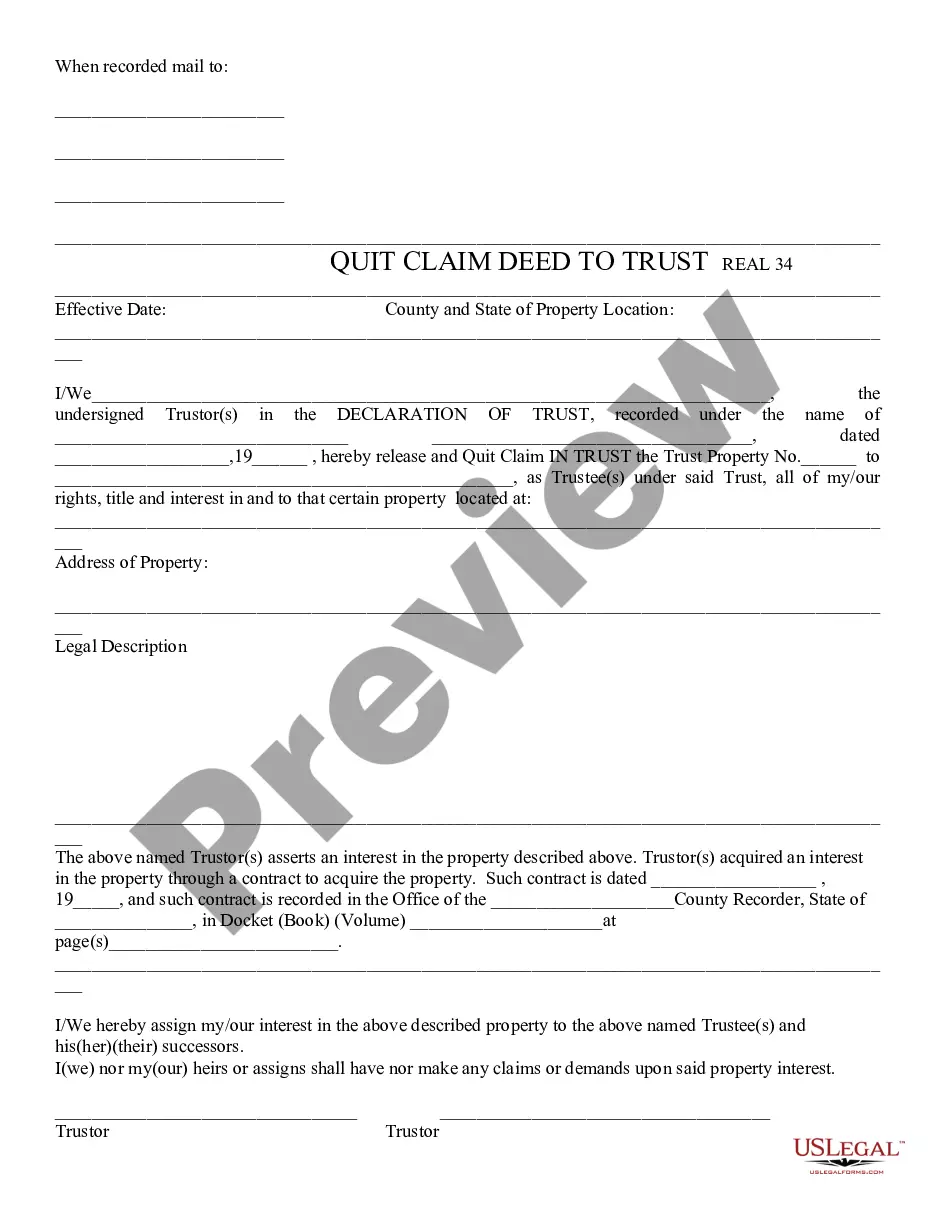

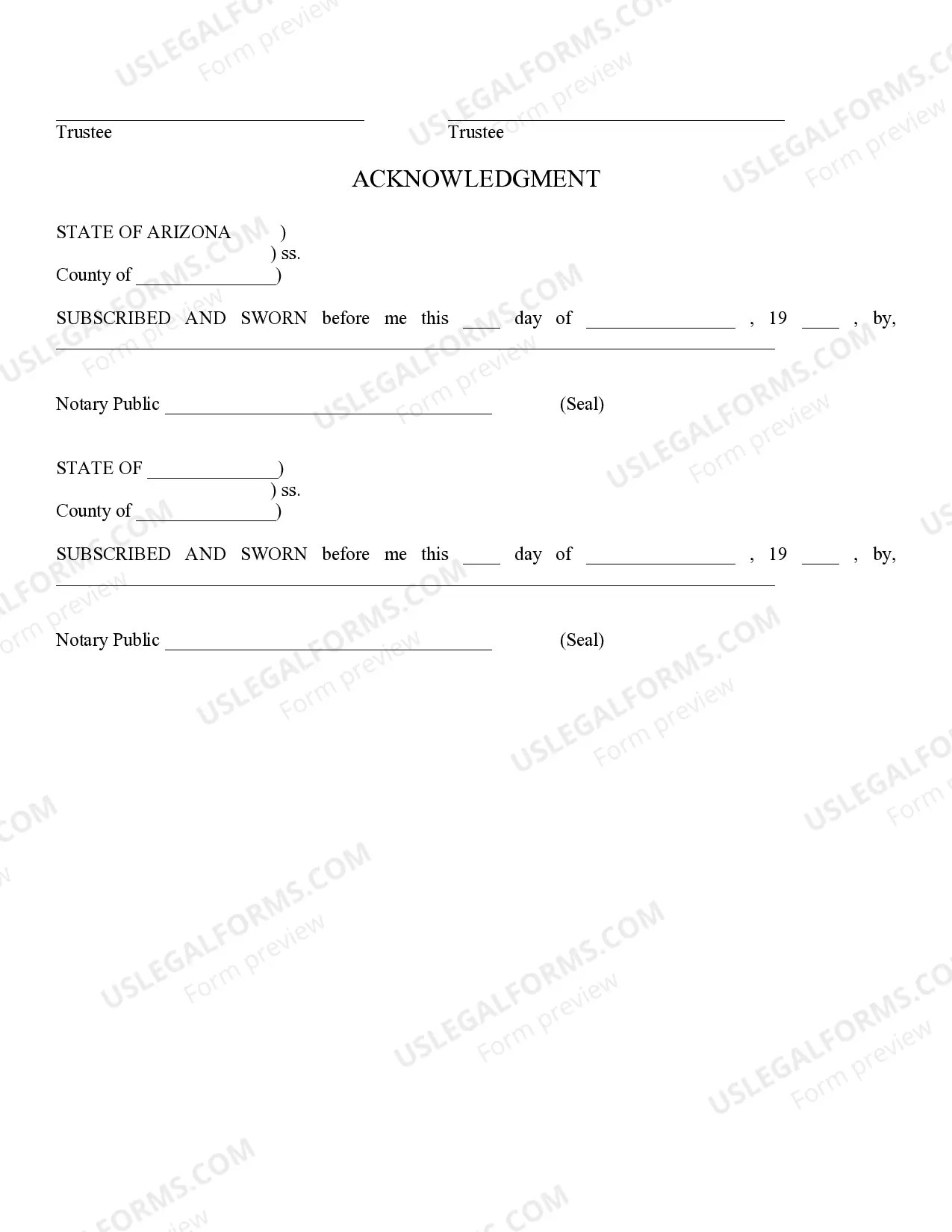

Quitclaim to Trust: This form is used by a Trustor of a trust, when he/she gives their rights to the property in the trust to the Trustee. The disclaimer further states that the Trustor will no longer claim any rights to the property handed over to the Trustee. It is available for download in both Word and Rich Text formats.

Surprise Arizona Quitclaim to Trust: Understanding the Intricacies of Property Transfer In Surprise, Arizona, homeowners looking to transfer their property to a trust have the option to utilize a Quitclaim to Trust. This legal instrument provides a seamless and relatively straightforward approach to transferring property ownership, offering flexibility and several benefits. A Surprise Arizona Quitclaim to Trust is a type of real estate deed primarily used to transfer property ownership from an individual to a trust. It involves the granter relinquishing their interest in the property, such as a house or land, and conveying it to the trust. The trust, established for the benefit of one or more beneficiaries, then assumes ownership of the property. This transfer method is oftentimes utilized in estate planning to ensure a seamless transition of assets, facilitate probate avoidance, and ease the distribution of ownership rights and responsibilities within a family trust. By executing a Quitclaim to Trust, homeowners can effectively ensure their desired property disposition and safeguard their assets for future generations. To initiate the process, the granter, who is the current property owner, needs to prepare the required documentation such as a quitclaim deed. The deed outlines the transfer of ownership, explicitly mentioning the property, its legal description, and the names of the trust and beneficiaries involved. It is essential to have a thorough understanding of Arizona's specific laws and requirements to properly execute the Quitclaim to Trust. While there aren't explicitly different types of Surprise Arizona Quitclaim to Trust, variations may arise depending on specific trust structures, purposes, and goals. Some common examples include: 1. Revocable Living Trust Quitclaim: This type of quitclaim deed transfers property ownership to a revocable living trust, allowing the granter to retain control over the property during their lifetime. It permits them to modify or revoke the trust if circumstances change. 2. Irrevocable Trust Quitclaim: This variation transfers property ownership to an irrevocable trust, wherein the granter relinquishes control and ownership rights permanently. Irrevocable trusts are often used for tax planning, asset protection, and charitable giving purposes. 3. Special Needs Trust Quitclaim: When a trust is specifically established to provide financial support and care for a disabled individual, a Quitclaim to Trust can facilitate the transfer of property to a special needs trust. This ensures ongoing assistance and protection of government benefits for the disabled beneficiary. 4. Testamentary Trust Quitclaim: Unlike the aforementioned types, this trust is created within a will and only becomes active after the granter's death. With a Quitclaim to Testamentary Trust, the property is transferred to the trust upon the granter's demise, thus avoiding probate. It is important to consult with an experienced attorney specializing in estate planning or real estate law to determine which type of Quitclaim to Trust is most suitable for individual circumstances. With their expertise, homeowners can rest assured that their property transfer aligns with their goals and best interests. In conclusion, a Surprise Arizona Quitclaim to Trust offers homeowners a convenient means of transferring property ownership to a trust. By executing a quitclaim deed, homeowners can facilitate the seamless transition of assets, reduce probate complexities, and ensure their property is protected and efficiently managed for the benefit of their loved ones.Surprise Arizona Quitclaim to Trust: Understanding the Intricacies of Property Transfer In Surprise, Arizona, homeowners looking to transfer their property to a trust have the option to utilize a Quitclaim to Trust. This legal instrument provides a seamless and relatively straightforward approach to transferring property ownership, offering flexibility and several benefits. A Surprise Arizona Quitclaim to Trust is a type of real estate deed primarily used to transfer property ownership from an individual to a trust. It involves the granter relinquishing their interest in the property, such as a house or land, and conveying it to the trust. The trust, established for the benefit of one or more beneficiaries, then assumes ownership of the property. This transfer method is oftentimes utilized in estate planning to ensure a seamless transition of assets, facilitate probate avoidance, and ease the distribution of ownership rights and responsibilities within a family trust. By executing a Quitclaim to Trust, homeowners can effectively ensure their desired property disposition and safeguard their assets for future generations. To initiate the process, the granter, who is the current property owner, needs to prepare the required documentation such as a quitclaim deed. The deed outlines the transfer of ownership, explicitly mentioning the property, its legal description, and the names of the trust and beneficiaries involved. It is essential to have a thorough understanding of Arizona's specific laws and requirements to properly execute the Quitclaim to Trust. While there aren't explicitly different types of Surprise Arizona Quitclaim to Trust, variations may arise depending on specific trust structures, purposes, and goals. Some common examples include: 1. Revocable Living Trust Quitclaim: This type of quitclaim deed transfers property ownership to a revocable living trust, allowing the granter to retain control over the property during their lifetime. It permits them to modify or revoke the trust if circumstances change. 2. Irrevocable Trust Quitclaim: This variation transfers property ownership to an irrevocable trust, wherein the granter relinquishes control and ownership rights permanently. Irrevocable trusts are often used for tax planning, asset protection, and charitable giving purposes. 3. Special Needs Trust Quitclaim: When a trust is specifically established to provide financial support and care for a disabled individual, a Quitclaim to Trust can facilitate the transfer of property to a special needs trust. This ensures ongoing assistance and protection of government benefits for the disabled beneficiary. 4. Testamentary Trust Quitclaim: Unlike the aforementioned types, this trust is created within a will and only becomes active after the granter's death. With a Quitclaim to Testamentary Trust, the property is transferred to the trust upon the granter's demise, thus avoiding probate. It is important to consult with an experienced attorney specializing in estate planning or real estate law to determine which type of Quitclaim to Trust is most suitable for individual circumstances. With their expertise, homeowners can rest assured that their property transfer aligns with their goals and best interests. In conclusion, a Surprise Arizona Quitclaim to Trust offers homeowners a convenient means of transferring property ownership to a trust. By executing a quitclaim deed, homeowners can facilitate the seamless transition of assets, reduce probate complexities, and ensure their property is protected and efficiently managed for the benefit of their loved ones.