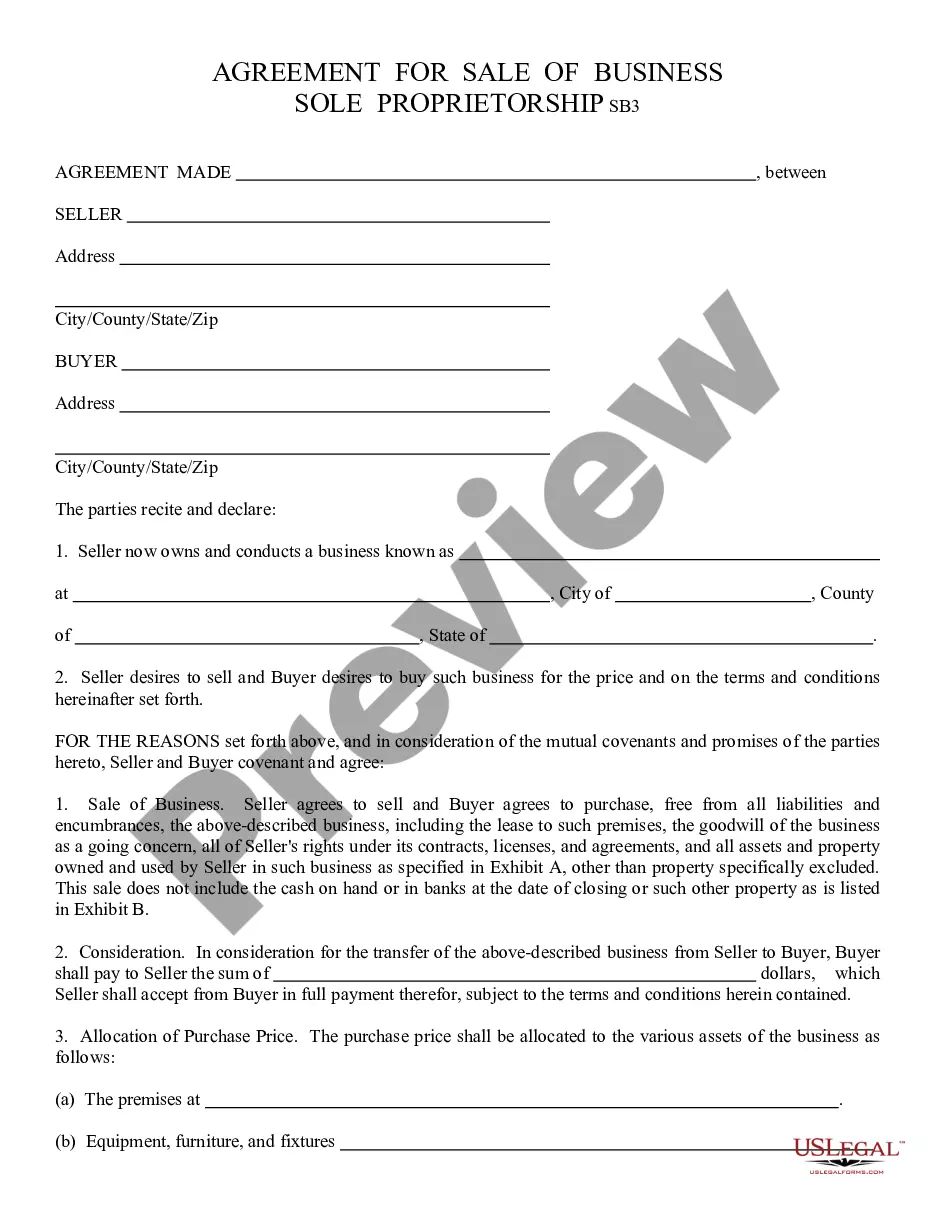

Sale of Business, Sole Proprietorship: This is a contract between an Owner of a Sole Proprietorship and an intended Buyer. This contract lists the conditions to the sell, as well as the agreed upon purchase price. Both the Seller and Buyer must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Lima, Arizona Sale of Business, Sole, is a legal transaction that involves the transfer of ownership and control of a business from one individual to another without involving any partnerships or corporations. This specific form of transaction is commonly referred to as a "sole proprietorship sale." When it comes to the sale of business in Lima, Arizona, there are several types and aspects that one should consider. 1. Lima Arizona Sole Proprietorship Sale: In a sole proprietorship sale, a business is owned and operated by a single individual who has complete control and liability. The sale of such a business entails transferring the assets, liabilities, customer base, and any existing contracts or agreements to a new owner, who will take over the entire operation. 2. Key Considerations in a Lima Arizona Sole Proprietorship Sale: — Assets and Liabilities Transfer: The seller and buyer need to negotiate and agree upon the transfer of assets such as equipment, inventory, licenses, permits, leases, intellectual property, and any outstanding debts or obligations. — Valuation: Determining the fair market value of the business is crucial for both parties. This involves assessing the tangible and intangible assets, profitability, market position, customer base, and future potential of the business. — Due Diligence: The buyer should conduct a thorough investigation of the business's financial records, legal compliance, contracts, customer satisfaction, and overall performance before finalizing the sale to ensure there are no hidden risks or liabilities. — Purchase Agreement: A legally binding purchase agreement should be drafted, outlining the terms and conditions of the sale, payment structure, transition period, non-compete agreements, and other relevant clauses to protect the interests of both parties. — Licensing and Permits: Depending on the nature of the business, the buyer may need to obtain new licenses and permits to legally operate the business in Lima, Arizona. — Employee Considerations: If there are employees involved in the business, the treatment of existing employees, potential severance packages, and any obligations under existing employment contracts must be addressed during the sale process. 3. Advantages and Challenges of Lima Arizona Sole Proprietorship Sale: Advantages: — Simplicity: Sole proprietorship sales involve fewer complex legal structures, making the sale process more straightforward. — Complete Control: The buyer gains full control and decision-making authority over the business. — Profit Retention: The buyer can directly retain all profits generated by the business. Challenges: — Personal Liability: The buyer becomes personally liable for all business debts, obligations, and legal issues. — Limited Financing Options: Securing financing for a sole proprietorship sale might be more challenging than for other business structures, as lenders often prefer more established and secure entities. — Continuity: The future success of the business may depend on the buyer's ability to maintain relationships with existing customers, suppliers, and other key stakeholders. In conclusion, a Lima Arizona Sale of Business, Sole, involves the transfer of ownership and control of a sole proprietorship from one individual to another in Lima, Arizona. Addressing the various considerations and challenges during this process is crucial to ensure a smooth transition and protect the interests of both parties involved.Lima, Arizona Sale of Business, Sole, is a legal transaction that involves the transfer of ownership and control of a business from one individual to another without involving any partnerships or corporations. This specific form of transaction is commonly referred to as a "sole proprietorship sale." When it comes to the sale of business in Lima, Arizona, there are several types and aspects that one should consider. 1. Lima Arizona Sole Proprietorship Sale: In a sole proprietorship sale, a business is owned and operated by a single individual who has complete control and liability. The sale of such a business entails transferring the assets, liabilities, customer base, and any existing contracts or agreements to a new owner, who will take over the entire operation. 2. Key Considerations in a Lima Arizona Sole Proprietorship Sale: — Assets and Liabilities Transfer: The seller and buyer need to negotiate and agree upon the transfer of assets such as equipment, inventory, licenses, permits, leases, intellectual property, and any outstanding debts or obligations. — Valuation: Determining the fair market value of the business is crucial for both parties. This involves assessing the tangible and intangible assets, profitability, market position, customer base, and future potential of the business. — Due Diligence: The buyer should conduct a thorough investigation of the business's financial records, legal compliance, contracts, customer satisfaction, and overall performance before finalizing the sale to ensure there are no hidden risks or liabilities. — Purchase Agreement: A legally binding purchase agreement should be drafted, outlining the terms and conditions of the sale, payment structure, transition period, non-compete agreements, and other relevant clauses to protect the interests of both parties. — Licensing and Permits: Depending on the nature of the business, the buyer may need to obtain new licenses and permits to legally operate the business in Lima, Arizona. — Employee Considerations: If there are employees involved in the business, the treatment of existing employees, potential severance packages, and any obligations under existing employment contracts must be addressed during the sale process. 3. Advantages and Challenges of Lima Arizona Sole Proprietorship Sale: Advantages: — Simplicity: Sole proprietorship sales involve fewer complex legal structures, making the sale process more straightforward. — Complete Control: The buyer gains full control and decision-making authority over the business. — Profit Retention: The buyer can directly retain all profits generated by the business. Challenges: — Personal Liability: The buyer becomes personally liable for all business debts, obligations, and legal issues. — Limited Financing Options: Securing financing for a sole proprietorship sale might be more challenging than for other business structures, as lenders often prefer more established and secure entities. — Continuity: The future success of the business may depend on the buyer's ability to maintain relationships with existing customers, suppliers, and other key stakeholders. In conclusion, a Lima Arizona Sale of Business, Sole, involves the transfer of ownership and control of a sole proprietorship from one individual to another in Lima, Arizona. Addressing the various considerations and challenges during this process is crucial to ensure a smooth transition and protect the interests of both parties involved.