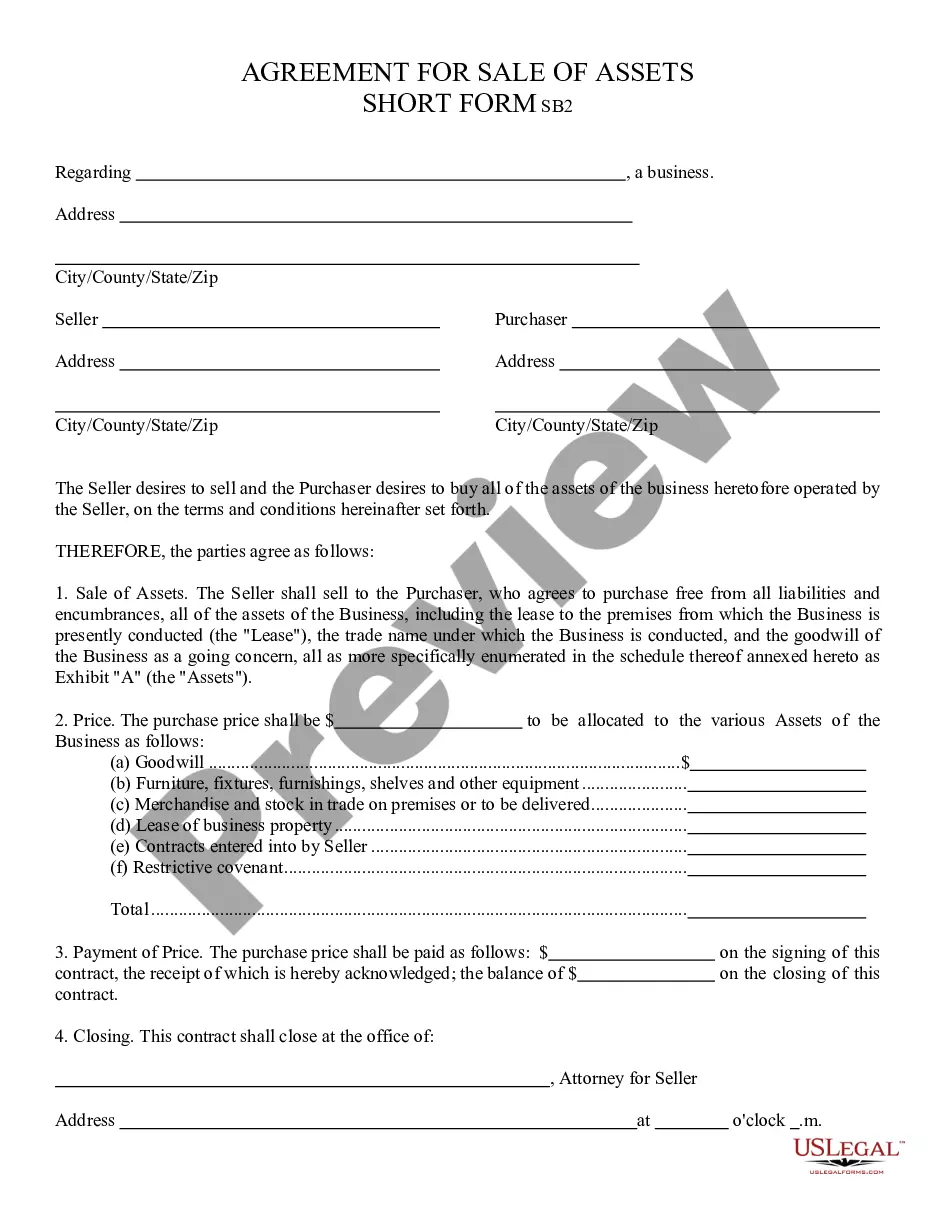

Seller desires to sell and purchaser will buy all of the assets of a business that is being operated by seller. Purchaser agrees to buy free from all liabilities and encumbrances, all the assets of the business, including the lease to the premises from which the business is presently conducted. Purchaser also agrees to buy the business trade name and the goodwill of the business. Other provisions of the agreement are: the purchase price, payment of the purchase price, and prorations.

Chandler Arizona Sale of Assets - Asset Purchase

Description

How to fill out Chandler Arizona Sale Of Assets - Asset Purchase?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our valuable site with thousands of document templates makes it easy to locate and acquire nearly any document sample you seek.

You can download, complete, and sign the Chandler Arizona Sale of Assets - Asset Purchase in just a few minutes instead of spending hours searching the internet for a suitable template.

Using our collection is a superb approach to enhance the security of your document submission.

If you don’t have a profile yet, adhere to the instructions outlined below.

Feel free to fully leverage our platform and make your document experience as effortless as possible!

- Our skilled legal experts frequently examine all documents to guarantee that the templates are suitable for a specific area and adhere to updated laws and regulations.

- How do you acquire the Chandler Arizona Sale of Assets - Asset Purchase.

- If you already possess a profile, simply sign in to your account.

- The Download button will be visible on all the samples you view.

- Additionally, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

The difference between the sale of stock and the sale of assets is rooted in the scope of the transaction. While selling stock transfers ownership of the entire company and its liabilities, an asset sale focuses on specific items without assuming broader company liabilities. Buyers often prefer asset purchases to limit their risk exposure, especially in situations with uncertain company debts.

42-12004 - Class four property. 1. Real and personal property and improvements to the property that are used for residential purposes, including residential property that is owned in foreclosure by a financial institution, that is not otherwise included in another classification and that is valued at full cash value.

How is Personal Property Valued? Based on the original cost and age of all personal property in your possession as of December 31 of the prior year, the County Assessor will calculate the current replacement cost new less depreciation of each item.

Tax rates are applied to assessed values. The assessment ratio for residential property in Arizona is 10%. That means assessed values are equal to 10% of the LPV. A financial advisor in Arizona can help you understand how homeownership fits into your overall financial goals.

Depending on where you choose to buy a home, property taxes can range from negligible amounts to nearly matching a mortgage payment. Across Arizona, the effective annual property tax rate stands at 0.60%, the 12th lowest among states.

Real and personal property that is used for residential purposes and occupied by a relative of the owner, as described in section 42-12053, as the relative's primary residence, that is not otherwise included in class one, two, four, six, seven or eight and that is valued at full cash value. 3.

The Assessed Value is based on the Full Cash Value, and the assessment ratio for the legal class of the property. The tax rates for the county and local governmental jurisdictions in which the business operates are applied to the Assessed value.

The Arizona property tax system is administered jointly by the Arizona Department of Revenue (Department) and the 15 county assessors and treasurers.

42-12004 - Class four property. 1. Real and personal property and improvements to the property that are used for residential purposes, including residential property that is owned in foreclosure by a financial institution, that is not otherwise included in another classification and that is valued at full cash value.

Class 3 property means Assessed Property that is or is intended to be developed as multifamily rental units under common management (e.g., apartments), including any ancillary uses thereto.