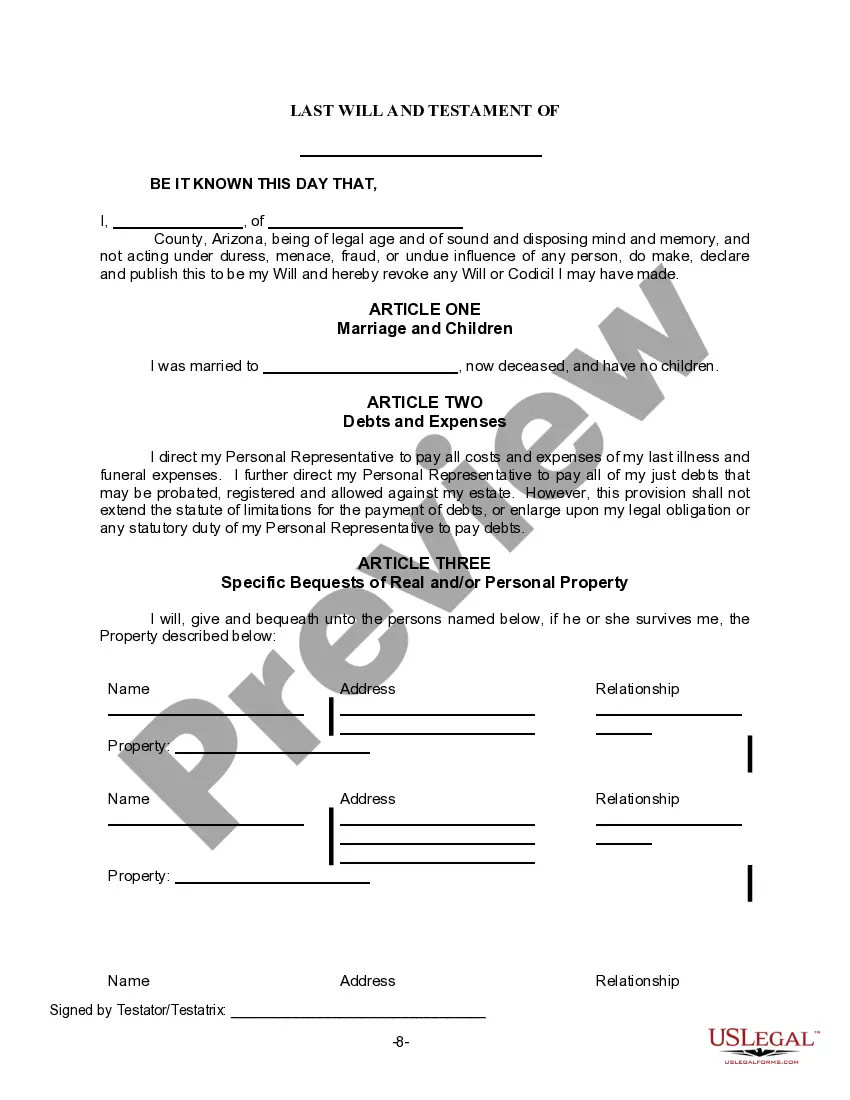

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

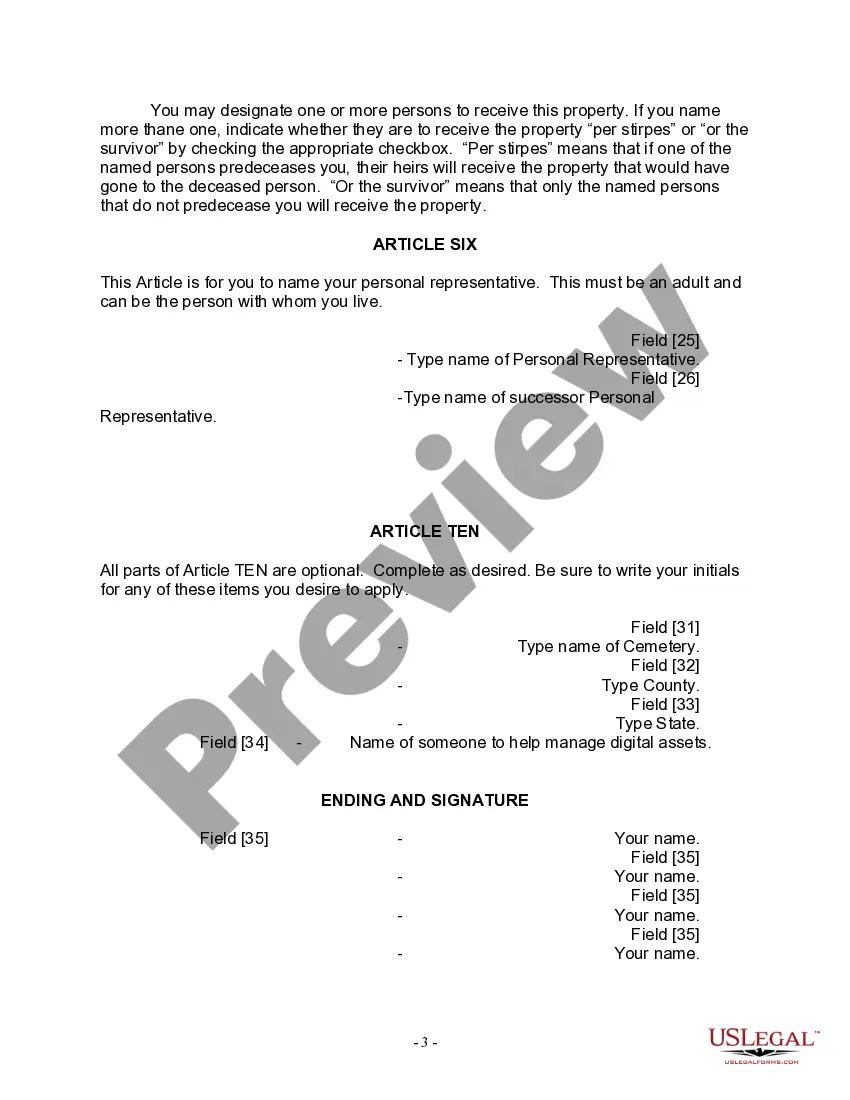

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

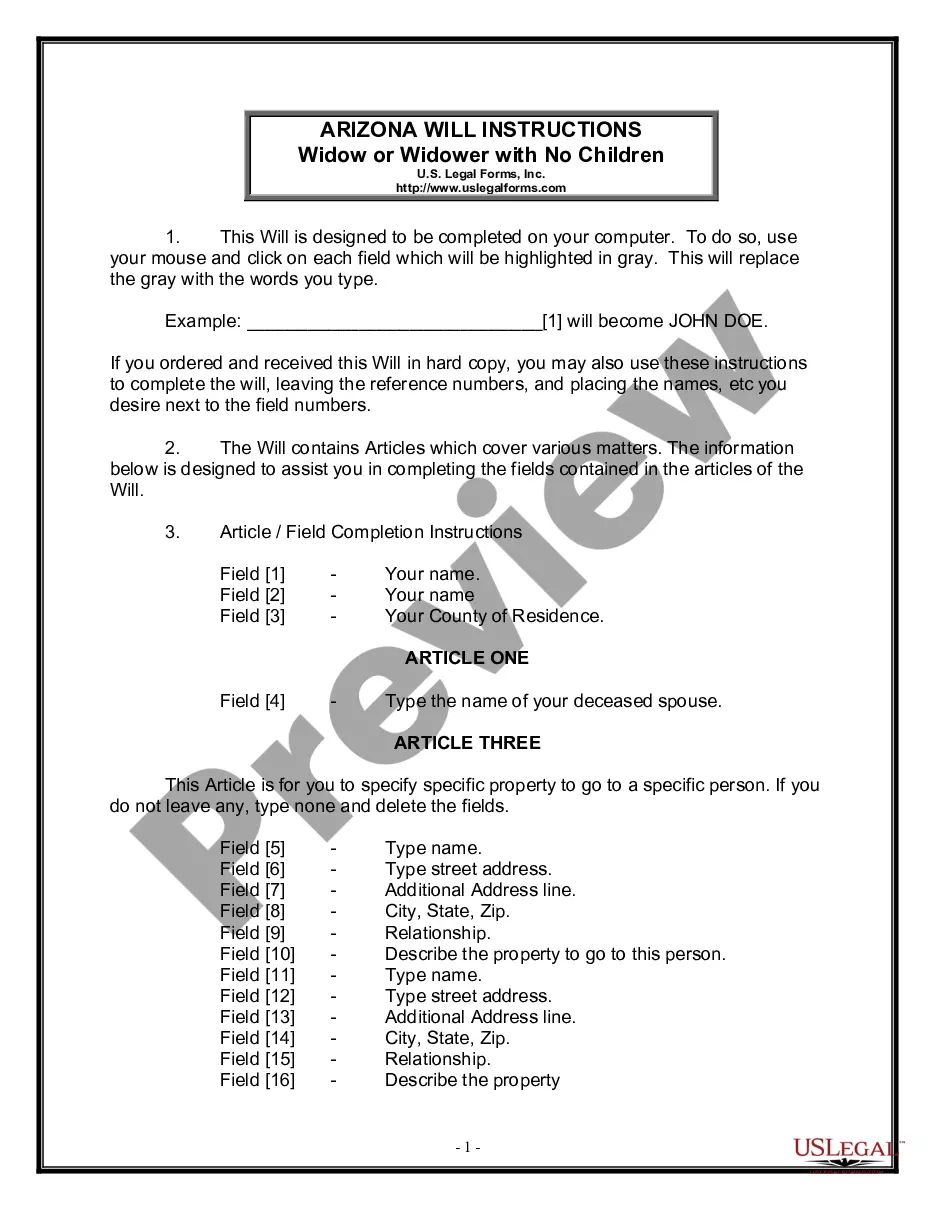

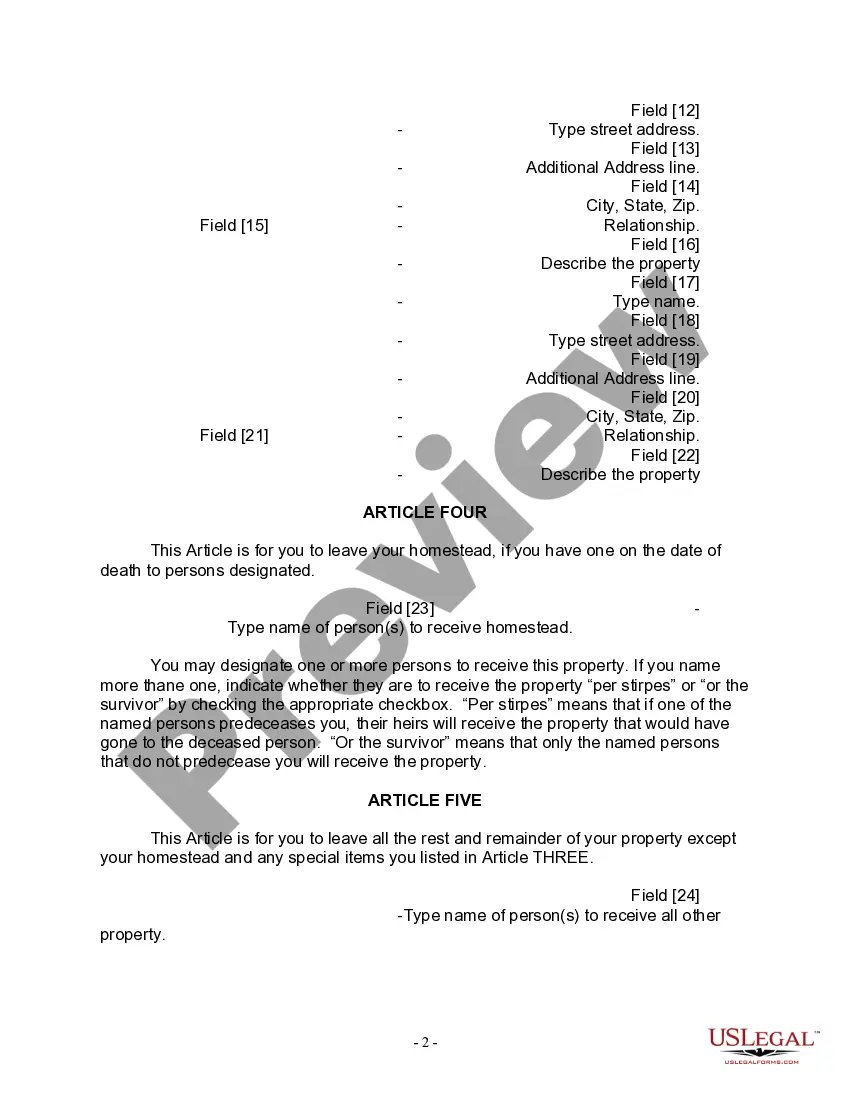

Tempe Arizona Legal Last Will Form for a Widow or Widower with no Children In Tempe, Arizona, it is crucial for individuals to plan their estate and create a last will to ensure their wishes are securely documented and legally enforceable. A last will is a legal document that outlines how a person's assets will be distributed after their death, and it can offer peace of mind for the surviving loved ones. For widows or widowers without children, understanding the specifics of a Tempe Arizona Legal Last Will Form is essential. The Tempe Arizona Legal Last Will Form for a Widow or Widower with no Children is designed specifically to address the unique circumstances of individuals who have lost their spouse and have no children. This form allows them to maintain control over their assets, decide who will inherit their belongings, and appoint an executor to carry out their wishes. Key provisions found in this Last Will Form may include: 1. Naming an Executor: A widow or widower must name an executor in their last will. The executor is responsible for managing the distribution of assets, paying any outstanding debts, and fulfilling the requests specified in the will. It is crucial to select a trusted individual or a professional executor who will handle these responsibilities diligently. 2. Asset Distribution: The widow or widower can clearly state how their assets will be distributed among their beneficiaries. They may choose to leave specific items, such as heirlooms or sentimental belongings, to particular individuals, while allocating the remaining assets to named beneficiaries. The last will provides an opportunity for the widow or widower to ensure their valued possessions are passed on to loved ones. 3. Beneficiaries: In the last will, the widow or widower should clearly identify the individuals or organizations that will inherit their assets. These beneficiaries can be family members, friends, charities, or any other preferred parties the individual wishes to include. 4. Alternate Beneficiaries: In the event that a named beneficiary predeceases the widow or widower, it is vital to designate alternate beneficiaries. This ensures that if the primary beneficiary is unable to receive the designated assets, the alternate beneficiaries will step in and receive the inheritance instead. 5. Specific Bequests: If there are specific items, investments, properties, or financial accounts that the widow or widower wishes to allocate to certain individuals or organizations, they must be clearly outlined in the last will. This provision can eliminate any potential confusion or conflict among beneficiaries. Different types of Tempe Arizona Legal Last Will Forms for a Widow or Widower with no Children may include variations in their overall format, but the key provisions mentioned above remain constant. It is recommended to consult with an estate planning attorney to obtain the most appropriate and updated legal last will form to ensure compliance with Arizona laws and regulations. By utilizing the Tempe Arizona Legal Last Will Form for a Widow or Widower with no Children, individuals can actively participate in the planning of their estate and make critical decisions regarding the distribution of their assets. This comprehensive document aims to safeguard their wishes and provide clarity and peace of mind for both the widow or widower and their beneficiaries.Tempe Arizona Legal Last Will Form for a Widow or Widower with no Children In Tempe, Arizona, it is crucial for individuals to plan their estate and create a last will to ensure their wishes are securely documented and legally enforceable. A last will is a legal document that outlines how a person's assets will be distributed after their death, and it can offer peace of mind for the surviving loved ones. For widows or widowers without children, understanding the specifics of a Tempe Arizona Legal Last Will Form is essential. The Tempe Arizona Legal Last Will Form for a Widow or Widower with no Children is designed specifically to address the unique circumstances of individuals who have lost their spouse and have no children. This form allows them to maintain control over their assets, decide who will inherit their belongings, and appoint an executor to carry out their wishes. Key provisions found in this Last Will Form may include: 1. Naming an Executor: A widow or widower must name an executor in their last will. The executor is responsible for managing the distribution of assets, paying any outstanding debts, and fulfilling the requests specified in the will. It is crucial to select a trusted individual or a professional executor who will handle these responsibilities diligently. 2. Asset Distribution: The widow or widower can clearly state how their assets will be distributed among their beneficiaries. They may choose to leave specific items, such as heirlooms or sentimental belongings, to particular individuals, while allocating the remaining assets to named beneficiaries. The last will provides an opportunity for the widow or widower to ensure their valued possessions are passed on to loved ones. 3. Beneficiaries: In the last will, the widow or widower should clearly identify the individuals or organizations that will inherit their assets. These beneficiaries can be family members, friends, charities, or any other preferred parties the individual wishes to include. 4. Alternate Beneficiaries: In the event that a named beneficiary predeceases the widow or widower, it is vital to designate alternate beneficiaries. This ensures that if the primary beneficiary is unable to receive the designated assets, the alternate beneficiaries will step in and receive the inheritance instead. 5. Specific Bequests: If there are specific items, investments, properties, or financial accounts that the widow or widower wishes to allocate to certain individuals or organizations, they must be clearly outlined in the last will. This provision can eliminate any potential confusion or conflict among beneficiaries. Different types of Tempe Arizona Legal Last Will Forms for a Widow or Widower with no Children may include variations in their overall format, but the key provisions mentioned above remain constant. It is recommended to consult with an estate planning attorney to obtain the most appropriate and updated legal last will form to ensure compliance with Arizona laws and regulations. By utilizing the Tempe Arizona Legal Last Will Form for a Widow or Widower with no Children, individuals can actively participate in the planning of their estate and make critical decisions regarding the distribution of their assets. This comprehensive document aims to safeguard their wishes and provide clarity and peace of mind for both the widow or widower and their beneficiaries.