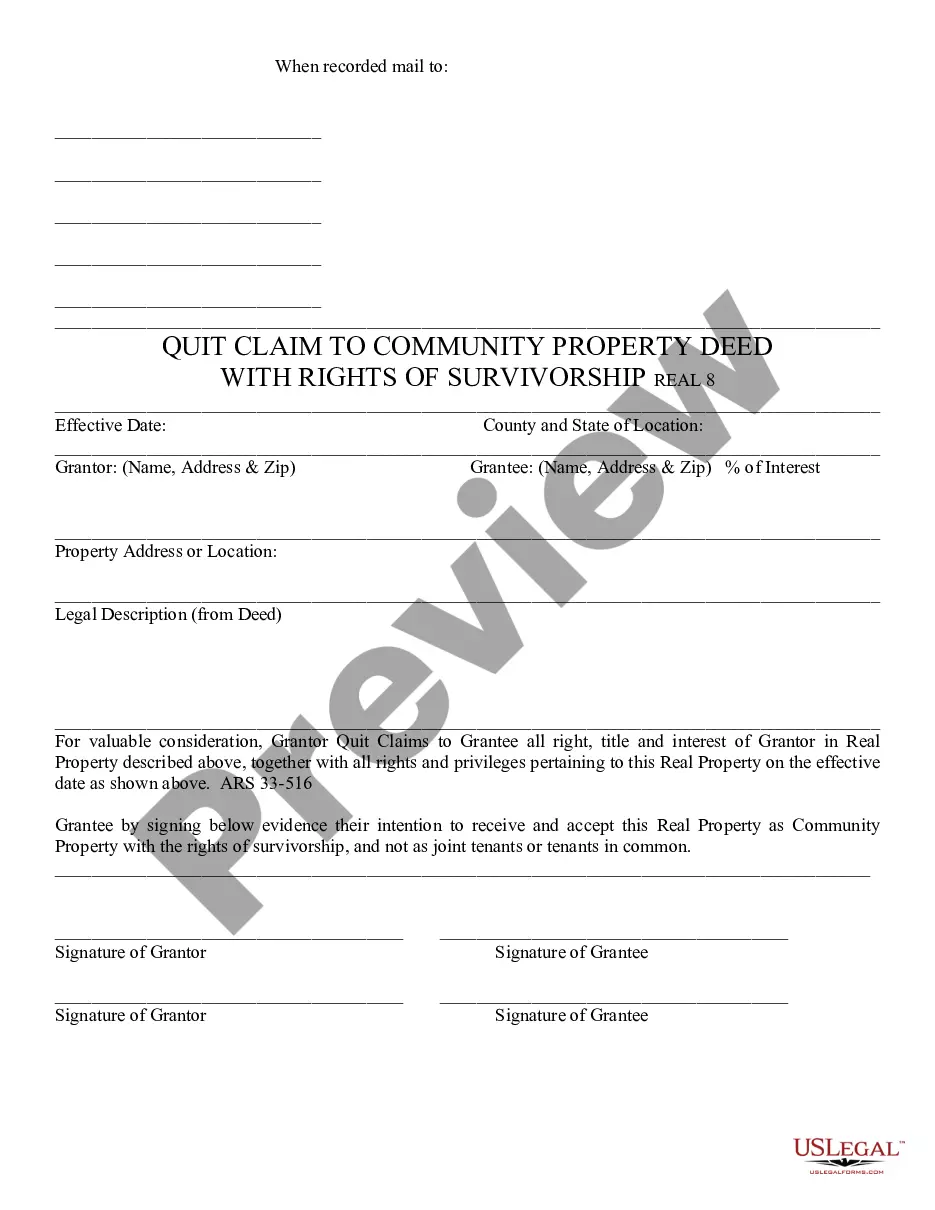

Quit Claim to Community Property w/rights of survivorship: This form is used by a Grantor of a parcel of land, when he/she gives and/or sells his/her interest in said property to Grantees, with the right of survivorship. The disclaimer further states that the Grantor will no longer claim any rights in the property sold to the Grantees. It is available for download in both Word and Rich Text formats.

Glendale Arizona Quitclaim to Community Property with rights of survivorship

Description

How to fill out Arizona Quitclaim To Community Property With Rights Of Survivorship?

Are you in search of a reliable and cost-effective provider of legal forms to obtain the Glendale Arizona Quitclaim to Community Property with rights of survivorship? US Legal Forms is your ideal option.

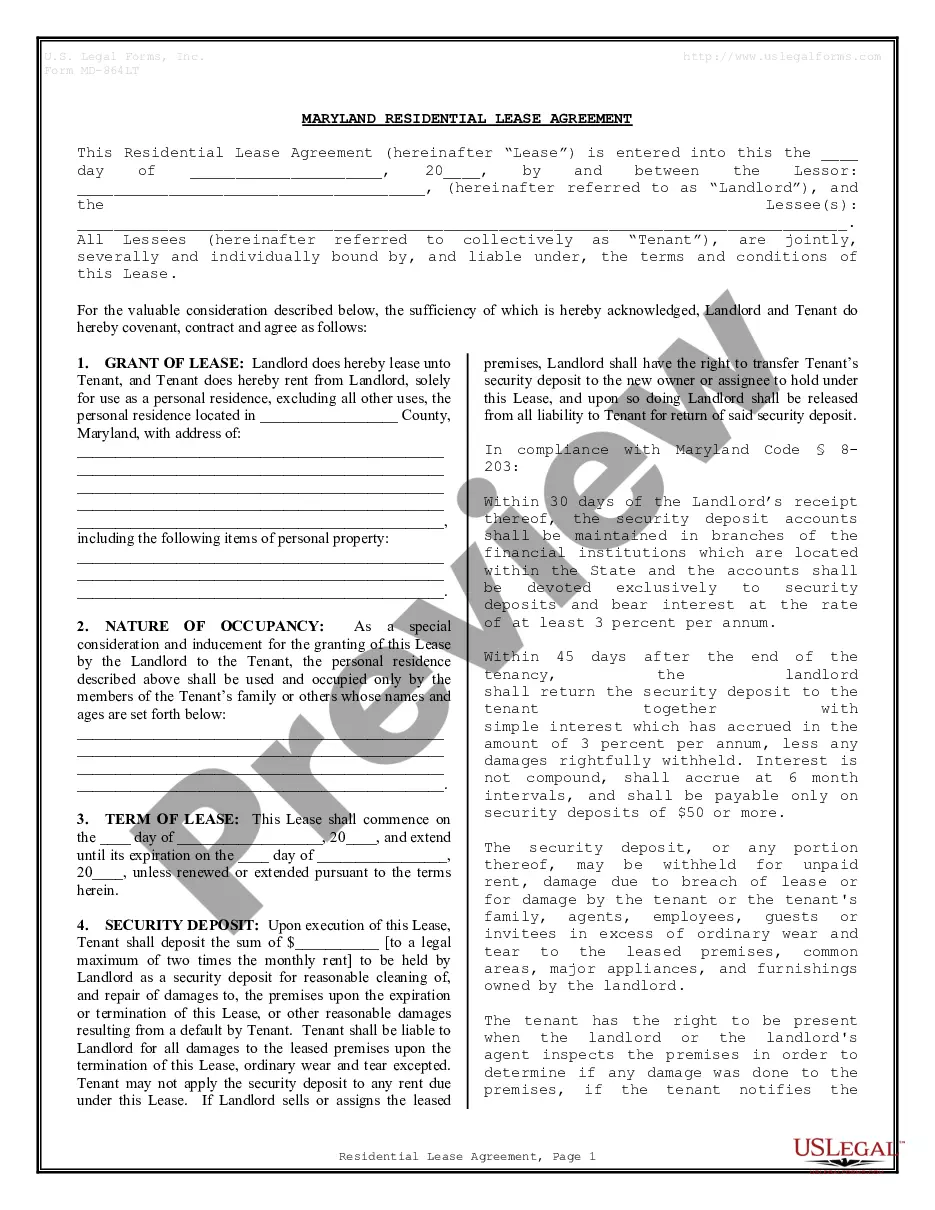

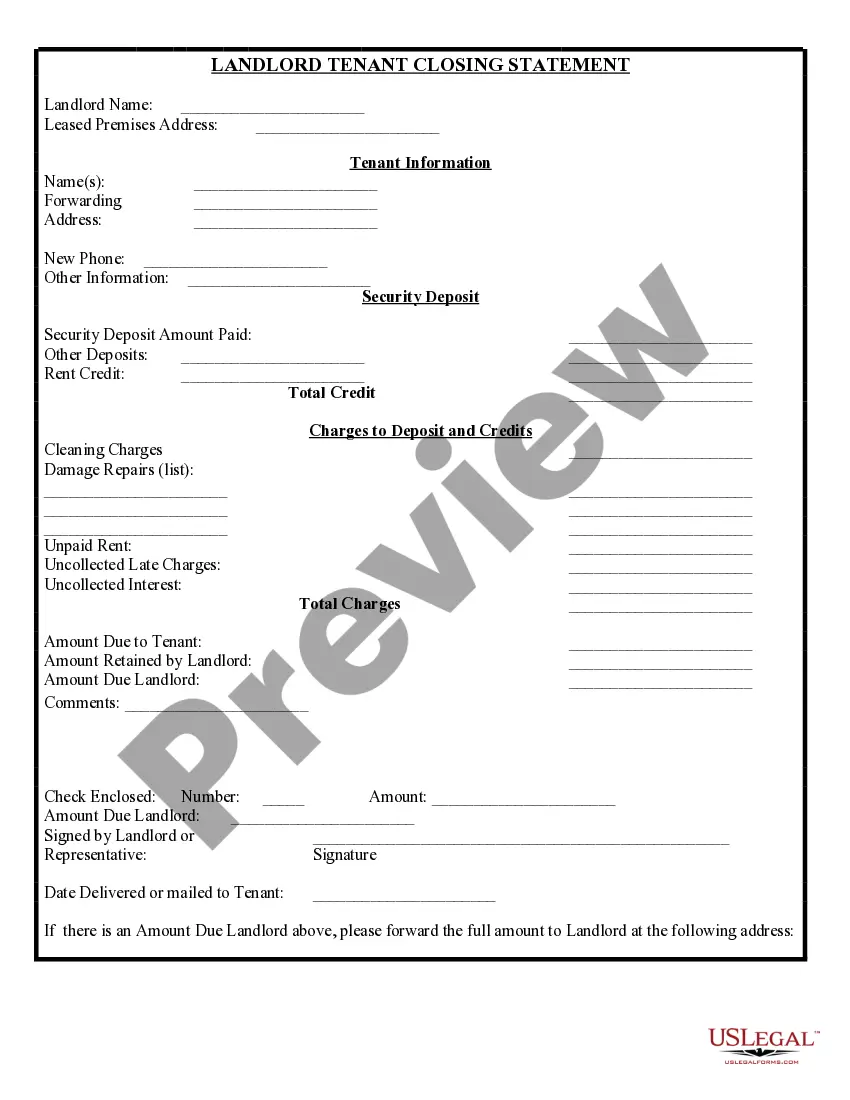

Whether you require a straightforward contract to establish guidelines for living together with your significant other or a collection of documents to finalize your divorce in court, we have you covered. Our site features over 85,000 current legal document templates for personal and business purposes. All the templates we provide are specific and tailored to meet the standards of various states and counties.

To access the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please remember that you can always download your previously acquired form templates anytime from the My documents section.

Is this your first time visiting our website? No need to worry. You can create an account in just a few minutes, but beforehand, ensure to do the following.

Now you can set up your account. Then choose your subscription plan and proceed to payment. Once payment is finalized, download the Glendale Arizona Quitclaim to Community Property with rights of survivorship in any available format. You can revisit the website at any time and redownload the document at no additional costs.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time trying to learn about legal documents online once and for all.

- Verify that the Glendale Arizona Quitclaim to Community Property with rights of survivorship complies with the rules of your state and locality.

- Examine the details of the form (if available) to understand who and what the document is meant for.

- Restart the search if the template does not fit your legal needs.

Form popularity

FAQ

Married couples in Arizona often benefit from holding title as community property with rights of survivorship. This approach provides several advantages, including enhanced protection from creditors and automatic transfer of the property upon one spouse's death. A Glendale Arizona Quitclaim to Community Property with rights of survivorship is an effective method to establish this arrangement. It promotes clarity and security in property ownership for couples, enhancing their overall estate planning.

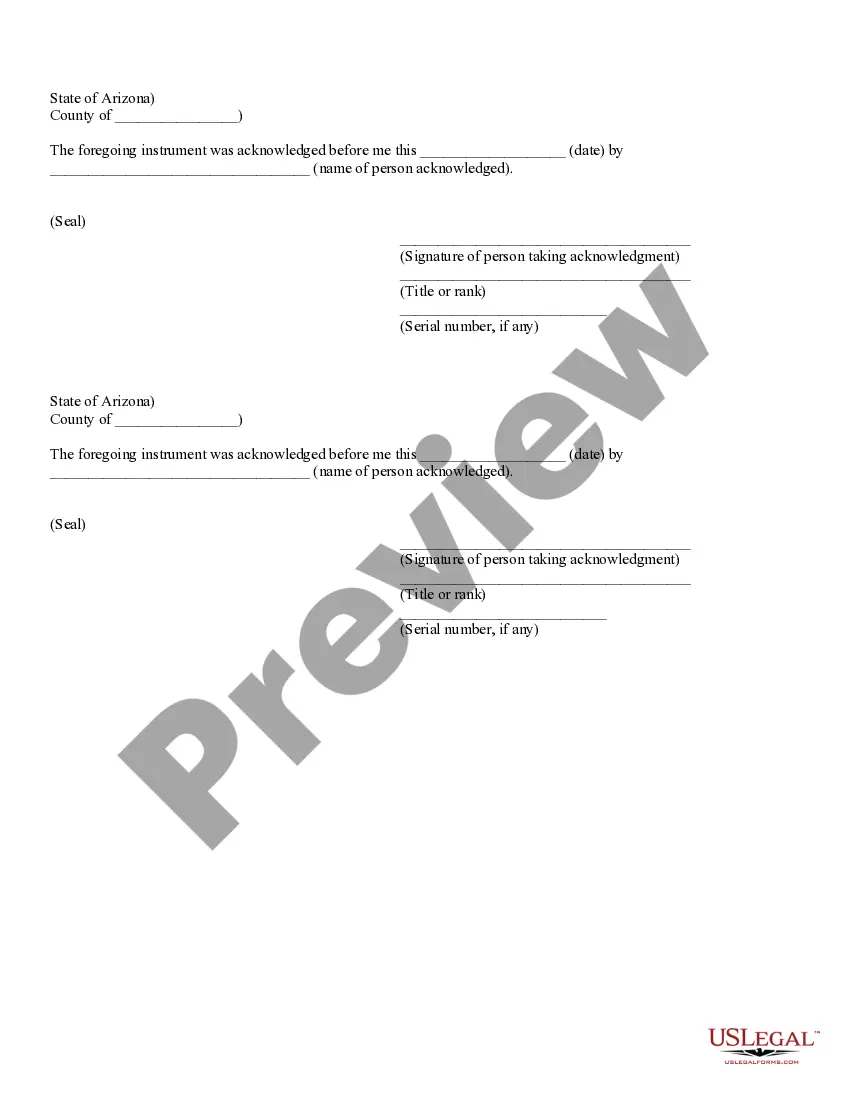

To transfer a property title in Arizona, you typically need to complete a deed, such as a quitclaim deed. If you choose to pursue a Glendale Arizona Quitclaim to Community Property with rights of survivorship, this approach simplifies the title transfer process, especially for married couples. You should execute the deed in front of a notary public, then file it with the county recorder's office. This process ensures a clear and legal transfer of property rights.

In Arizona, the right of survivorship is not automatic for all property types but is a feature of joint tenancy and community property with rights of survivorship. For those looking to secure their property effectively, opting for a Glendale Arizona Quitclaim to Community Property with rights of survivorship is beneficial. This specific arrangement guarantees that property automatically transfers to the surviving spouse when one partner passes away. Thus, it simplifies the transfer process and provides peace of mind.

Yes, Arizona recognizes joint tenancy as a legal form of property ownership. However, it's important to convert your property to Glendale Arizona Quitclaim to Community Property with rights of survivorship if you want specific survivorship benefits. This helps ensure that property will automatically pass to the surviving spouse upon death, eliminating the need for probate. Understanding these distinctions is crucial for managing property effectively in Arizona.

The requirements for a quitclaim deed in Arizona include providing the names of the grantor and grantee, a clear property description, and the phrase 'to community property with rights of survivorship.' The document must be signed by the grantor and notarized. After this, you should file the deed with the county recorder's office to finalize the transfer. US Legal Forms can provide templates that simplify the drafting and filing processes.

Transferring property title to a family member in Arizona typically involves using a quitclaim deed. This deed should specifically state 'to community property with rights of survivorship' for added benefits. You will need to fill out the deed accurately, have it notarized, and then file it with the county recorder's office. US Legal Forms offers templates and guidance to ease the process of title transfer.

To create an effective quitclaim deed in Arizona, you need a legal document that clearly identifies the current owner and the recipient. It should include a specific description of the property, along with the phrase 'to community property with rights of survivorship.' Additionally, both parties must sign the deed in front of a notary. Using platforms like US Legal Forms can streamline this process, ensuring you meet all legal requirements.

A quitclaim deed can override a will concerning the property it transfers; once the deed is executed, ownership shifts immediately. Therefore, the property in question is no longer part of the deceased's estate and does not go through probate. When people in Glendale, Arizona, utilize a quitclaim to community property with rights of survivorship, they effectively ensure their wishes are honored without the complexities of a will.

The disadvantages of quitclaim deeds include the risk of transferring property with hidden title issues, as they offer no warranties or guarantees. This means that if there are encumbrances or liens, the new owner may assume responsibility. In Glendale, Arizona, when considering a quitclaim to community property with rights of survivorship, it's crucial to evaluate the property’s history to avoid future complications.

Transferring a property title to a family member in Arizona typically involves preparing a quitclaim deed. You can easily create this deed and ensure it includes all necessary details about the property and the current owner. Platforms like USLegalForms can provide customizable templates to facilitate the Glendale Arizona quitclaim to community property with rights of survivorship.