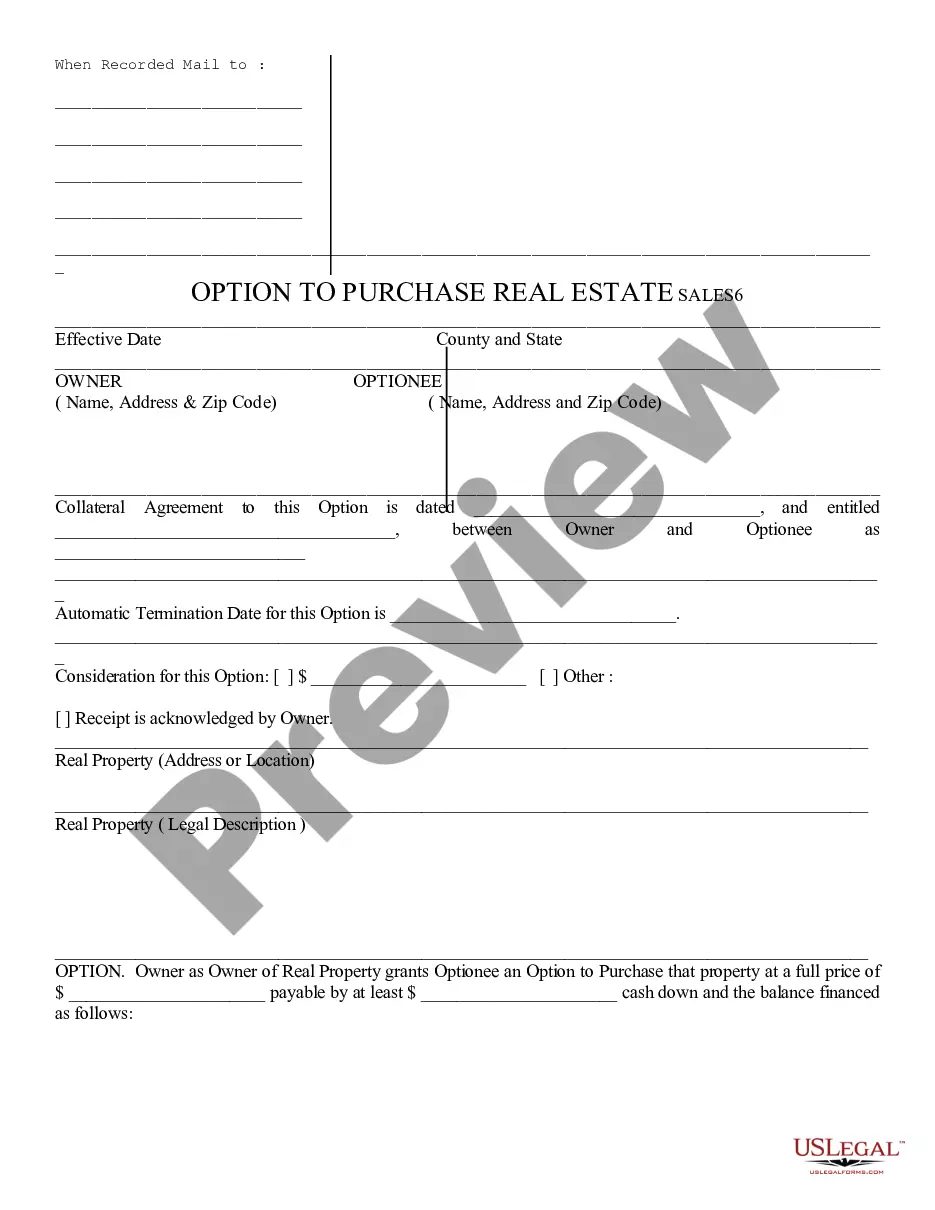

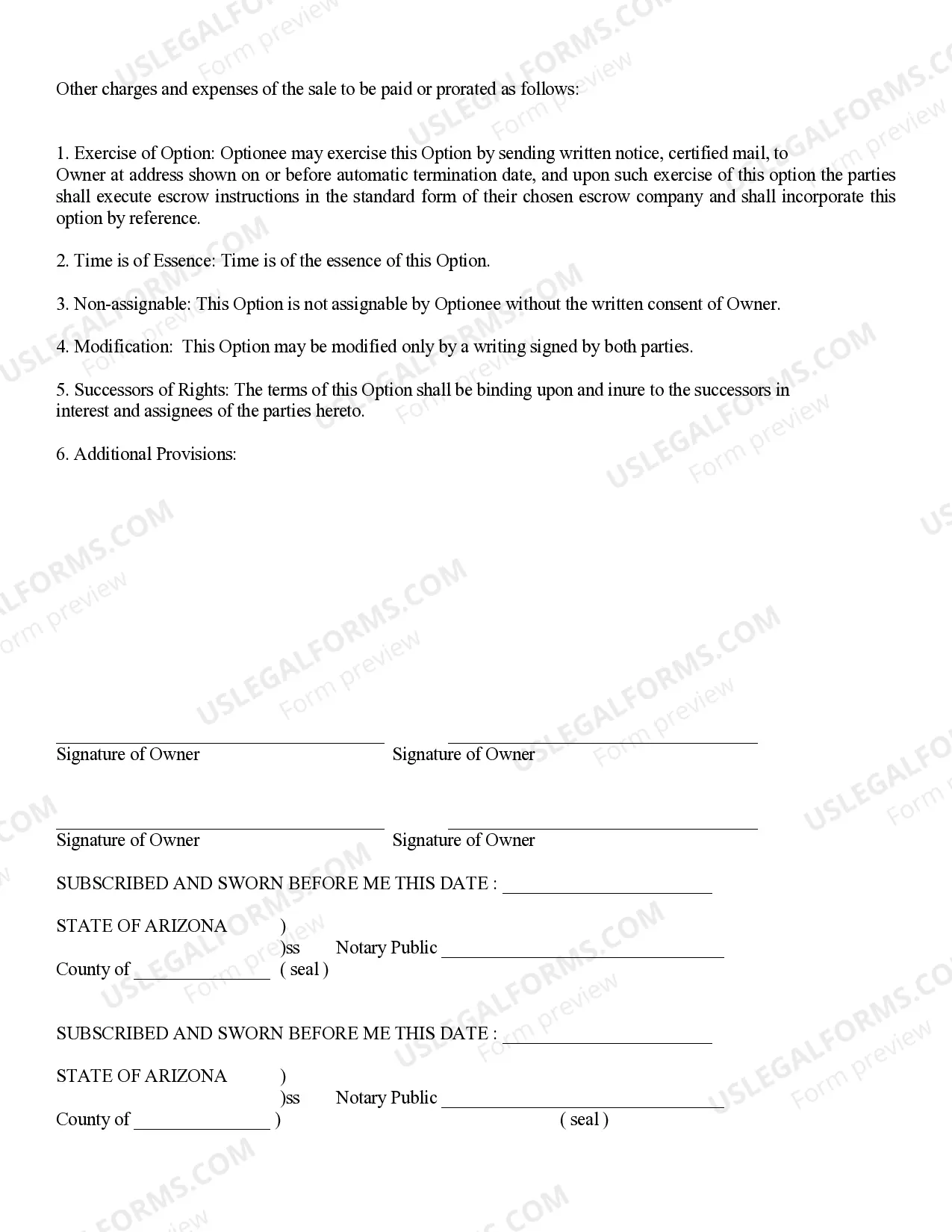

Option to Purchase - Residential: This form is an agreement between an Owner of land and an Optionee. In this contract, the Owner gives the Optionee the opportunity, or option, to purchase his/her property at a specific price, during a limited time frame. The Option to Purchase must be signed by both parties, in front of a Notary Public, in order to be valid. This form is available in both Word and Rich Text formats.

Tempe Arizona Option to Purchase - Residential

Description

How to fill out Arizona Option To Purchase - Residential?

Do you require a reliable and budget-friendly legal forms supplier to obtain the Tempe Arizona Option to Purchase - Residential? US Legal Forms is your primary option.

Whether you need a simple agreement to establish guidelines for living with your partner or a set of documents to facilitate your divorce proceedings in court, we have you covered. Our platform provides over 85,000 current legal document templates for individual and business use. All templates that we provide are not generic and structured in accordance with the specifications of particular state and county.

To download the document, you must Log In to your account, locate the required template, and click the Download button next to it. Please keep in mind that you can download your previously acquired form templates at any moment in the My documents tab.

Are you a newcomer to our website? No problem. You can create an account in just a few minutes, but beforehand, ensure to do the following.

Now you can set up your account. Then choose the subscription option and proceed to payment. After the payment is completed, download the Tempe Arizona Option to Purchase - Residential in any available format. You can revisit the website whenever necessary and redownload the document at no additional cost.

Locating current legal documents has never been simpler. Give US Legal Forms a chance today, and forget about wasting your precious time understanding legal paperwork online for good.

- Check if the Tempe Arizona Option to Purchase - Residential complies with the laws of your state and locality.

- Review the form’s description (if available) to understand for whom and what the document is intended.

- Restart the search if the template does not meet your legal needs.

Form popularity

FAQ

Salt River Project (SRP) ? Surface water is collected from the Salt and Verde River watersheds, stored in six SRP reservoirs and diverted into SRP canals at Granite Reef Dam in Mesa, Arizona.

If your income is: Less than the basic rate threshold of £12,570 ? you'll pay 0% in tax on rental income. Above £12,570 and below the higher rate threshold of £50,270 - you'll pay 20% in tax on rental income. Above £50,270 and below the additional rate threshold of £150,000 ? you'll pay 40% in tax on rental income.

The Phoenix tax rate for these properties is 5.3% and the combined rate, including state and county taxes is 12.57%, according to the city's Finance Department.

Tempe's water meets all the federal, state and local water quality standards.

To start or transfer water, sewer and solid waste service, call Customer Services at 480-350-8361, Monday-Friday, a.m. to p.m., except city holidays. A minimum of 24 hours advanced notice is required to make changes to service.

Public Housing and Housing Choice Vouchers (Section 8) To apply for either type of help, visit your local Public Housing Agency (PHA). Some PHAs have long waiting lists, so you may want to apply at more than one PHA. Your PHA can also give you a list of locations at which your voucher can be used.

Tempe Transaction Privilege Tax & Use Tax Rates City/town name: tempe city code: tebusiness codetax rateHotel/Motel (Additional Tax)1445.00%Residential Rental, Leasing & Licensing for Use0451.80%Commercial Rental, Leasing & Licensing for Use2131.80%Rental, Leasing & Licensing for Use of TPP2141.80%20 more rows

You can pay online anytime. There is no charge for credit card payments. You can pay by phone - 480-350-8361. You can pay by drop box or mail.

Short-Term Rental TPTLess than 30 days rentalTempe Hotel Rate: 1.8%City Business Code: 044Tempe Hotel/Motel (Additional tax): 5.0%City Business Code: 144Arizona & Maricopa County Transient Lodging: 7.27%State of Arizona & Maricopa County Business Code: 025Total TPT: 14.07%Apply, File & Pay at AZTaxes.gov

Please visit or call 877-428-8844 ? Dial 7-1-1 for TTY ? Monday through Friday between AM & PM MST and a call center representative will provide a listing of subsidized and low-income based properties in Arizona.