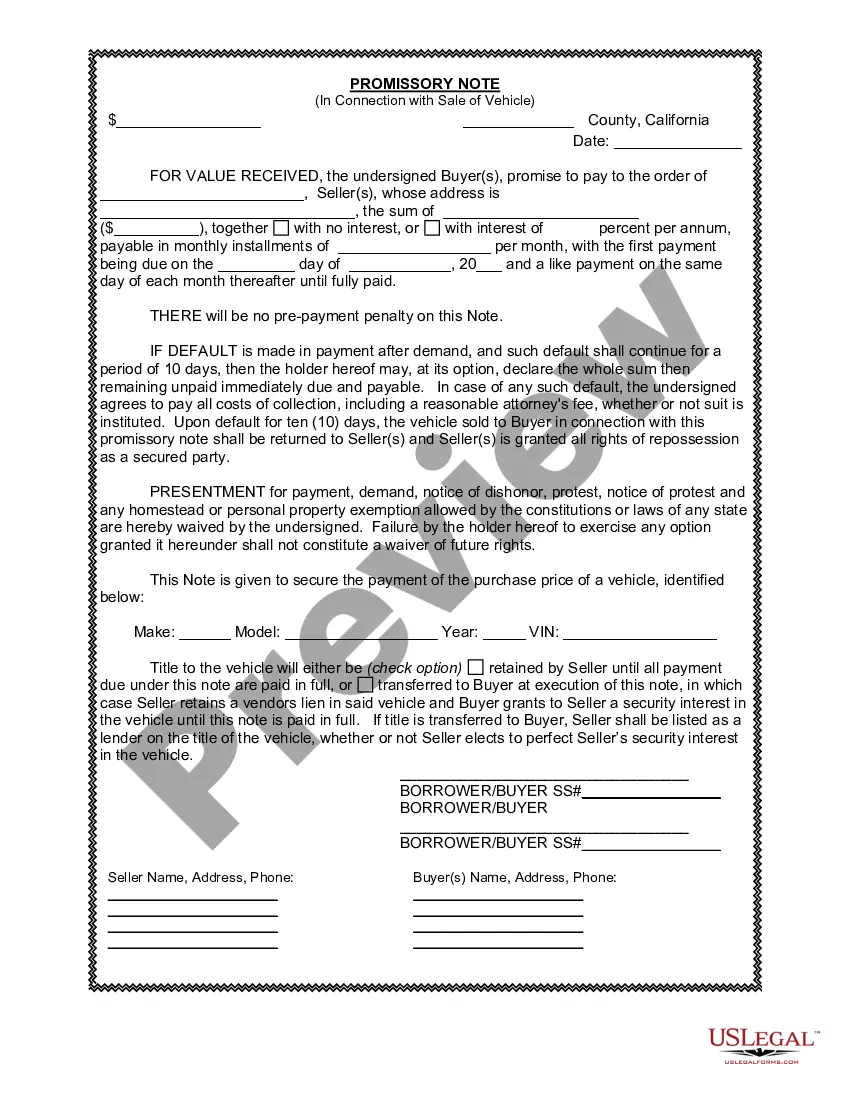

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Burbank California Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan or financing agreement between the buyer and seller of a vehicle. This document serves as an important agreement to ensure the payment of the vehicle's purchase price over an agreed-upon period. Keywords: Burbank California, Promissory Note, Sale of Vehicle, Sale of Automobile, financing agreement, loan, purchase price, payment terms There are various types of Burbank California Promissory Notes in Connection with Sale of Vehicle or Automobile, including: 1. Simple Promissory Note: This is the most common type of promissory note used in Burbank, California, for the sale of a vehicle. It includes the basic terms of the loan, such as the principal amount, interest rate, repayment term, and any additional terms agreed upon by the buyer and seller. 2. Secured Promissory Note: In some cases, the seller may require the buyer to provide collateral to secure the loan. This type of promissory note includes provisions for securing the loan with the vehicle itself. If the buyer defaults on the payments, the seller has the right to repossess the vehicle. 3. Balloon Promissory Note: A balloon promissory note is a type of financing agreement that involves smaller monthly payments throughout the loan term, with a larger "balloon" payment due at the end. This type of note allows the buyer to have lower monthly payments but requires a larger lump sum payment at the end of the term. 4. Installment Promissory Note: An installment promissory note divides the total purchase price of the vehicle into equal monthly or periodic payments over an agreed-upon period. The note specifies the number of installments, the due dates, and any interest that may be charged. 5. Default Promissory Note: This type of promissory note outlines the consequences and remedies in case of default by the buyer. It includes provisions for late payment fees, repossession rights, and potential legal action the seller may take if the buyer fails to fulfill their payment obligations. 6. Prepayment Promissory Note: This type of promissory note allows the buyer to make early payments or pay off the loan before the agreed-upon term without incurring any penalties or fees. It provides flexibility for the buyer and can potentially save them money on interest payments. When drafting a Burbank California Promissory Note in Connection with Sale of Vehicle or Automobile, it is important to consult with a legal professional to ensure compliance with local laws and regulations. Additionally, both the buyer and seller should carefully review and understand the terms of the promissory note before signing to protect their interests in the transaction.A Burbank California Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan or financing agreement between the buyer and seller of a vehicle. This document serves as an important agreement to ensure the payment of the vehicle's purchase price over an agreed-upon period. Keywords: Burbank California, Promissory Note, Sale of Vehicle, Sale of Automobile, financing agreement, loan, purchase price, payment terms There are various types of Burbank California Promissory Notes in Connection with Sale of Vehicle or Automobile, including: 1. Simple Promissory Note: This is the most common type of promissory note used in Burbank, California, for the sale of a vehicle. It includes the basic terms of the loan, such as the principal amount, interest rate, repayment term, and any additional terms agreed upon by the buyer and seller. 2. Secured Promissory Note: In some cases, the seller may require the buyer to provide collateral to secure the loan. This type of promissory note includes provisions for securing the loan with the vehicle itself. If the buyer defaults on the payments, the seller has the right to repossess the vehicle. 3. Balloon Promissory Note: A balloon promissory note is a type of financing agreement that involves smaller monthly payments throughout the loan term, with a larger "balloon" payment due at the end. This type of note allows the buyer to have lower monthly payments but requires a larger lump sum payment at the end of the term. 4. Installment Promissory Note: An installment promissory note divides the total purchase price of the vehicle into equal monthly or periodic payments over an agreed-upon period. The note specifies the number of installments, the due dates, and any interest that may be charged. 5. Default Promissory Note: This type of promissory note outlines the consequences and remedies in case of default by the buyer. It includes provisions for late payment fees, repossession rights, and potential legal action the seller may take if the buyer fails to fulfill their payment obligations. 6. Prepayment Promissory Note: This type of promissory note allows the buyer to make early payments or pay off the loan before the agreed-upon term without incurring any penalties or fees. It provides flexibility for the buyer and can potentially save them money on interest payments. When drafting a Burbank California Promissory Note in Connection with Sale of Vehicle or Automobile, it is important to consult with a legal professional to ensure compliance with local laws and regulations. Additionally, both the buyer and seller should carefully review and understand the terms of the promissory note before signing to protect their interests in the transaction.