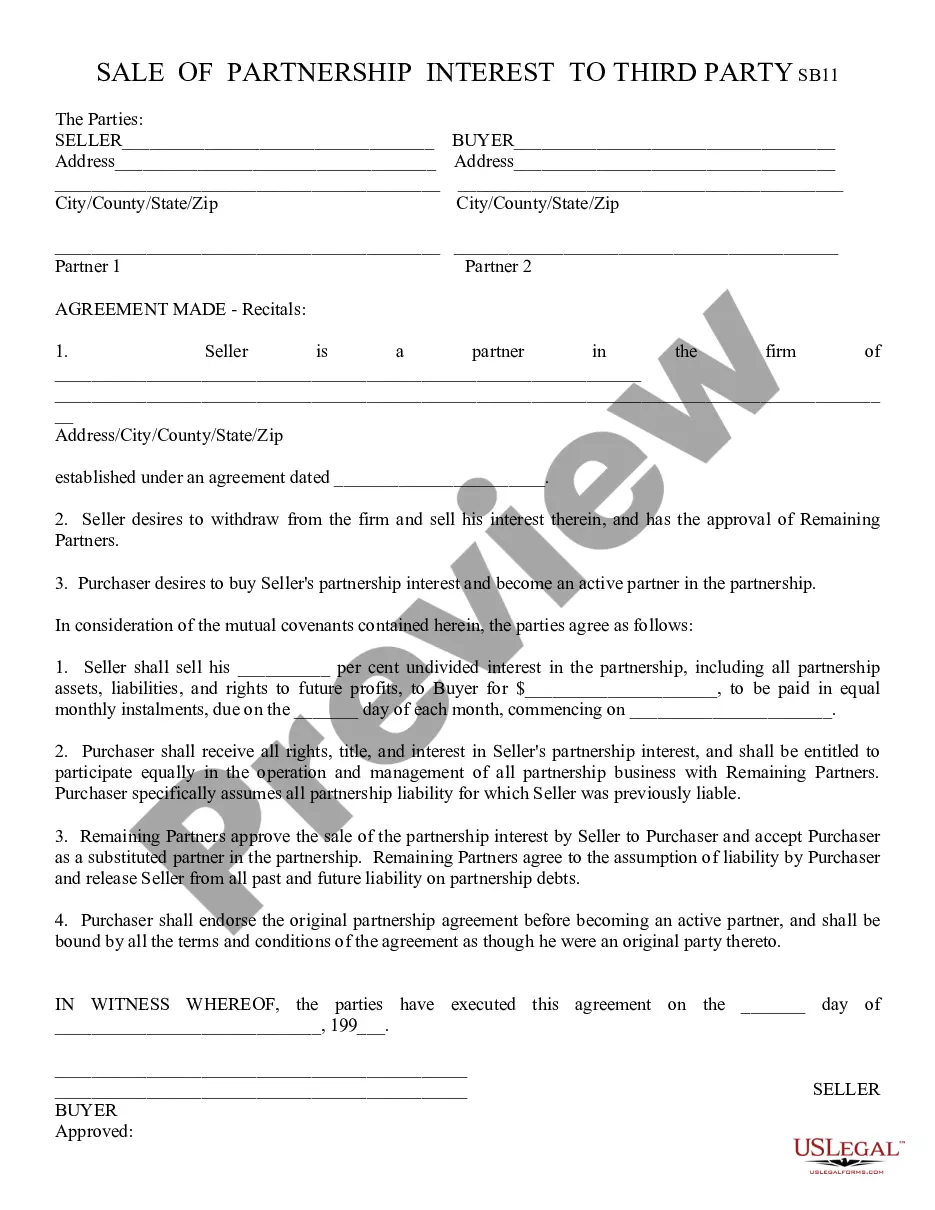

This is a contract between a Partner in a business and an intended Purchaser of his/her interest in the company. When a Partner wishes to sell his/her interest in a company, he/she must seek the approval of the remaining Partners. If they agree to the sell, the Partner may sell his/her interest to a Third Party. Both the Partner/Seller and the Third Party Purchaser must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Tempe Arizona Sale of Partnership Interest to Third Party: A Comprehensive Overview Introduction: The sale of partnership interest is a significant transaction in Tempe, Arizona, involving the transfer of ownership of a partnership interest from an existing partner to a third party. This detailed description aims to shed light on this process, its legal implications, requirements, and potential variations. Understanding Partnership Interest: A partnership interest represents an individual's share of ownership, rights, and obligations in a partnership business. These interests can be bought, sold, or transferred, enabling partners to diversify their investments, exit partnerships, or introduce new partners into an existing venture. Types of Tempe Arizona Sale of Partnership Interest to Third Party: 1. Voluntary Sale of Partnership Interest: Sometimes, an existing partner may opt to sell their partnership interest willingly. This type of sale is mutually agreed upon by the partner looking to exit and the remaining partners. Common reasons for voluntary sales include retirement, financial obligations, change in personal circumstances, or strategic repositioning. 2. Involuntary Sale of Partnership Interest: In certain instances, a partner's interest might be sold involuntarily. This could occur due to bankruptcy, divorce proceedings, creditor claims, or court-ordered sales. In such cases, the sale may be initiated by external factors rather than the partner's own volition. 3. Transfer Restrictions and Negotiations: Partnership agreements often impose restrictions on the sale or transfer of partnership interests. These restrictions can include rights of first refusal, mandatory buyouts by other partners, or a provision requiring unanimous consent for any sale. Before initiating a sale to a third party, partners must review the partnership agreement and adhere to any stipulated procedures or pre-approval requirements. Legal Process: 1. Valuation: Determining the fair value of the partnership interest is crucial. It involves assessing the financial condition and performance of the partnership, analyzing potential risks, and projecting future income streams. Partners may seek professional assistance from appraisers or financial advisors to determine the appropriate sale price. 2. Drafting a Purchase Agreement: Once a willing buyer is identified, a comprehensive purchase agreement is drafted. This agreement should outline the specific terms of the sale, including the purchase price, payment schedule, closing date, and any other relevant provisions. It is essential to engage legal counsel during this stage to ensure legal compliance and protect the interests of all involved parties. 3. Approval from Partners and Third Party: Before finalizing the sale, partners must seek approval from the other partners or the partnership itself, as mandated by the partnership agreement. The potential third-party buyer should also undertake due diligence procedures, including reviewing financial records, partnership agreements, and any associated liabilities. 4. Closing the Transaction: Once all parties have agreed to the terms, the sale is finalized through an appropriate closing process. This typically involves the execution of formal documents, the transfer of partnership interest certificates, and the exchange of funds. It is advisable to consult legal professionals and accountants to ensure compliance with tax regulations and to properly document the transaction. Conclusion: The Tempe Arizona sale of partnership interest to a third party is a complex process that requires careful consideration of legal requirements, financial implications, and partnership agreements. Whether it is a voluntary or involuntary sale, partners must navigate through various stages, including valuation, negotiations, approval procedures, and closing formalities. Seeking guidance from legal and financial experts is highly recommended ensuring a smooth and legally compliant transfer of ownership.Tempe Arizona Sale of Partnership Interest to Third Party: A Comprehensive Overview Introduction: The sale of partnership interest is a significant transaction in Tempe, Arizona, involving the transfer of ownership of a partnership interest from an existing partner to a third party. This detailed description aims to shed light on this process, its legal implications, requirements, and potential variations. Understanding Partnership Interest: A partnership interest represents an individual's share of ownership, rights, and obligations in a partnership business. These interests can be bought, sold, or transferred, enabling partners to diversify their investments, exit partnerships, or introduce new partners into an existing venture. Types of Tempe Arizona Sale of Partnership Interest to Third Party: 1. Voluntary Sale of Partnership Interest: Sometimes, an existing partner may opt to sell their partnership interest willingly. This type of sale is mutually agreed upon by the partner looking to exit and the remaining partners. Common reasons for voluntary sales include retirement, financial obligations, change in personal circumstances, or strategic repositioning. 2. Involuntary Sale of Partnership Interest: In certain instances, a partner's interest might be sold involuntarily. This could occur due to bankruptcy, divorce proceedings, creditor claims, or court-ordered sales. In such cases, the sale may be initiated by external factors rather than the partner's own volition. 3. Transfer Restrictions and Negotiations: Partnership agreements often impose restrictions on the sale or transfer of partnership interests. These restrictions can include rights of first refusal, mandatory buyouts by other partners, or a provision requiring unanimous consent for any sale. Before initiating a sale to a third party, partners must review the partnership agreement and adhere to any stipulated procedures or pre-approval requirements. Legal Process: 1. Valuation: Determining the fair value of the partnership interest is crucial. It involves assessing the financial condition and performance of the partnership, analyzing potential risks, and projecting future income streams. Partners may seek professional assistance from appraisers or financial advisors to determine the appropriate sale price. 2. Drafting a Purchase Agreement: Once a willing buyer is identified, a comprehensive purchase agreement is drafted. This agreement should outline the specific terms of the sale, including the purchase price, payment schedule, closing date, and any other relevant provisions. It is essential to engage legal counsel during this stage to ensure legal compliance and protect the interests of all involved parties. 3. Approval from Partners and Third Party: Before finalizing the sale, partners must seek approval from the other partners or the partnership itself, as mandated by the partnership agreement. The potential third-party buyer should also undertake due diligence procedures, including reviewing financial records, partnership agreements, and any associated liabilities. 4. Closing the Transaction: Once all parties have agreed to the terms, the sale is finalized through an appropriate closing process. This typically involves the execution of formal documents, the transfer of partnership interest certificates, and the exchange of funds. It is advisable to consult legal professionals and accountants to ensure compliance with tax regulations and to properly document the transaction. Conclusion: The Tempe Arizona sale of partnership interest to a third party is a complex process that requires careful consideration of legal requirements, financial implications, and partnership agreements. Whether it is a voluntary or involuntary sale, partners must navigate through various stages, including valuation, negotiations, approval procedures, and closing formalities. Seeking guidance from legal and financial experts is highly recommended ensuring a smooth and legally compliant transfer of ownership.