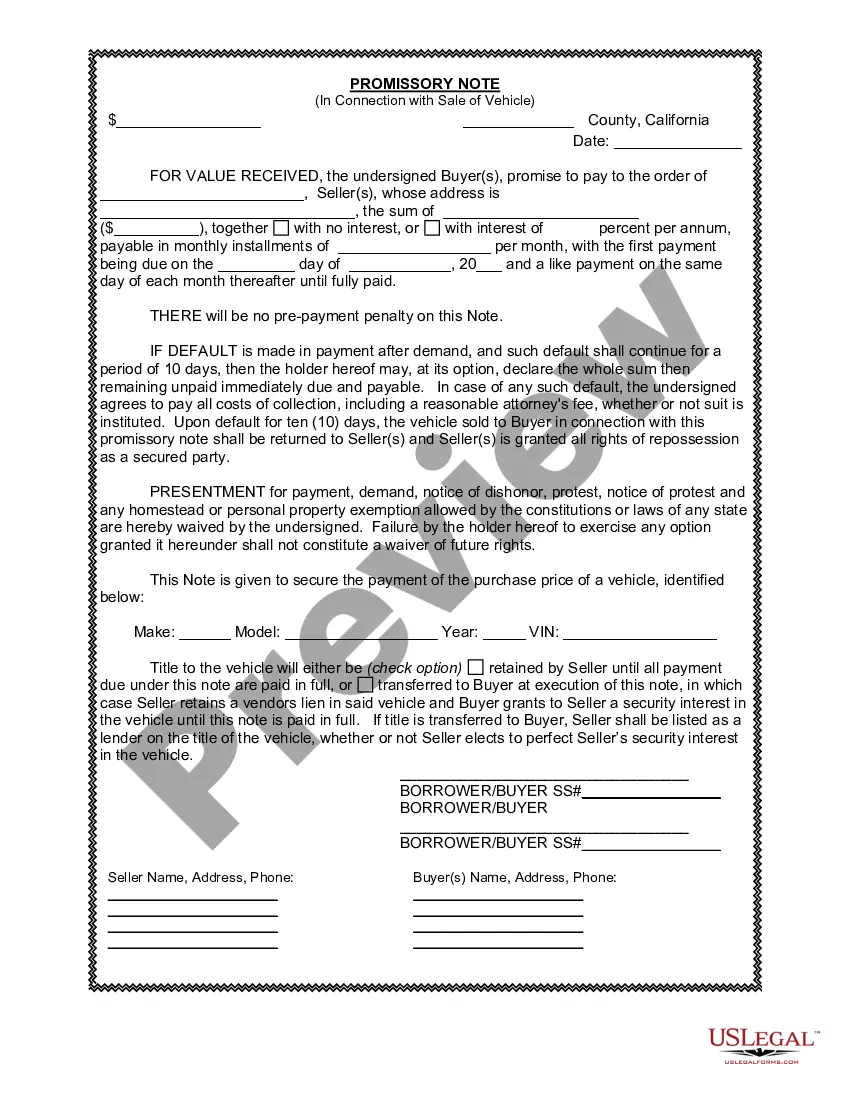

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Vista California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between a buyer and seller in a vehicle sale. This note serves as written evidence of the debt owed by the buyer to the seller for the purchase of the vehicle. The Promissory Note is important in protecting the interests of both parties involved in the transaction. It clearly defines the terms of the repayment schedule, interest rates, and consequences for defaulting on the payment. This legal agreement ensures that the buyer will pay the agreed-upon amount for the vehicle over a specific period of time, instead of paying in full upfront. There are different types of Vista California Promissory Notes in Connection with Sale of Vehicle or Automobile that can be used: 1. Installment Promissory Note: This type of promissory note arranges for the buyer to make regular, fixed payments over the specified period. The buyer agrees to pay the principal amount along with accrued interest until the debt is fully repaid. 2. Balloon Promissory Note: This note allows the buyer to make smaller monthly payments, with a large final payment known as a "balloon payment" due at the end of the term. This type of arrangement is suitable for buyers who expect to have a significant sum available at the end of the note. 3. Secured Promissory Note: In this type of promissory note, the debt is secured by the vehicle itself. If the buyer fails to make the agreed-upon payments, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: Unlike the secured note, this type of promissory note is not backed by any collateral. The seller relies solely on the buyer's promise to repay the debt. 5. Simple Interest Promissory Note: This note includes an interest rate that is charged only on the outstanding principal amount. It ensures that the buyer pays interest on the remaining balance, reducing the overall interest paid if the buyer repays the debt early. When using any of these promissory notes, it is crucial to follow the California laws regarding vehicle sales and financing. Consulting with a legal professional or using pre-made templates specific to Vista, California can help ensure compliance with the state's regulations and protect the rights of both buyer and seller.A Vista California Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between a buyer and seller in a vehicle sale. This note serves as written evidence of the debt owed by the buyer to the seller for the purchase of the vehicle. The Promissory Note is important in protecting the interests of both parties involved in the transaction. It clearly defines the terms of the repayment schedule, interest rates, and consequences for defaulting on the payment. This legal agreement ensures that the buyer will pay the agreed-upon amount for the vehicle over a specific period of time, instead of paying in full upfront. There are different types of Vista California Promissory Notes in Connection with Sale of Vehicle or Automobile that can be used: 1. Installment Promissory Note: This type of promissory note arranges for the buyer to make regular, fixed payments over the specified period. The buyer agrees to pay the principal amount along with accrued interest until the debt is fully repaid. 2. Balloon Promissory Note: This note allows the buyer to make smaller monthly payments, with a large final payment known as a "balloon payment" due at the end of the term. This type of arrangement is suitable for buyers who expect to have a significant sum available at the end of the note. 3. Secured Promissory Note: In this type of promissory note, the debt is secured by the vehicle itself. If the buyer fails to make the agreed-upon payments, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: Unlike the secured note, this type of promissory note is not backed by any collateral. The seller relies solely on the buyer's promise to repay the debt. 5. Simple Interest Promissory Note: This note includes an interest rate that is charged only on the outstanding principal amount. It ensures that the buyer pays interest on the remaining balance, reducing the overall interest paid if the buyer repays the debt early. When using any of these promissory notes, it is crucial to follow the California laws regarding vehicle sales and financing. Consulting with a legal professional or using pre-made templates specific to Vista, California can help ensure compliance with the state's regulations and protect the rights of both buyer and seller.