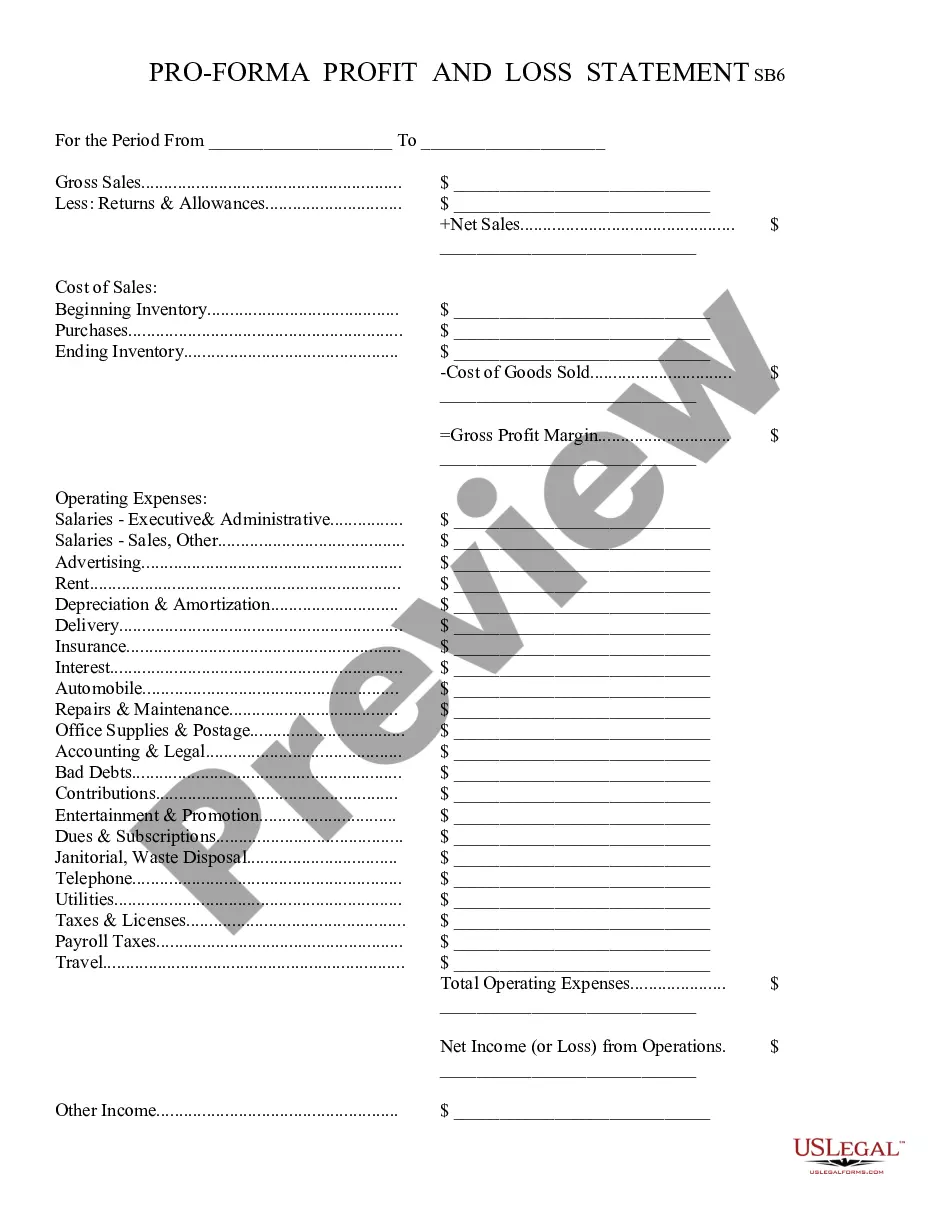

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

A profit and loss statement, also known as an income statement or P&L statement, is a financial report that summarizes the revenue, costs, and expenses incurred during a specific period of time by a company or organization in Tucson, Arizona. It provides a comprehensive overview of the financial performance, profitability, and operational efficiency of the business. In Tucson, Arizona, various types of profit and loss statements exist, tailored to specific sectors or industries. Some common types may include: 1. Retail Profit and Loss Statement: This type of P&L statement is designed for businesses engaged in retail activities, such as stores, boutiques, or supermarkets in Tucson, Arizona. It captures the revenue generated from sales, cost of goods sold (COGS), operating expenses, and eventually calculates the gross profit and net income or loss. 2. Restaurant Profit and Loss Statement: Restaurants in Tucson, Arizona typically use this specific P&L statement to evaluate their financial performance. It considers revenue from food and beverage sales, COGS, labor costs, rent, utility expenses, marketing expenses, and other related costs. It provides insights into key performance indicators (KPIs) like food cost percentage and labor cost percentage. 3. Real Estate Profit and Loss Statement: This variation of P&L statement is applicable to real estate companies, property management firms, or real estate investors operating in Tucson, Arizona. It tracks rental income, maintenance expenses, property taxes, insurance costs, vacancies, and any other associated charges to determine the profitability of real estate investments. 4. Manufacturing Profit and Loss Statement: Manufacturers in Tucson, Arizona can use this type of P&L statement to analyze their financial performance. It incorporates revenue from sales of manufactured goods, COGS, direct labor costs, raw material expenses, production overheads, depreciation, and other production-related expenses. Regardless of the industry, a Tucson, Arizona profit and loss statement typically includes the following key components: 1. Revenue: The total income generated from sales or services provided within the specified period. 2. Cost of Goods Sold: The direct costs associated with producing or purchasing the products or services sold. It includes raw materials, direct labor, and manufacturing overheads. 3. Gross Profit: Calculated by subtracting the cost of goods sold from the total revenue, it represents the profit earned before deducting operating expenses. 4. Operating Expenses: The costs incurred in the day-to-day operations of the business, including rent, utilities, salaries, marketing expenses, administrative costs, and other overheads. 5. Operating Income: Derived by subtracting the operating expenses from the gross profit, it reflects the profitability from core business operations. 6. Non-operating Income and Expenses: This section incorporates any additional revenue or costs not directly related to the core business operations, such as interest income or expenses, gains or losses from investments, or extraordinary items. 7. Net Income/Loss: The final figure obtained by deducting non-operating income or expenses from the operating income, representing the overall profit or loss after considering all revenue and expenses. In summary, a Tucson, Arizona profit and loss statement is a crucial financial tool that helps businesses evaluate their financial performance, identify areas for improvement, and make informed decisions to enhance profitability and success.A profit and loss statement, also known as an income statement or P&L statement, is a financial report that summarizes the revenue, costs, and expenses incurred during a specific period of time by a company or organization in Tucson, Arizona. It provides a comprehensive overview of the financial performance, profitability, and operational efficiency of the business. In Tucson, Arizona, various types of profit and loss statements exist, tailored to specific sectors or industries. Some common types may include: 1. Retail Profit and Loss Statement: This type of P&L statement is designed for businesses engaged in retail activities, such as stores, boutiques, or supermarkets in Tucson, Arizona. It captures the revenue generated from sales, cost of goods sold (COGS), operating expenses, and eventually calculates the gross profit and net income or loss. 2. Restaurant Profit and Loss Statement: Restaurants in Tucson, Arizona typically use this specific P&L statement to evaluate their financial performance. It considers revenue from food and beverage sales, COGS, labor costs, rent, utility expenses, marketing expenses, and other related costs. It provides insights into key performance indicators (KPIs) like food cost percentage and labor cost percentage. 3. Real Estate Profit and Loss Statement: This variation of P&L statement is applicable to real estate companies, property management firms, or real estate investors operating in Tucson, Arizona. It tracks rental income, maintenance expenses, property taxes, insurance costs, vacancies, and any other associated charges to determine the profitability of real estate investments. 4. Manufacturing Profit and Loss Statement: Manufacturers in Tucson, Arizona can use this type of P&L statement to analyze their financial performance. It incorporates revenue from sales of manufactured goods, COGS, direct labor costs, raw material expenses, production overheads, depreciation, and other production-related expenses. Regardless of the industry, a Tucson, Arizona profit and loss statement typically includes the following key components: 1. Revenue: The total income generated from sales or services provided within the specified period. 2. Cost of Goods Sold: The direct costs associated with producing or purchasing the products or services sold. It includes raw materials, direct labor, and manufacturing overheads. 3. Gross Profit: Calculated by subtracting the cost of goods sold from the total revenue, it represents the profit earned before deducting operating expenses. 4. Operating Expenses: The costs incurred in the day-to-day operations of the business, including rent, utilities, salaries, marketing expenses, administrative costs, and other overheads. 5. Operating Income: Derived by subtracting the operating expenses from the gross profit, it reflects the profitability from core business operations. 6. Non-operating Income and Expenses: This section incorporates any additional revenue or costs not directly related to the core business operations, such as interest income or expenses, gains or losses from investments, or extraordinary items. 7. Net Income/Loss: The final figure obtained by deducting non-operating income or expenses from the operating income, representing the overall profit or loss after considering all revenue and expenses. In summary, a Tucson, Arizona profit and loss statement is a crucial financial tool that helps businesses evaluate their financial performance, identify areas for improvement, and make informed decisions to enhance profitability and success.