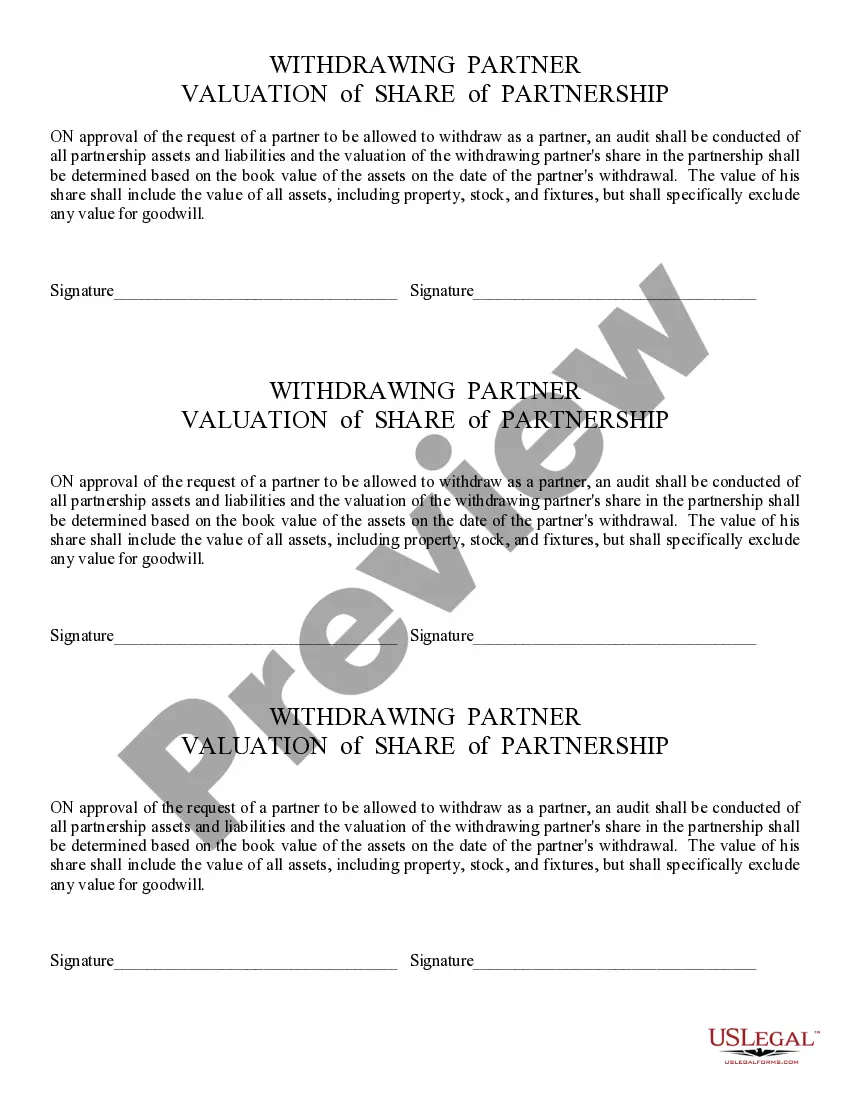

This form states that on approval of the request of a partner to be allowed to withdraw as a partner, an audit shall be conducted of all partnership assets and liabilities and the valuation of the withdrawing partner's share in the partnership shall be determined based on the book value of the assets on the date of the partner's withdrawal. The value of his share shall include the value of all assets, including property, stock, and fixtures, but shall specifically exclude any value for goodwill.

Phoenix Arizona Valuation of Share of Partner is a financial analysis and assessment process that determines the worth or value of a partner's share in a business or investment partnership based in Phoenix, Arizona. This valuation is essential in various scenarios such as buy-sell agreements, mergers and acquisitions, divorce settlements, shareholder disputes, or when a partner wants to exit or join a partnership. The valuation process involves analyzing the financial statements, assets, liabilities, cash flows, and other relevant factors of the partnership to determine the fair market value of the partner's share. Various methods and approaches can be used, depending on the nature of the partnership and the purpose of the valuation. These methods commonly include the income approach, market approach, and asset-based approach. 1. Income Approach: This method is often used when the partnership's income and cash flow are the primary drivers of the business's value. It involves assessing the present value of expected future earnings or cash flows generated by the partnership. 2. Market Approach: This method compares the partnership's value to similar businesses or partnerships that have been recently sold or acquired in the Phoenix, Arizona area. It relies on market multiples and industry-specific financial data to estimate the partner's share value. 3. Asset-Based Approach: In this method, the valuation is based on the net asset value of the partnership. It involves assessing the fair market value of the partnership's assets and subtracting its liabilities to determine the partner's share in the net assets. Additional factors, such as the partnership agreement, ownership rights, control, market conditions, economic outlook, and potential risks, may also be considered in the valuation process. It is important to note that Phoenix Arizona Valuation of Share of Partner can vary depending on the specific needs and circumstances of each case. Different valuation scenarios may include fair value, fair market value, intrinsic value, investment value, or liquidation value. Overall, Phoenix Arizona Valuation of Share of Partner is a comprehensive and meticulous financial analysis used to determine the worth of a partner's share in a business or investment partnership based in Phoenix, Arizona, allowing for informed decision-making in various business transactions and legal matters.Phoenix Arizona Valuation of Share of Partner is a financial analysis and assessment process that determines the worth or value of a partner's share in a business or investment partnership based in Phoenix, Arizona. This valuation is essential in various scenarios such as buy-sell agreements, mergers and acquisitions, divorce settlements, shareholder disputes, or when a partner wants to exit or join a partnership. The valuation process involves analyzing the financial statements, assets, liabilities, cash flows, and other relevant factors of the partnership to determine the fair market value of the partner's share. Various methods and approaches can be used, depending on the nature of the partnership and the purpose of the valuation. These methods commonly include the income approach, market approach, and asset-based approach. 1. Income Approach: This method is often used when the partnership's income and cash flow are the primary drivers of the business's value. It involves assessing the present value of expected future earnings or cash flows generated by the partnership. 2. Market Approach: This method compares the partnership's value to similar businesses or partnerships that have been recently sold or acquired in the Phoenix, Arizona area. It relies on market multiples and industry-specific financial data to estimate the partner's share value. 3. Asset-Based Approach: In this method, the valuation is based on the net asset value of the partnership. It involves assessing the fair market value of the partnership's assets and subtracting its liabilities to determine the partner's share in the net assets. Additional factors, such as the partnership agreement, ownership rights, control, market conditions, economic outlook, and potential risks, may also be considered in the valuation process. It is important to note that Phoenix Arizona Valuation of Share of Partner can vary depending on the specific needs and circumstances of each case. Different valuation scenarios may include fair value, fair market value, intrinsic value, investment value, or liquidation value. Overall, Phoenix Arizona Valuation of Share of Partner is a comprehensive and meticulous financial analysis used to determine the worth of a partner's share in a business or investment partnership based in Phoenix, Arizona, allowing for informed decision-making in various business transactions and legal matters.