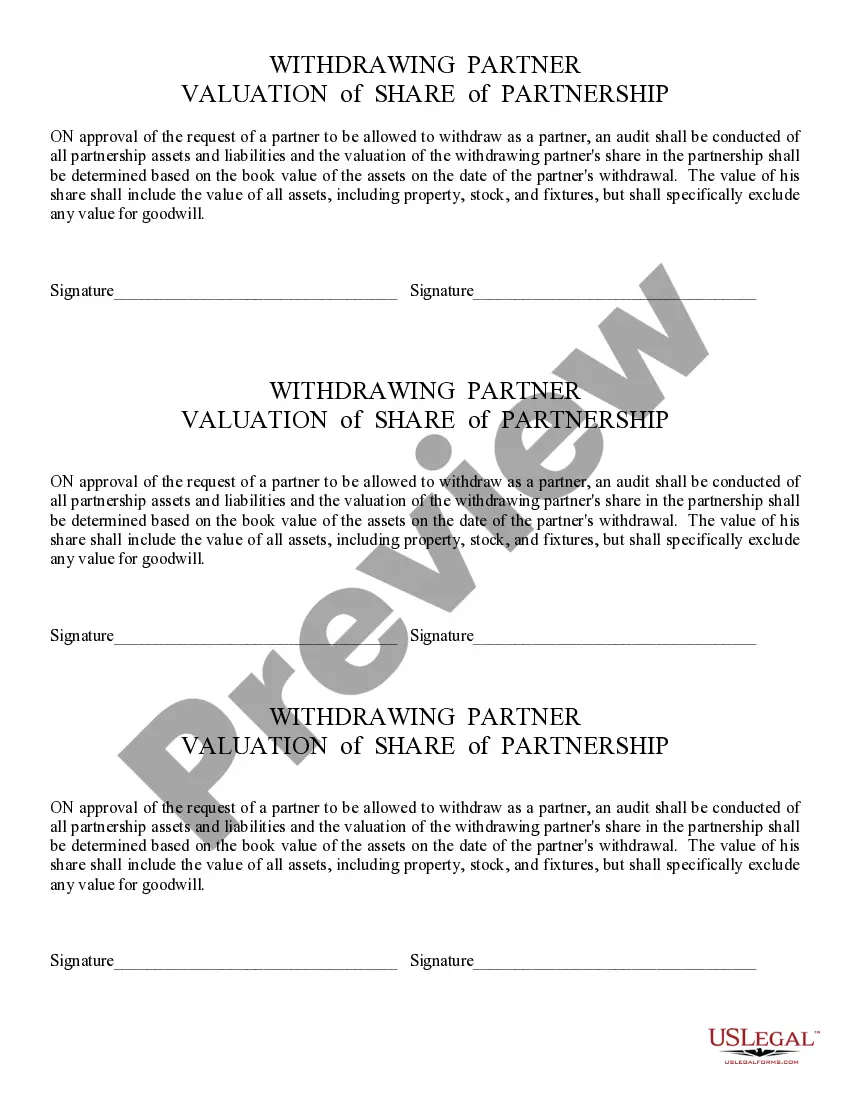

This form states that on approval of the request of a partner to be allowed to withdraw as a partner, an audit shall be conducted of all partnership assets and liabilities and the valuation of the withdrawing partner's share in the partnership shall be determined based on the book value of the assets on the date of the partner's withdrawal. The value of his share shall include the value of all assets, including property, stock, and fixtures, but shall specifically exclude any value for goodwill.

Title: Understanding Tempe Arizona Valuation of Share of Partner: A Comprehensive Guide Introduction: In partnership agreements, determining the valuation of a partner's share is crucial for various legal and financial purposes. Tempe, Arizona follows specific guidelines and methodologies for conducting the valuation of a partner's share in business entities. This article delves into the concept of Tempe Arizona Valuation of Share of Partner, exploring its importance, methods, and different types, if applicable. Keywords: — Tempe Arizona Valuation of Share of Partner — Tempe PartnershiValuationio— - Methods for Valuation of Share of Partner — Valuation Techniques in TempArizonaon— - Share Value Calculation in Tempe Partnership Section 1: Importance of Tempe Arizona Valuation of Share of Partner 1.1 Legal relevance and implications 1.2 Financial considerations in partnership dissolution 1.3 Determining fair buyout prices 1.4 Establishing ownership rights and control Section 2: Methods for Valuation of Share of Partner 2.1 Comparative Market Analysis (CMA) 2.2 Book Value Method 2.3 Earnings Multiplier Approach 2.4 Net Asset Value (NAV) Method 2.5 Income Capitalization Method Section 3: Types of Tempe Arizona Valuation of Share of Partner (if applicable) 3.1 Valuation of Share of Partner in General Partnerships 3.2 Valuation of Share of Partner in Limited Partnerships 3.3 Valuation of Share of Partner in Limited Liability Partnerships (Laps) 3.4 Valuation of Share of Partner in Limited Liability Companies (LCS) Section 4: Valuation Process in Tempe Arizona 4.1 Gathering necessary financial documents 4.2 Identifying valuation date and purpose 4.3 Selecting the appropriate valuation method 4.4 Conducting a thorough analysis 4.5 Preparing and documenting the valuation report Section 5: Key Factors Considered in Tempe Arizona Valuation of Share of Partner 5.1 Historical financial performance 5.2 Future growth prospects 5.3 Industry and market trends 5.4 Partnership agreement provisions 5.5 Non-financial contributions and obligations Conclusion: Tempe Arizona Valuation of Share of Partner is an essential process for partners seeking to understand the value of their ownership interest in a business. This valuation aids in determining fair buyout prices, resolving partnership dissolution disputes, and establishing each partner's contributions to the business. By employing various valuation methods, partners can gain insights into their share's worth and make informed decisions with confidence.Title: Understanding Tempe Arizona Valuation of Share of Partner: A Comprehensive Guide Introduction: In partnership agreements, determining the valuation of a partner's share is crucial for various legal and financial purposes. Tempe, Arizona follows specific guidelines and methodologies for conducting the valuation of a partner's share in business entities. This article delves into the concept of Tempe Arizona Valuation of Share of Partner, exploring its importance, methods, and different types, if applicable. Keywords: — Tempe Arizona Valuation of Share of Partner — Tempe PartnershiValuationio— - Methods for Valuation of Share of Partner — Valuation Techniques in TempArizonaon— - Share Value Calculation in Tempe Partnership Section 1: Importance of Tempe Arizona Valuation of Share of Partner 1.1 Legal relevance and implications 1.2 Financial considerations in partnership dissolution 1.3 Determining fair buyout prices 1.4 Establishing ownership rights and control Section 2: Methods for Valuation of Share of Partner 2.1 Comparative Market Analysis (CMA) 2.2 Book Value Method 2.3 Earnings Multiplier Approach 2.4 Net Asset Value (NAV) Method 2.5 Income Capitalization Method Section 3: Types of Tempe Arizona Valuation of Share of Partner (if applicable) 3.1 Valuation of Share of Partner in General Partnerships 3.2 Valuation of Share of Partner in Limited Partnerships 3.3 Valuation of Share of Partner in Limited Liability Partnerships (Laps) 3.4 Valuation of Share of Partner in Limited Liability Companies (LCS) Section 4: Valuation Process in Tempe Arizona 4.1 Gathering necessary financial documents 4.2 Identifying valuation date and purpose 4.3 Selecting the appropriate valuation method 4.4 Conducting a thorough analysis 4.5 Preparing and documenting the valuation report Section 5: Key Factors Considered in Tempe Arizona Valuation of Share of Partner 5.1 Historical financial performance 5.2 Future growth prospects 5.3 Industry and market trends 5.4 Partnership agreement provisions 5.5 Non-financial contributions and obligations Conclusion: Tempe Arizona Valuation of Share of Partner is an essential process for partners seeking to understand the value of their ownership interest in a business. This valuation aids in determining fair buyout prices, resolving partnership dissolution disputes, and establishing each partner's contributions to the business. By employing various valuation methods, partners can gain insights into their share's worth and make informed decisions with confidence.