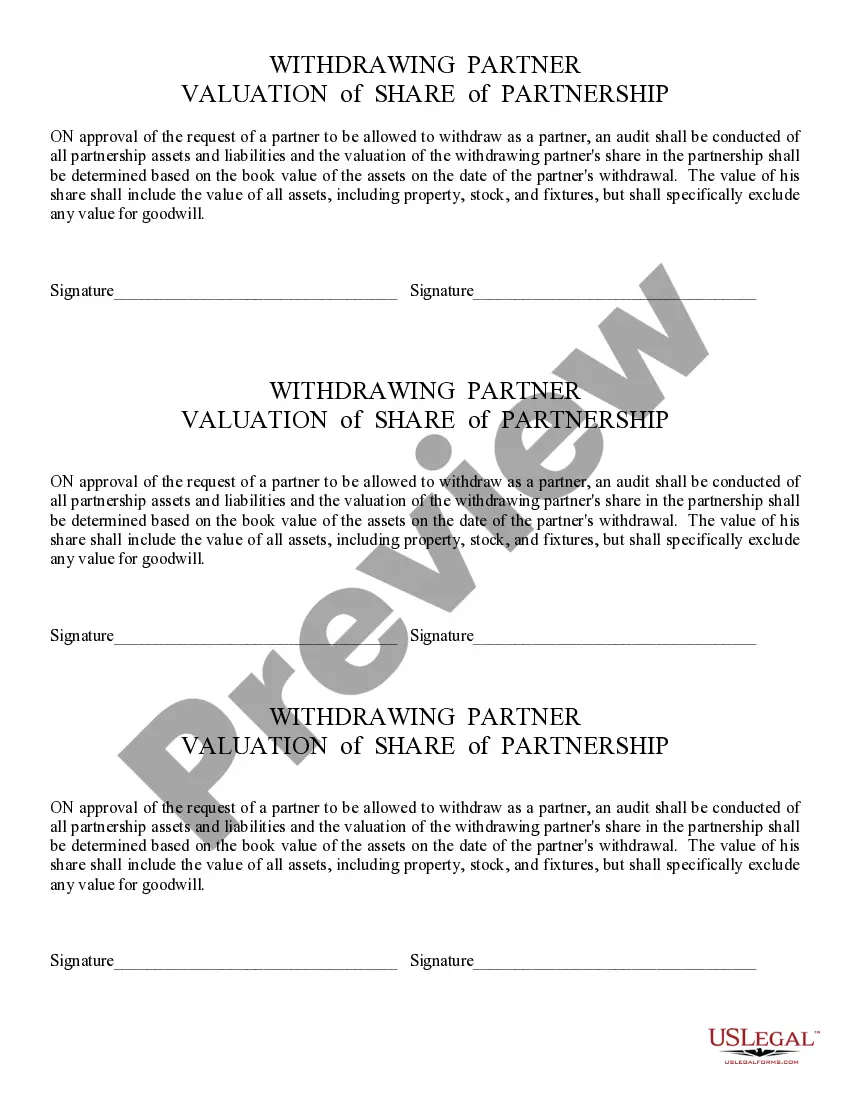

This form states that on approval of the request of a partner to be allowed to withdraw as a partner, an audit shall be conducted of all partnership assets and liabilities and the valuation of the withdrawing partner's share in the partnership shall be determined based on the book value of the assets on the date of the partner's withdrawal. The value of his share shall include the value of all assets, including property, stock, and fixtures, but shall specifically exclude any value for goodwill.

Tucson Arizona Valuation of Share of Partner is a process that involves determining the monetary worth or value of a partner's ownership interest in a business or partnership based in Tucson, Arizona. This valuation is crucial in various situations such as partnership dissolution, buyouts, mergers, acquisitions, or when an individual partner wants to sell or transfer their share of ownership. The valuation of a partner's share in Tucson, Arizona typically takes into account numerous factors to arrive at an accurate and fair value. Some relevant keywords that are essential to understanding this process include: 1. Business Valuation: Tucson Arizona Valuation of Share of Partner often involves valuing the entire business to accurately determine the partner's share. This includes evaluating the company's financial records, assets, liabilities, revenue, profitability, and growth potential. 2. Fair Market Value: Fair market value is the estimated price at which the partner's share would be sold in an open and competitive market. It considers market conditions, economic trends, and the company's specific circumstances. 3. Partnership Agreement: The valuation process is guided by the terms outlined in the partnership agreement, which includes provisions on how the partner's share should be valued. The agreement may specify different methods to determine the value, such as book value, earnings value, or market value. 4. Valuation Methods: There are various valuation methods used in Tucson Arizona Valuation of Share of Partner. These include the income approach, market approach, and asset-based approach. The income approach focuses on the company's ability to generate income, the market approach looks at similar transactions in the industry, and the asset-based approach evaluates tangible and intangible assets. 5. Buy-Sell Agreement: In some cases, partnerships have a buy-sell agreement in place, which addresses the valuation and transfer of a partner's share. This agreement helps simplify the valuation process and ensures a fair and smooth transition in ownership. 6. Independent Appraiser: To ensure an impartial and accurate valuation, it is often recommended hiring an independent appraiser or valuation expert who specializes in Tucson Arizona Valuation of Share of Partner. The appraiser assesses all relevant factors, performs necessary analyses, and provides a professional valuation report. Different types of Tucson Arizona Valuation of Share of Partner could include: 1. Partnership Dissolution Valuation: When a partnership is ending, the valuation determines the value of each partner's share for the purpose of dividing assets and settling liabilities. 2. Buyout Valuation: If one partner wants to buy out another partner's share, the valuation helps determine the fair price to pay for the share of ownership. 3. Mergers and Acquisitions Valuation: Valuation is crucial when two partnerships wish to merge or one partnership wants to acquire another. The valuation assesses the value of each partner's share to negotiate fair exchange ratios or purchase prices. 4. Succession Planning Valuation: In cases where a partner retires or intends to pass on their share of ownership, the valuation is utilized to determine the value for the purposes of transition planning, estate planning, or selling the share to another partner or third party. In summary, Tucson Arizona Valuation of Share of Partner is a comprehensive process that involves determining the value of a partner's ownership interest. It considers various factors, terms outlined in the partnership agreement, and utilizes different valuation methods to arrive at a fair and accurate value. Hiring an independent appraiser is often recommended ensuring an impartial and professional valuation.Tucson Arizona Valuation of Share of Partner is a process that involves determining the monetary worth or value of a partner's ownership interest in a business or partnership based in Tucson, Arizona. This valuation is crucial in various situations such as partnership dissolution, buyouts, mergers, acquisitions, or when an individual partner wants to sell or transfer their share of ownership. The valuation of a partner's share in Tucson, Arizona typically takes into account numerous factors to arrive at an accurate and fair value. Some relevant keywords that are essential to understanding this process include: 1. Business Valuation: Tucson Arizona Valuation of Share of Partner often involves valuing the entire business to accurately determine the partner's share. This includes evaluating the company's financial records, assets, liabilities, revenue, profitability, and growth potential. 2. Fair Market Value: Fair market value is the estimated price at which the partner's share would be sold in an open and competitive market. It considers market conditions, economic trends, and the company's specific circumstances. 3. Partnership Agreement: The valuation process is guided by the terms outlined in the partnership agreement, which includes provisions on how the partner's share should be valued. The agreement may specify different methods to determine the value, such as book value, earnings value, or market value. 4. Valuation Methods: There are various valuation methods used in Tucson Arizona Valuation of Share of Partner. These include the income approach, market approach, and asset-based approach. The income approach focuses on the company's ability to generate income, the market approach looks at similar transactions in the industry, and the asset-based approach evaluates tangible and intangible assets. 5. Buy-Sell Agreement: In some cases, partnerships have a buy-sell agreement in place, which addresses the valuation and transfer of a partner's share. This agreement helps simplify the valuation process and ensures a fair and smooth transition in ownership. 6. Independent Appraiser: To ensure an impartial and accurate valuation, it is often recommended hiring an independent appraiser or valuation expert who specializes in Tucson Arizona Valuation of Share of Partner. The appraiser assesses all relevant factors, performs necessary analyses, and provides a professional valuation report. Different types of Tucson Arizona Valuation of Share of Partner could include: 1. Partnership Dissolution Valuation: When a partnership is ending, the valuation determines the value of each partner's share for the purpose of dividing assets and settling liabilities. 2. Buyout Valuation: If one partner wants to buy out another partner's share, the valuation helps determine the fair price to pay for the share of ownership. 3. Mergers and Acquisitions Valuation: Valuation is crucial when two partnerships wish to merge or one partnership wants to acquire another. The valuation assesses the value of each partner's share to negotiate fair exchange ratios or purchase prices. 4. Succession Planning Valuation: In cases where a partner retires or intends to pass on their share of ownership, the valuation is utilized to determine the value for the purposes of transition planning, estate planning, or selling the share to another partner or third party. In summary, Tucson Arizona Valuation of Share of Partner is a comprehensive process that involves determining the value of a partner's ownership interest. It considers various factors, terms outlined in the partnership agreement, and utilizes different valuation methods to arrive at a fair and accurate value. Hiring an independent appraiser is often recommended ensuring an impartial and professional valuation.