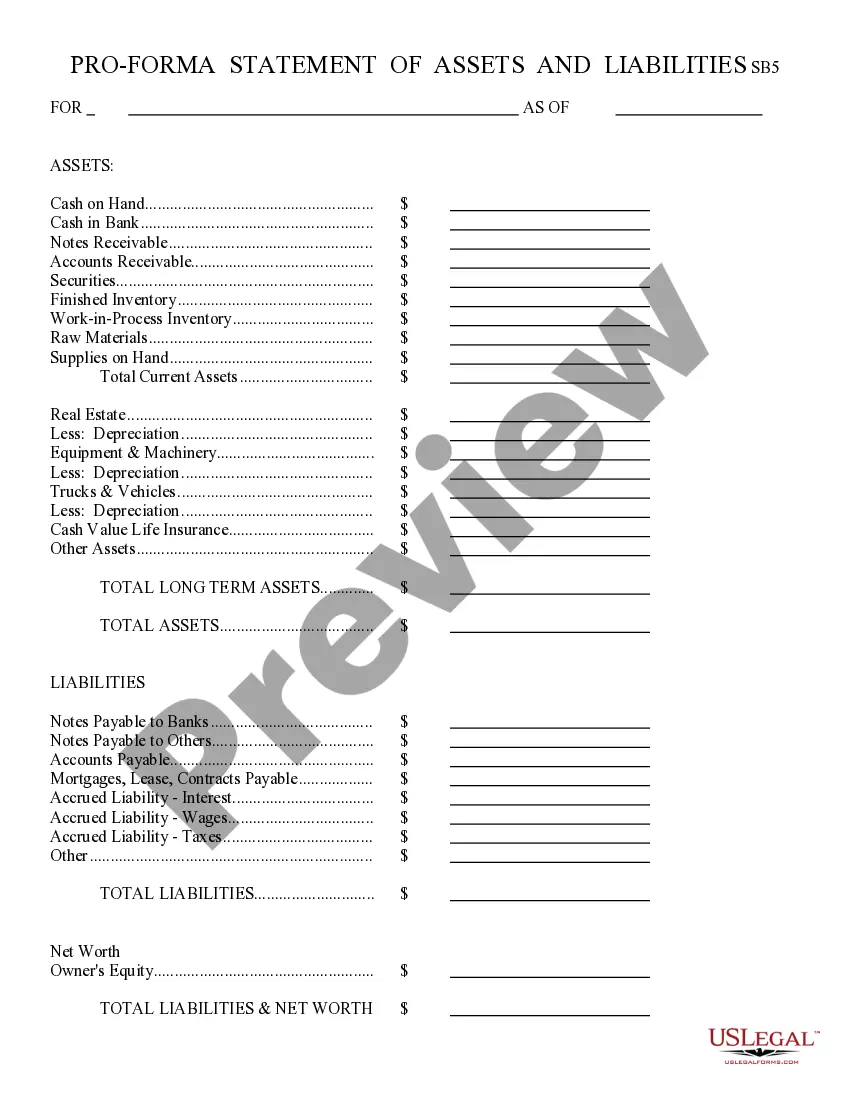

Statement of Assets; Liabilities: This is a general Statement of Assets and Liabilities for a company. It lists in detail, all assets, including real property and machinery, as well as all liabilities, or expendentures, such as rent. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

The Maricopa Arizona Statement of Assets and Liabilities — Asset Purchase is a legal document that outlines the financial condition and ownership of assets and liabilities related to a specific transaction in Maricopa, Arizona. This statement is commonly used in various business transactions such as mergers, acquisitions, or selling/buying assets. The Maricopa Arizona Statement of Assets and Liabilities — Asset Purchase typically includes a comprehensive list of all assets and liabilities involved in the transaction. Assets can include tangible items such as real estate, equipment, inventory, and intellectual property, while liabilities may consist of debts, loans, or other financial obligations. This statement aims to provide transparency and clarity to both parties involved in the asset purchase, ensuring that all crucial information about the assets' value, condition, and potential risks is disclosed. It helps the buyer understand the financial implications of the transaction and assesses the overall financial health of the seller. Different types of Maricopa Arizona Statement of Assets and Liabilities — Asset Purchase may include: 1. Commercial Asset Purchase Agreement: This type of asset purchase agreement specifically applies to commercial entities like businesses, corporations, or partnerships. It outlines the terms and conditions of the asset purchase, including the price, payment terms, and warranties. 2. Real Estate Asset Purchase Agreement: This statement is used when the asset being purchased is a real estate property. It includes details regarding the property's location, legal description, purchase price, encumbrances, and any specific conditions or contingencies. 3. Intellectual Property Asset Purchase Agreement: This type of agreement is specifically designed for the transfer of intellectual property assets like patents, trademarks, copyrights, or trade secrets. It outlines the transfer of ownership rights and may include provisions regarding ongoing licensing or royalties. 4. Distressed Asset Purchase Agreement: In certain cases, the assets being purchased may be distressed or facing financial difficulties. This agreement outlines the terms and conditions under which the buyer acquires such assets, often at a discounted price, and details any associated risks or liabilities. When preparing a Maricopa Arizona Statement of Assets and Liabilities — Asset Purchase, it is essential to seek legal advice to ensure compliance with local laws and regulations, as well as to protect the rights and interests of both parties involved in the transaction.The Maricopa Arizona Statement of Assets and Liabilities — Asset Purchase is a legal document that outlines the financial condition and ownership of assets and liabilities related to a specific transaction in Maricopa, Arizona. This statement is commonly used in various business transactions such as mergers, acquisitions, or selling/buying assets. The Maricopa Arizona Statement of Assets and Liabilities — Asset Purchase typically includes a comprehensive list of all assets and liabilities involved in the transaction. Assets can include tangible items such as real estate, equipment, inventory, and intellectual property, while liabilities may consist of debts, loans, or other financial obligations. This statement aims to provide transparency and clarity to both parties involved in the asset purchase, ensuring that all crucial information about the assets' value, condition, and potential risks is disclosed. It helps the buyer understand the financial implications of the transaction and assesses the overall financial health of the seller. Different types of Maricopa Arizona Statement of Assets and Liabilities — Asset Purchase may include: 1. Commercial Asset Purchase Agreement: This type of asset purchase agreement specifically applies to commercial entities like businesses, corporations, or partnerships. It outlines the terms and conditions of the asset purchase, including the price, payment terms, and warranties. 2. Real Estate Asset Purchase Agreement: This statement is used when the asset being purchased is a real estate property. It includes details regarding the property's location, legal description, purchase price, encumbrances, and any specific conditions or contingencies. 3. Intellectual Property Asset Purchase Agreement: This type of agreement is specifically designed for the transfer of intellectual property assets like patents, trademarks, copyrights, or trade secrets. It outlines the transfer of ownership rights and may include provisions regarding ongoing licensing or royalties. 4. Distressed Asset Purchase Agreement: In certain cases, the assets being purchased may be distressed or facing financial difficulties. This agreement outlines the terms and conditions under which the buyer acquires such assets, often at a discounted price, and details any associated risks or liabilities. When preparing a Maricopa Arizona Statement of Assets and Liabilities — Asset Purchase, it is essential to seek legal advice to ensure compliance with local laws and regulations, as well as to protect the rights and interests of both parties involved in the transaction.