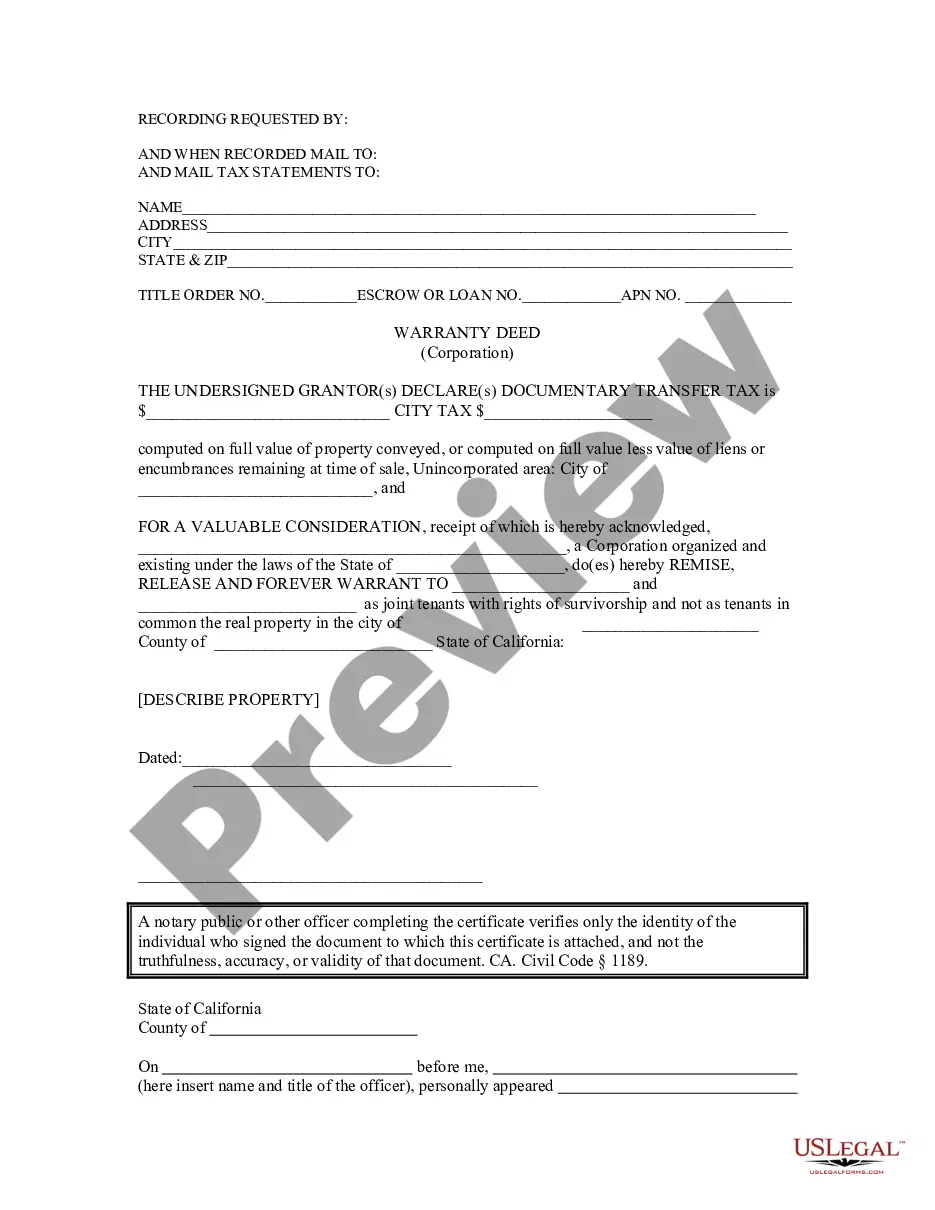

This form is a warranty deed from a grantor corporation to a grantee. The deed complies with the applicable laws in your state. A warranty deed provides certain assurances that good title is being conveyed.

A Vacaville California Warranty Deed for Corporation is a legal document used to transfer ownership of real estate from a corporation to another party, known as the grantee. This deed provides a warranty that the corporation holds clear and marketable title to the property and assures the grantee against any potential claims or defects in the title. Keywords: Vacaville California, Warranty Deed, Corporation, ownership transfer, real estate, grantee, clear title, marketable title, claims, defects. There are different types of Vacaville California Warranty Deeds for Corporation, including: 1. General Warranty Deed: This type of deed guarantees the grantee that the corporation has full ownership of the property and will defend the title against any past, present, or future claims to the property. 2. Special Warranty Deed: In this type of deed, the corporation only warrants and defends the title against claims that have arisen during their ownership period. This means that the grantee is protected against any defects in the title occurring during the corporation's ownership, but not prior to that. 3. Bargain and Sale Deed: This deed implies that the corporation holds the property and has the authority to transfer ownership, but it does not provide any specific warranty or guarantee against defects in the title. It merely conveys whatever interest the corporation has in the property. 4. Quitclaim Deed: This type of deed transfers the corporation's interest in the property to the grantee without making any claims regarding the title. It offers the least protection to the grantee, as it does not guarantee that the corporation has any ownership rights to the property or that the title is clear. Note: It is crucial to consult with a qualified attorney or real estate professional to ensure the appropriate type of Vacaville California Warranty Deed for Corporation is used, as each deed carries different levels of protection and liabilities for both the corporation and the grantee.A Vacaville California Warranty Deed for Corporation is a legal document used to transfer ownership of real estate from a corporation to another party, known as the grantee. This deed provides a warranty that the corporation holds clear and marketable title to the property and assures the grantee against any potential claims or defects in the title. Keywords: Vacaville California, Warranty Deed, Corporation, ownership transfer, real estate, grantee, clear title, marketable title, claims, defects. There are different types of Vacaville California Warranty Deeds for Corporation, including: 1. General Warranty Deed: This type of deed guarantees the grantee that the corporation has full ownership of the property and will defend the title against any past, present, or future claims to the property. 2. Special Warranty Deed: In this type of deed, the corporation only warrants and defends the title against claims that have arisen during their ownership period. This means that the grantee is protected against any defects in the title occurring during the corporation's ownership, but not prior to that. 3. Bargain and Sale Deed: This deed implies that the corporation holds the property and has the authority to transfer ownership, but it does not provide any specific warranty or guarantee against defects in the title. It merely conveys whatever interest the corporation has in the property. 4. Quitclaim Deed: This type of deed transfers the corporation's interest in the property to the grantee without making any claims regarding the title. It offers the least protection to the grantee, as it does not guarantee that the corporation has any ownership rights to the property or that the title is clear. Note: It is crucial to consult with a qualified attorney or real estate professional to ensure the appropriate type of Vacaville California Warranty Deed for Corporation is used, as each deed carries different levels of protection and liabilities for both the corporation and the grantee.