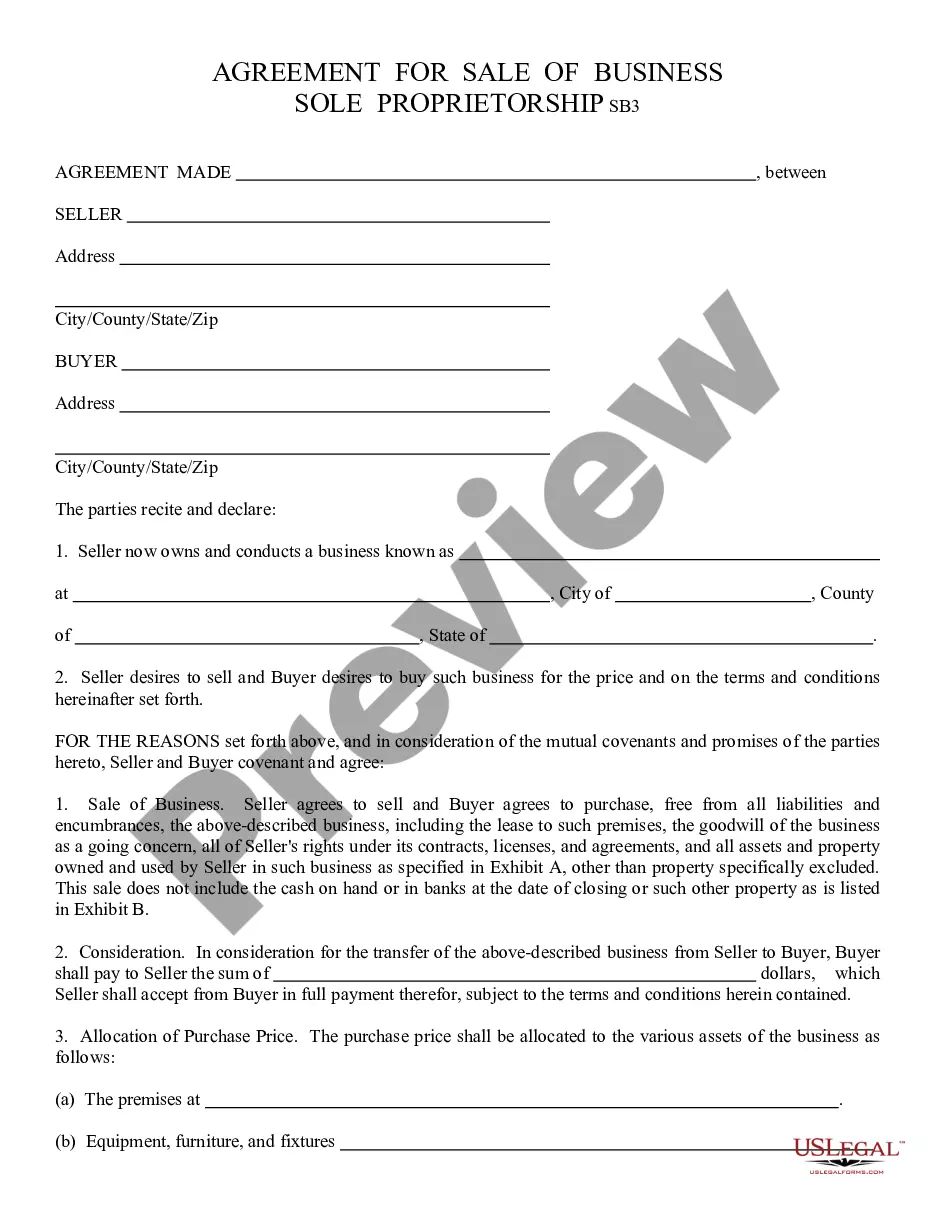

Sale of Business, Sole Proprietorship: This is a contract between an Owner of a Sole Proprietorship and an intended Buyer. This contract lists the conditions to the sell, as well as the agreed upon purchase price. Both the Seller and Buyer must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Chandler Arizona Sale of Business, Sole

Description

How to fill out Chandler Arizona Sale Of Business, Sole?

Are you searching for a dependable and economical legal document supplier to obtain the Chandler Arizona Sale of Business, Sole? US Legal Forms is your ideal answer.

Whether you need a simple agreement to set standards for living with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we have you covered. Our platform provides over 85,000 current legal document templates for personal and corporate use. All templates we provide access to are not generic; they are tailored based on the needs of specific states and regions.

To download the document, you must Log In to your account, find the required template, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates anytime from the My documents section.

Are you unfamiliar with our platform? No problem. You can easily create an account, but before you do, ensure to follow these steps: Check if the Chandler Arizona Sale of Business, Sole complies with your state and local laws. Review the form’s description (if available) to understand who and what the document is suited for. Begin the search again if the template does not fit your particular situation.

Try US Legal Forms today, and stop wasting your precious time trying to navigate legal documents online once and for all.

- Now you can create your account.

- Then choose the subscription option and continue to payment.

- Once the payment is finalized, download the Chandler Arizona Sale of Business, Sole in any available file format.

- You can return to the website at any moment and redownload the document free of charge.

- Finding current legal documents has never been simpler.

Form popularity

FAQ

The highest sales tax rate in Arizona can reach up to approximately 10.7%, depending on the total local and state combined rates. Chandler, Arizona, has a sales tax rate that might differ based on specific transactions, so it’s vital to check local regulations. Understanding this helps businesses plan effectively, especially when considering the implications during a Chandler Arizona Sale of Business, Sole.

Sales tax in Arizona is a tax imposed on the sale of goods and some services. The base rate is set by the state, but local cities, including Chandler, may add their rates to that base. As a result, when conducting transactions in Chandler, Arizona Sale of Business, Sole, it’s important to account for the total sales tax to accurately calculate your costs and potential profits.

To calculate the sales tax in Arizona, first, identify the taxable amount from your sale. Multiply that amount by the current sales tax rate for your jurisdiction, which varies across the state. For a business in Chandler, Arizona, that means staying updated on local rates, as there can be additional taxes. This calculation is essential when handling the Chandler Arizona Sale of Business, Sole, ensuring you comply with tax obligations.

When forming an LLC in Arizona, you generally need a business license depending on your business type and location. This requirement applies even when you engage in a Chandler Arizona Sale of Business, Sole. It's essential to check with your local government for specific licensing requirements. Using a platform like US Legal Forms helps streamline the process, ensuring you have all the necessary documentation for your LLC and compliance with local laws.

Yes, Chandler, AZ requires most businesses to obtain a business license to operate legally. This license not only permits you to conduct business but also ensures compliance with local regulations. If you're considering a Chandler Arizona Sale of Business, Sole, securing the appropriate business license will be a necessary step in the process.

The privilege tax in Chandler, Arizona is part of the broader transaction privilege tax system. This tax rate can differ based on the type of business activities conducted, so it is vital to review the latest information. Familiarity with the Chandler privilege tax is beneficial for anyone pursuing a Chandler Arizona Sale of Business, Sole, as it directly impacts financial obligations.

To apply for the Arizona transaction privilege tax, you must complete an application form, available through the Arizona Department of Revenue's website. After submitting the form, you'll receive a transaction privilege tax license, which is necessary for legally operating a business in the state. If you are navigating a Chandler Arizona Sale of Business, Sole, this application process is an essential step.

The privilege tax, or transaction privilege tax, is a tax imposed on businesses for the privilege of conducting business in Arizona. This tax is applicable to gross receipts from sales and various services, making it vital for business owners to factor it into their financial planning. For those considering a Chandler Arizona Sale of Business, Sole, comprehending this tax will play a significant role in your strategy.

Chandler, AZ imposes a transaction privilege tax, which varies depending on the type of business activity. The current tax rate can fluctuate, so it's wise to check the city’s official website or consult a local tax professional for the most accurate information. Understanding this rate is crucial for anyone interested in a Chandler Arizona Sale of Business, Sole.

In Chandler, Arizona, the rental tax applies to all businesses engaging in the rental or leasing of residential or commercial properties. This tax is calculated based on the gross rental income generated by your property. It's important to stay informed about local tax regulations to ensure compliance, especially when considering a Chandler Arizona Sale of Business, Sole.