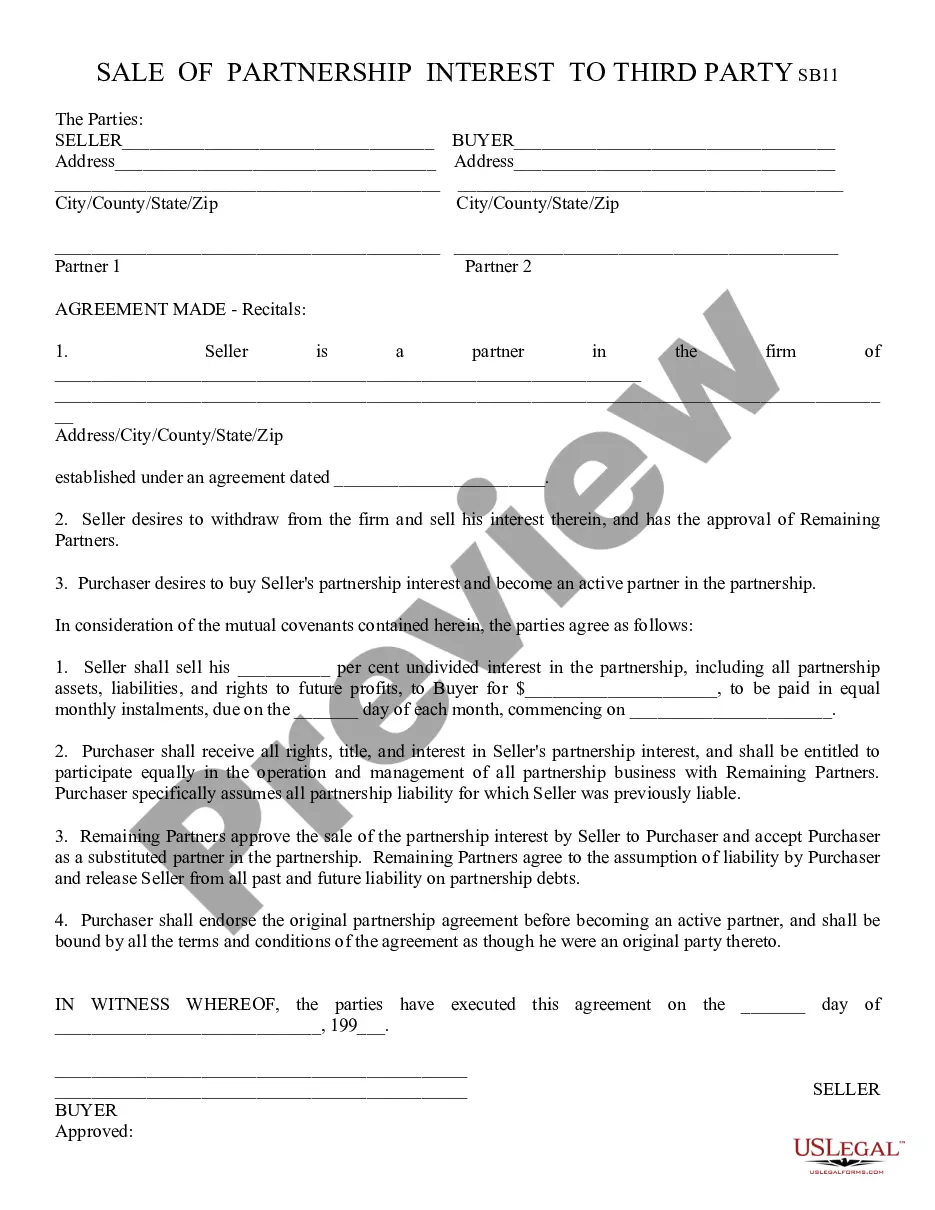

This is a contract between a Partner in a business and an intended Purchaser of his/her interest in the company. When a Partner wishes to sell his/her interest in a company, he/she must seek the approval of the remaining Partners. If they agree to the sell, the Partner may sell his/her interest to a Third Party. Both the Partner/Seller and the Third Party Purchaser must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

The Phoenix Arizona Sale of Partnership Interest to Third Party refers to the legal process by which the ownership rights and financial stake in a partnership are transferred from one party (the seller) to a third party (the buyer). This transaction can involve various types of partnership interests, each with its unique characteristics and considerations. One type of Phoenix Arizona Sale of Partnership Interest to Third Party is the sale of a general partnership interest. In a general partnership, partners share both the profits and the liabilities of the business equally. When one partner decides to sell their interest to a third party, a formal agreement is typically executed, outlining the terms and conditions of the sale, including the purchase price, allocation of future profits, and potential buyout provisions. Another type of Phoenix Arizona Sale of Partnership Interest to Third Party involves limited partnerships. In a limited partnership, there are two types of partners: general partners, who have management control and unlimited personal liability, and limited partners, who invest capital but have limited liability. When a limited partner wishes to sell their partnership interest, it often requires the consent of the general partner(s) and adherence to partnership agreements or operating agreements. The sale of a partnership interest can also pertain to a limited liability partnership (LLP) or a limited liability company (LLC). Both Laps and LCS provide partners or members with limited personal liability protection. However, the process of selling partnership interests in these structures might involve additional legal requirements, such as obtaining approvals from regulatory authorities or compliance with specific provisions stated in the partnership agreement or the LLC operating agreement. In any type of Phoenix Arizona Sale of Partnership Interest to Third Party, certain key elements should be considered. Firstly, the valuation of the partnership interest plays a crucial role in determining the appropriate purchase price. Professional appraisals and financial evaluations may be required to establish a fair market value. Additionally, the parties involved should carefully review the partnership agreement or operating agreement to understand any restrictions or obligations relating to the sale of partnership interests. It is essential to comply with any provisions regarding rights of first refusal, buyout rights, transfer restrictions, or approval requirements. Lastly, the legal documentation, including a purchase and sale agreement or a formal assignment of partnership interest, must be properly drafted and executed to ensure the legality and enforceability of the transaction. In summary, the Phoenix Arizona Sale of Partnership Interest to Third Party involves the transfer of ownership rights and financial stake in a partnership from a seller to a third-party buyer. Various types of partnership interests, such as general partnerships, limited partnerships, Laps, and LCS, can be subject to this transaction. Careful consideration of valuation, compliance with partnership agreements, and meticulous documentation are fundamental to completing a successful sale.The Phoenix Arizona Sale of Partnership Interest to Third Party refers to the legal process by which the ownership rights and financial stake in a partnership are transferred from one party (the seller) to a third party (the buyer). This transaction can involve various types of partnership interests, each with its unique characteristics and considerations. One type of Phoenix Arizona Sale of Partnership Interest to Third Party is the sale of a general partnership interest. In a general partnership, partners share both the profits and the liabilities of the business equally. When one partner decides to sell their interest to a third party, a formal agreement is typically executed, outlining the terms and conditions of the sale, including the purchase price, allocation of future profits, and potential buyout provisions. Another type of Phoenix Arizona Sale of Partnership Interest to Third Party involves limited partnerships. In a limited partnership, there are two types of partners: general partners, who have management control and unlimited personal liability, and limited partners, who invest capital but have limited liability. When a limited partner wishes to sell their partnership interest, it often requires the consent of the general partner(s) and adherence to partnership agreements or operating agreements. The sale of a partnership interest can also pertain to a limited liability partnership (LLP) or a limited liability company (LLC). Both Laps and LCS provide partners or members with limited personal liability protection. However, the process of selling partnership interests in these structures might involve additional legal requirements, such as obtaining approvals from regulatory authorities or compliance with specific provisions stated in the partnership agreement or the LLC operating agreement. In any type of Phoenix Arizona Sale of Partnership Interest to Third Party, certain key elements should be considered. Firstly, the valuation of the partnership interest plays a crucial role in determining the appropriate purchase price. Professional appraisals and financial evaluations may be required to establish a fair market value. Additionally, the parties involved should carefully review the partnership agreement or operating agreement to understand any restrictions or obligations relating to the sale of partnership interests. It is essential to comply with any provisions regarding rights of first refusal, buyout rights, transfer restrictions, or approval requirements. Lastly, the legal documentation, including a purchase and sale agreement or a formal assignment of partnership interest, must be properly drafted and executed to ensure the legality and enforceability of the transaction. In summary, the Phoenix Arizona Sale of Partnership Interest to Third Party involves the transfer of ownership rights and financial stake in a partnership from a seller to a third-party buyer. Various types of partnership interests, such as general partnerships, limited partnerships, Laps, and LCS, can be subject to this transaction. Careful consideration of valuation, compliance with partnership agreements, and meticulous documentation are fundamental to completing a successful sale.