The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

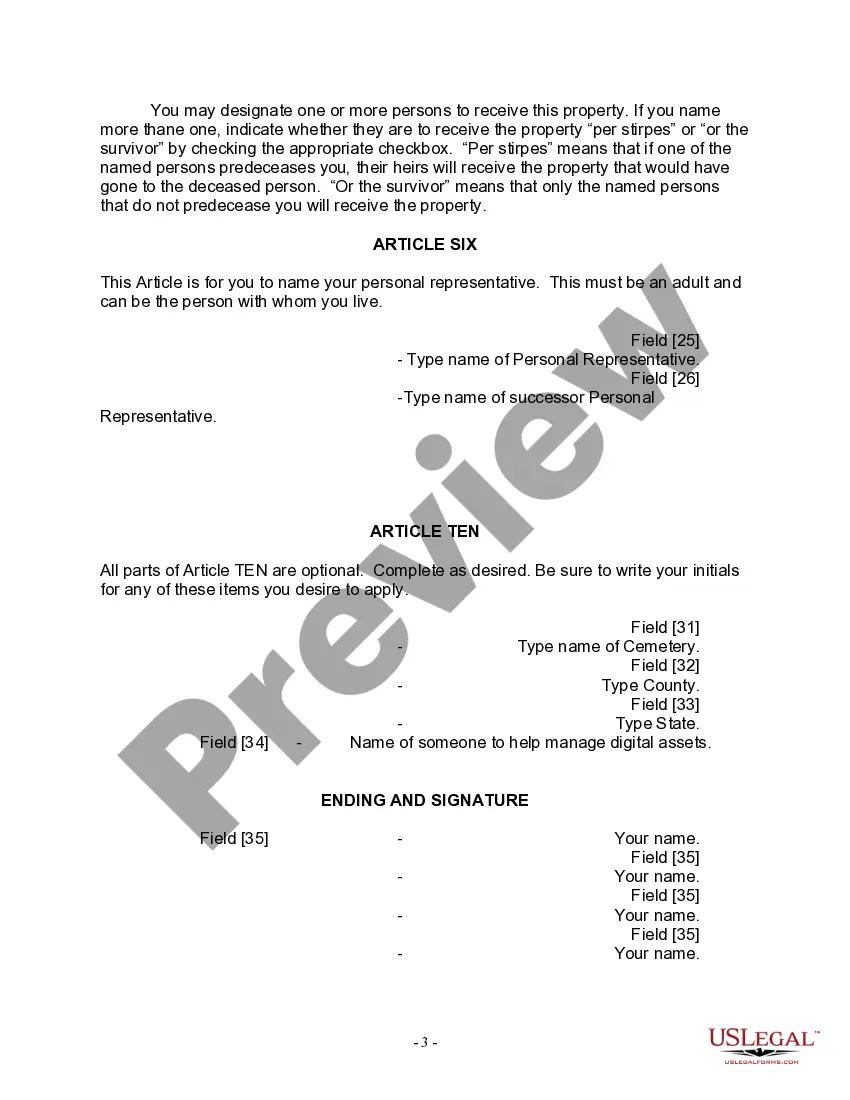

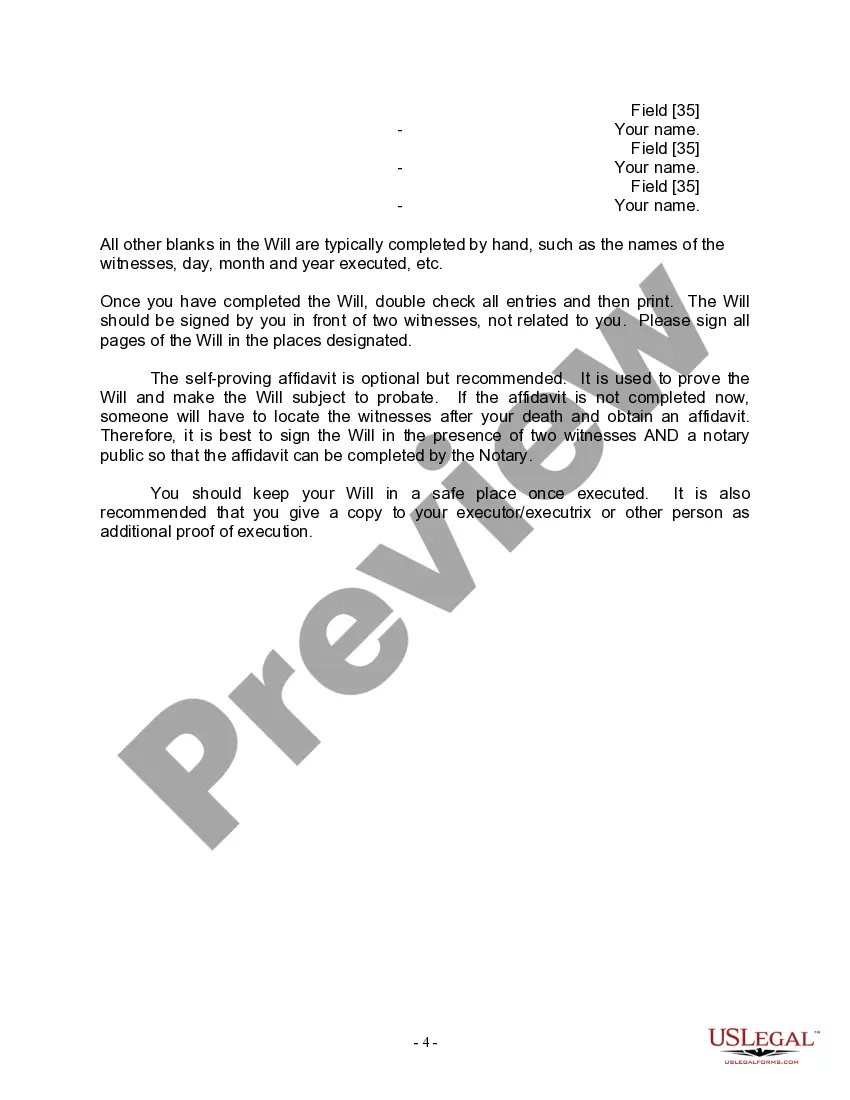

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

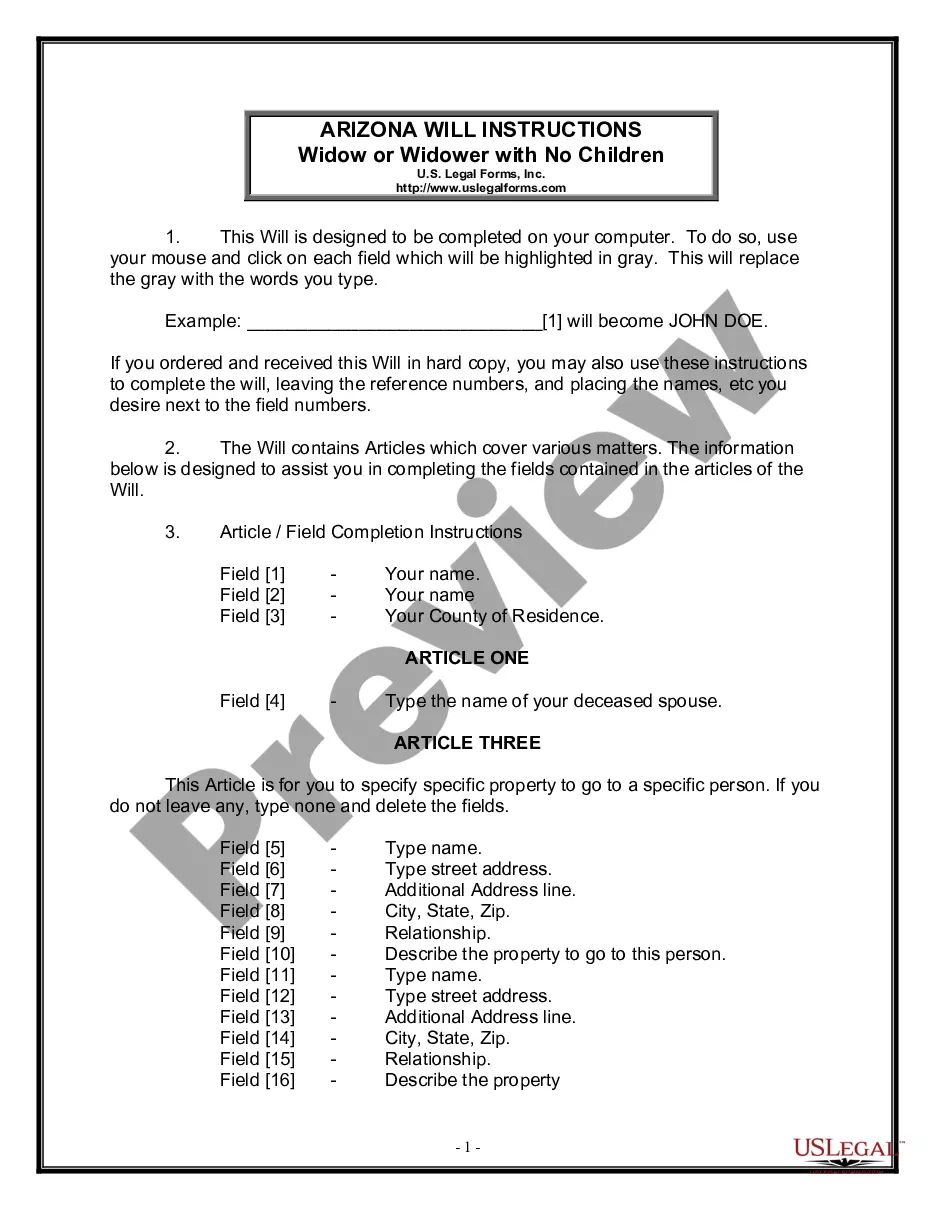

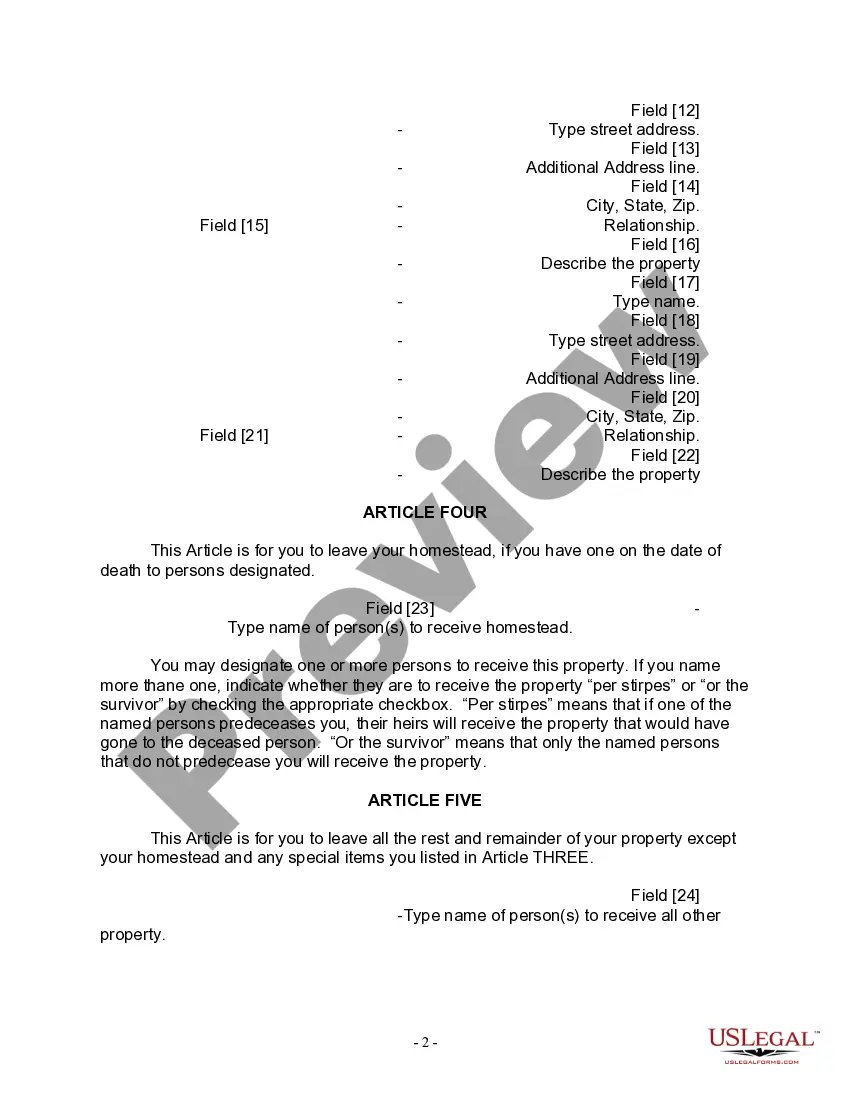

The Maricopa Arizona Legal Last Will Form for a Widow or Widower with no Children is a crucial legal document that allows individuals in Maricopa, Arizona, who have no children and have become widows or widowers to outline their final wishes and distribute their assets after their passing. This legal form is an essential tool to ensure that one's estate is handled according to their desires, providing peace of mind to the individual and their loved ones during an already difficult time. The Maricopa Arizona Legal Last Will Form for a Widow or Widower with no Children typically includes several key components: 1. Testator Information: This section requires the individual to provide their full name, address, and other identifying details, such as their date of birth and social security number. 2. Executor Appointment: The testator may appoint an executor in their will, who will be responsible for carrying out the instructions outlined in the document. It is crucial to select a trustworthy person who is willing to assume this role. 3. Asset Distribution: In this section, the testator can detail how they wish to distribute their assets, including real estate, money, personal possessions, and investments. It is possible to name specific individuals or charitable organizations as beneficiaries. 4. Debts and Taxes: The legal last will form also addresses any outstanding debts and taxes. The testator can specify how these obligations should be settled using the available assets. 5. Alternate Beneficiaries: To ensure smooth asset distribution, the testator may include an alternate beneficiary, in case the primary beneficiary predeceases them or is unable to receive the assets. 6. Funeral and Burial Instructions: This section allows the testator to express their preferences regarding funeral arrangements, burial, or cremation. It is advisable to discuss these wishes with family members or close friends ahead of time to ensure they are aware of the instructions. 7. Witnesses and Notary: To validate the will and ensure its legal binding, it must be signed by the testator and two witnesses who are not named as beneficiaries. A notary public may also be required to certify the signatures. While there may not be different types of Maricopa Arizona Legal Last Will Forms explicitly designed for widows or widowers with no children, these individuals can still use the standard Maricopa Arizona Legal Last Will Form to convey their wishes and ensure a smooth transfer of assets. It is crucial to regularly review and update the document as circumstances change, such as acquiring new assets, experiencing the loss of a loved one, or entering into a new relationship. Consulting an attorney specializing in estate planning is advisable to ensure the document is drafted correctly and in accordance with Arizona state laws.The Maricopa Arizona Legal Last Will Form for a Widow or Widower with no Children is a crucial legal document that allows individuals in Maricopa, Arizona, who have no children and have become widows or widowers to outline their final wishes and distribute their assets after their passing. This legal form is an essential tool to ensure that one's estate is handled according to their desires, providing peace of mind to the individual and their loved ones during an already difficult time. The Maricopa Arizona Legal Last Will Form for a Widow or Widower with no Children typically includes several key components: 1. Testator Information: This section requires the individual to provide their full name, address, and other identifying details, such as their date of birth and social security number. 2. Executor Appointment: The testator may appoint an executor in their will, who will be responsible for carrying out the instructions outlined in the document. It is crucial to select a trustworthy person who is willing to assume this role. 3. Asset Distribution: In this section, the testator can detail how they wish to distribute their assets, including real estate, money, personal possessions, and investments. It is possible to name specific individuals or charitable organizations as beneficiaries. 4. Debts and Taxes: The legal last will form also addresses any outstanding debts and taxes. The testator can specify how these obligations should be settled using the available assets. 5. Alternate Beneficiaries: To ensure smooth asset distribution, the testator may include an alternate beneficiary, in case the primary beneficiary predeceases them or is unable to receive the assets. 6. Funeral and Burial Instructions: This section allows the testator to express their preferences regarding funeral arrangements, burial, or cremation. It is advisable to discuss these wishes with family members or close friends ahead of time to ensure they are aware of the instructions. 7. Witnesses and Notary: To validate the will and ensure its legal binding, it must be signed by the testator and two witnesses who are not named as beneficiaries. A notary public may also be required to certify the signatures. While there may not be different types of Maricopa Arizona Legal Last Will Forms explicitly designed for widows or widowers with no children, these individuals can still use the standard Maricopa Arizona Legal Last Will Form to convey their wishes and ensure a smooth transfer of assets. It is crucial to regularly review and update the document as circumstances change, such as acquiring new assets, experiencing the loss of a loved one, or entering into a new relationship. Consulting an attorney specializing in estate planning is advisable to ensure the document is drafted correctly and in accordance with Arizona state laws.