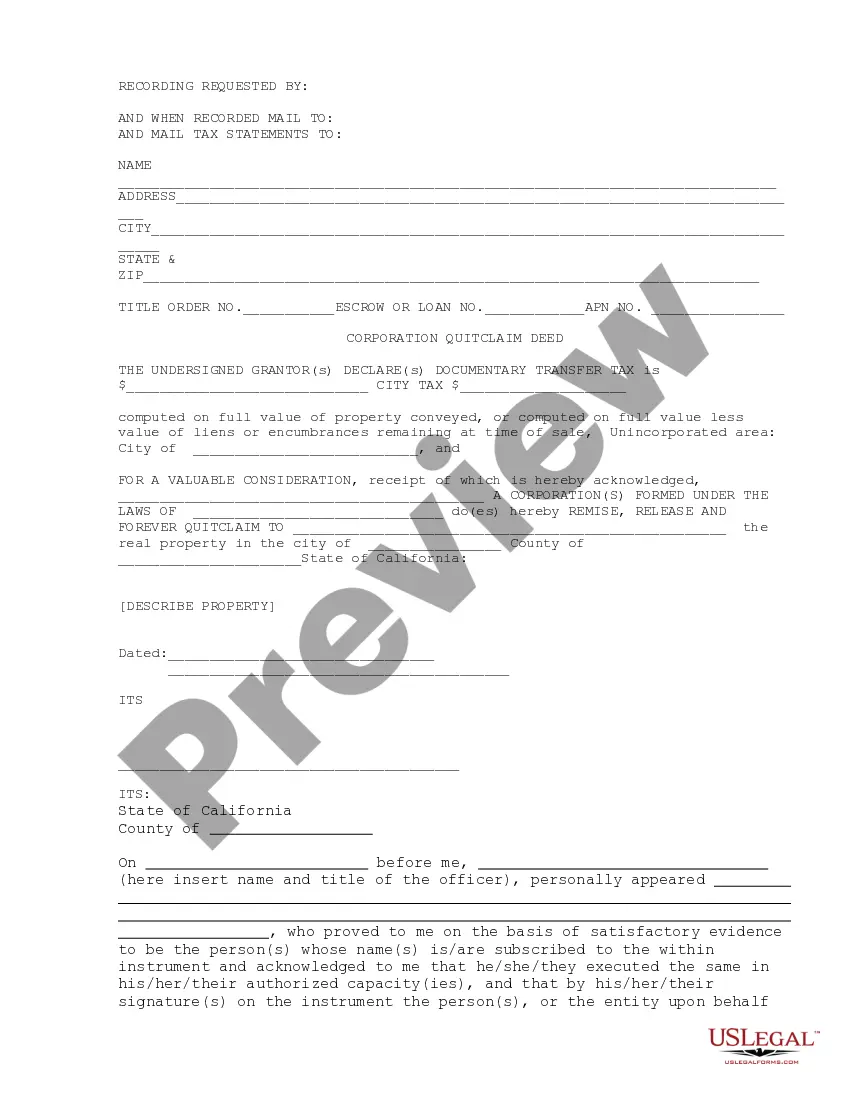

This form is a quitclaim deed from a grantor corporation to a grantee. The deed complies with the applicable laws in your state. A quitclaim deed is the simplest property transfer possible. The grantor relinquishes whatever claim he has on the property and conveys the claim to the grantee, who assumes ownership.

The Hayward California Quitclaim Deed for Corporation is a legal document used in the state of California to transfer ownership of real property from a corporation to another party. It is essential for corporations that want to transfer their interest in a property without making any warranties or guarantees regarding the property's title. This type of deed is often used when a corporation is transferring property to a shareholder, another corporation, or any other entity. Unlike a warranty deed, a quitclaim deed offers no guarantees about the property's title, and it simply transfers the corporation's interest in the property to the recipient. There are different types of Hayward California Quitclaim Deeds for Corporations, depending on the specific scenario. Some common examples include: 1. Corporation to Individual: In this case, a corporation transfers its interest in a property to an individual, such as a shareholder or an employee. 2. Corporation to Corporation: A corporation might transfer its interest in a property to another corporation for various reasons, such as mergers, acquisitions, or reorganizations. 3. Corporation to Trust: It is possible for a corporation to transfer a property to a trust, allowing the trust to manage and distribute the property according to its terms. 4. Corporation to Partnership: When a corporation wants to transfer its interest in a property to a partnership, a quitclaim deed can be used to facilitate the transfer. Regardless of the specific type, a Hayward California Quitclaim Deed for Corporation should include essential information such as the full legal names of the transferring corporation and the recipient, a clear description of the property being transferred, the effective date of the transfer, and the signature of an authorized representative of the corporation. It is crucial to consult with a qualified attorney or a real estate professional when preparing or executing a quitclaim deed to ensure all legal requirements are met and the transaction is legally valid.The Hayward California Quitclaim Deed for Corporation is a legal document used in the state of California to transfer ownership of real property from a corporation to another party. It is essential for corporations that want to transfer their interest in a property without making any warranties or guarantees regarding the property's title. This type of deed is often used when a corporation is transferring property to a shareholder, another corporation, or any other entity. Unlike a warranty deed, a quitclaim deed offers no guarantees about the property's title, and it simply transfers the corporation's interest in the property to the recipient. There are different types of Hayward California Quitclaim Deeds for Corporations, depending on the specific scenario. Some common examples include: 1. Corporation to Individual: In this case, a corporation transfers its interest in a property to an individual, such as a shareholder or an employee. 2. Corporation to Corporation: A corporation might transfer its interest in a property to another corporation for various reasons, such as mergers, acquisitions, or reorganizations. 3. Corporation to Trust: It is possible for a corporation to transfer a property to a trust, allowing the trust to manage and distribute the property according to its terms. 4. Corporation to Partnership: When a corporation wants to transfer its interest in a property to a partnership, a quitclaim deed can be used to facilitate the transfer. Regardless of the specific type, a Hayward California Quitclaim Deed for Corporation should include essential information such as the full legal names of the transferring corporation and the recipient, a clear description of the property being transferred, the effective date of the transfer, and the signature of an authorized representative of the corporation. It is crucial to consult with a qualified attorney or a real estate professional when preparing or executing a quitclaim deed to ensure all legal requirements are met and the transaction is legally valid.