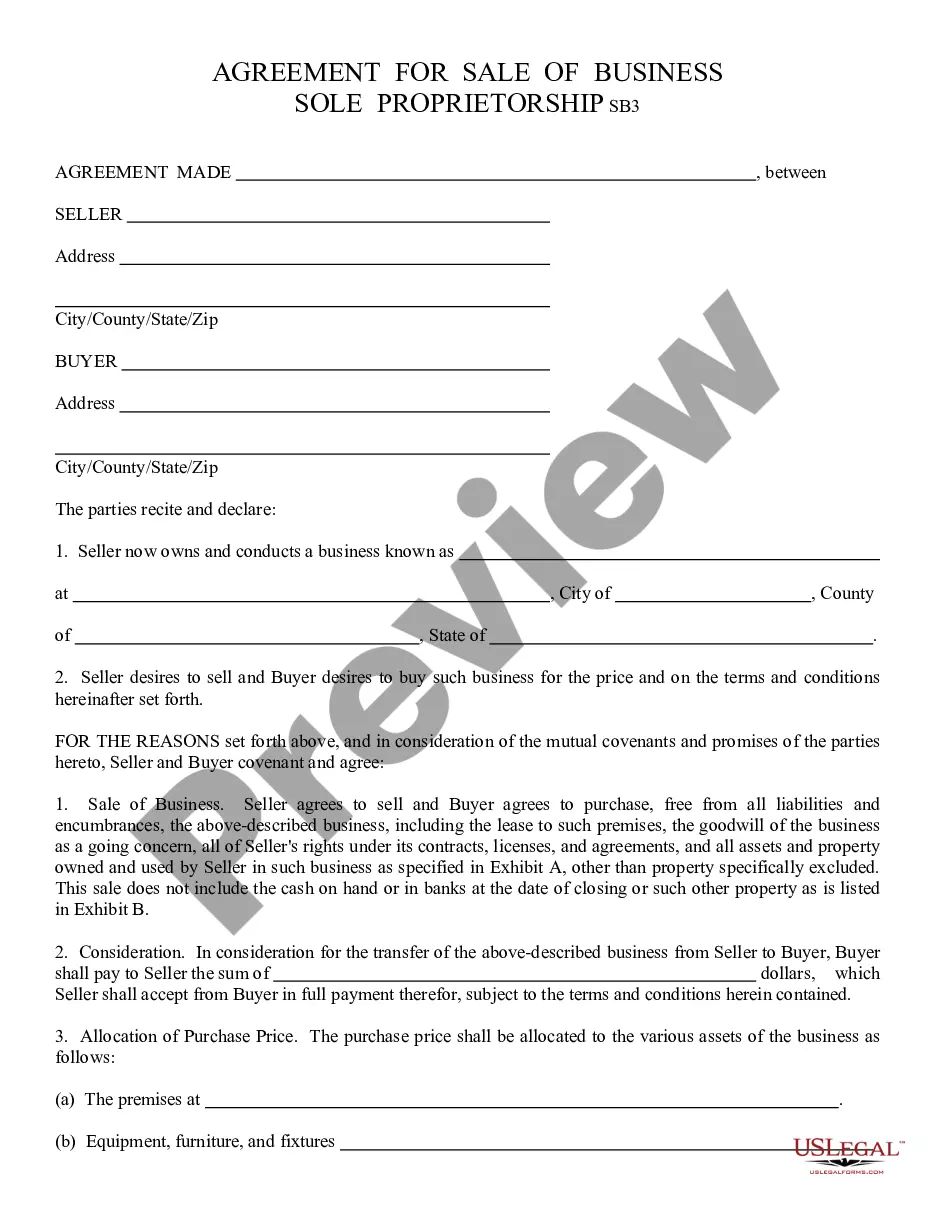

Sale of Business, Sole Proprietorship: This is a contract between an Owner of a Sole Proprietorship and an intended Buyer. This contract lists the conditions to the sell, as well as the agreed upon purchase price. Both the Seller and Buyer must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Glendale Arizona Sale of Business, Sole The sale of a business, sole proprietorship, is a common transaction in Glendale, Arizona for those looking to either embark on a new venture or exit from an existing one. It involves the transfer of ownership and all underlying assets and liabilities from the current sole proprietor to a new individual or entity. This process can be complex and requires careful consideration of various legal, financial, and operational factors. In Glendale, Arizona, there are several types of sales of business, sole, each catering to different circumstances and requirements. These include: 1. Asset Sale: This type of sale involves the transfer of specific assets and liabilities of the sole proprietorship. The buyer acquires individual assets such as equipment, inventory, intellectual property, customer lists, and real estate. This option allows for a more selective acquisition and enables the buyer to cherry-pick the most valuable assets while leaving behind less desirable ones. 2. Stock Sale: In a stock sale, the sole proprietor sells the entire ownership interest in the business. The buyer purchases the shares of the business, which includes all assets and liabilities, known and unknown, associated with it. This option may provide certain tax benefits for both the buyer and the seller, but it also means the buyer is assuming all previous obligations and liabilities of the business. 3. Merger or Acquisition: In some cases, a sole proprietor may opt to merge their business with or be acquired by another company. This process involves combining resources and operations, either by joining forces or assimilating the sole proprietorship into a larger organization. Mergers and acquisitions can offer synergistic opportunities, expanded market reach, and increased scalability. When engaging in a Glendale Arizona Sale of Business, Sole, it is vital to consider various essential elements and seek professional assistance. These elements may include conducting a thorough valuation of the business to determine its worth, drafting and negotiating comprehensive legal agreements, addressing tax implications, ensuring proper due diligence, and securing necessary licenses and permits for the new owner. In summary, the sale of a business, sole proprietorship, in Glendale, Arizona, encompasses the transfer of ownership, assets, and liabilities from a sole proprietor to a new individual or entity. The various types of sales, including asset sales, stock sales, and mergers or acquisitions, provide different options for buyers and sellers to meet their specific needs. Seeking expert advice and employing proper due diligence is crucial to ensure a successful and legally compliant transaction.Glendale Arizona Sale of Business, Sole The sale of a business, sole proprietorship, is a common transaction in Glendale, Arizona for those looking to either embark on a new venture or exit from an existing one. It involves the transfer of ownership and all underlying assets and liabilities from the current sole proprietor to a new individual or entity. This process can be complex and requires careful consideration of various legal, financial, and operational factors. In Glendale, Arizona, there are several types of sales of business, sole, each catering to different circumstances and requirements. These include: 1. Asset Sale: This type of sale involves the transfer of specific assets and liabilities of the sole proprietorship. The buyer acquires individual assets such as equipment, inventory, intellectual property, customer lists, and real estate. This option allows for a more selective acquisition and enables the buyer to cherry-pick the most valuable assets while leaving behind less desirable ones. 2. Stock Sale: In a stock sale, the sole proprietor sells the entire ownership interest in the business. The buyer purchases the shares of the business, which includes all assets and liabilities, known and unknown, associated with it. This option may provide certain tax benefits for both the buyer and the seller, but it also means the buyer is assuming all previous obligations and liabilities of the business. 3. Merger or Acquisition: In some cases, a sole proprietor may opt to merge their business with or be acquired by another company. This process involves combining resources and operations, either by joining forces or assimilating the sole proprietorship into a larger organization. Mergers and acquisitions can offer synergistic opportunities, expanded market reach, and increased scalability. When engaging in a Glendale Arizona Sale of Business, Sole, it is vital to consider various essential elements and seek professional assistance. These elements may include conducting a thorough valuation of the business to determine its worth, drafting and negotiating comprehensive legal agreements, addressing tax implications, ensuring proper due diligence, and securing necessary licenses and permits for the new owner. In summary, the sale of a business, sole proprietorship, in Glendale, Arizona, encompasses the transfer of ownership, assets, and liabilities from a sole proprietor to a new individual or entity. The various types of sales, including asset sales, stock sales, and mergers or acquisitions, provide different options for buyers and sellers to meet their specific needs. Seeking expert advice and employing proper due diligence is crucial to ensure a successful and legally compliant transaction.