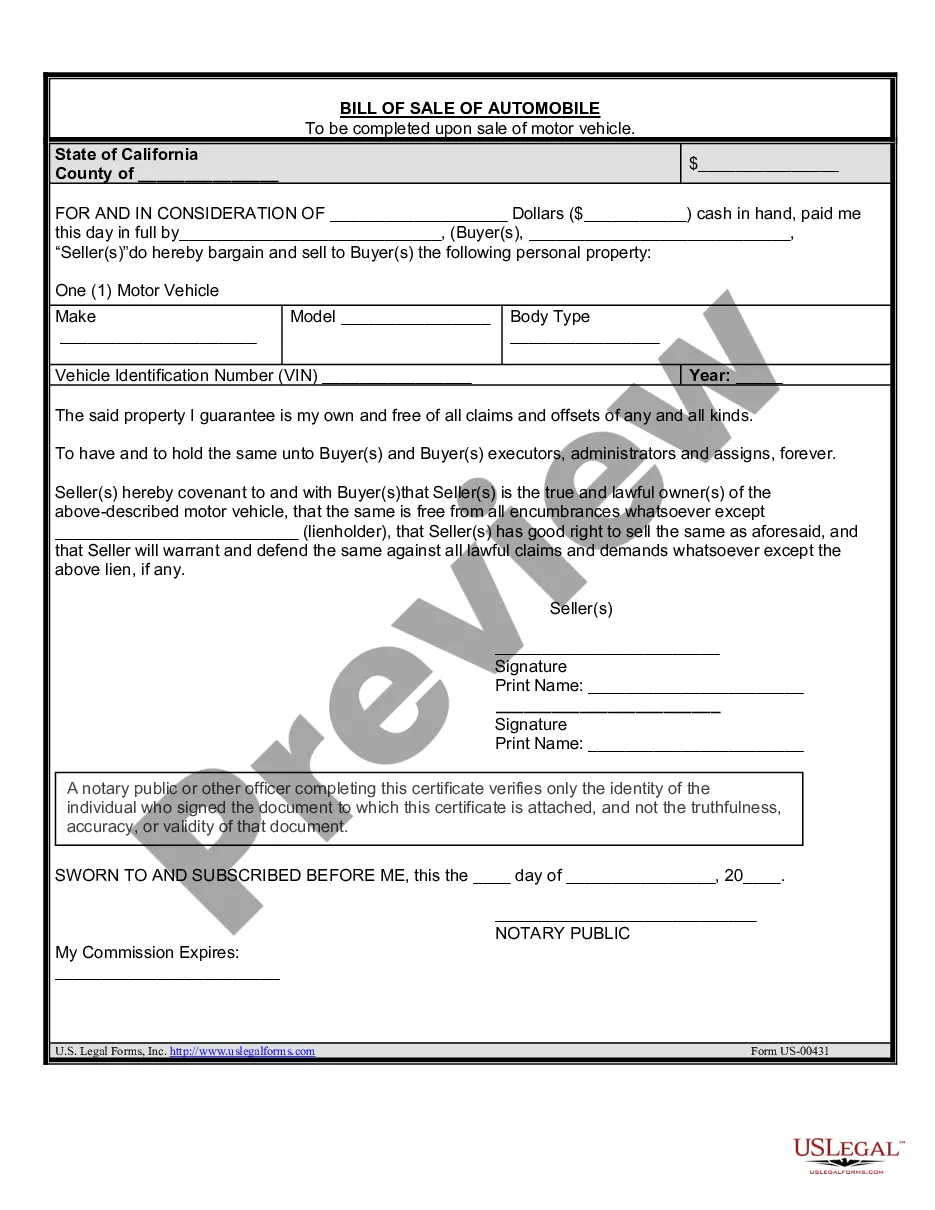

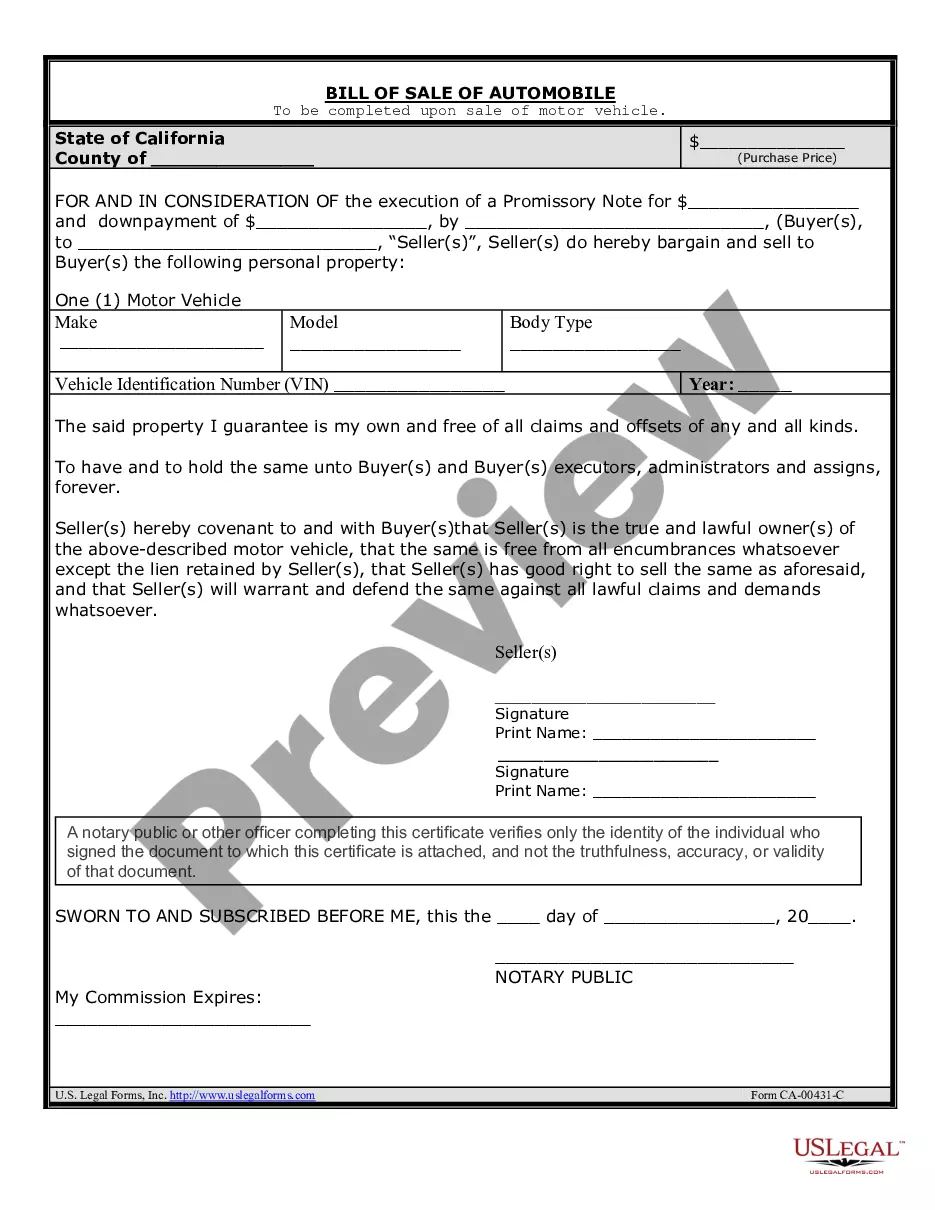

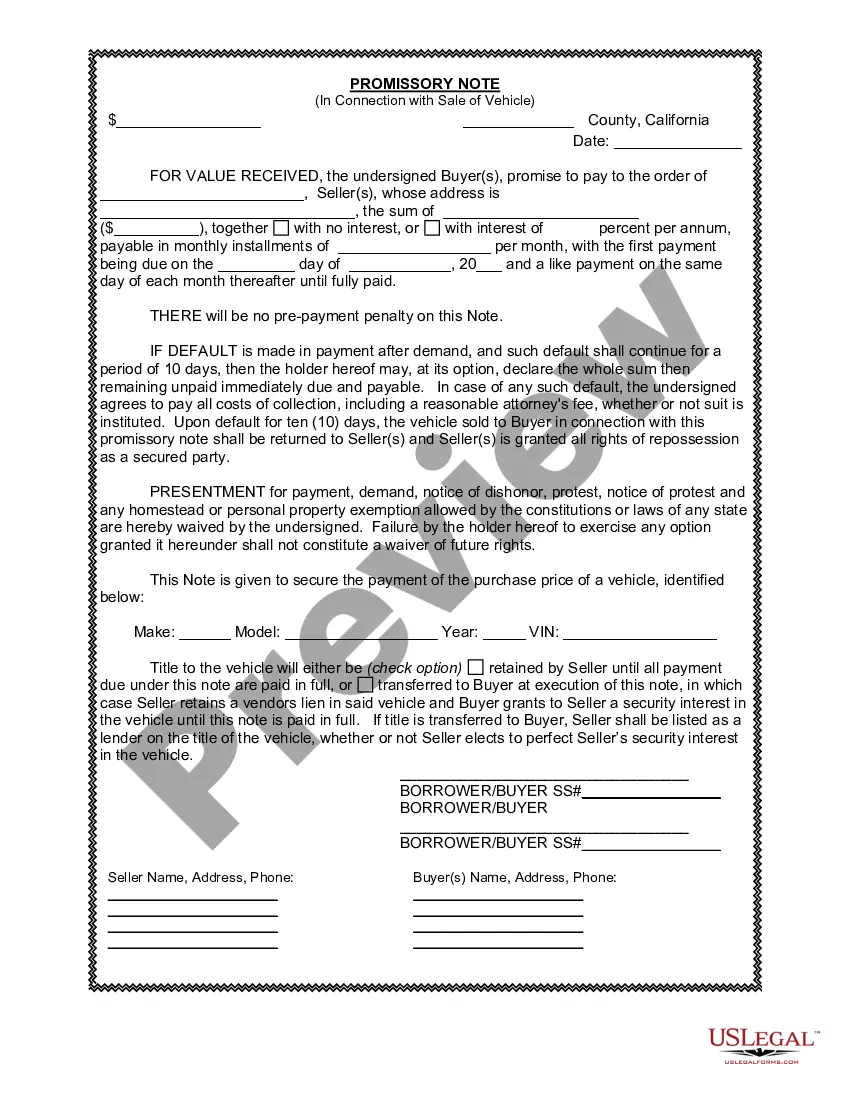

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

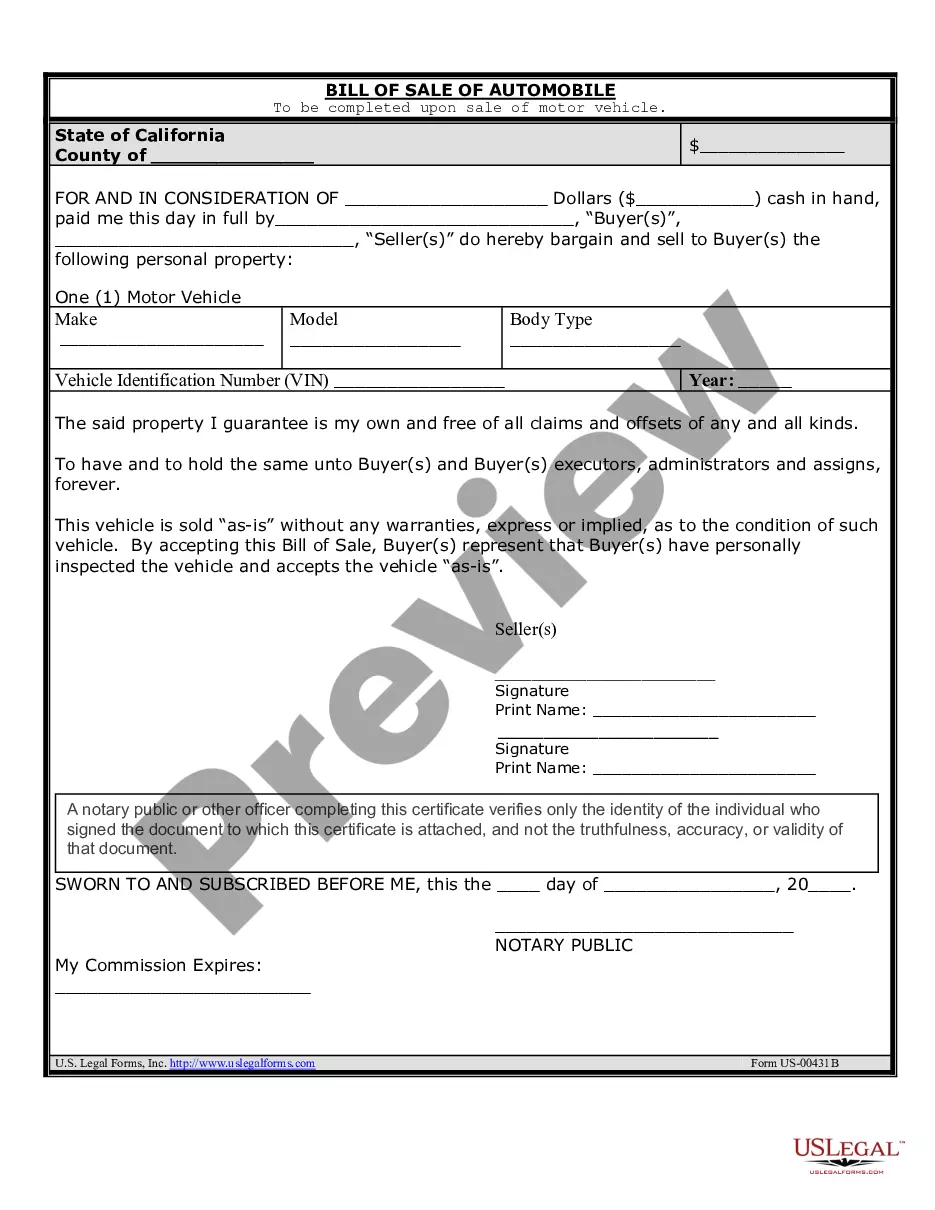

A Rialto California Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and seller. It serves as a formal record of the transaction, ensuring that both parties understand their financial obligations and rights. The note specifies the agreed-upon purchase price, payment schedule, interest rate (if applicable), and consequences for default. Different types of Rialto California Promissory Notes in Connection with the Sale of Vehicle or Automobile may include: 1. Simple Promissory Note: This is the most basic type of promissory note, which outlines the loan amount, repayment terms, and the buyer's obligation to repay the seller within a specific timeframe. 2. Installment Promissory Note: This type of note sets out a structured payment plan, allowing the buyer to make regular installments over a predetermined period, typically with accrued interest. 3. Secured Promissory Note: In this type of note, the buyer provides collateral, such as the vehicle being purchased, to secure the loan. If the buyer defaults, the seller has the right to repossess the collateral. 4. Balloon Promissory Note: This note structure involves making smaller periodic payments followed by a large final payment, known as a balloon payment, which typically encompasses the remaining loan balance. 5. Adjustable Rate Promissory Note: With this type of note, the interest rate on the loan may vary over time, typically based on a predetermined index, such as the prime rate. When using a Rialto California Promissory Note in Connection with the Sale of a Vehicle or Automobile, it is essential to include specific keywords and phrases to ensure clarity and legality. Some relevant keywords to include in the content could be "contract," "terms and conditions," "principal amount," "interest rate," "monthly installments," "due date," "default," "collateral," "repayment schedule," and "legal obligations." It is crucial to consult with legal professionals or seek appropriate legal forms to ensure that all necessary elements are included in the promissory note, and it complies with California state laws and regulations.A Rialto California Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and seller. It serves as a formal record of the transaction, ensuring that both parties understand their financial obligations and rights. The note specifies the agreed-upon purchase price, payment schedule, interest rate (if applicable), and consequences for default. Different types of Rialto California Promissory Notes in Connection with the Sale of Vehicle or Automobile may include: 1. Simple Promissory Note: This is the most basic type of promissory note, which outlines the loan amount, repayment terms, and the buyer's obligation to repay the seller within a specific timeframe. 2. Installment Promissory Note: This type of note sets out a structured payment plan, allowing the buyer to make regular installments over a predetermined period, typically with accrued interest. 3. Secured Promissory Note: In this type of note, the buyer provides collateral, such as the vehicle being purchased, to secure the loan. If the buyer defaults, the seller has the right to repossess the collateral. 4. Balloon Promissory Note: This note structure involves making smaller periodic payments followed by a large final payment, known as a balloon payment, which typically encompasses the remaining loan balance. 5. Adjustable Rate Promissory Note: With this type of note, the interest rate on the loan may vary over time, typically based on a predetermined index, such as the prime rate. When using a Rialto California Promissory Note in Connection with the Sale of a Vehicle or Automobile, it is essential to include specific keywords and phrases to ensure clarity and legality. Some relevant keywords to include in the content could be "contract," "terms and conditions," "principal amount," "interest rate," "monthly installments," "due date," "default," "collateral," "repayment schedule," and "legal obligations." It is crucial to consult with legal professionals or seek appropriate legal forms to ensure that all necessary elements are included in the promissory note, and it complies with California state laws and regulations.