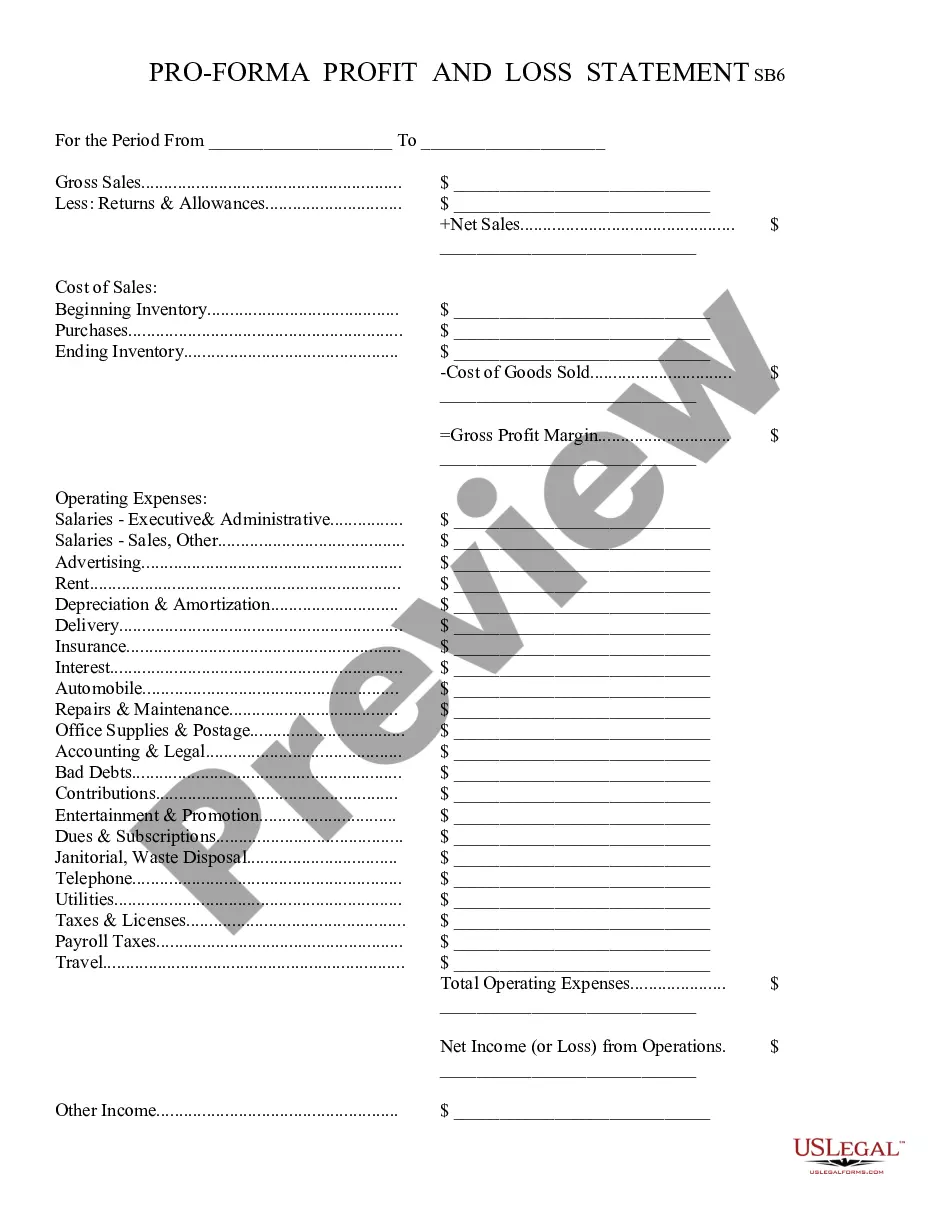

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

A Tempe Arizona profit and loss statement, also known as an income statement or statement of earnings, is a financial document that summarizes the revenues, expenses, and net income of a business or individual based in Tempe, Arizona. It provides a detailed breakdown of the financial performance over a specific period, typically monthly, quarterly, or annually. Keywords: Tempe Arizona, profit and loss statement, income statement, statement of earnings, financial document, revenues, expenses, net income, financial performance. The purpose of a Tempe Arizona profit and loss statement is to assess the profitability and financial health of a business or individual in Tempe, Arizona. It showcases the firm's ability to generate revenue, control costs, and maximize profits. Additionally, lenders, investors, and business owners rely on this statement to make informed decisions regarding the business's operations and financial strategies. The structure of a Tempe Arizona profit and loss statement typically includes several key sections. The most common sections are: 1. Revenue: This section outlines the total sales, service fees, or any other income generated during the accounting period. It covers all income sources directly related to the primary business activities. 2. Cost of Goods Sold (COGS): COGS reflects the direct costs associated with the production or acquisition of goods or services sold. This includes raw materials, labor, and manufacturing overheads. 3. Gross Profit: Gross profit is calculated by deducting the COGS from the total revenue. It represents the amount left over after accounting for direct expenses. 4. Operating Expenses: This section includes all indirect expenses incurred to run the business. Examples include rent, utilities, salaries, marketing expenses, office supplies, and insurance costs. 5. Operating Income: Operating income, also known as operating profit or earnings before interest and taxes (EBIT), is derived by subtracting operating expenses from the gross profit. 6. Non-Operating Items: This section accounts for revenues and expenses not directly related to the core business operations. It may include interest income, interest expenses, gains/losses from sale of assets, and other miscellaneous income/expenses. 7. Net Income: Net income represents the final profit or loss after accounting for all revenue, expenses, and taxes. It is calculated by subtracting non-operating items from the operating income. Types of Tempe Arizona profit and loss statements can vary based on the specific needs of the business or individual. Some examples include: 1. Monthly Income Statement: This statement provides a snapshot of the financial performance on a month-to-month basis and is helpful for short-term analysis and decision-making. 2. Quarterly Income Statement: This statement summarizes the financial performance over a three-month period and is useful for identifying trends and making mid-term financial assessments. 3. Annual Income Statement: This statement covers a full year and offers a comprehensive view of the financial performance, allowing for long-term planning, assessing year-over-year growth, and comparing the financial health of multiple years. In conclusion, a Tempe Arizona profit and loss statement provides a detailed breakdown of revenues, expenses, and net income, enabling businesses and individuals in Tempe, Arizona, to assess financial performance, make informed decisions, and plan for the future. It plays a crucial role in managing finances and serves as an essential tool for business growth and stability.A Tempe Arizona profit and loss statement, also known as an income statement or statement of earnings, is a financial document that summarizes the revenues, expenses, and net income of a business or individual based in Tempe, Arizona. It provides a detailed breakdown of the financial performance over a specific period, typically monthly, quarterly, or annually. Keywords: Tempe Arizona, profit and loss statement, income statement, statement of earnings, financial document, revenues, expenses, net income, financial performance. The purpose of a Tempe Arizona profit and loss statement is to assess the profitability and financial health of a business or individual in Tempe, Arizona. It showcases the firm's ability to generate revenue, control costs, and maximize profits. Additionally, lenders, investors, and business owners rely on this statement to make informed decisions regarding the business's operations and financial strategies. The structure of a Tempe Arizona profit and loss statement typically includes several key sections. The most common sections are: 1. Revenue: This section outlines the total sales, service fees, or any other income generated during the accounting period. It covers all income sources directly related to the primary business activities. 2. Cost of Goods Sold (COGS): COGS reflects the direct costs associated with the production or acquisition of goods or services sold. This includes raw materials, labor, and manufacturing overheads. 3. Gross Profit: Gross profit is calculated by deducting the COGS from the total revenue. It represents the amount left over after accounting for direct expenses. 4. Operating Expenses: This section includes all indirect expenses incurred to run the business. Examples include rent, utilities, salaries, marketing expenses, office supplies, and insurance costs. 5. Operating Income: Operating income, also known as operating profit or earnings before interest and taxes (EBIT), is derived by subtracting operating expenses from the gross profit. 6. Non-Operating Items: This section accounts for revenues and expenses not directly related to the core business operations. It may include interest income, interest expenses, gains/losses from sale of assets, and other miscellaneous income/expenses. 7. Net Income: Net income represents the final profit or loss after accounting for all revenue, expenses, and taxes. It is calculated by subtracting non-operating items from the operating income. Types of Tempe Arizona profit and loss statements can vary based on the specific needs of the business or individual. Some examples include: 1. Monthly Income Statement: This statement provides a snapshot of the financial performance on a month-to-month basis and is helpful for short-term analysis and decision-making. 2. Quarterly Income Statement: This statement summarizes the financial performance over a three-month period and is useful for identifying trends and making mid-term financial assessments. 3. Annual Income Statement: This statement covers a full year and offers a comprehensive view of the financial performance, allowing for long-term planning, assessing year-over-year growth, and comparing the financial health of multiple years. In conclusion, a Tempe Arizona profit and loss statement provides a detailed breakdown of revenues, expenses, and net income, enabling businesses and individuals in Tempe, Arizona, to assess financial performance, make informed decisions, and plan for the future. It plays a crucial role in managing finances and serves as an essential tool for business growth and stability.