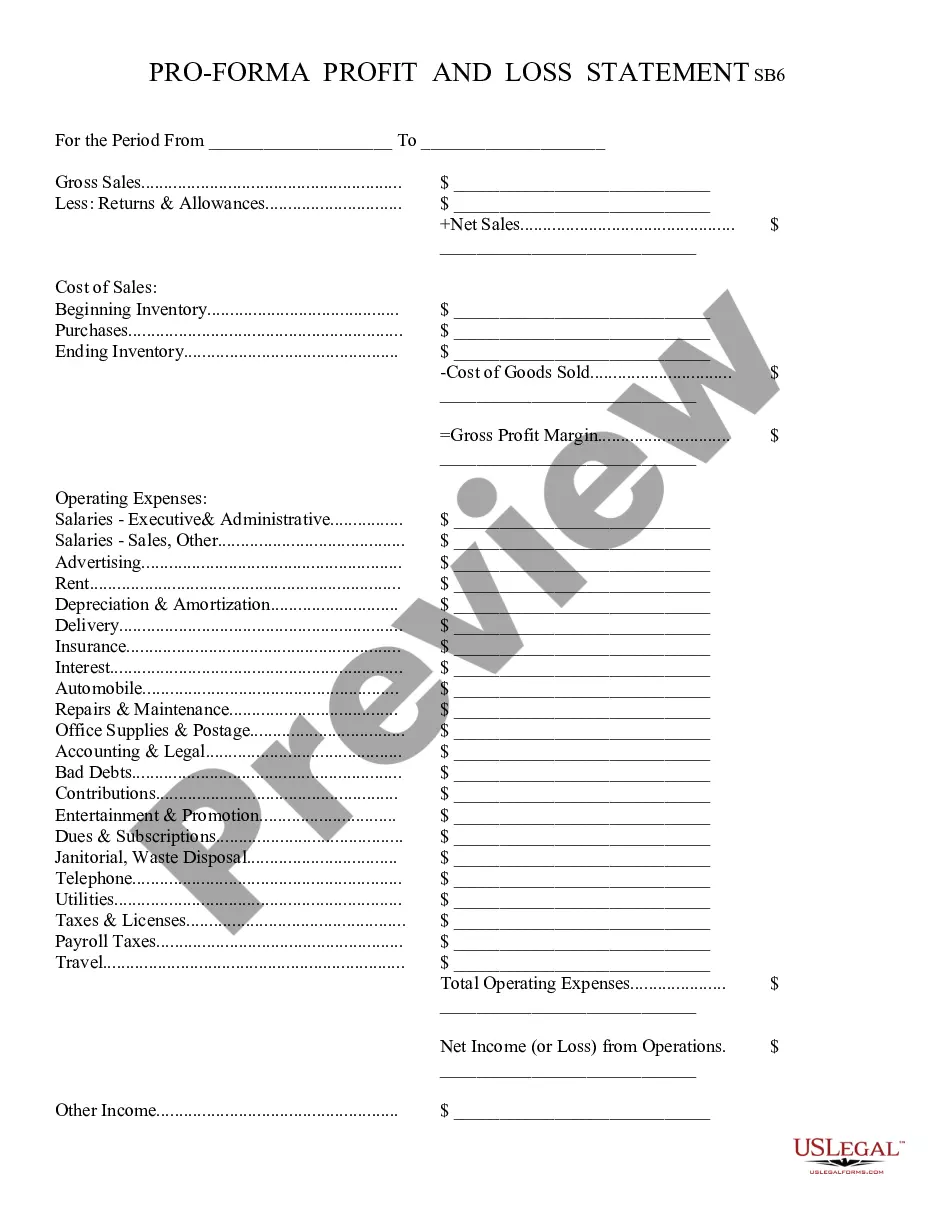

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

Chandler Arizona Profit and Loss Statement (P&L) is a financial document that summarizes the revenues, costs, and expenses incurred by businesses in Chandler, Arizona, over a specific period of time. It offers comprehensive insights into the financial performance and profitability of a company. Keywords: Chandler Arizona, Profit and Loss Statement, financial document, revenues, costs, expenses, financial performance, profitability. A typical Chandler Arizona Profit and Loss Statement includes the following key components: 1. Revenues: This section lists all the sales and revenue generated by a business within a specific time frame. It encompasses various income sources, such as product sales, service fees, and any other income directly related to the core operations of the business. 2. Cost of Goods Sold (COGS): Also known as the Cost of Revenue, this section includes all the direct costs incurred in producing or delivering the goods or services sold by the business. It covers expenses like raw materials, direct labor, manufacturing overhead, and shipping costs. 3. Gross Profit: Gross profit is calculated by subtracting the COGS from the total revenues. It represents the amount of money left after covering the direct costs associated with the production or delivery of goods and services. Gross profit is a crucial metric indicating the efficiency of a business's operations. 4. Operating Expenses: This segment outlines all the expenses not directly related to the production of goods or services. It includes items such as rent, utilities, salaries, insurance, marketing, and administrative costs. Operating expenses help determine the efficiency of the business's support staff and operations. 5. Operating Income: Operating income, also referred to as Earnings Before Interest and Taxes (EBIT), is calculated by subtracting the operating expenses from the gross profit. It showcases the profitability of a company's primary activities before accounting for interest expenses or taxes. 6. Other Income and Expenses: This section includes any non-operational income or expenses that are not part of the core business activities. Examples may include gains or losses from investments, interest earned on savings, or interest paid on loans. 7. Net Income: Net income, often referred to as the bottom line, represents the final profit earned by a business after accounting for all expenses, including taxes and interest. It is calculated by subtracting the total expenses, including non-operational items, from the operating income. Net income is a crucial indicator of a company's financial health and profitability. Different types of Chandler Arizona Profit and Loss Statements may exist based on the specific industry, size, or nature of the business. However, the fundamental structure and purpose remain the same — to provide a comprehensive overview of a company's financial performance for a given period.Chandler Arizona Profit and Loss Statement (P&L) is a financial document that summarizes the revenues, costs, and expenses incurred by businesses in Chandler, Arizona, over a specific period of time. It offers comprehensive insights into the financial performance and profitability of a company. Keywords: Chandler Arizona, Profit and Loss Statement, financial document, revenues, costs, expenses, financial performance, profitability. A typical Chandler Arizona Profit and Loss Statement includes the following key components: 1. Revenues: This section lists all the sales and revenue generated by a business within a specific time frame. It encompasses various income sources, such as product sales, service fees, and any other income directly related to the core operations of the business. 2. Cost of Goods Sold (COGS): Also known as the Cost of Revenue, this section includes all the direct costs incurred in producing or delivering the goods or services sold by the business. It covers expenses like raw materials, direct labor, manufacturing overhead, and shipping costs. 3. Gross Profit: Gross profit is calculated by subtracting the COGS from the total revenues. It represents the amount of money left after covering the direct costs associated with the production or delivery of goods and services. Gross profit is a crucial metric indicating the efficiency of a business's operations. 4. Operating Expenses: This segment outlines all the expenses not directly related to the production of goods or services. It includes items such as rent, utilities, salaries, insurance, marketing, and administrative costs. Operating expenses help determine the efficiency of the business's support staff and operations. 5. Operating Income: Operating income, also referred to as Earnings Before Interest and Taxes (EBIT), is calculated by subtracting the operating expenses from the gross profit. It showcases the profitability of a company's primary activities before accounting for interest expenses or taxes. 6. Other Income and Expenses: This section includes any non-operational income or expenses that are not part of the core business activities. Examples may include gains or losses from investments, interest earned on savings, or interest paid on loans. 7. Net Income: Net income, often referred to as the bottom line, represents the final profit earned by a business after accounting for all expenses, including taxes and interest. It is calculated by subtracting the total expenses, including non-operational items, from the operating income. Net income is a crucial indicator of a company's financial health and profitability. Different types of Chandler Arizona Profit and Loss Statements may exist based on the specific industry, size, or nature of the business. However, the fundamental structure and purpose remain the same — to provide a comprehensive overview of a company's financial performance for a given period.