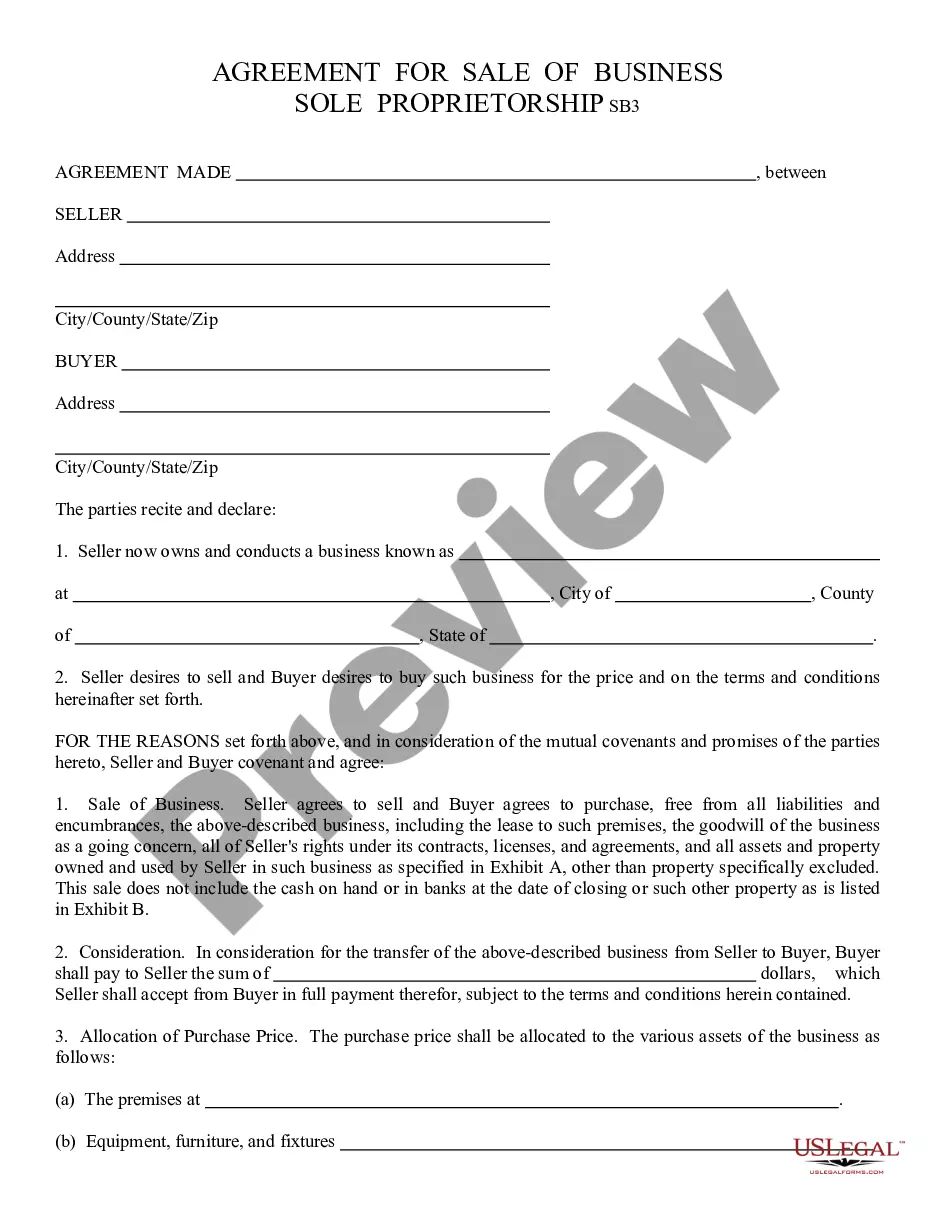

Sale of Business, Sole Proprietorship: This is a contract between an Owner of a Sole Proprietorship and an intended Buyer. This contract lists the conditions to the sell, as well as the agreed upon purchase price. Both the Seller and Buyer must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Surprise Arizona Sale of Business, Sole The Surprise Arizona Sale of Business, Sole refers to the legal process of transferring ownership of a business entity from one individual to another, where the seller is the sole proprietor of the business. This type of sale specifically pertains to the city of Surprise, Arizona, and encompasses various industries and sectors within the region. In Surprise, Arizona, there are two primary types of Sale of Business, Sole transactions that commonly occur: 1. Asset Sale: This type of sale involves the transfer of specific assets of the business from the seller to the buyer. Assets may include tangible items such as equipment, inventory, furniture, fixtures, and contracts, as well as intangible assets like customer lists, trademarks, and goodwill. By acquiring these assets, the buyer gains control over the operations and resources necessary to continue the business. 2. Stock Sale: In contrast to an asset sale, a stock sale involves the transfer of the seller's ownership shares, or stocks, of the business entity to the buyer. This type of sale typically occurs when the business operates as a corporation or a limited liability company (LLC). By purchasing the stocks, the buyer assumes complete control and ownership of the business entity, along with its assets, liabilities, and ongoing operations. The Surprise Arizona Sale of Business, Sole process involves several crucial steps: 1. Valuation: Both the seller and the buyer need to determine the value of the business. This is often done by reviewing financial statements, analyzing market trends, assessing the tangible and intangible assets, and considering the business's potential for future growth. The valuation helps in negotiating a fair price for the sale. 2. Negotiation: The buyer and the seller engage in discussions to negotiate the terms and conditions of the sale. This includes determining the purchase price, payment terms, transition period, and any contingencies or warranties that may be involved. 3. Due Diligence: The buyer thoroughly examines the business's financial records, legal documents, contracts, suppliers, customer relationships, and any potential liabilities. This step ensures that the buyer has a comprehensive understanding of the business's current state and its prospects moving forward. 4. Business Purchase Agreement: Once both parties have agreed on the terms of the sale, a legally binding agreement, known as the business purchase agreement, is drafted. This document outlines the specifics of the sale, including the purchase price, asset list, payment terms, disclosure of warranties, and other relevant provisions. 5. Closing: During the closing stage, the buyer provides the agreed-upon payment to the seller, and the legal documents are finalized and executed. This includes transferring ownership of assets, updating necessary registrations and permits, and notifying relevant parties such as customers, vendors, and employees regarding the change in ownership. The Surprise Arizona Sale of Business, Sole can be a complex process requiring expertise in finance, legal matters, and business operations. Therefore, it is often advisable to seek professional assistance from business brokers, attorneys, or accountants to facilitate a smooth and successful sale.Surprise Arizona Sale of Business, Sole The Surprise Arizona Sale of Business, Sole refers to the legal process of transferring ownership of a business entity from one individual to another, where the seller is the sole proprietor of the business. This type of sale specifically pertains to the city of Surprise, Arizona, and encompasses various industries and sectors within the region. In Surprise, Arizona, there are two primary types of Sale of Business, Sole transactions that commonly occur: 1. Asset Sale: This type of sale involves the transfer of specific assets of the business from the seller to the buyer. Assets may include tangible items such as equipment, inventory, furniture, fixtures, and contracts, as well as intangible assets like customer lists, trademarks, and goodwill. By acquiring these assets, the buyer gains control over the operations and resources necessary to continue the business. 2. Stock Sale: In contrast to an asset sale, a stock sale involves the transfer of the seller's ownership shares, or stocks, of the business entity to the buyer. This type of sale typically occurs when the business operates as a corporation or a limited liability company (LLC). By purchasing the stocks, the buyer assumes complete control and ownership of the business entity, along with its assets, liabilities, and ongoing operations. The Surprise Arizona Sale of Business, Sole process involves several crucial steps: 1. Valuation: Both the seller and the buyer need to determine the value of the business. This is often done by reviewing financial statements, analyzing market trends, assessing the tangible and intangible assets, and considering the business's potential for future growth. The valuation helps in negotiating a fair price for the sale. 2. Negotiation: The buyer and the seller engage in discussions to negotiate the terms and conditions of the sale. This includes determining the purchase price, payment terms, transition period, and any contingencies or warranties that may be involved. 3. Due Diligence: The buyer thoroughly examines the business's financial records, legal documents, contracts, suppliers, customer relationships, and any potential liabilities. This step ensures that the buyer has a comprehensive understanding of the business's current state and its prospects moving forward. 4. Business Purchase Agreement: Once both parties have agreed on the terms of the sale, a legally binding agreement, known as the business purchase agreement, is drafted. This document outlines the specifics of the sale, including the purchase price, asset list, payment terms, disclosure of warranties, and other relevant provisions. 5. Closing: During the closing stage, the buyer provides the agreed-upon payment to the seller, and the legal documents are finalized and executed. This includes transferring ownership of assets, updating necessary registrations and permits, and notifying relevant parties such as customers, vendors, and employees regarding the change in ownership. The Surprise Arizona Sale of Business, Sole can be a complex process requiring expertise in finance, legal matters, and business operations. Therefore, it is often advisable to seek professional assistance from business brokers, attorneys, or accountants to facilitate a smooth and successful sale.